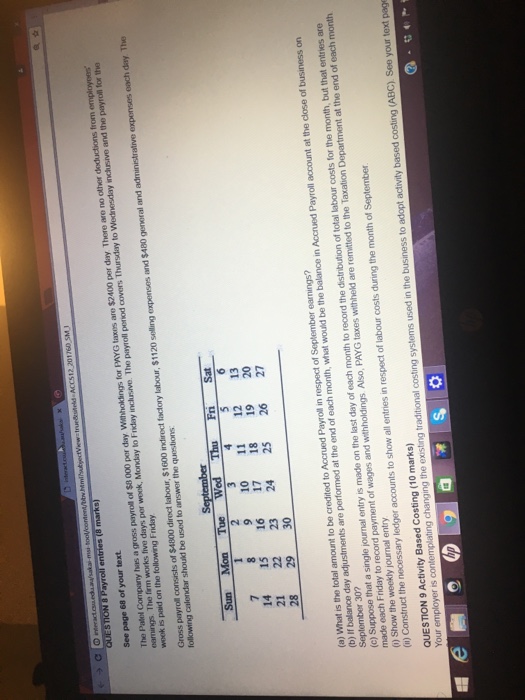

The Patel Company has a gross payroll of $8 000 per day Withholdings for PAYG taxies are $2400 per day. There are no other deductions from employees' earnings. The firm works five days per week, Monday to Friday inclusive. The payroll period covers Thursday to Wednesday inclusive and the payroll for the week is paid on the following Friday. Gross payroll consists of $4800 direct labour, $1600 indirect factory labour, $1120 selling expenses and $480 general and administrative expenses each day. The following calendar should be used to answer the questions: (a) What is the total amount to be credited to Accrued Payroll in respect of September earnings? (b) If balance day adjustments are performed at the end of each month, what would be the balance in Accrued Payroll account at the close of business on September 30? (c) Suppose that a single journal entry is made on the last day of each month to record the distribution of total labour costs for the month, but that entries are made each Friday to record payment of wages and withholdings Also, PAYG taxes withheld are remitted to the Taxation Department at the end of each month. (i) Show the weekly journal entry (ii) Construct the necessary ledger accounts to show all entries in respect of labour costs during the month of September. The Patel Company has a gross payroll of $8 000 per day Withholdings for PAYG taxies are $2400 per day. There are no other deductions from employees' earnings. The firm works five days per week, Monday to Friday inclusive. The payroll period covers Thursday to Wednesday inclusive and the payroll for the week is paid on the following Friday. Gross payroll consists of $4800 direct labour, $1600 indirect factory labour, $1120 selling expenses and $480 general and administrative expenses each day. The following calendar should be used to answer the questions: (a) What is the total amount to be credited to Accrued Payroll in respect of September earnings? (b) If balance day adjustments are performed at the end of each month, what would be the balance in Accrued Payroll account at the close of business on September 30? (c) Suppose that a single journal entry is made on the last day of each month to record the distribution of total labour costs for the month, but that entries are made each Friday to record payment of wages and withholdings Also, PAYG taxes withheld are remitted to the Taxation Department at the end of each month. (i) Show the weekly journal entry (ii) Construct the necessary ledger accounts to show all entries in respect of labour costs during the month of September