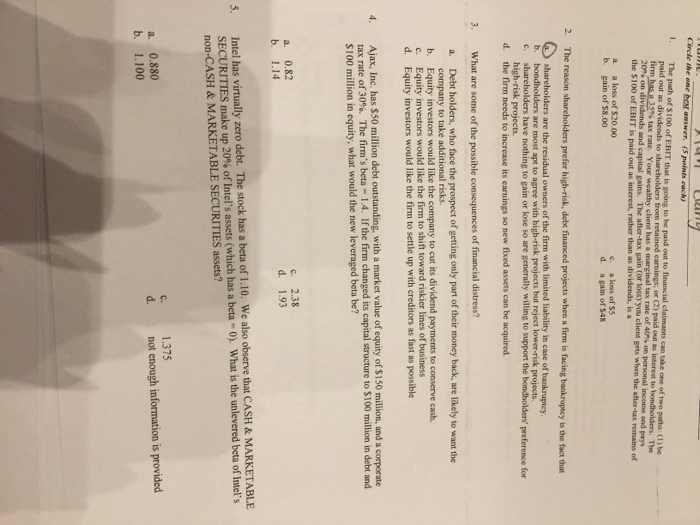

The path of $100 of EBIT that is going to be paid out to financial claimants can take one of two paths. (1) be paid out as dividends to shareholders from retained earnings: or (2) paid out as interest to bondholders. The firm has a 35% tax rate. You wealthy client has a marginal tax rate of 40% on personal income and pays, 20% on dividends and capital gains. The after-tax gain (or loss) you client gets when the after-tax remains of the $100 of EBIt is paid out as interest, rather than as dividends, is a a. a loss of $20,000 b. gain of $8,00 c. a loss of $5 d. a gain of $48 The reason shareholders prefer high-risk, debt financed projects when a firm is facing bankruptcy is the fact that a. shareholders are the residual owners of the firm with limited liability in case of bankruptcy. b. bondholders are most apt to agree with high-risk projects but reject lower-risk projects. c. shareholders have nothing to gain or lose so are generally willing to support the bondholder's preference for high-risk projects. d. the firm needs in increase its earnings so new fixed assets can be acquired. What are some of the possible consequences of financial distress? a. Debt holders, who face the prospect of getting only part of their money back are likely to want the company to take additional risks. b. Equity investors would like the company to cut its dividend payments to conserve cash. c. Equity investors would like the firm to shift toward riskier lines of business d. Equity investors would like the firm to settle up with creditors as fast as possible Ajax, Inc. has $50 million debt outstanding with a market value of equity of $150 million, and a comp orate tax rate of 30%. The firms beta = 1.4. If the firm changed its capital structure of $100 million in debt and $100 million in equity, what would the new leveraged beta be? a. 0.82 b. 1.14 c. 2.38 d. 1.93 Intel virtually zero debt. The stock has a beta of 1.10. We also observe that CASH & MARKETABLE SECURITIES make up 20% of Intel's assets (which has a beta = 0). What is the unlevered beta of Intel's non-CASH & MARKETABLE SECURITIES assets? a. 0.880 b. 1.100 c. 1.375 d. not enough information is provided