Answered step by step

Verified Expert Solution

Question

1 Approved Answer

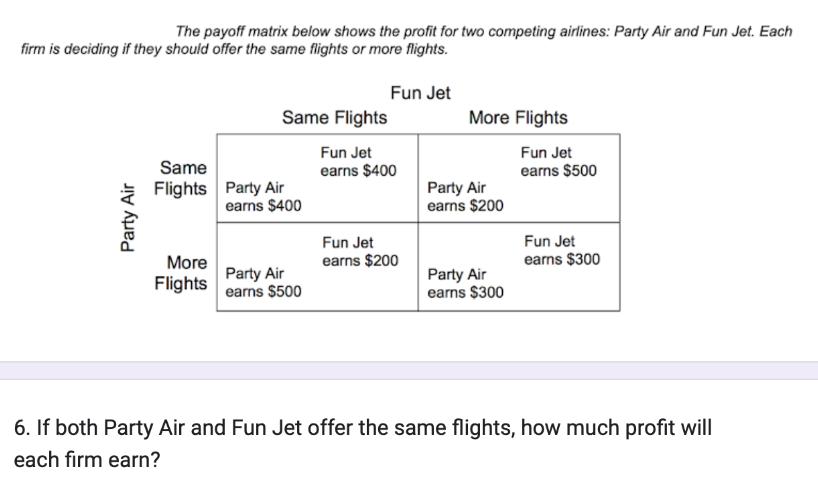

The payoff matrix below shows the profit for two competing airlines: Party Air and Fun Jet. Each firm is deciding if they should offer

The payoff matrix below shows the profit for two competing airlines: Party Air and Fun Jet. Each firm is deciding if they should offer the same flights or more flights. Party Air Fun Jet Same Flights More Flights Same Fun Jet earns $400 Fun Jet earns $500 Flights Party Air earns $400 Party Air earns $200 Fun Jet Fun Jet More earns $200 earns $300 Flights Party Air earns $500 Party Air earns $300 6. If both Party Air and Fun Jet offer the same flights, how much profit will each firm earn? 7. If Party Air offers more flights and Fun Jet offers the same flights, how much profit will Fun Jet earn? Your answer 8. Does Party Air have a dominant strategy? If so, what is it? * Your answer 9. Does Fun Jet have a dominant strategy? If so, what is it? * Your answer 10. Given this information, is there a Nash equilibrium? If so, what will each firm decide to do? Your answer 11. Assume instead that these firms decide to collude to maximize profit. What will each firm decide to do?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

If both Party Air and Fun Jet offer the same flights well look at the cor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started