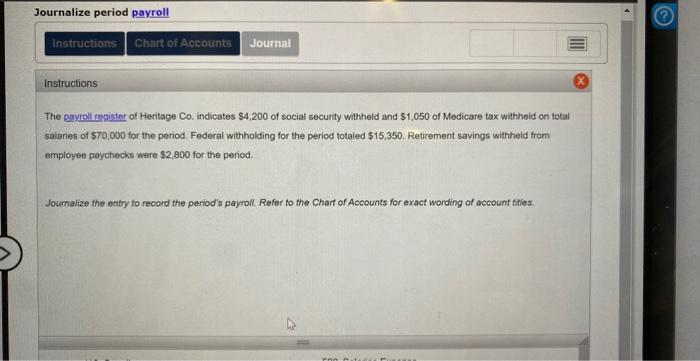

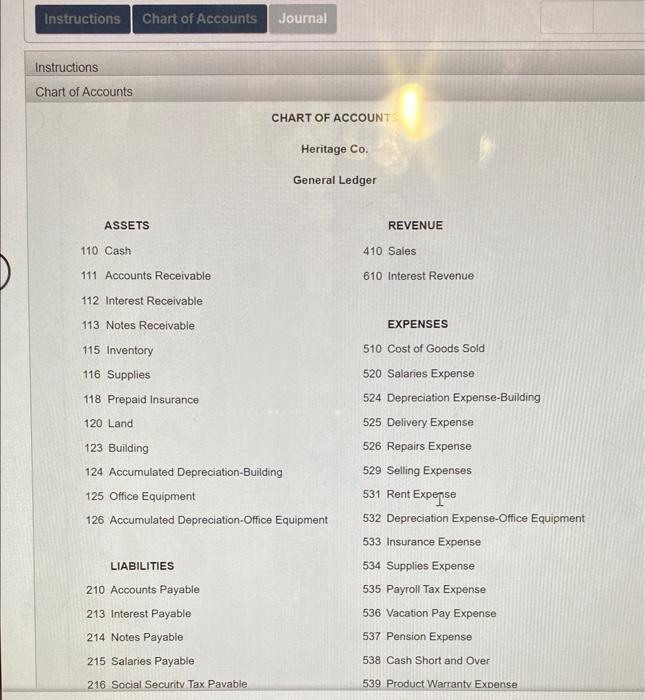

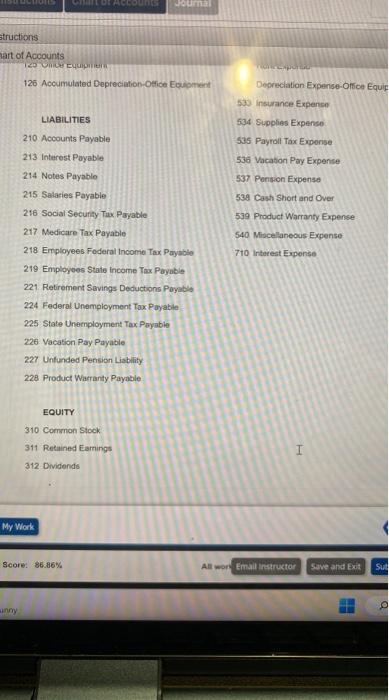

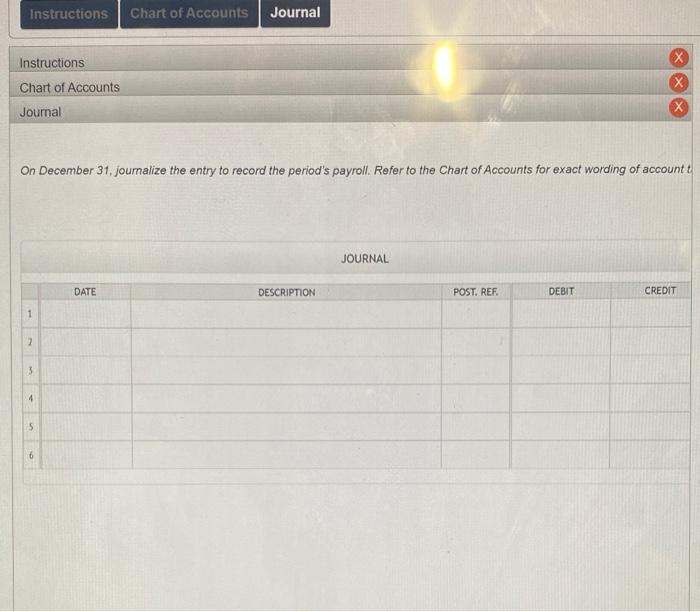

The payroll register of Heritage Co. indicates $4,200 of social security withheld and $1,050 of Medicare tax withheld on total salaries of $70,000 for the period. Federal withholding for the period totaled $15,350. Retirement savings withheld from employee paychecks were $2,800 for the period. Joumalize the entry to record the period's payroll. Refer to the Chart of Accounts for exact wording of account tites. Instructions Chant of Accounts Journal Instructions Chart of Accounts CHART OF ACCOUNT Heritage Co. General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Accounts Receivable 610 Interest Revenue 112 Interest Receivable 113 Notes Receivable EXPENSES 115 Inventory 510 Cost of Goods Sold 116 Supplies 520 Salaries Expense 118 Prepaid Insurance 524 Depreciation Expense-Building 120 Land 525 Delivery Expense 123 Building 526 Repairs Expense 124 Accumulated Depreciation-Building 529 Selling Expenses 125 Office Equipment 531 Rent Expepse 126 Accumulated Depreciation-Office Equipment 532 Depreciation Expense-Office Equipment 533 Insurance Expense LIABILITIES 534 Supplies Expense 210 Accounts Payable 535 Payroll Tax Expense 213 Interest Payable 536 Vacation Pay Expense 214 Notes Payable 537 Pension Expense 215 Salaries Payable 538 Cash Short and Over 216 Social Securitv Tax Pavable 539 Product Warrantv Exbense LIABILITIES 532 insurance Expense 125 Accumulated Depreciation-Otice Equprwent 534 Supplies Expense- 210 Accounts Payable 535 Payroll Tax Experise 213 Interest Payable 536 Vacation Pay Expense 214 Notes Payablo 537 Pension Expense 215 Salasies Payable 539 Cash Short and Over 216 Social Security Tax Poyable 539 Product Warranty Expense 217 Medicare Tax Payable 540 Miscellaneous Expense 218 Employees Foderal Income Tax Payable 710 Interest Exponse 219 Employees State income Tax Payoble 221. Retirement Servings Deductions Payable 224 Federal Unemployment Tax Payabie 225 State Unemployment Tax Payabie 226. Vacation Pay Payable 227 Unfunded Pension Liability 228 Product Wastanty Payable: EQUITY 310 Common Stock 311 Retained Earnings 312. Dividends My Work Score: 86.86% All wor Email neaructor save and Exit On December 31, joumalize the entry to record the period's payroll. Refer to the Chart of Accounts for exact wording of account t