Answered step by step

Verified Expert Solution

Question

1 Approved Answer

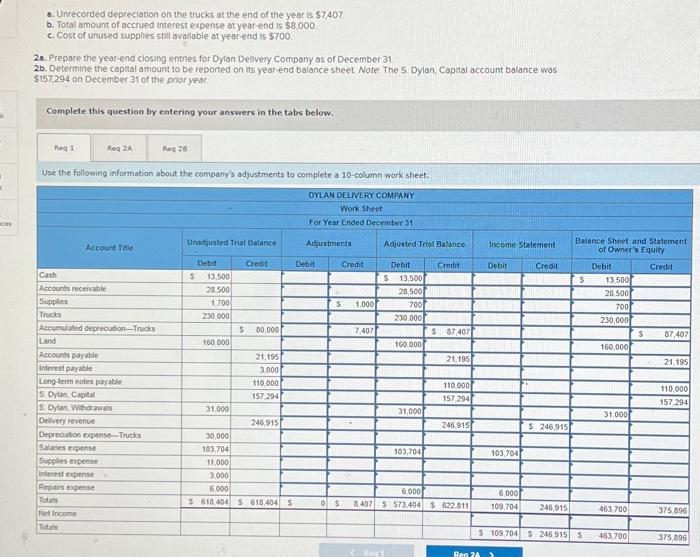

Unrecorded depreciation on the trucks at the end of the year is $7,407. b. Total amount of accrued interest expense at year-end is $8,000. c.

Unrecorded depreciation on the trucks at the end of the year is $7,407. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $700. 28. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $157,294 on December 31 of the prior year. DYLAN DELIVERY COMPANY Work Sheet For Year Ended December 31 Account Title Cash Accounts receivable Supplies Trucks Accumulated depreciation-Trucks Req 28 Land Accounts payable Interest payable Long-term notes payable S. Dylan, Capital S. Dylan, Withdrawals Delivery revenue Depreciation expense-Trucks Salaries expense Supplies expense Interest expense Repairs expense Totals Net Income Totals Unadjusted Trial Balance S Debit 13,500 28,500 1,700 230,000 160,000 31,000 Credit S 80,000 21,195 3,000 110,000 157,294 246,915 30,000 103,704 11,000 3,000 6,000 S 618,404 S 618,404 S Adjustments Debit Credit S 1,000 0 $ 7,407 8,407 Adjusted Trial Balance $ Debit Reg 1 13,500 28,500 700 230,000 FELI $ 87,407 160,000 31,000 103,704 6.000 $ 573,404 Credit 21,195 110,000 157,294 agen 246,915 LAT $ 622,811 Ka Income Statement Reg 24 Debit 103,704 6,000 109,704 Credit $ 246,915 246,915 Balance Sheet and Statement of Owner's Equity Debit Credit S $ 109,704 S 246,915 S 13,500 28,500 700 230,000 160,000 31,000 463,700 463,700 $ 87,407 21,195 110,000 157,294 375,896 375,896 HOTE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started