Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The photo above is the correct answer but I don't understand which functions to use on excel, Please show the equations you used for the

The photo above is the correct answer but I don't understand which functions to use on excel, Please show the equations you used for the excel answers. Thank you!

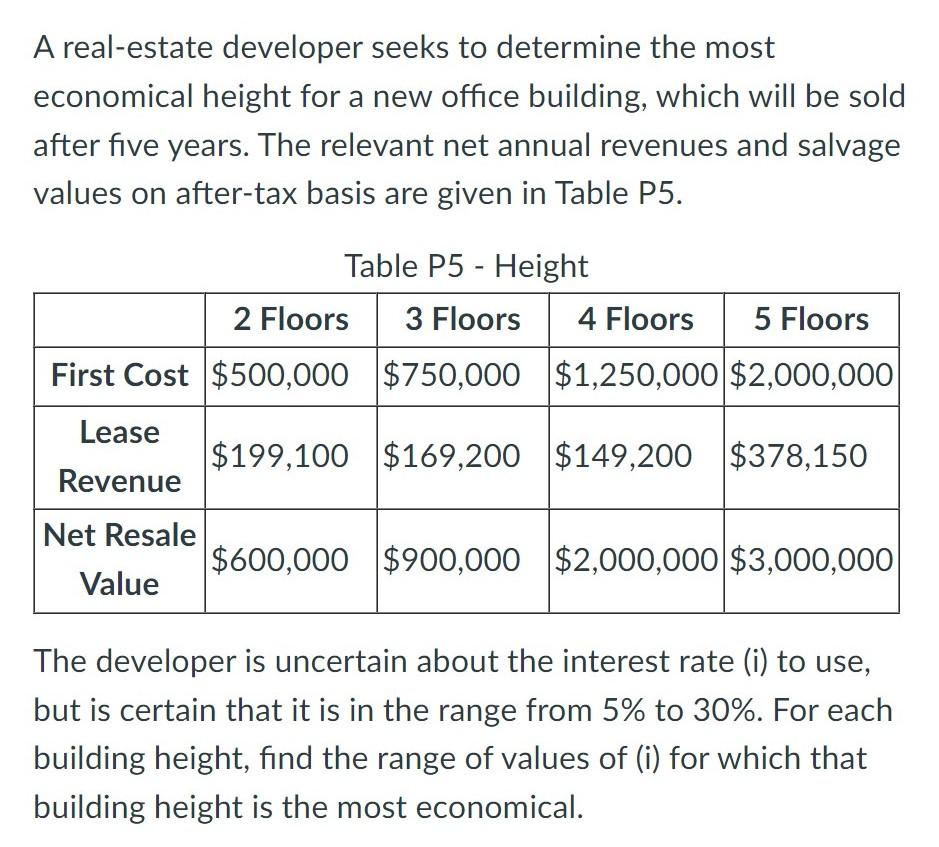

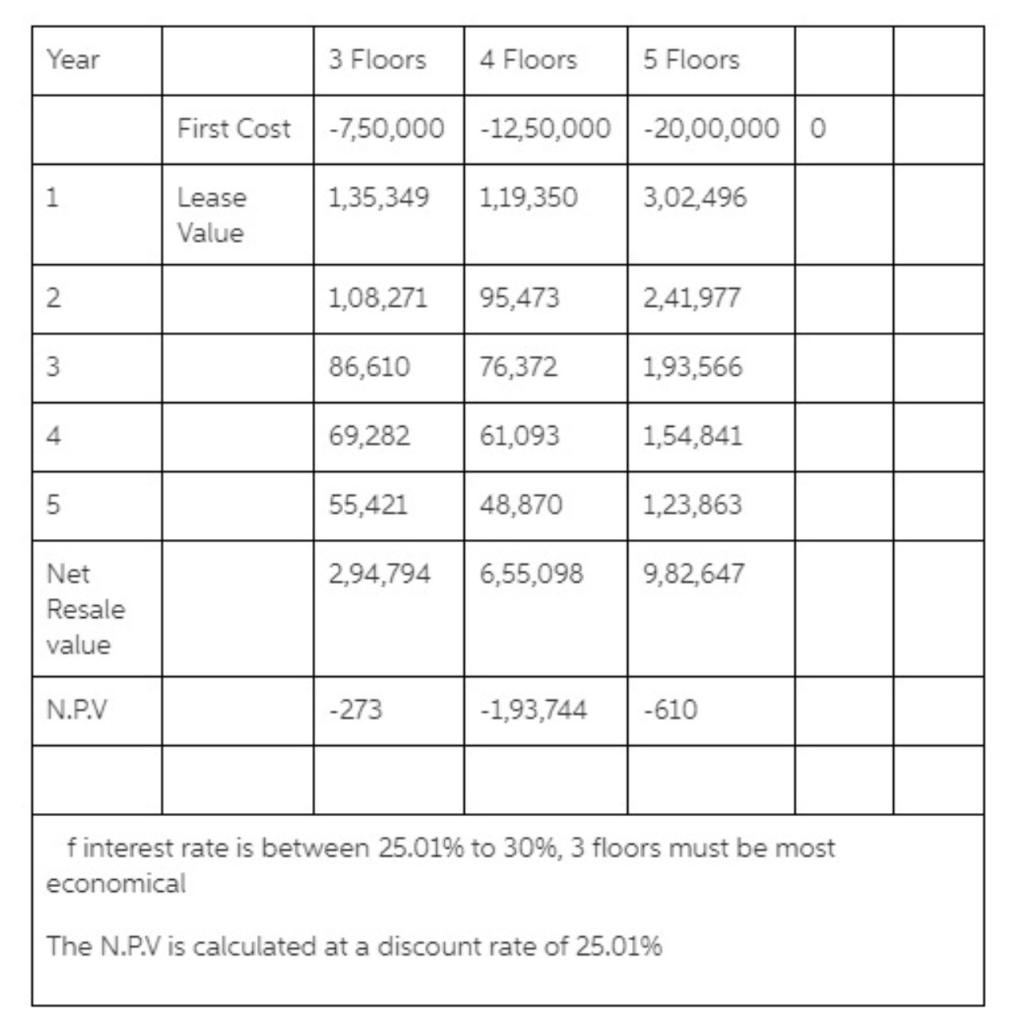

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The relevant net annual revenues and salvage values on after-tax basis are given in Table P5. Table P5 Height - 2 Floors 3 Floors 4 Floors 5 Floors $500,000 $750,000 $1,250,000 $2,000,000 First Cost Lease $199,100 $169,200 $149,200 $378,150 Revenue Net Resale $600,000 $900,000 $2,000,000 $3,000,000 Value The developer is uncertain about the interest rate (i) to use, but is certain that it is in the range from 5% to 30%. For each building height, find the range of values of (i) for which that building height is the most economical. Year 3 Floors 4 Floors 5 Floors -7,50,000 -12,50,000 -20,00,000 0 1 1,35,349 1,19,350 3,02,496 2 1,08,271 95,473 2,41,977 3 86,610 76,372 1,93,566 4 69,282 61,093 1,54,841 5 55,421 48,870 1,23,863 Net 2,94,794 6,55,098 9,82,647 Resale value N.P.V -273 -1,93,744 -610 f interest rate is between 25.01% to 30%, 3 floors must be most economical The N.P.V is calculated at a discount rate of 25.01% First Cost Lease Value A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The relevant net annual revenues and salvage values on after-tax basis are given in Table P5. Table P5 Height - 2 Floors 3 Floors 4 Floors 5 Floors $500,000 $750,000 $1,250,000 $2,000,000 First Cost Lease $199,100 $169,200 $149,200 $378,150 Revenue Net Resale $600,000 $900,000 $2,000,000 $3,000,000 Value The developer is uncertain about the interest rate (i) to use, but is certain that it is in the range from 5% to 30%. For each building height, find the range of values of (i) for which that building height is the most economical. Year 3 Floors 4 Floors 5 Floors -7,50,000 -12,50,000 -20,00,000 0 1 1,35,349 1,19,350 3,02,496 2 1,08,271 95,473 2,41,977 3 86,610 76,372 1,93,566 4 69,282 61,093 1,54,841 5 55,421 48,870 1,23,863 Net 2,94,794 6,55,098 9,82,647 Resale value N.P.V -273 -1,93,744 -610 f interest rate is between 25.01% to 30%, 3 floors must be most economical The N.P.V is calculated at a discount rate of 25.01% First Cost Lease ValueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started