Question

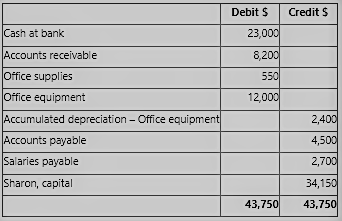

The post-closing trial balance of Sharon Accounting Services as at 30 June 2021 is as follows: The following transactions occurred during the month of July

The post-closing trial balance of Sharon Accounting Services as at 30 June 2021 is as follows:

The following transactions occurred during the month of July 2021.

| July 1 | Paid employee salaries, $2,700 for June. Sharon pays her employees accrued salaries on the first day of each calendar month. |

| 1 | Paid office rent for the month of July, $2,300. |

| 8 | Received $7,200 cash from a client on account. |

| 9 | Purchased office supplies on credit, $2,000 |

| 14 | Paid $3,500 of the accounts payable. |

| 15 | Invoiced customers for accounting services performed, $12,300. |

| 25 | Sharon withdrew capital of $2,250. |

| 31 | Paid $4,200 for a one-year insurance policy. |

Required

a) Journalise the transactions for the month of July 2021. Narrations are required. (16 Marks)

b) Prepare the cash at bank ledger account as at 31 July 2021. (4 Marks)

Debit $ Credits Cash at bank 23,000 Accounts receivable 8,200 550 12,000 Office supplies Office equipment Accumulated depreciation - Office equipment Accounts payable Salaries payable 2,400 4,500 2,700 Sharon, capital 34,150 43,750 43,750Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started