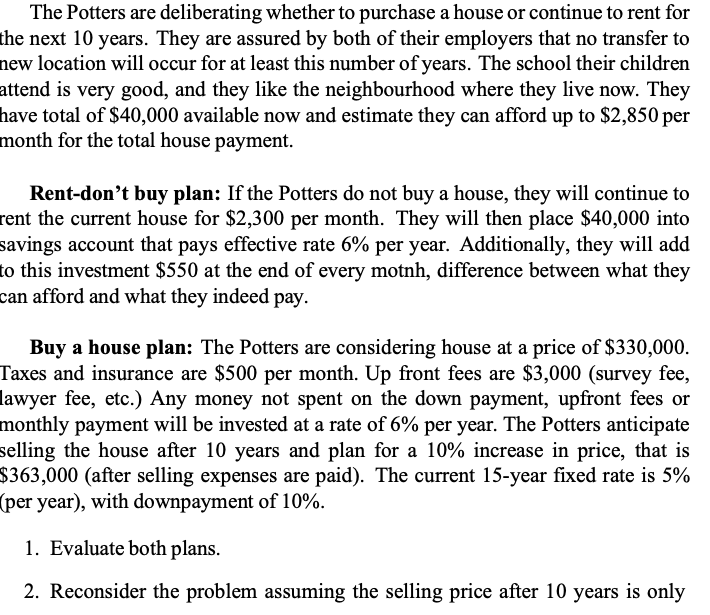

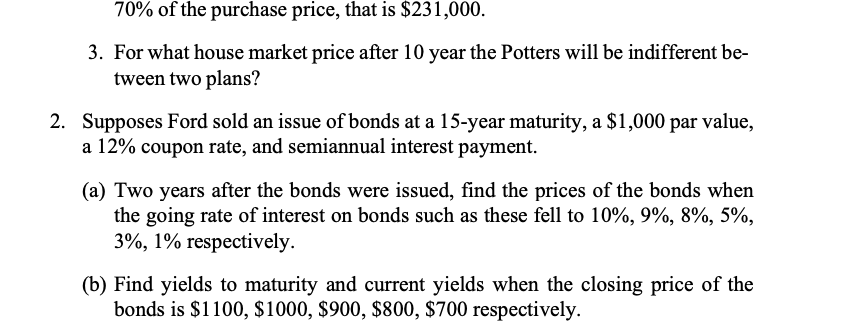

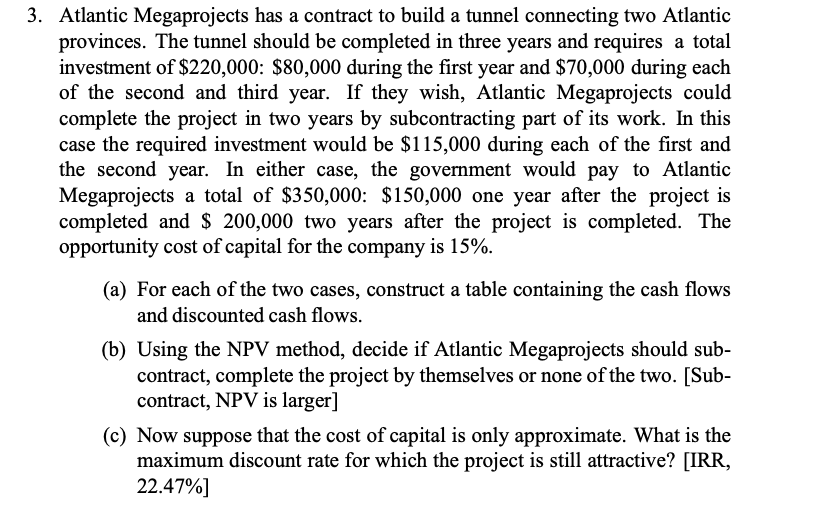

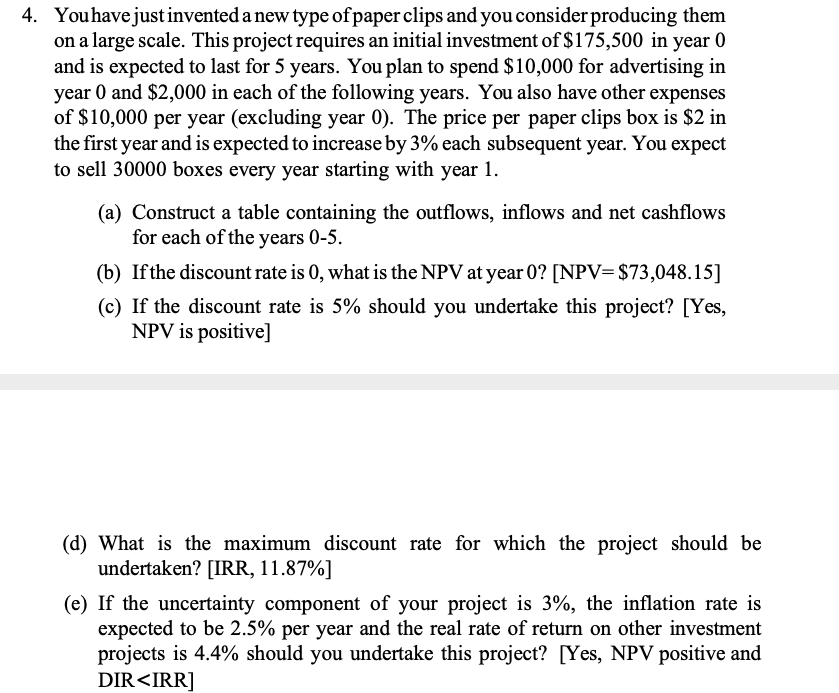

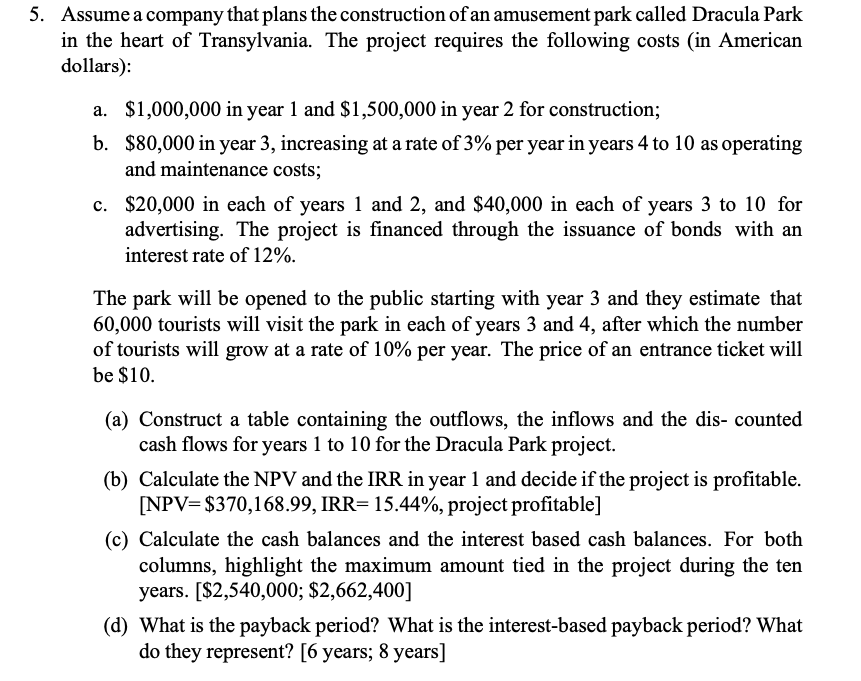

The Potters are deliberating whether to purchase a house or continue to rent for the next 10 years. They are assured by both of their employers that no transfer to new location will occur for at least this number of years. The school their children attend is very good, and they like the neighbourhood where they live now. They have total of $40,000 available now and estimate they can afford up to $2,850 per month for the total house payment. Rent-don't buy plan: If the Potters do not buy a house, they will continue to rent the current house for $2,300 per month. They will then place $40,000 into savings account that pays effective rate 6% per year. Additionally, they will add to this investment $550 at the end of every moth, difference between what they can afford and what they indeed pay. Buy a house plan: The Potters are considering house at a price of $330,000. Taxes and insurance are $500 per month. Up front fees are $3,000 (survey fee, awyer fee, etc.) Any money not spent on the down payment, upfront fees or monthly payment will be invested at a rate of 6% per year. The Potters anticipate selling the house after 10 years and plan for a 10% increase in price, that is $363,000 (after selling expenses are paid). The current 15-year fixed rate is 5% (per year), with downpayment of 10%. 1. Evaluate both plans. 2. Reconsider the problem assuming the selling price after 10 years is only70% of the purchase price, that is $231,000. 3. For what house market price after 10 year the Potters will be indifferent be- tween two plans? 2. Supposes Ford sold an issue of bonds at a 15-year maturity, a $1,000 par value, a 12% coupon rate, and semiannual interest payment. (a) Two years after the bonds were issued, nd the prices of the bonds when the going rate of interest on bonds such as these fell to 10%, 9%, 8%, 5%, 3%, 1% respectively. (b) Find yields to maturity and current yields when the closing price of the bonds is $1100, $1000, $900, $800, $700 respectively. 3. Atlantic Megaprojects has a contract to build a tunnel connecting two Atlantic provinces. The tunnel should be completed in three years and requires a total investment of $220,000: $80,000 during the rst year and $70,000 during each of the second and third year. If they wish, Atlantic Megaprojects could complete the project in two years by subcontracting part of its work. In this case the required investment would be $115,000 during each of the rst and the second year. In either case, the government would pay to Atlantic Megaprojects a total of $350,000: $150,000 one year aer the project is completed and $ 200,000 two years after the project is completed. The Opportunity cost of capital for the company is 15%. (a) For each of the two cases, construct a table containing the cash ows and discounted cash ows. (b) Using the NP'vr method, decide if Atlantic Megaprojects should sub- contract, complete the project by themselves or none of the two. [Sub- contract, NPV is larger] (c) Now suppose that the cost of capital is only approximate. What is the maximum discount rate for which the project is still attractive? [IRR, 22-47%] 4. You have just invented a new type of paper clips and you consider producing them on a large scale. This project requires an initial investment of $175,500 in year 0 and is expected to last for 5 years. You plan to spend $10,000 for advertising in year 0 and $2,000 in each of the following years. You also have other expenses of $10,000 per year (excluding year 0). The price per paper clips box is $2 in the first year and is expected to increase by 3% each subsequent year. You expect to sell 30000 boxes every year starting with year 1. (a) Construct a table containing the outflows, inflows and net cashflows for each of the years 0-5. (b) If the discount rate is 0, what is the NPV at year 0? [NPV=$73,048.15] (c) If the discount rate is 5% should you undertake this project? [Yes, NPV is positive] (d) What is the maximum discount rate for which the project should be undertaken? [IRR, 11.87%] (e) If the uncertainty component of your project is 3%, the inflation rate is expected to be 2.5% per year and the real rate of return on other investment projects is 4.4% should you undertake this project? [Yes, NPV positive and DIR