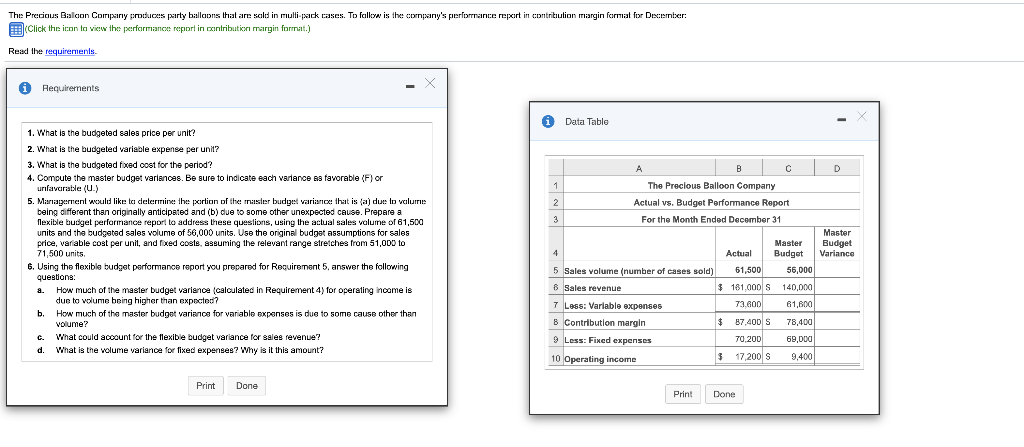

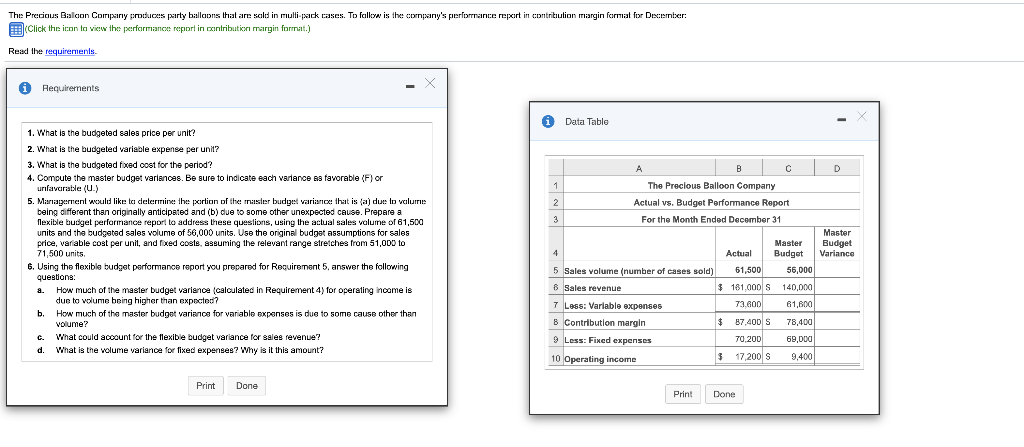

The Precious Balcon Company produces party balloons that are sold in multipack cases. To follow is the company's performance report in contribution margin format for December: Click the icon to view the performance report in contribution margin form.it.) Read the requirements Requirements i Data Table D 1 A B The Precious Balloon Company Actual vs. Budget Performance Report For the Month Ended December 31 2 3 1. What is the budgeted sales price per unit? 2. What is the budgeted variable expense per unit? 3. What is the budgeted fixed cost for the period? 4. Compute the master budget variances. Be sure to indicate each variance as favorable (F) or unfavorable (U.) 5. Management would like to determine the portion of the master budget variance that is (a) due to valuirie being offerent than originally anticipated and (b) due to some other unexpected cause. Prepare a Nexible budget performance report to address these questions, using the actual sales volume of 61,500 units and the budgeted sales volume of 56,000 units. Use the original budget assumptions for sales price, variable cost per unit, and foxed costs, assuming the relevant range stretches from 51,000 to 71,500 units. 6. Using the flexible budget performance report you prepared for Requirement 5 answer the following questions: . 4) a. How much of the master budget variance calculated in Requirement 4) for operating income is due to volume being higher than expected? b. How much of the master budget variance for variable expenses is due to some cause other than volume? What could account for the flexible budget variance for sales revenue? d. What is the volume variance for fixed expenses? Why is it this amount? Master Budget Variance Master 4 Actual Budget 5 Sales volume (number of cases sold) 61,500 56,000 8 Sales revenue $ 181,000 S 140,000 7 Less: Variable expenses 73.600 61,600 8 8 Contribution margin $ 87.400 78,400 9 Less: Fixed expenses 70,200 69,000 10 Operating income $ 17,200 S 9,400 Print Done Print Done The Precious Balcon Company produces party balloons that are sold in multipack cases. To follow is the company's performance report in contribution margin format for December: Click the icon to view the performance report in contribution margin form.it.) Read the requirements Requirements i Data Table D 1 A B The Precious Balloon Company Actual vs. Budget Performance Report For the Month Ended December 31 2 3 1. What is the budgeted sales price per unit? 2. What is the budgeted variable expense per unit? 3. What is the budgeted fixed cost for the period? 4. Compute the master budget variances. Be sure to indicate each variance as favorable (F) or unfavorable (U.) 5. Management would like to determine the portion of the master budget variance that is (a) due to valuirie being offerent than originally anticipated and (b) due to some other unexpected cause. Prepare a Nexible budget performance report to address these questions, using the actual sales volume of 61,500 units and the budgeted sales volume of 56,000 units. Use the original budget assumptions for sales price, variable cost per unit, and foxed costs, assuming the relevant range stretches from 51,000 to 71,500 units. 6. Using the flexible budget performance report you prepared for Requirement 5 answer the following questions: . 4) a. How much of the master budget variance calculated in Requirement 4) for operating income is due to volume being higher than expected? b. How much of the master budget variance for variable expenses is due to some cause other than volume? What could account for the flexible budget variance for sales revenue? d. What is the volume variance for fixed expenses? Why is it this amount? Master Budget Variance Master 4 Actual Budget 5 Sales volume (number of cases sold) 61,500 56,000 8 Sales revenue $ 181,000 S 140,000 7 Less: Variable expenses 73.600 61,600 8 8 Contribution margin $ 87.400 78,400 9 Less: Fixed expenses 70,200 69,000 10 Operating income $ 17,200 S 9,400 Print Done Print Done