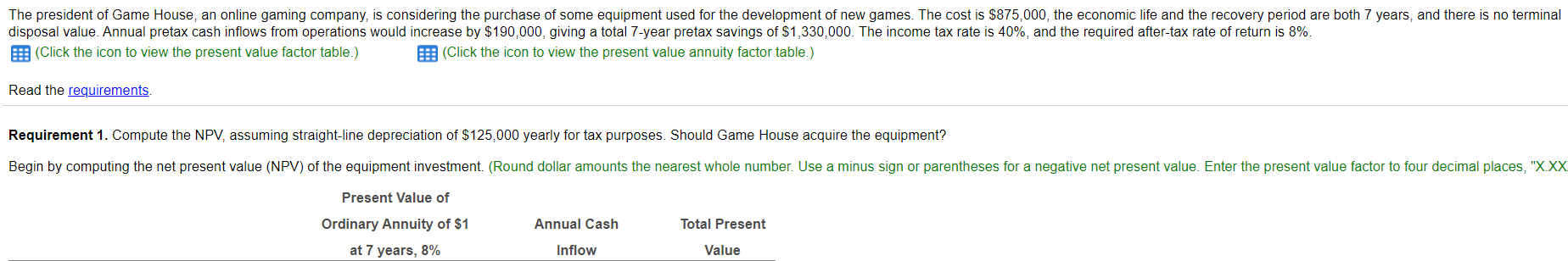

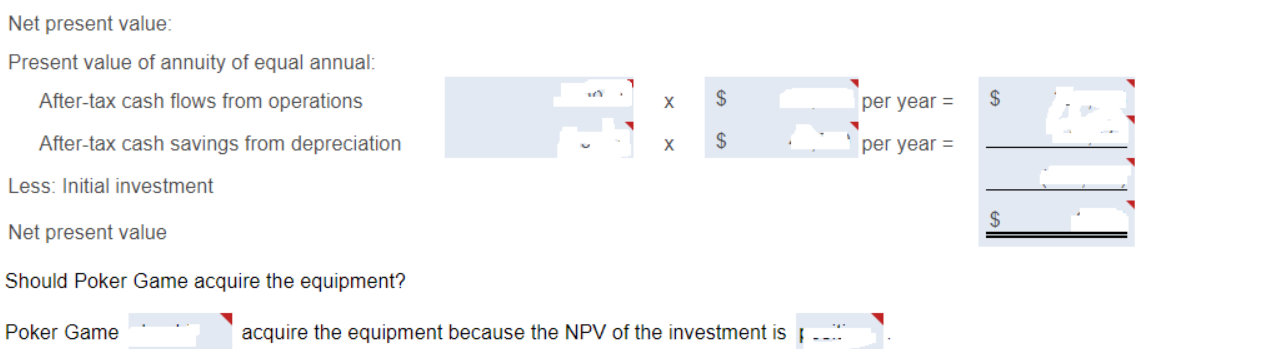

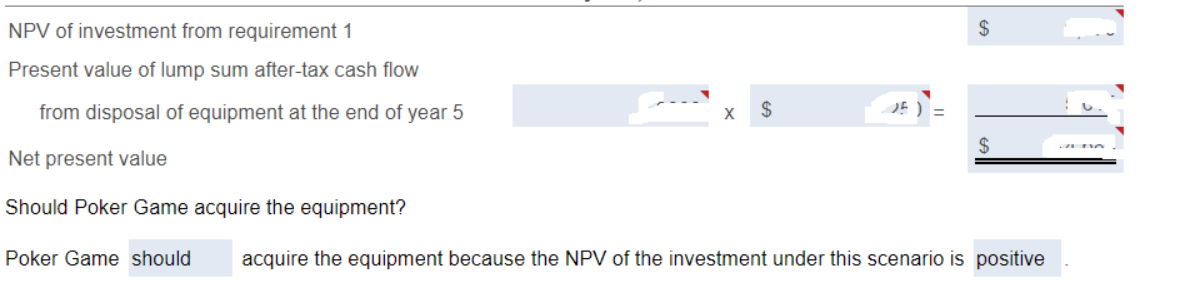

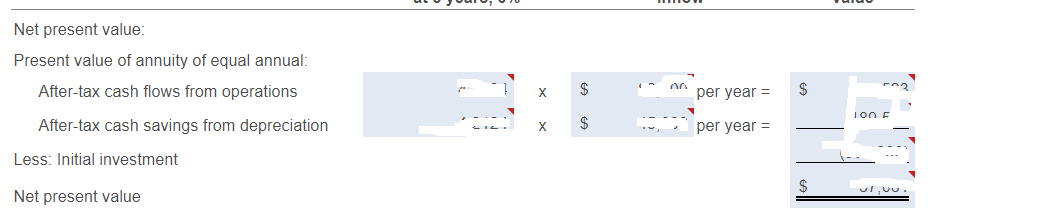

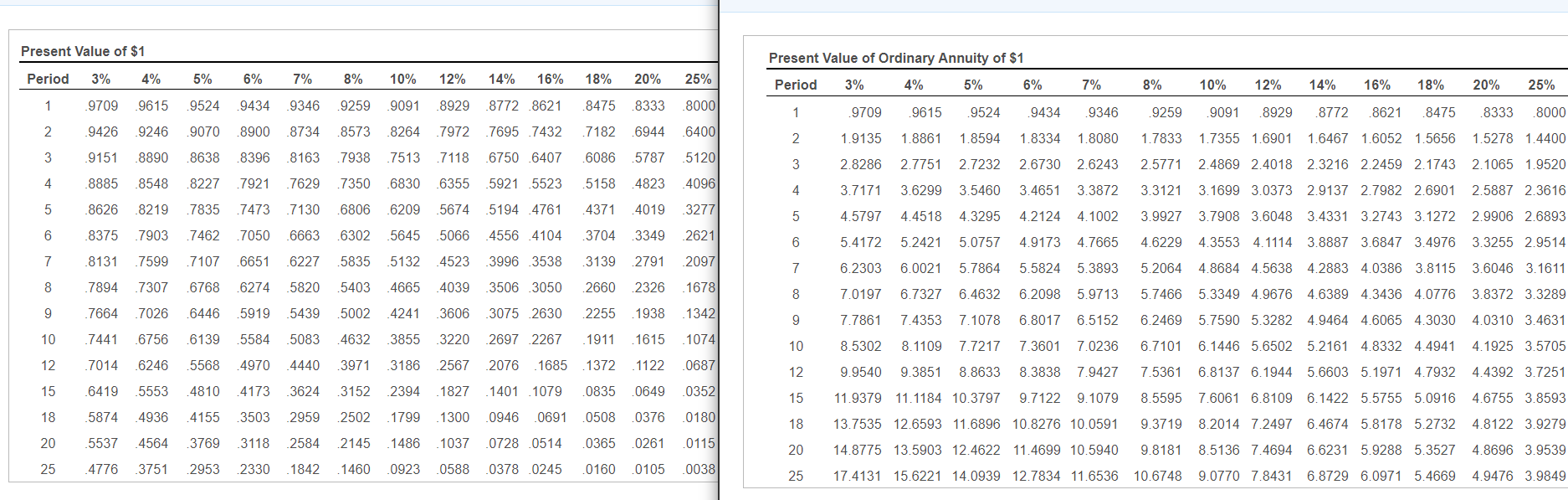

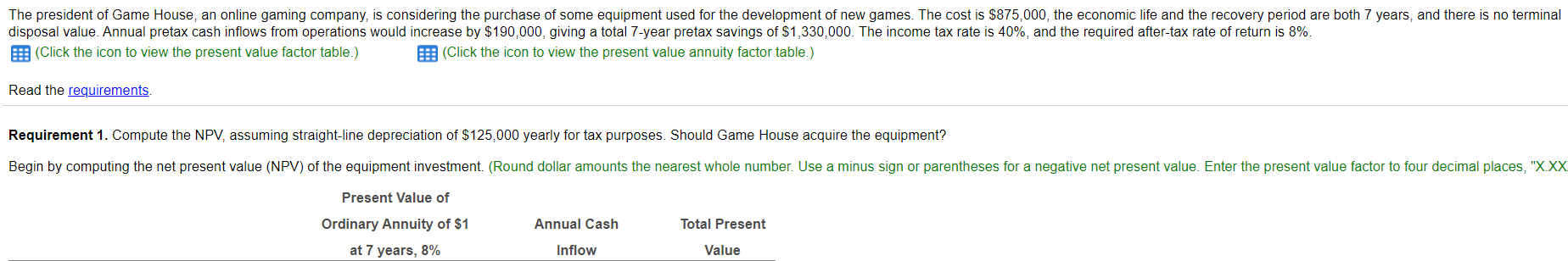

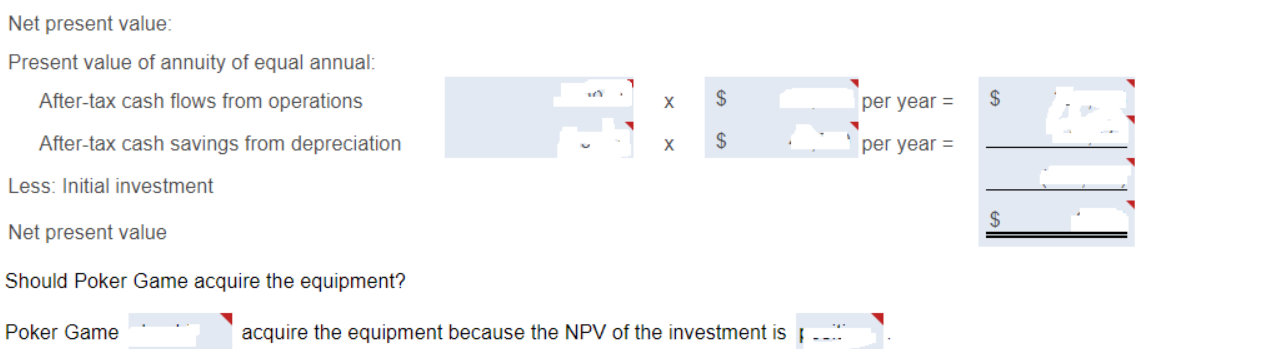

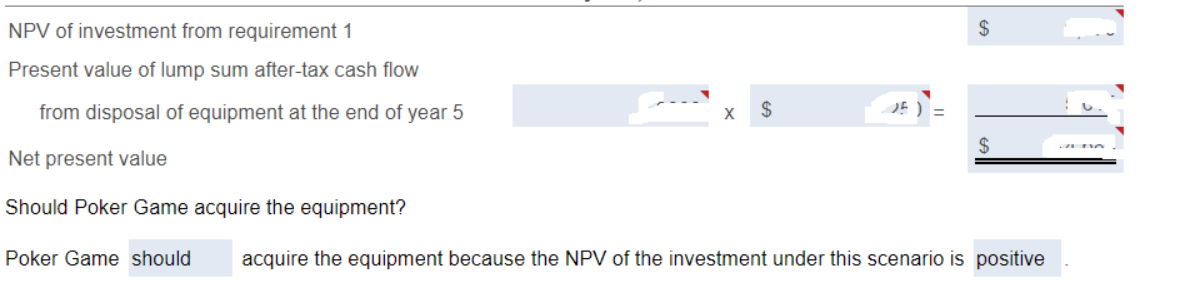

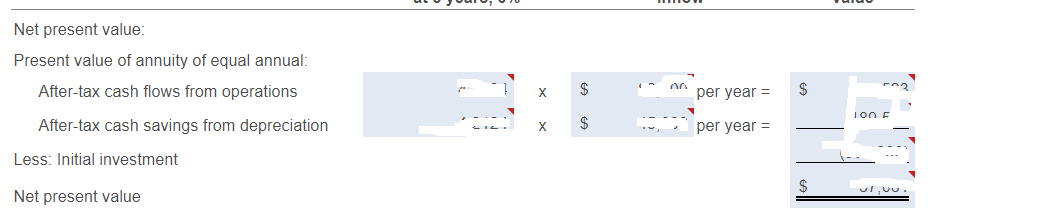

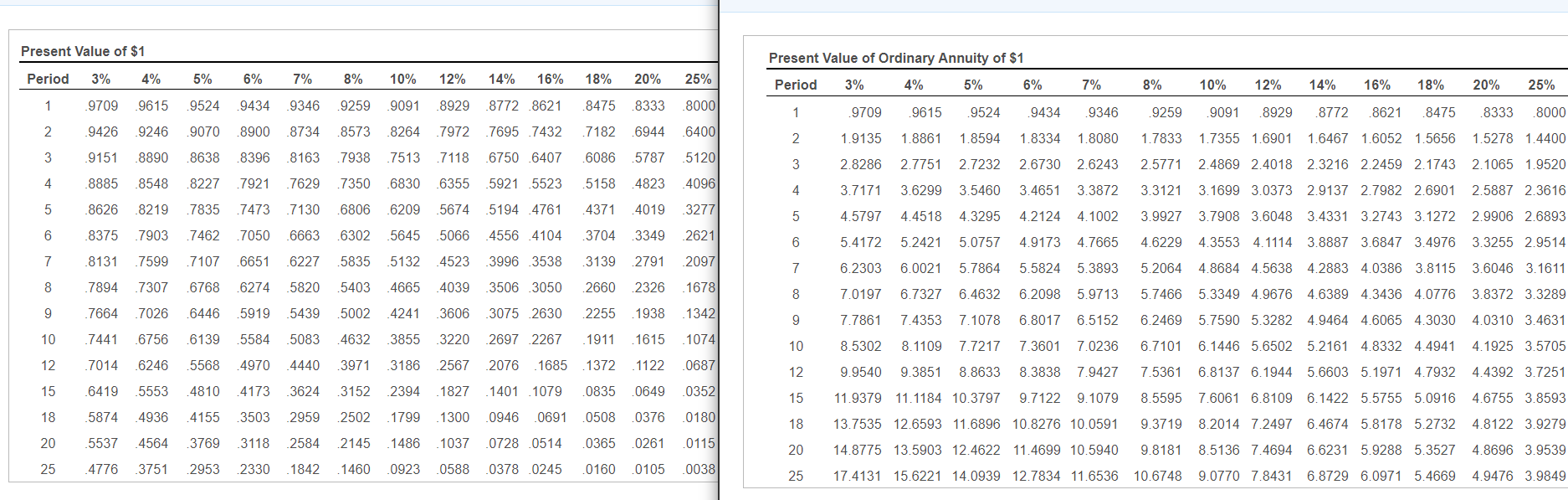

The president of Game House, an online gaming company, is considering the purchase of some equipment used for the development of new games. The cost is $875,000, the economic life and the recovery period are both 7 years, and there is no terminal disposal value. Annual pretax cash inflows from operations would increase by $190,000, giving a total 7-year pretax savings of $1,330,000. The income tax rate is 40%, and the required after-tax rate of return is 8%. (Click the icon to view the present value factor table.) E (Click the icon to view the present value annuity factor table.) Read the requirements Requirement 1. Compute the NPV, assuming straight-line depreciation of $125,000 yearly for tax purposes. Should Game House acquire the equipment? Begin by computing the net present value (NPV) of the equipment investment. (Round dollar amounts the nearest whole number. Use a minus sign or parentheses for a negative net present value. Enter the present value factor to four decimal places, "X.XX Present Value of Annual Cash Total Present Ordinary Annuity of $1 at 7 years, 8% Inflow Value Net present value: Present value of annuity of equal annual: After-tax cash flows from operations X $ per year = $ After-tax cash savings from depreciation $ per year = Less: Initial investment $ Net present value Should Poker Game acquire the equipment? Poker Game acquire the equipment because the NPV of the investment is -- NPV of investment from requirement 1 Present value of lump sum after-tax cash flow from disposal of equipment at the end of year 5 $ 5 Net present value Should Poker Game acquire the equipment? Poker Game should acquire the equipment because the NPV of the investment under this scenario is positive Net present value: Present value of annuity of equal annual: After-tax cash flows from operations X $ * per year = ION After-tax cash savings from depreciation X $ per year = Less: Initial investment I,UU. Net present value Present Value of $1 Present Value of Ordinary Annuity of $1 Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 25% Period 3% 4% 5% 6% 7% 8% 10% 12% 14% 16% 18% 20% 25% 1 9709 9615 9524 9434 9346 9259 9091 8929 8772 8621 8475 8333 8000 1 .9709 .9615 9524 9434 9346 9259 9091 8929 8772 8621 .8475 .8333 8000 2 9426 9246 9070 8900 .8734 .8573 .8264 .7972 7695 7432 7182 .6944 6400 2 1.9135 1.8861 1.8594 1.8334 1.8080 1.7833 1.7355 1.6901 1.6467 1.6052 1.5656 1.5278 1.4400 3 9151 8890 8638 8396 8163 7938 7513 7118 6750 6407 6086 5787 5120 3 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 1.9520 4 8885 8548 8227 7921 .7629 7350 6830 6355 5921 5523 5158 4823 4096 4 3.7171 3.6299 3.5460 3.4651 3.3872 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 2.3616 5 8626 8219 7835 7473 .7130 6806 6209 5674 5194 4761 4371 4019 3277 5 4.5797 4.4518 4.3295 4.2124 4.1002 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 2.6893 6 .8375 7903 .7462 .7050 6663 6302 5645 5066 4556 4104 3704 3349 2621 6 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 2.9514 7 8131 .7599 .7107 6651 .6227 .5835 5132 4523 3996 3538 3139 2791 2097 7 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 4.8684 4.5638 4.2883 4.0386 3.8115 3.6046 3.1611 8 .7894 .7307 .6768 6274 5820 5403 4665 4039 3506 3050 2660 2326 1678 8 7.0197 6.7327 6.4632 6.2098 5.9713 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 3.3289 9 -7664 .7026 .6446 5919 5439 5002 4241 3606 3075 2630 2255 1938 1342 9 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 3.4631 10 .7441 .6756 .6139 5584 5083 4632 3855 3220 2697 2267 1911 1615 1074 10 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.1446 5.6502 5.2161 4.8332 4.4941 4.1925 3.5705 12 .7014 6246 5568 4970 4440 3971 3186 2567 2076 . 1685 .1372 1122 0687 12 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 3.7251 15 6419 5553 4810 4173 3624 3152 2394 . 1827 1401 1079 0835 0649 0352 15 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 7.6061 6.8109 6.1422 5.5755 5.0916 4.6755 3.8593 18 5874 4936 4155 3503 2959 2502 1799 1300 0946 0691 0508 .0376 0180 18 13.7535 12.6593 11.6896 10.8276 10.0591 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 3.9279 20 5537 4564 3769 3118 2584 2145 1486 1037 0728 0514 0365 0261 0115 20 14.8775 13.5903 12.4622 11.4699 10.5940 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 3.9539 25 4776 3751 2953 2330 1842 .1460 0923 0588 0378 .0245 .0160 0105 0038 25 17.4131 15.6221 14.0939 12.7834 11.6536 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 3.9849