The previous question was provided to allow for comparison with expected market returns but i needed help with 23

The previous question was provided to allow for comparison with expected market returns but i needed help with 23

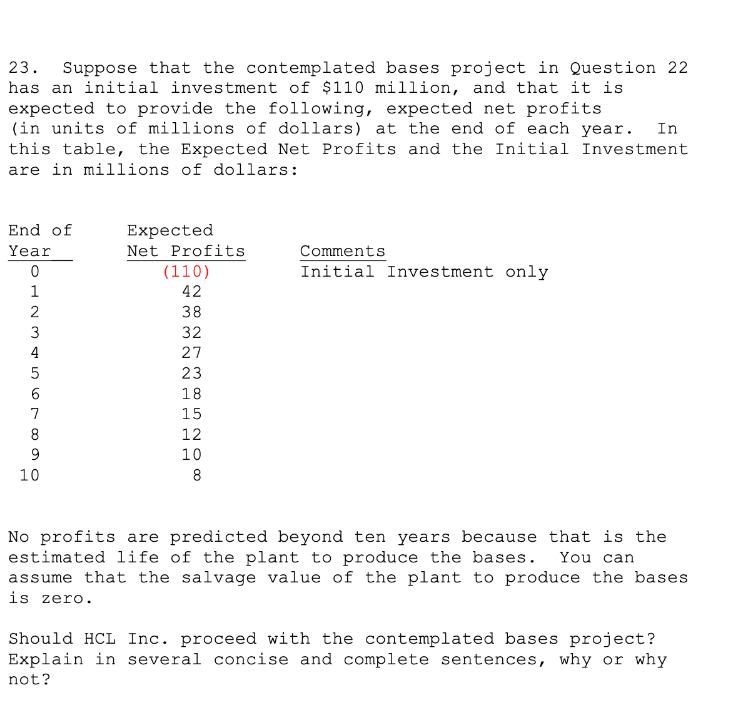

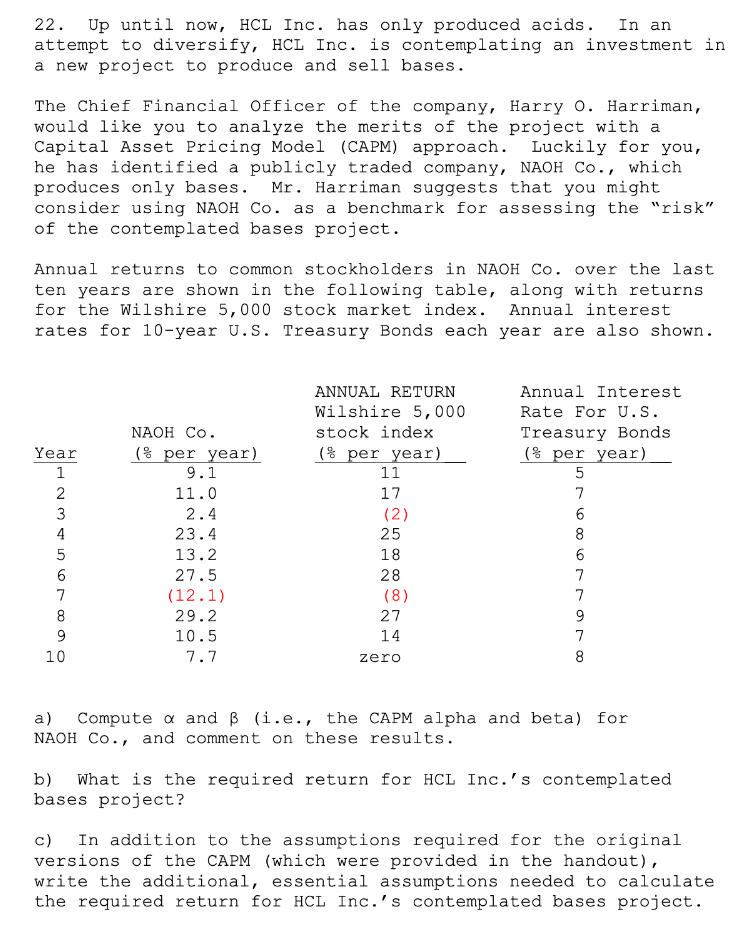

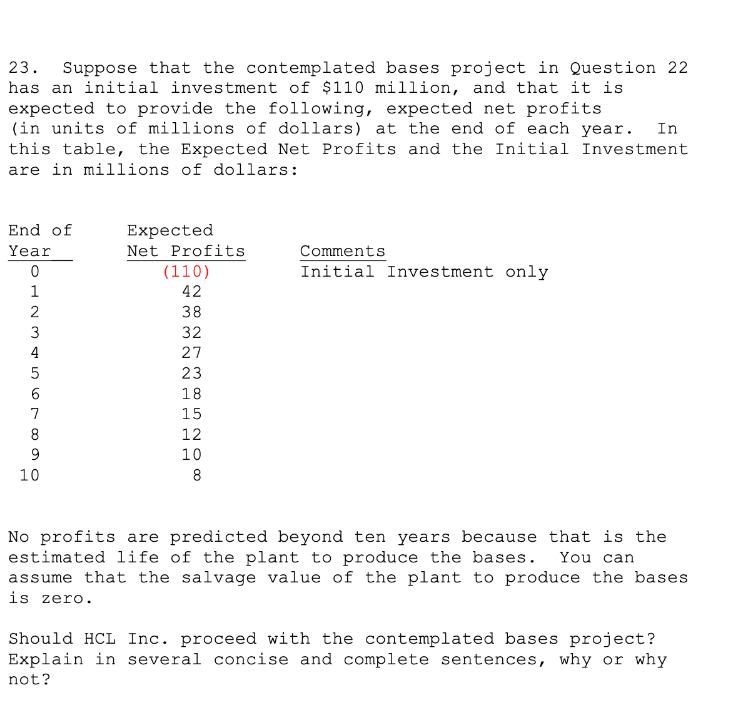

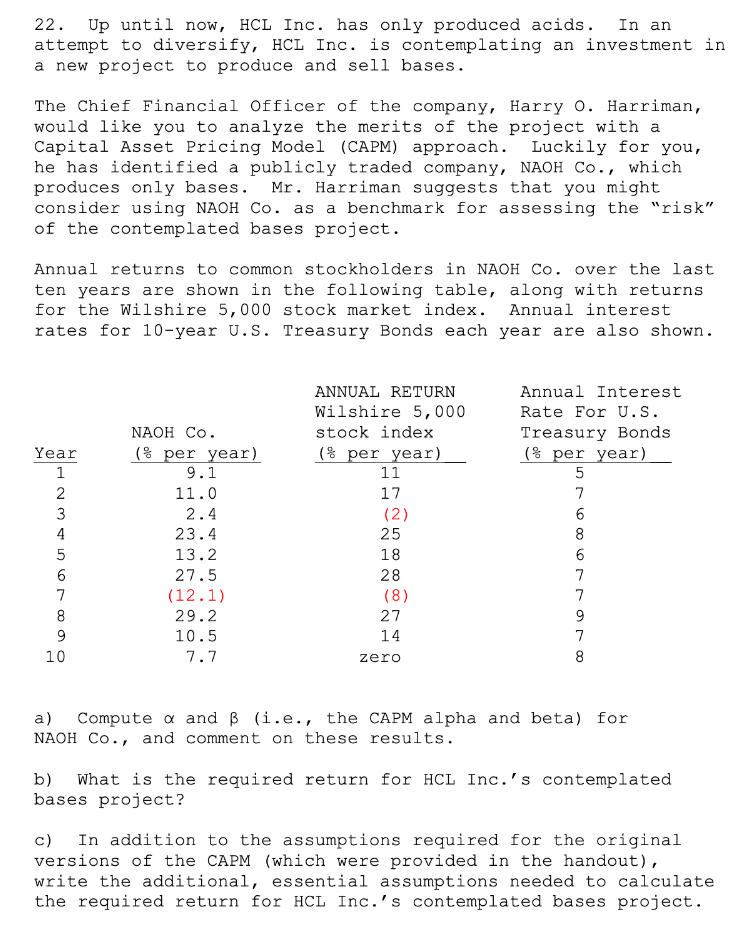

23. Suppose that the contemplated bases project in question 22 has an initial investment of $110 million, and that it is expected to provide the following, expected net profits (in units of millions of dollars) at the end of each year. In this table, the Expected Net Profits and the Initial Investment are in millions of dollars: InitialInvestmentonlyComments No profits are predicted beyond ten years because that is the estimated life of the plant to produce the bases. You can assume that the salvage value of the plant to produce the bases is zero. Should HCL Inc. proceed with the contemplated bases project? Explain in several concise and complete sentences, why or why not? 22. Up until now, HCL Inc. has only produced acids. In an attempt to diversify, HCL Inc. is contemplating an investment in a new project to produce and sell bases. The Chief Financial officer of the company, Harry o. Harriman, would like you to analyze the merits of the project with a Capital Asset Pricing Model (CAPM) approach. Luckily for you, he has identified a publicly traded company, NAOH Co., which produces only bases. Mr. Harriman suggests that you might consider using NAOH Co. as a benchmark for assessing the "risk" of the contemplated bases project. Annual returns to common stockholders in NAOH Co. over the last ten years are shown in the following table, along with returns for the Wilshire 5,000 stock market index. Annual interest rates for 10-year U.S. Treasury Bonds each year are also shown. a) Compute and (i.e., the CAPM alpha and beta) for NAOH Co., and comment on these results. b) What is the required return for HCL Inc.'s contemplated bases project? c) In addition to the assumptions required for the original versions of the CAPM (which were provided in the handout), write the additional, essential assumptions needed to calculate the required return for HCL Inc.'s contemplated bases project. 23. Suppose that the contemplated bases project in question 22 has an initial investment of $110 million, and that it is expected to provide the following, expected net profits (in units of millions of dollars) at the end of each year. In this table, the Expected Net Profits and the Initial Investment are in millions of dollars: InitialInvestmentonlyComments No profits are predicted beyond ten years because that is the estimated life of the plant to produce the bases. You can assume that the salvage value of the plant to produce the bases is zero. Should HCL Inc. proceed with the contemplated bases project? Explain in several concise and complete sentences, why or why not? 22. Up until now, HCL Inc. has only produced acids. In an attempt to diversify, HCL Inc. is contemplating an investment in a new project to produce and sell bases. The Chief Financial officer of the company, Harry o. Harriman, would like you to analyze the merits of the project with a Capital Asset Pricing Model (CAPM) approach. Luckily for you, he has identified a publicly traded company, NAOH Co., which produces only bases. Mr. Harriman suggests that you might consider using NAOH Co. as a benchmark for assessing the "risk" of the contemplated bases project. Annual returns to common stockholders in NAOH Co. over the last ten years are shown in the following table, along with returns for the Wilshire 5,000 stock market index. Annual interest rates for 10-year U.S. Treasury Bonds each year are also shown. a) Compute and (i.e., the CAPM alpha and beta) for NAOH Co., and comment on these results. b) What is the required return for HCL Inc.'s contemplated bases project? c) In addition to the assumptions required for the original versions of the CAPM (which were provided in the handout), write the additional, essential assumptions needed to calculate the required return for HCL Inc.'s contemplated bases project

The previous question was provided to allow for comparison with expected market returns but i needed help with 23

The previous question was provided to allow for comparison with expected market returns but i needed help with 23