Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The price of an asset is currently 100. The profit for a bull spread created by a purchased European call on the asset with

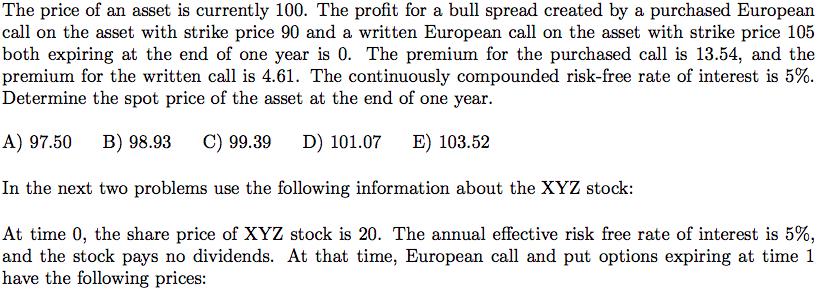

The price of an asset is currently 100. The profit for a bull spread created by a purchased European call on the asset with strike price 90 and a written European call on the asset with strike price 105 both expiring at the end of one year is 0. The premium for the purchased call is 13.54, and the premium for the written call is 4.61. The continuously compounded risk-free rate of interest is 5%. Determine the spot price of the asset at the end of one year. A) 97.50 B) 98.93 C) 99.39 D) 101.07 E) 103.52 In the next two problems use the following information about the XYZ stock: At time 0, the share price of XYZ stock is 20. The annual effective risk free rate of interest is 5%, and the stock pays no dividends. At that time, European call and put options expiring at time 1 have the following prices:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Step 2 Step 3 It is given that a bull spread has been created as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started