Question

The price of oil can fluctuate dramatically based on the economic principles of supply and demand. As new economic powers emerge, such as China and

The price of oil can fluctuate dramatically based on the economic principles of supply and demand. As new economic powers emerge, such as China and India, the demand for oil continues to increase. Add the recent political instability of major oil exporting nations in the Middle East, and it is no wonder that oil prices are volatile.

As a manager it is important to understand that the unpredictable oil market can dramatically affect profit margins. Most companies, especially those extremely dependent on oil, hedge this risk by purchasing oil futures to lock in prices. This makes it easier to predict future cash flows and eliminates the risk of uncertainty in the oil markets.

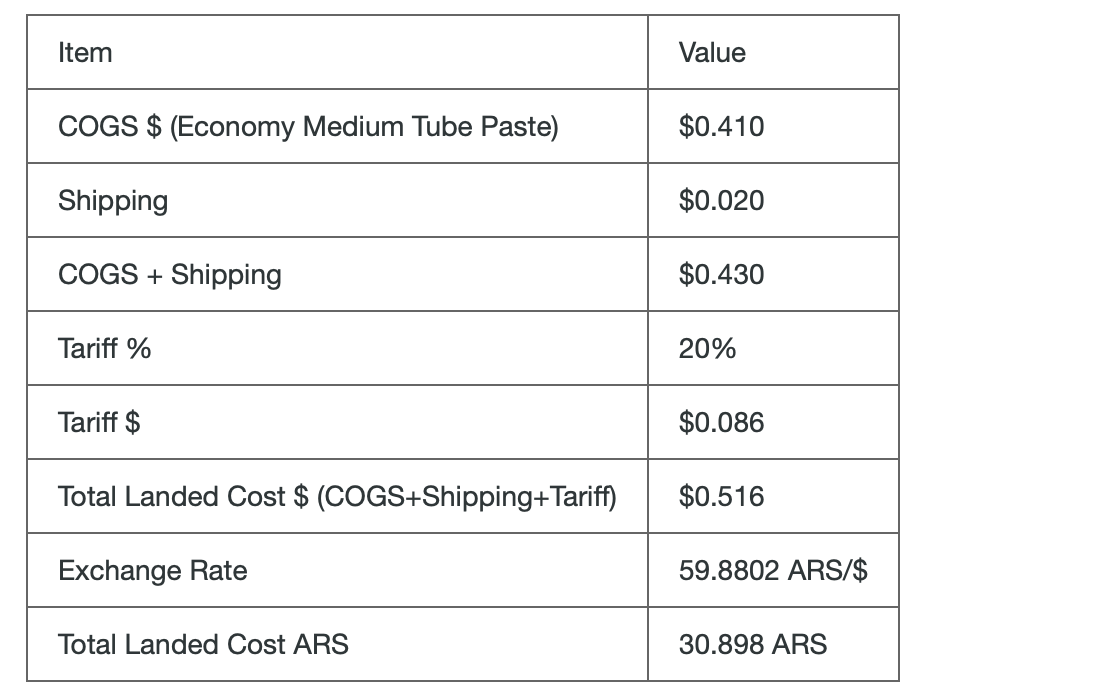

When oil prices increase, the cost of shipping and landing goods in foreign countries often increase as well. Allstar is selling toothpaste in Argentina that is sourced from your Peru plant. Due to a spike in crude oil prices and speculation of future increases, your shipping costs are expected to double next period (increase 100%). Consider a particular SKU you sell in Argentina, the Economy Medium Tube of Paste (EMTP). The EMTP currently has revenue per unit for Allstar of 46.35 ARS (this revenue per unit is the MSRP less allowance and average channel volume discount). Allstar currently sells 1,000,000 EMTP units per year in Argentina.

Per unit production, shipping, and tariff costs from the Peru plant to Argentina for the previous period are

The exchange rate is 59.8802 ARS/$ (Argentina Pesos per U.S. Dollar).

First, what is the total landed cost (in ARS) for this SKU after the change in shipping costs? ARS

Second, consider how, if at all, you should change the SKU price in Argentina.

If Allstar maintains the local price for their toothpaste (price to market), what will be the total gross margin (in ARS)? ARS

What should Allstar raise the local price to (in ARS) if they want to cover the increased costs, maintaining the same 33.338% gross margin (pass through)? ARS

Assuming each percentage increase in price corresponds to an equal percentage decrease in volume, what will the sales volume be at the higher price? units

For the higher price, what will be the total gross margin (in ARS)? ARS

Which pricing strategy will yield the highest total gross margin (ARS)? Price to market or pass through

\begin{tabular}{|l|l|} \hline Item & Value \\ \hline COGS \$ (Economy Medium Tube Paste) & $0.410 \\ \hline Shipping & $0.020 \\ \hline COGS + Shipping & $0.430 \\ \hline Tariff \% & 20% \\ \hline Tariff \$ & $0.086 \\ \hline Total Landed Cost \$ (COGS+Shipping+Tariff) & $0.516 \\ \hline Exchange Rate & 59.8802ARS/$ \\ \hline Total Landed Cost ARS & 30.898ARS \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Item & Value \\ \hline COGS \$ (Economy Medium Tube Paste) & $0.410 \\ \hline Shipping & $0.020 \\ \hline COGS + Shipping & $0.430 \\ \hline Tariff \% & 20% \\ \hline Tariff \$ & $0.086 \\ \hline Total Landed Cost \$ (COGS+Shipping+Tariff) & $0.516 \\ \hline Exchange Rate & 59.8802ARS/$ \\ \hline Total Landed Cost ARS & 30.898ARS \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started