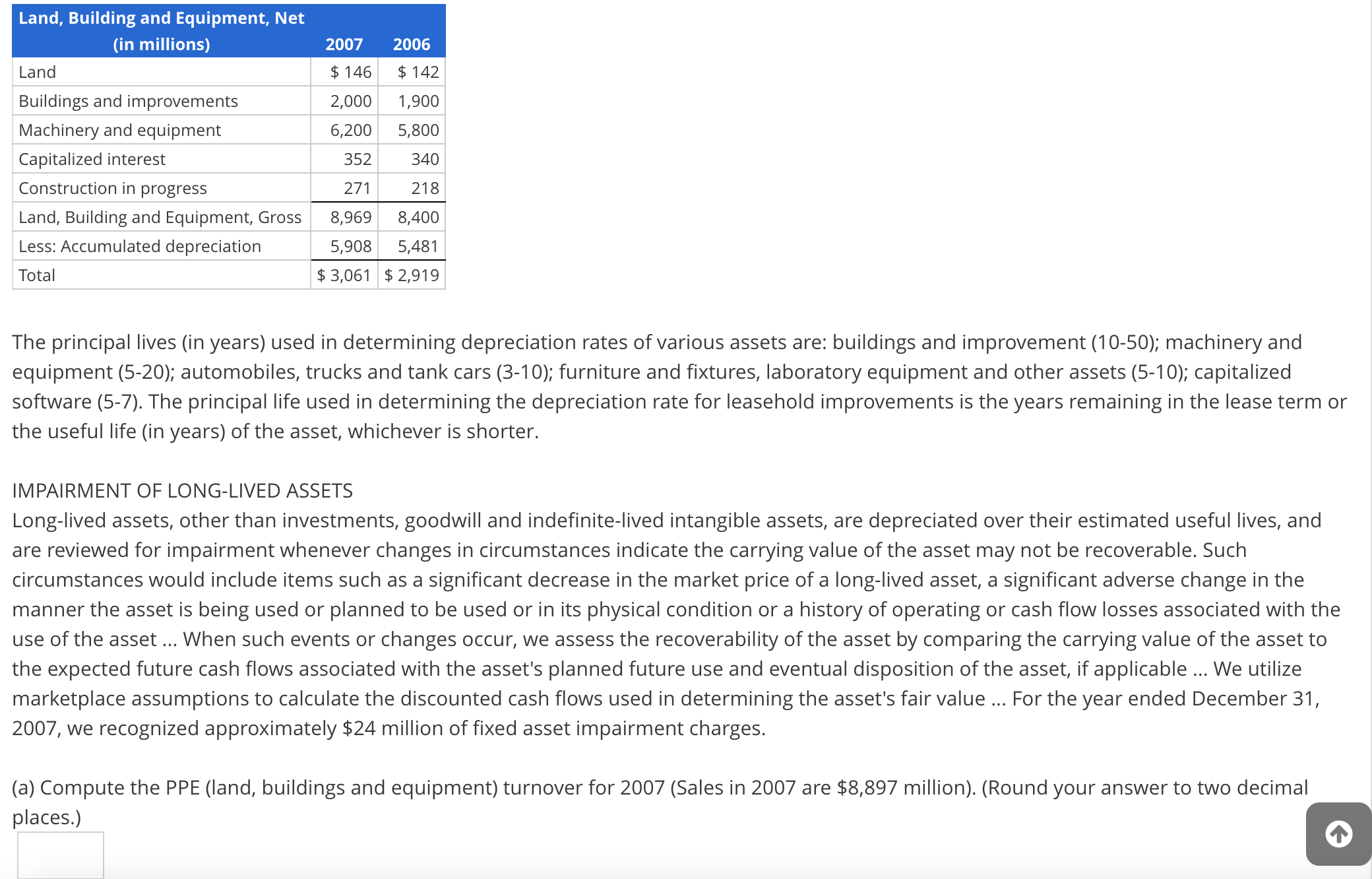

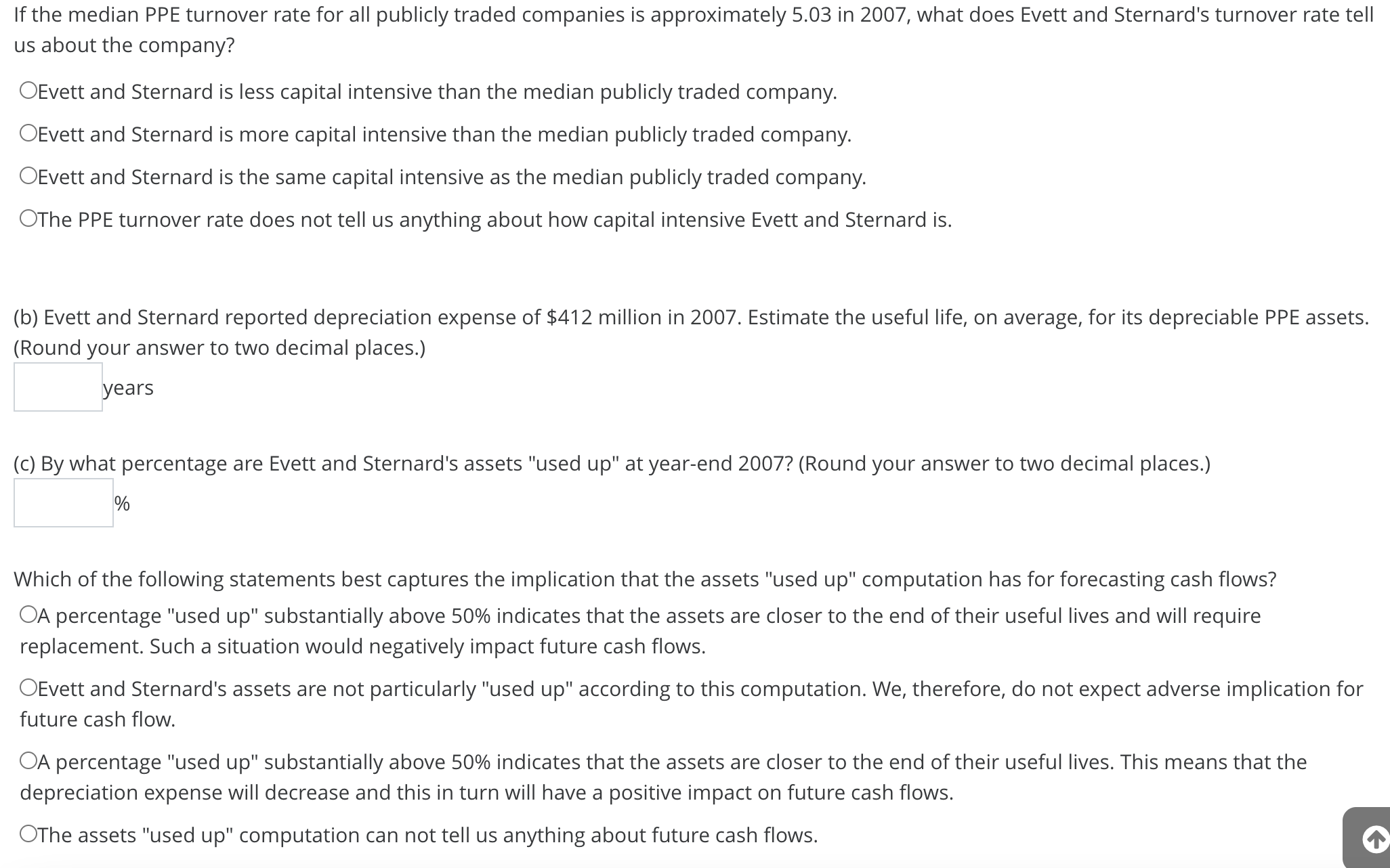

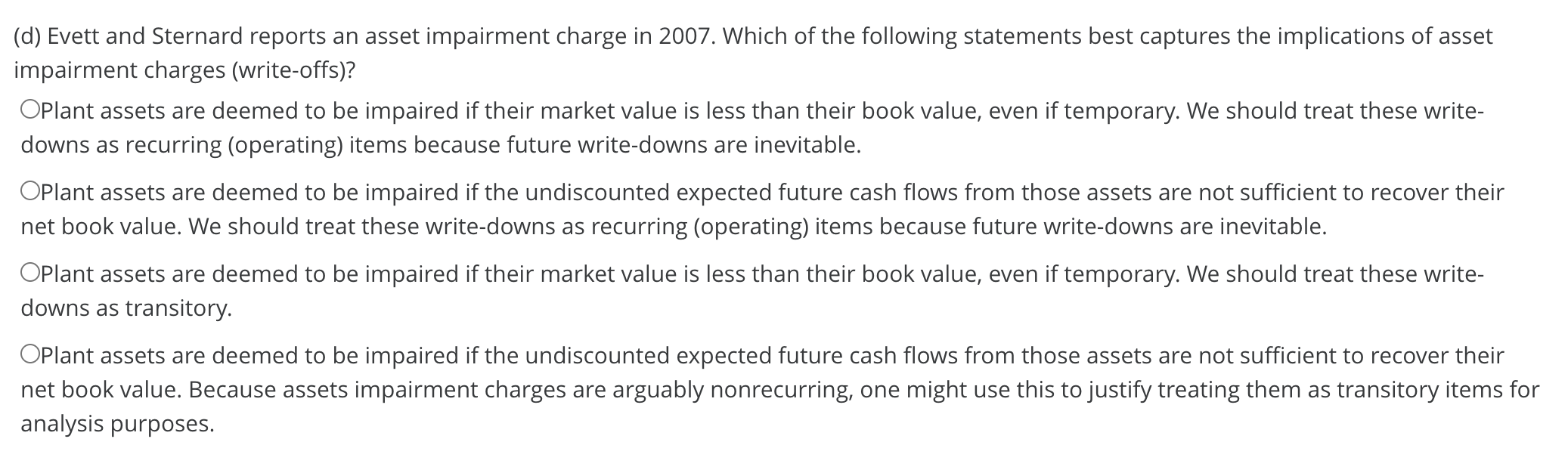

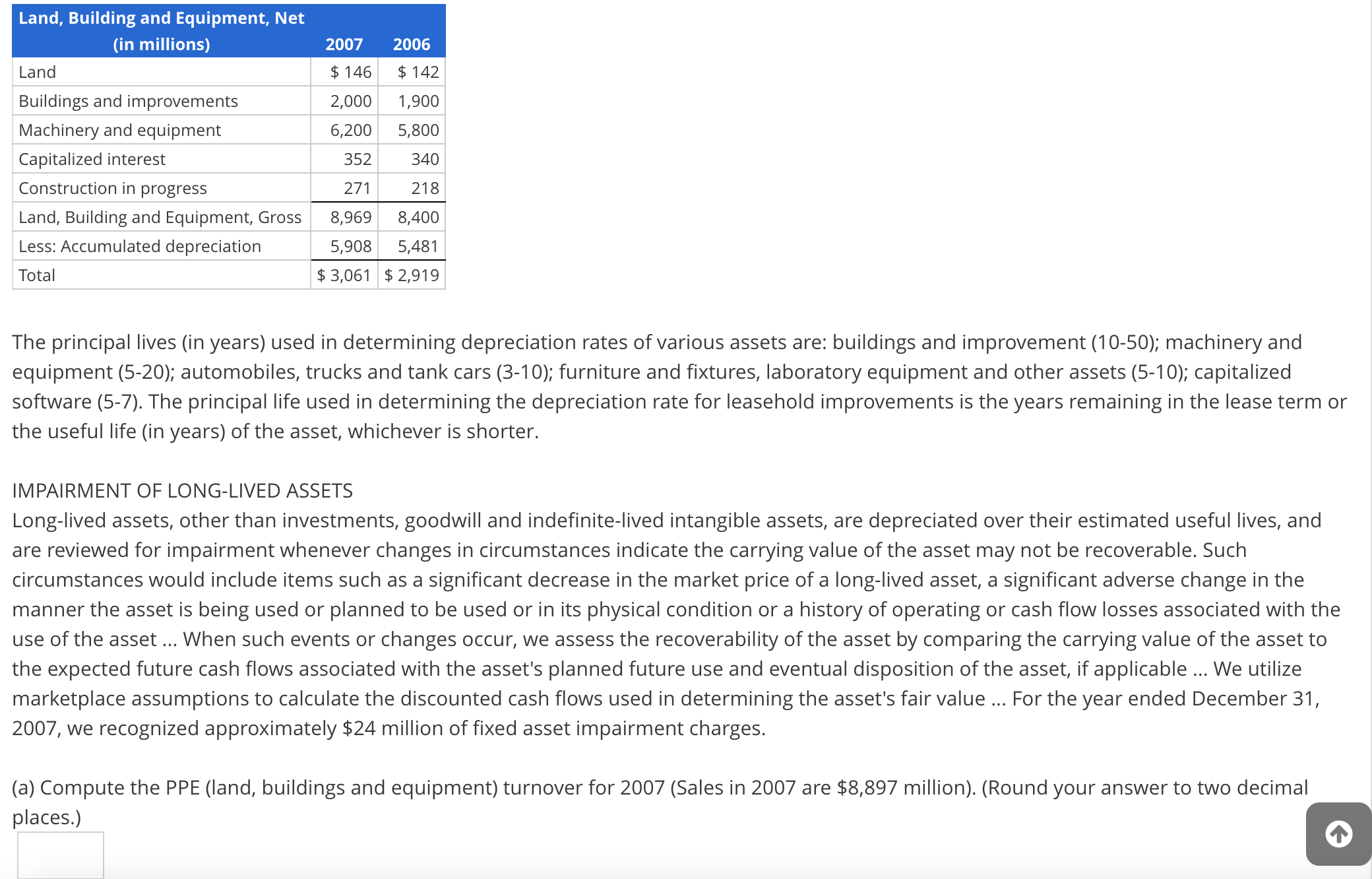

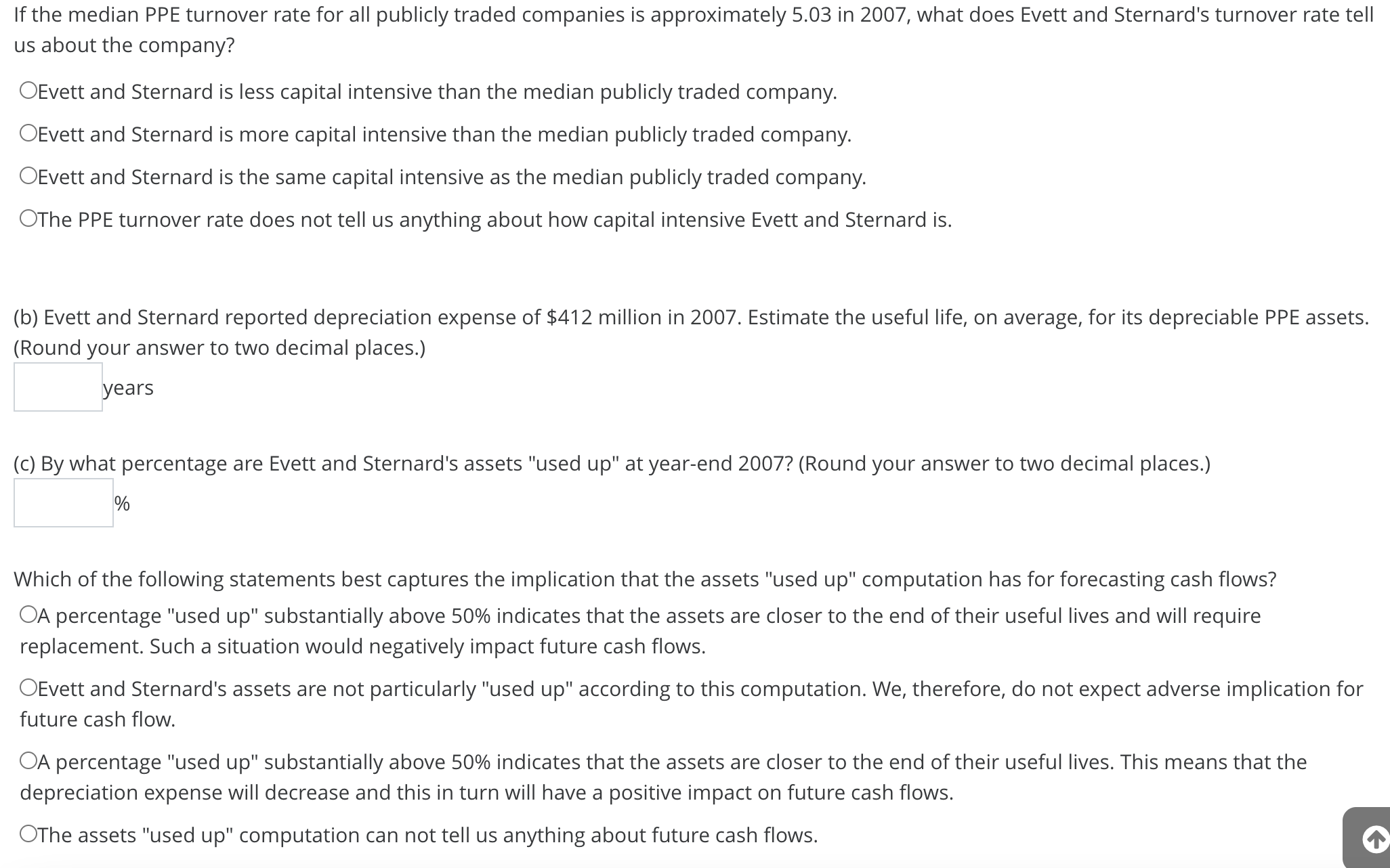

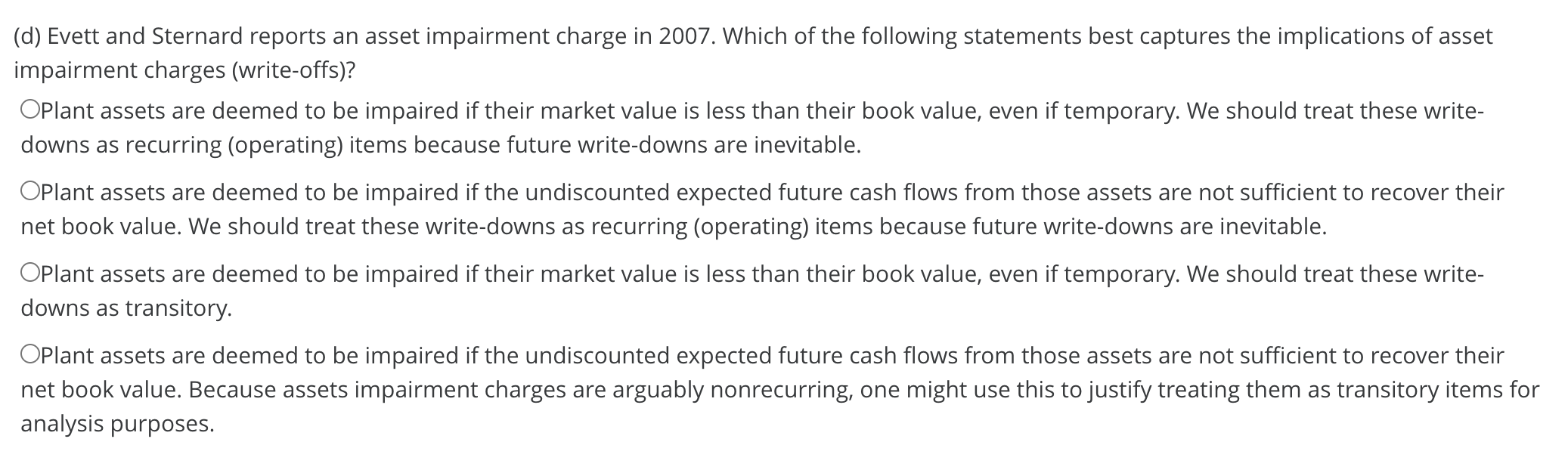

The principal lives (in years) used in determining depreciation rates of various assets are: buildings and improvement (10-50); machinery and equipment (5-20); automobiles, trucks and tank cars (3-10); furniture and fixtures, laboratory equipment and other assets (5-10); capitalized the useful life (in years) of the asset, whichever is shorter. IMPAIRMENT OF LONG-LIVED ASSETS are reviewed for impairment whenever changes in circumstances indicate the carring value of the asset may circumstances would include items such as a significant decrease in the market price of a long-lived asset, a significant adverse change in the 2007, we recognized approximately $24 million of fixed asset impairment charges. (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8,897 million). (Round your answer to two decimal places.) If the median PPE turnover rate for all publicly traded companies is approximately 5.03 in 2007 , what does Evett and Sternard's turnover rate tell us about the company? OEvett and Sternard is less capital intensive than the median publicly traded company. OEvett and Sternard is more capital intensive than the median publicly traded company. OEvett and Sternard is the same capital intensive as the median publicly traded company. OThe PPE turnover rate does not tell us anything about how capital intensive Evett and Sternard is. (b) Evett and Sternard reported depreciation expense of $412 million in 2007 . Estimate the useful life, on average, for its depreciable PPE assets. (Round your answer to two decimal places.) rears (c) By what percentage are Evett and Sternard's assets "used up" at year-end 2007? (Round your answer to two decimal places.) % OA percentage "used up" substantially above 50% indicates that the assets are closer to the end of their useful lives and wire replacement. Such a situation would negatively impact future cash flows. OEvett and Sternard's assets are not particularly "used up" according to this computation. We, therefore, do not expect adverse implication for future cash flow. depreciation expense will decrease and this in turn will have a positive impact on future cash flows. OThe assets "used up" computation can not tell us anything about future cash flows. (d) Evett and Sternard reports an asset impairment charge in 2007. Which of the following statements best captures the implications of asset impairment charges (write-offs)? OPlant assets are deemed to be impaired if their market value is less than their book value, even if temporary. We should treat these writedowns as recurring (operating) items because future write-downs are inevitable. Oplant assets are deemed to be impaired if the undiscounted expected future cash flows from those assets are not sufficient to recover their net book value. We should treat these write-downs as recurring (operating) items because future write-downs are inevitable. OPlant assets are deemed to be impaired if their market value is less than their book value, even if temporary. We should treat these writedowns as transitory. OPlant assets are deemed to be impaired if the undiscounted expected future cash flows from those assets are not sufficient to recover their net book value. Because assets impairment charges are arguably nonrecurring, one might use this to justify treating them as transitory items fo analysis purposes. The principal lives (in years) used in determining depreciation rates of various assets are: buildings and improvement (10-50); machinery and equipment (5-20); automobiles, trucks and tank cars (3-10); furniture and fixtures, laboratory equipment and other assets (5-10); capitalized the useful life (in years) of the asset, whichever is shorter. IMPAIRMENT OF LONG-LIVED ASSETS are reviewed for impairment whenever changes in circumstances indicate the carring value of the asset may circumstances would include items such as a significant decrease in the market price of a long-lived asset, a significant adverse change in the 2007, we recognized approximately $24 million of fixed asset impairment charges. (a) Compute the PPE (land, buildings and equipment) turnover for 2007 (Sales in 2007 are $8,897 million). (Round your answer to two decimal places.) If the median PPE turnover rate for all publicly traded companies is approximately 5.03 in 2007 , what does Evett and Sternard's turnover rate tell us about the company? OEvett and Sternard is less capital intensive than the median publicly traded company. OEvett and Sternard is more capital intensive than the median publicly traded company. OEvett and Sternard is the same capital intensive as the median publicly traded company. OThe PPE turnover rate does not tell us anything about how capital intensive Evett and Sternard is. (b) Evett and Sternard reported depreciation expense of $412 million in 2007 . Estimate the useful life, on average, for its depreciable PPE assets. (Round your answer to two decimal places.) rears (c) By what percentage are Evett and Sternard's assets "used up" at year-end 2007? (Round your answer to two decimal places.) % OA percentage "used up" substantially above 50% indicates that the assets are closer to the end of their useful lives and wire replacement. Such a situation would negatively impact future cash flows. OEvett and Sternard's assets are not particularly "used up" according to this computation. We, therefore, do not expect adverse implication for future cash flow. depreciation expense will decrease and this in turn will have a positive impact on future cash flows. OThe assets "used up" computation can not tell us anything about future cash flows. (d) Evett and Sternard reports an asset impairment charge in 2007. Which of the following statements best captures the implications of asset impairment charges (write-offs)? OPlant assets are deemed to be impaired if their market value is less than their book value, even if temporary. We should treat these writedowns as recurring (operating) items because future write-downs are inevitable. Oplant assets are deemed to be impaired if the undiscounted expected future cash flows from those assets are not sufficient to recover their net book value. We should treat these write-downs as recurring (operating) items because future write-downs are inevitable. OPlant assets are deemed to be impaired if their market value is less than their book value, even if temporary. We should treat these writedowns as transitory. OPlant assets are deemed to be impaired if the undiscounted expected future cash flows from those assets are not sufficient to recover their net book value. Because assets impairment charges are arguably nonrecurring, one might use this to justify treating them as transitory items fo analysis purposes