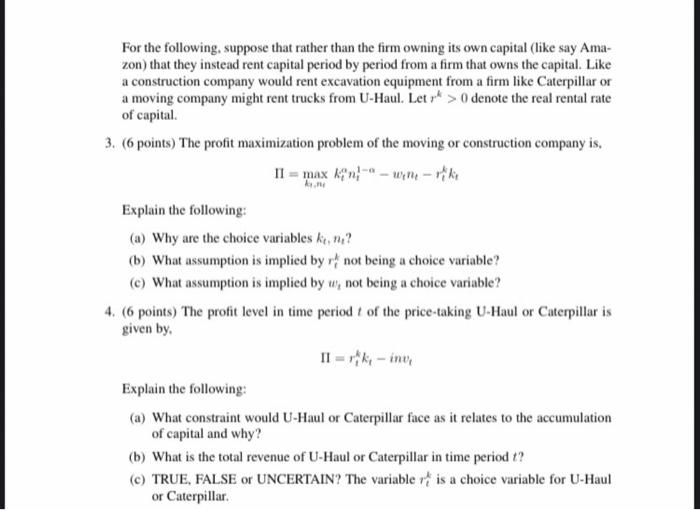

The problem of the firm given in class was to maximize the real firm value sabject to technology and capital law of motion constraints. Note that the class derivation used net investment as the investment concept and the optimal condition that implicitly defines capitaliaveatment demand was given by, mpheany where r>0 is the teal interest rate. If instead I had used gross imvestmeat as the imvectment concept, the optimal condition that implicitly defines capitalimestment demand woald be given by. m10k1=r+b where 01 is the depreciation rate of capital. Note that the object (firm value) that woald need to be maximized under the gross imertment concept in real terms would be gives by maxn1m2n1f(k1,n1)w1n1[k2k1(1)]+1+r1[f(k2,n2)w2n2+k2(1)] Let the production function for all t=1.2 be given by. y=f(k4,n4)=kqn43a4,00 denote the real rental rate of capital. 3. (6 points) The profit maximization peoblem of the moving of construction compuny is, For the following, suppose that rather than the firm owning its own capital (like say Amazon) that they instead rent capital period by period from a firm that owns the capital. Like a construction company would rent excavation equipment from a firm like Caterpillar or a moving company might rent trucks from U-Haul. Let rk>0 denote the real rental rate of capital. 3. (6 points) The profit maximization problem of the moving or construction company is, II=maxkt,ntktnt1wtntrtkki Explain the following: (a) Why are the choice variables kt,nt ? (b) What assumption is implied by rtk not being a choice variable? (c) What assumption is implied by w1 not being a choice variable? 4. (6 points) The profit level in time period t of the price-taking U-Haul or Caterpillar is given by, =rtkktimvt Explain the following: (a) What constraint would U-Haul or Caterpillar face as it relates to the accumulation of capital and why? (b) What is the total revenue of U-Haul or Caterpillar in time period t ? (c) TRUE, FALSE or UNCERTAIN? The variable rtk is a choice variable for U-Haul or Caterpillar. The problem of the firm given in class was to maximize the real firm value sabject to technology and capital law of motion constraints. Note that the class derivation used net investment as the investment concept and the optimal condition that implicitly defines capitaliaveatment demand was given by, mpheany where r>0 is the teal interest rate. If instead I had used gross imvestmeat as the imvectment concept, the optimal condition that implicitly defines capitalimestment demand woald be given by. m10k1=r+b where 01 is the depreciation rate of capital. Note that the object (firm value) that woald need to be maximized under the gross imertment concept in real terms would be gives by maxn1m2n1f(k1,n1)w1n1[k2k1(1)]+1+r1[f(k2,n2)w2n2+k2(1)] Let the production function for all t=1.2 be given by. y=f(k4,n4)=kqn43a4,00 denote the real rental rate of capital. 3. (6 points) The profit maximization peoblem of the moving of construction compuny is, For the following, suppose that rather than the firm owning its own capital (like say Amazon) that they instead rent capital period by period from a firm that owns the capital. Like a construction company would rent excavation equipment from a firm like Caterpillar or a moving company might rent trucks from U-Haul. Let rk>0 denote the real rental rate of capital. 3. (6 points) The profit maximization problem of the moving or construction company is, II=maxkt,ntktnt1wtntrtkki Explain the following: (a) Why are the choice variables kt,nt ? (b) What assumption is implied by rtk not being a choice variable? (c) What assumption is implied by w1 not being a choice variable? 4. (6 points) The profit level in time period t of the price-taking U-Haul or Caterpillar is given by, =rtkktimvt Explain the following: (a) What constraint would U-Haul or Caterpillar face as it relates to the accumulation of capital and why? (b) What is the total revenue of U-Haul or Caterpillar in time period t ? (c) TRUE, FALSE or UNCERTAIN? The variable rtk is a choice variable for U-Haul or Caterpillar