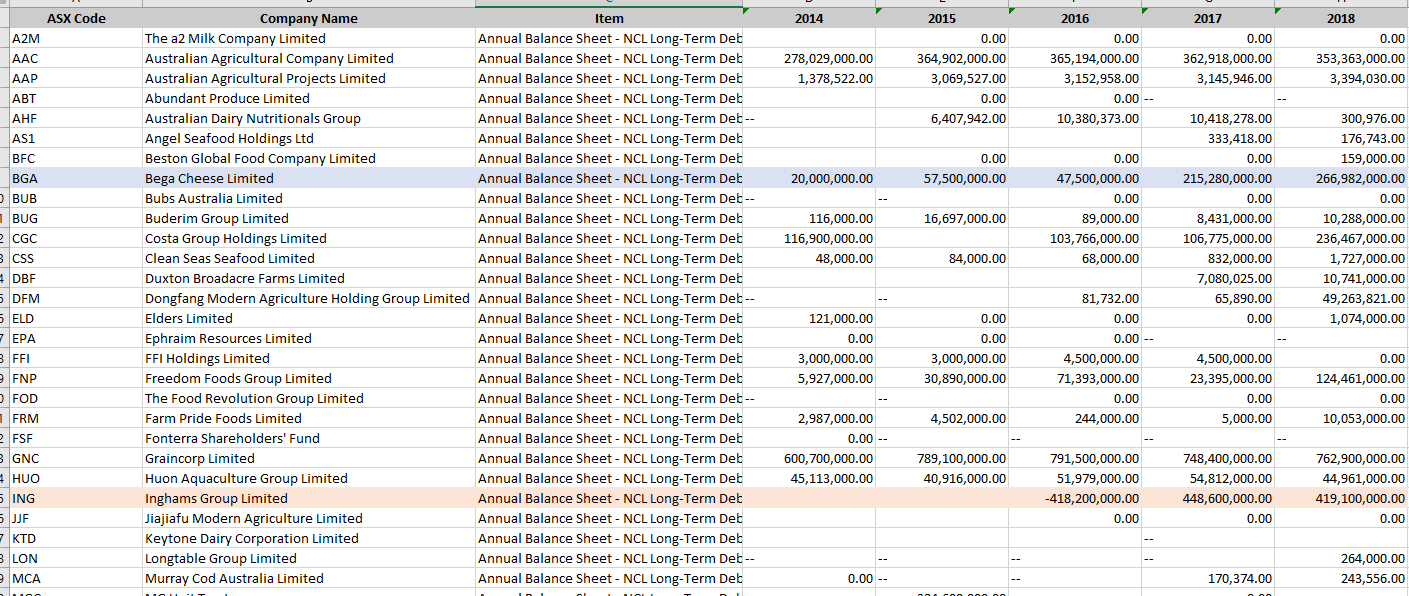

The problem with the red colour data, this company ING is listed in 2016, why its long term liability is negative, in my understanding, its long term liability should be positive, can someone explain to me why it is negative please, thank you.

ASX Code Company Name Item 2014 2015 2016 2017 2018 A2M The a2 Milk Company Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 0.00 0.00 0.00 AAC Australian Agricultural Company Limited Annual Balance Sheet - NCL Long-Term Deb 278,029,000.00 364,902,000.00 365,194,000.00 362,918,000.00 353,363,000.00 AAP Australian Agricultural Projects Limited Annual Balance Sheet - NCL Long-Term Deb 1,378,522.00 3,069,527.00 3,152,958.00 3,145,946.00 3,394,030.00 ABT Abundant Produce Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 0.00 -- AHF Australian Dairy Nutritionals Group Annual Balance Sheet - NCL Long-Term Deb-- 6,407,942.00 10,380,3 10,418,278.00 300,976.00 AS1 Angel Seafood Holdings Ltd Annual Balance Sheet - NCL Long-Term Deb 333,418.00 176,743.00 BFC Beston Global Food Company Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 0.00 0.00 159,000.00 BGA Bega Cheese Limited Annual Balance Sheet - NCL Long-Term Deb 20,000,000.00 57,500,000.00 47,500,000.00 215,280,000.00 266,982,000.00 BUB Bubs Australia Limited Annual Balance Sheet - NCL Long-Term Deb-- 0.00 0.00 0.00 BUG Buderim Group Limited Annual Balance Sheet - NCL Long-Term Deb 116,000.00 16,697,000.00 89,000.00 8,431,000.00 10,288,000.00 CGC Costa Group Holdings Limited Annual Balance Sheet - NCL Long-Term Deb 116,900,000.00 103,766,000.00 106,775,000.00 236,467,000.00 CSS Clean Seas Seafood Limited Annual Balance Sheet - NCL Long-Term Deb 48,000.00 84,000.00 68,000.00 832,000.00 1,727,000.00 DBF Duxton Broadacre Farms Limited Annual Balance Sheet - NCL Long-Term Deb 7,080,025.00 10,741,000.00 DFM Dongfang Modern Agriculture Holding Group Limited Annual Balance Sheet - NCL Long-Term Deb-- 81,732.00 65,890.00 49,263,821.00 ELD Elders Limited Annual Balance Sheet - NCL Long-Term Deb 121,000.00 0.00 0.00 0.00 1,074,000.00 EPA Ephraim Resources Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 0.00 0.00 - FFI FFI Holdings Limited Annual Balance Sheet - NCL Long-Term Deb 3,000,000.00 3,000,000.00 4,500,000.00 4,500,000.00 0.00 FNP Freedom Foods Group Limited Annual Balance Sheet - NCL Long-Term Deb 5,927,000.00 30,890,000.00 71,393,000.00 23,395,000.00 124,461,000.00 FOD The Food Revolution Group Limited Annual Balance Sheet - NCL Long-Term Deb-- 0.00 0.00 0.00 FRM Farm Pride Foods Limited Annual Balance Sheet - NCL Long-Term Deb 2,987,000.00 4,502,000.00 244,000.00 5,000.00 10,053,000.00 FSF Fonterra Shareholders' Fund Annual Balance Sheet - NCL Long-Term Deb 0.00 -- GNC Graincorp Limited Annual Balance Sheet - NCL Long-Term Deb 600,700,000.00 789,100,000.00 791,500,000.00 748,400,000.00 762,900,000.00 HUO Huon Aquaculture Group Limited Annual Balance Sheet - NCL Long-Term Deb 45,113,0 40,916,000.00 51,979,000.00 54,812,000.00 44,961,000.00 ING Inghams Group Limited Annual Balance Sheet - NCL Long-Term Deb -418,200,000.00 448,600,000.00 419,100,000.00 JJF Jiajiafu Modern Agriculture Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 0.00 0.00 KTD Keytone Dairy Corporation Limited Annual Balance Sheet - NCL Long-Term Deb LON Longtable Group Limited Annual Balance Sheet - NCL Long-Term Deb-- 264,000.00 MCA Murray Cod Australia Limited Annual Balance Sheet - NCL Long-Term Deb 0.00 -- 170,374.00 243,556.00