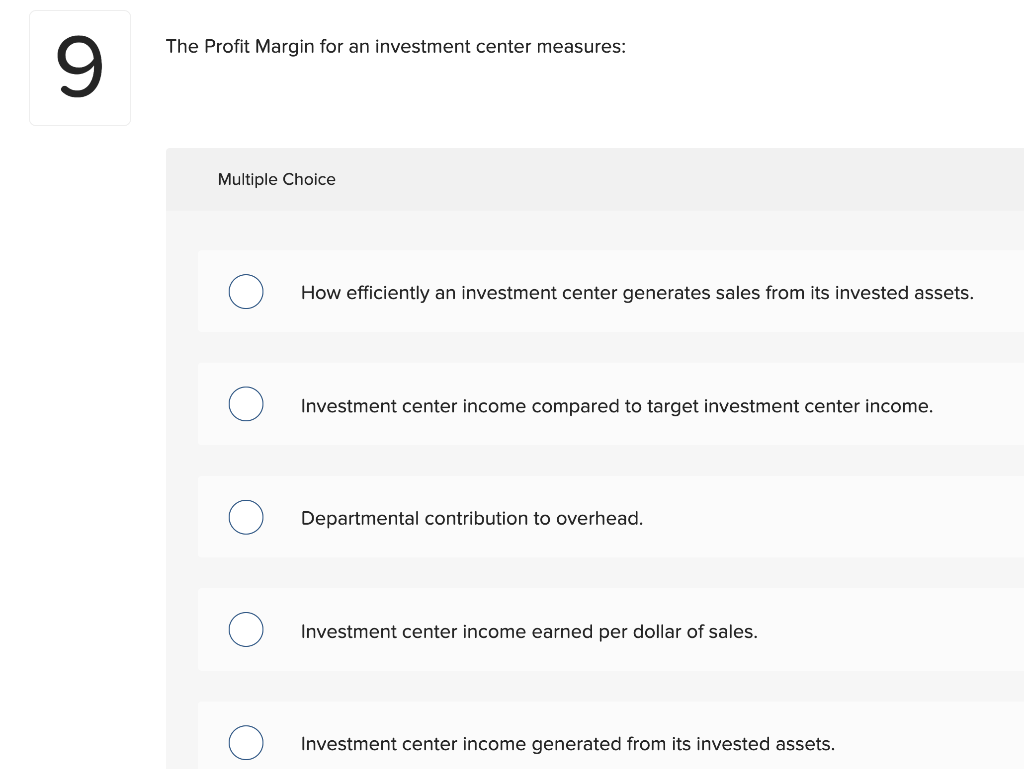

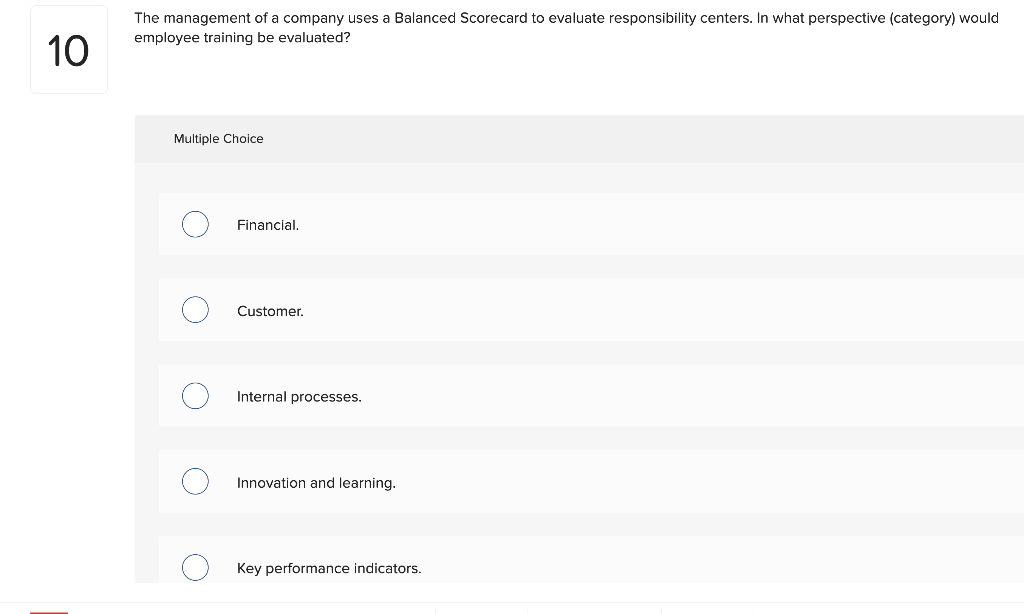

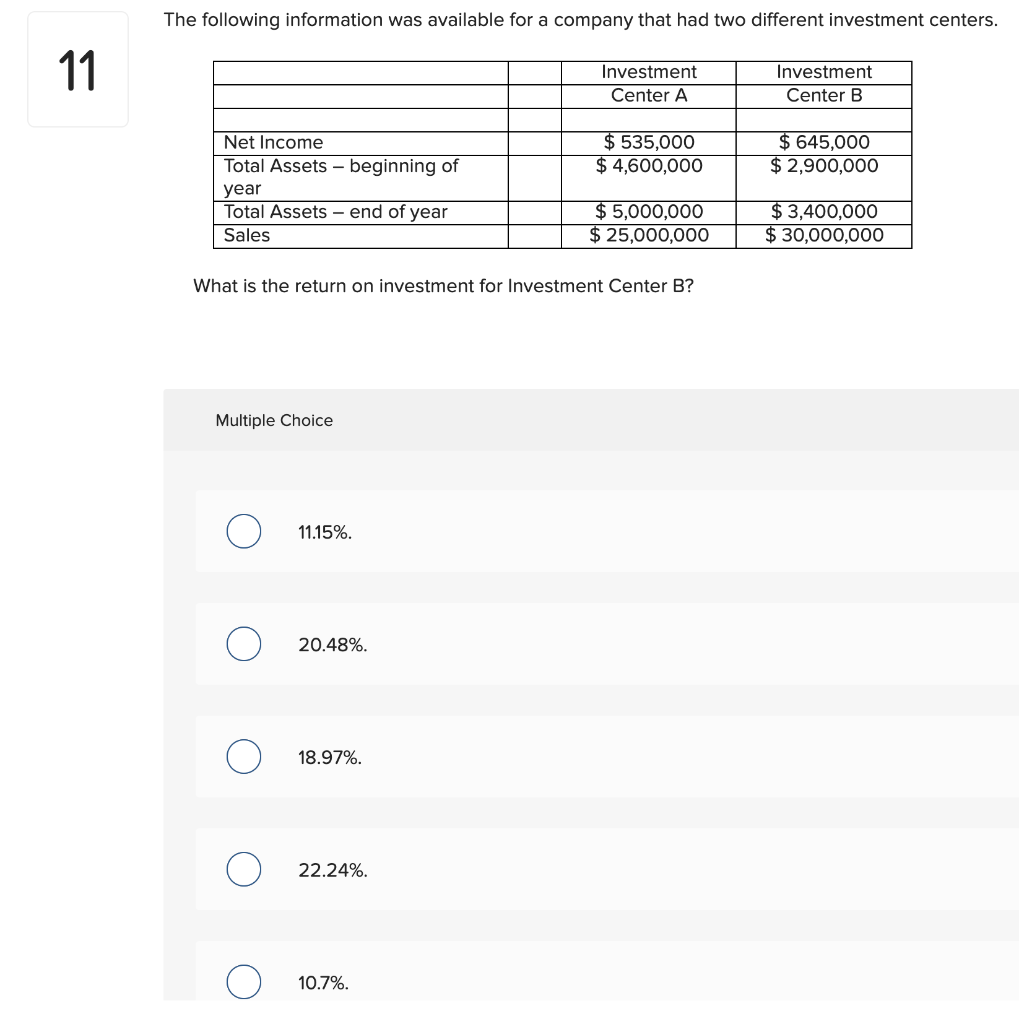

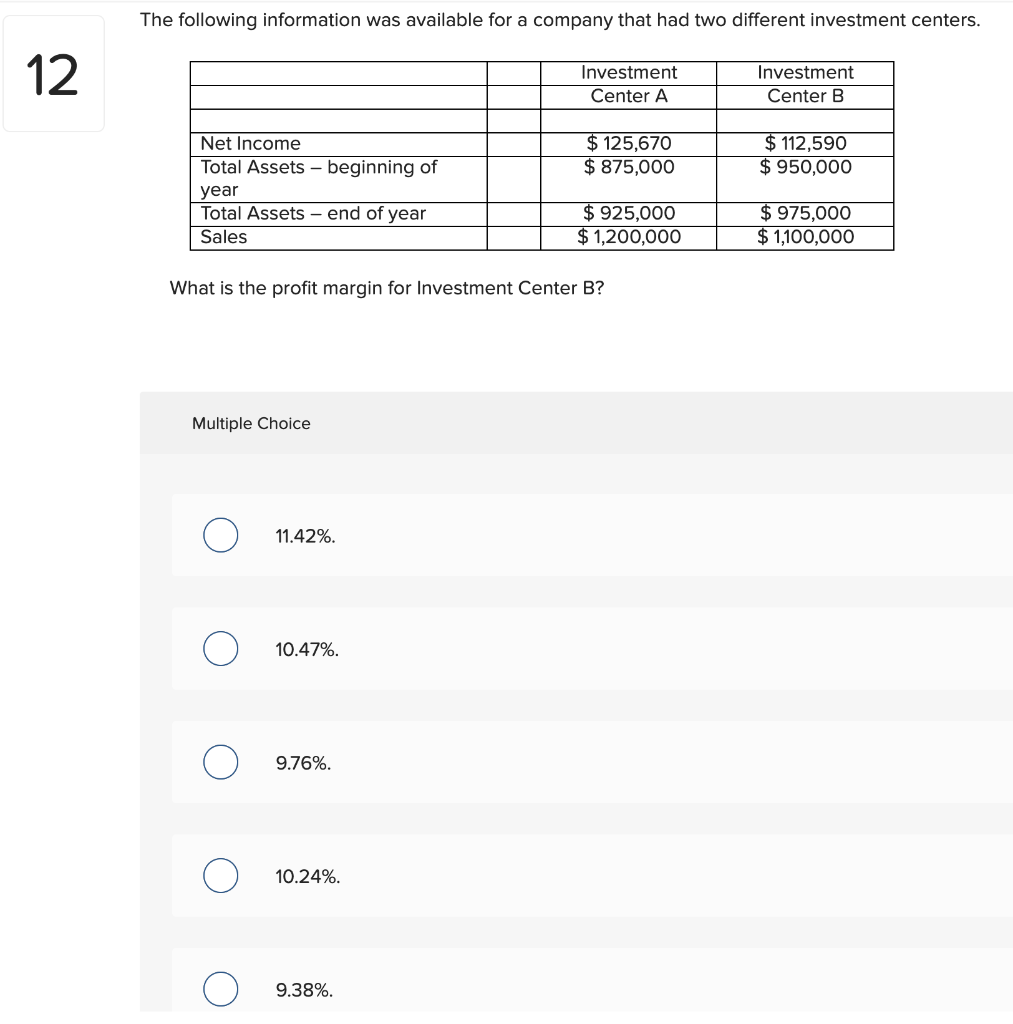

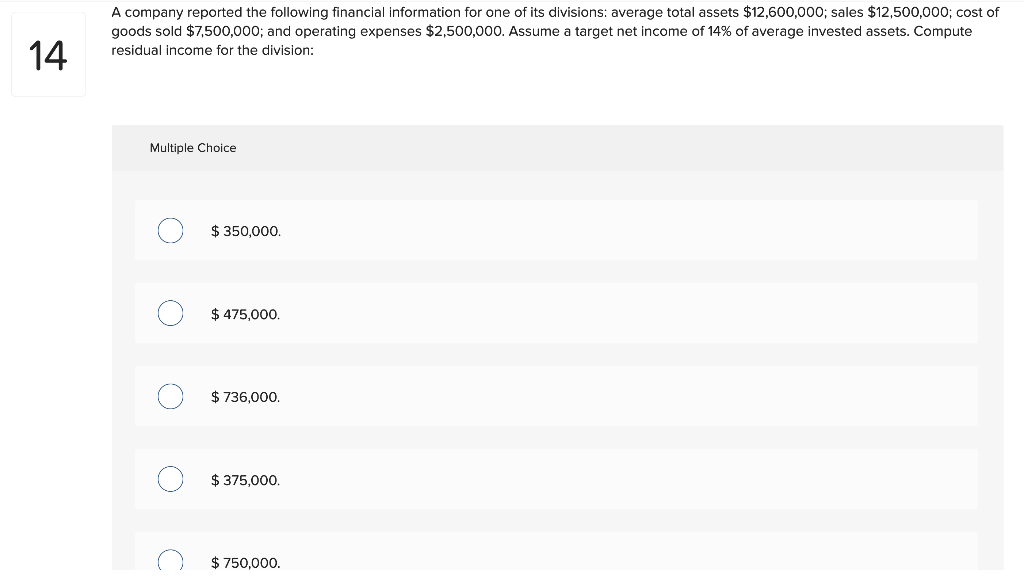

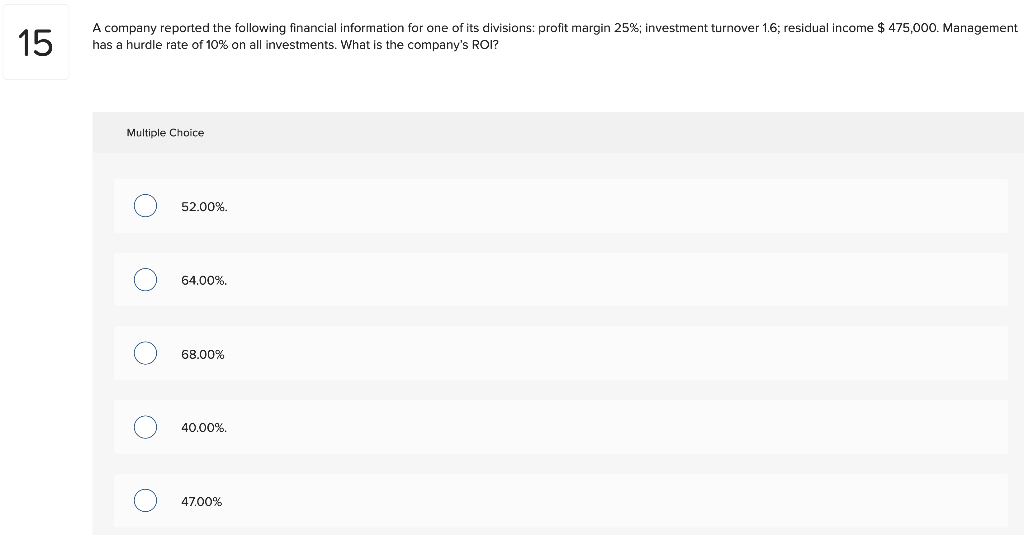

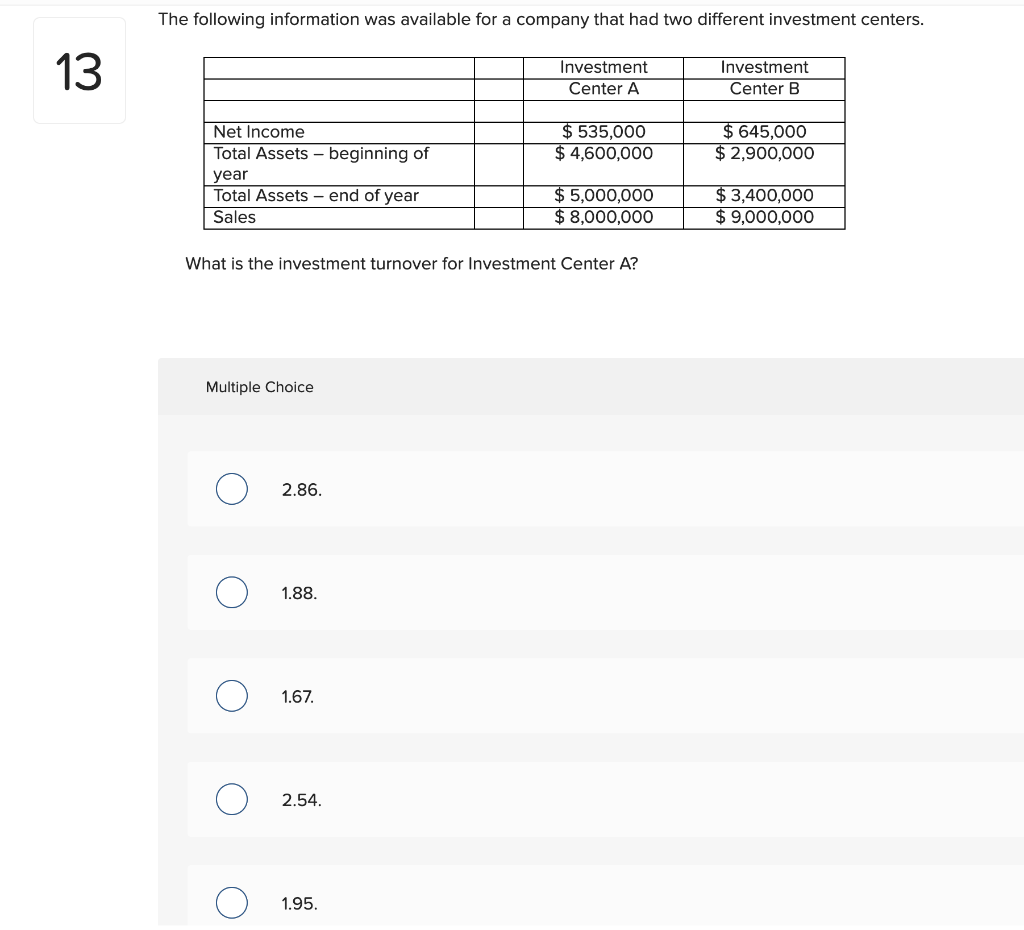

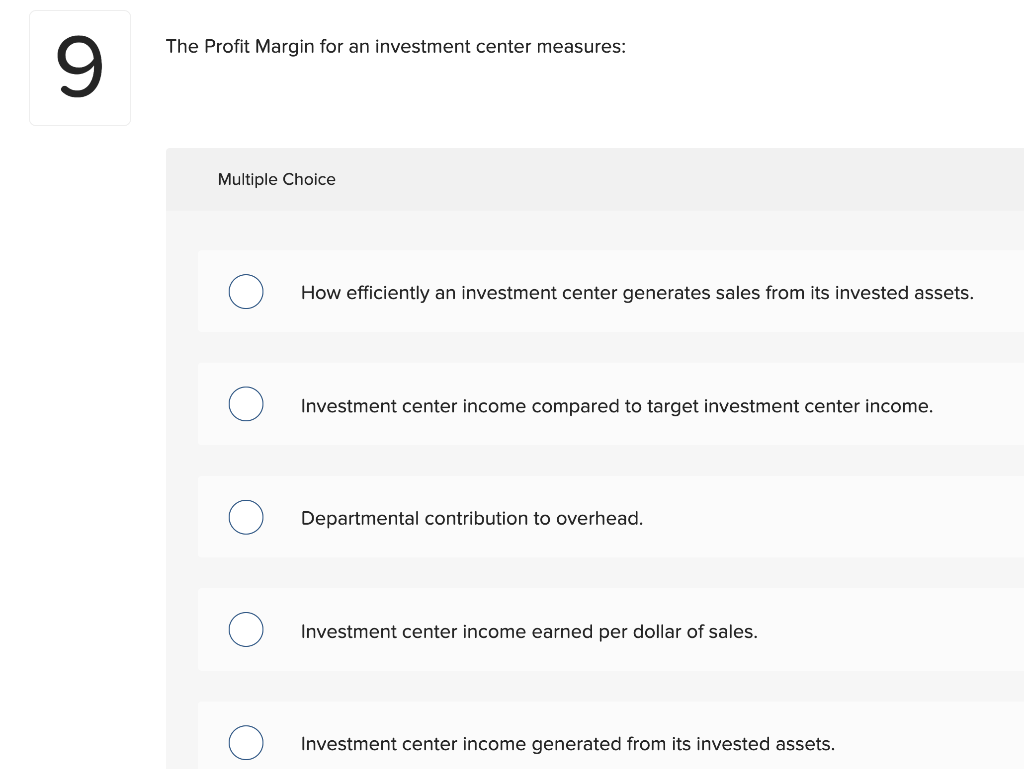

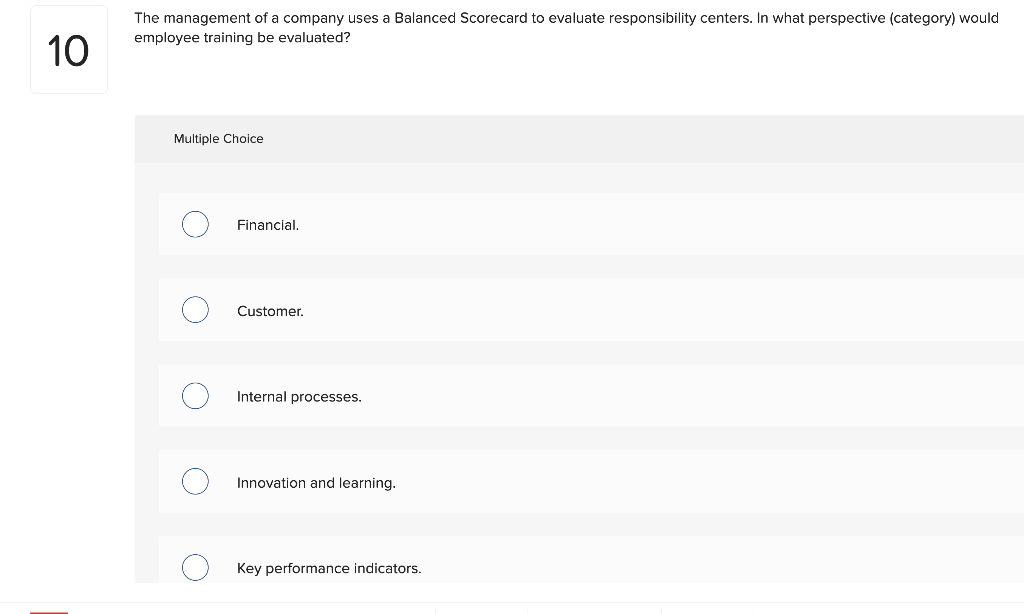

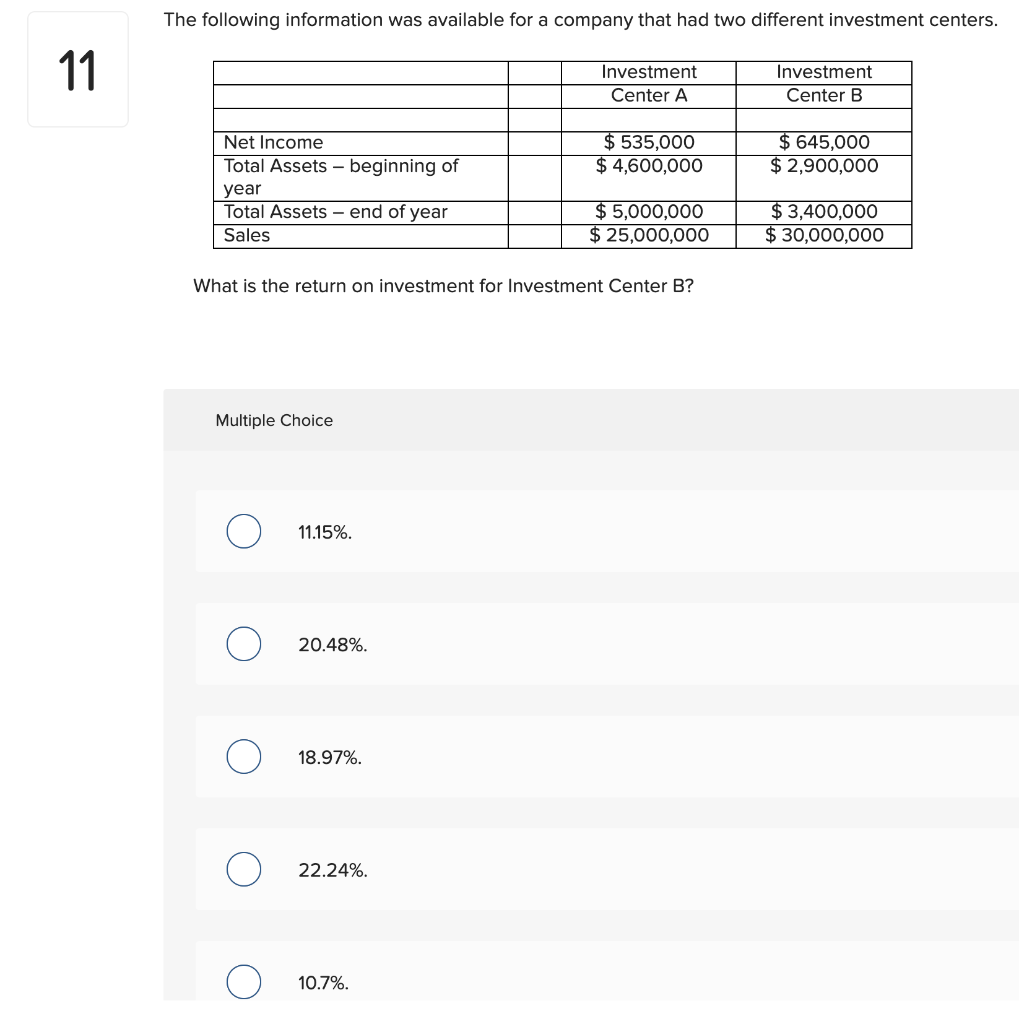

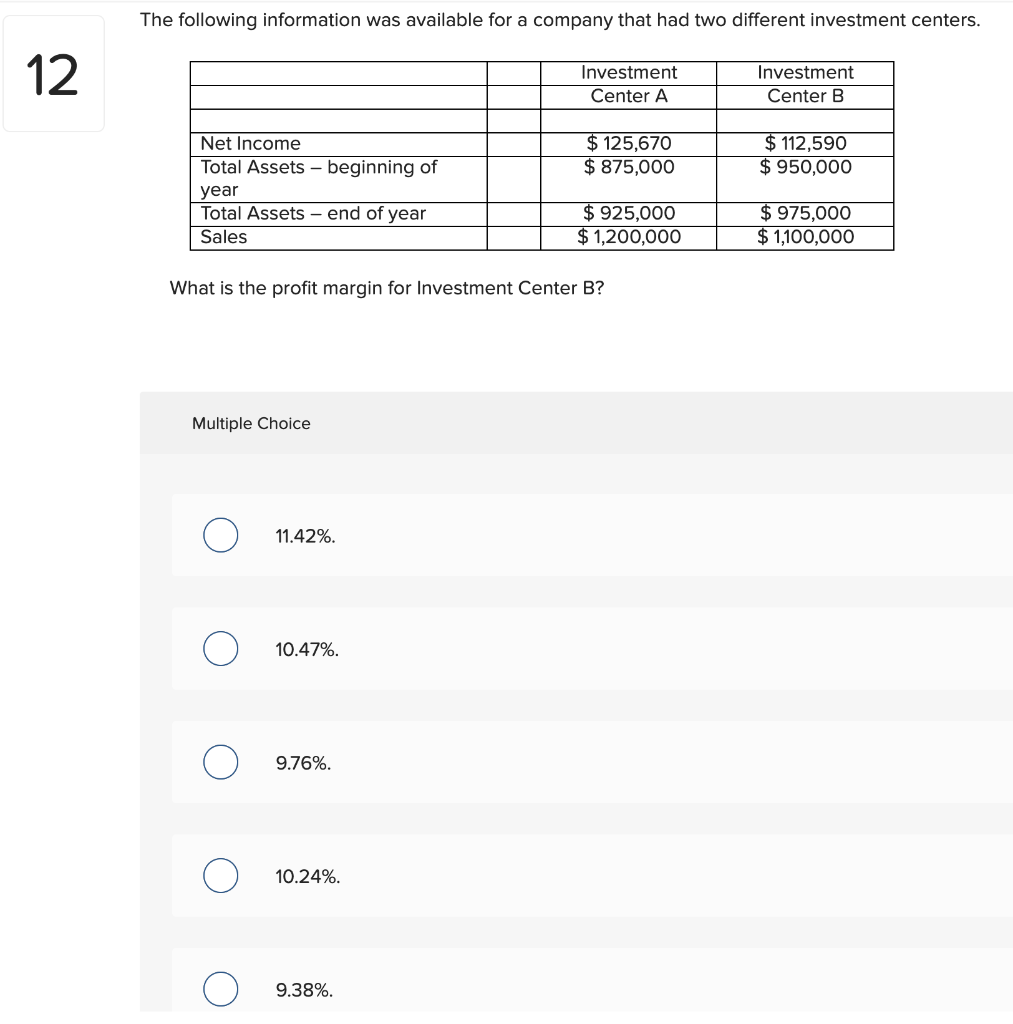

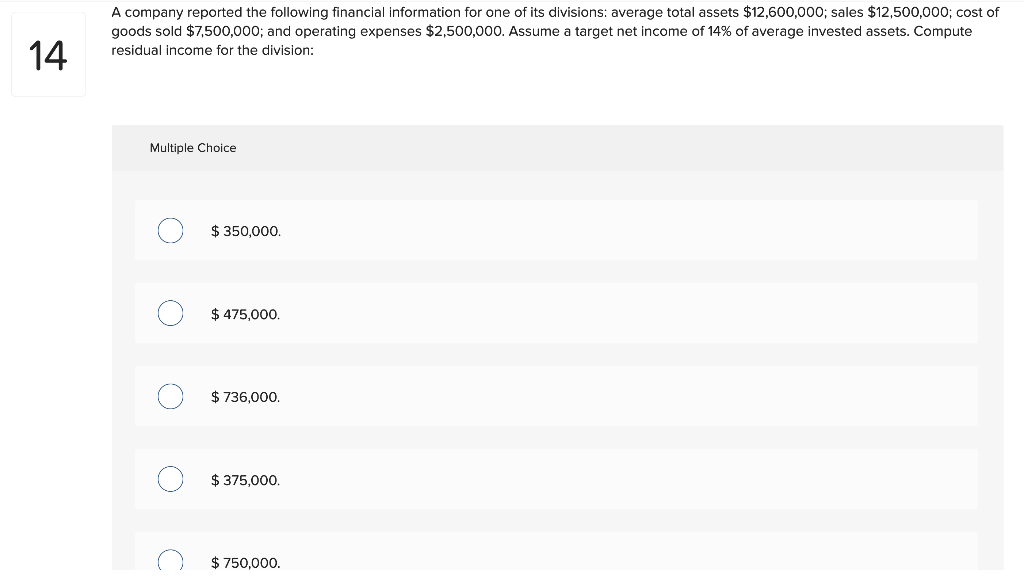

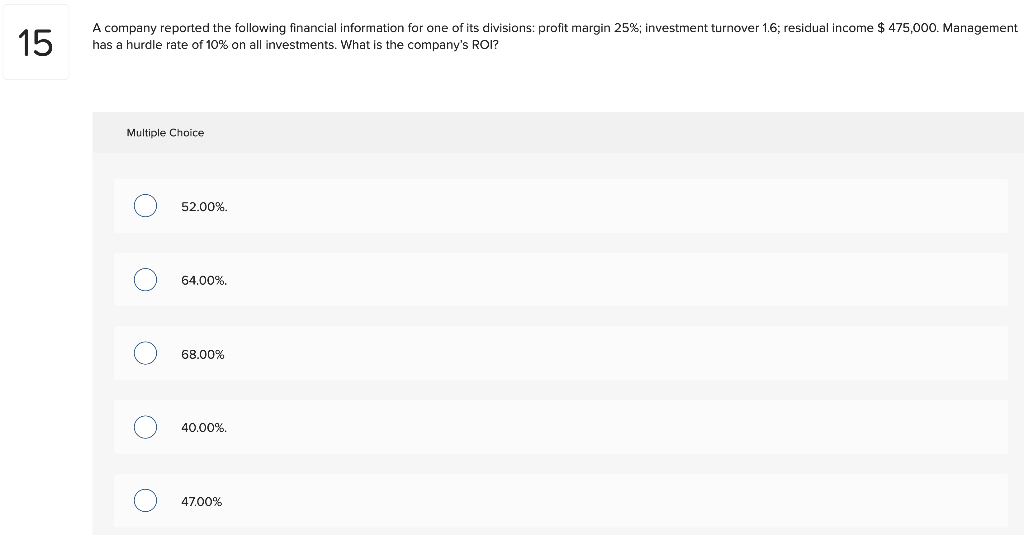

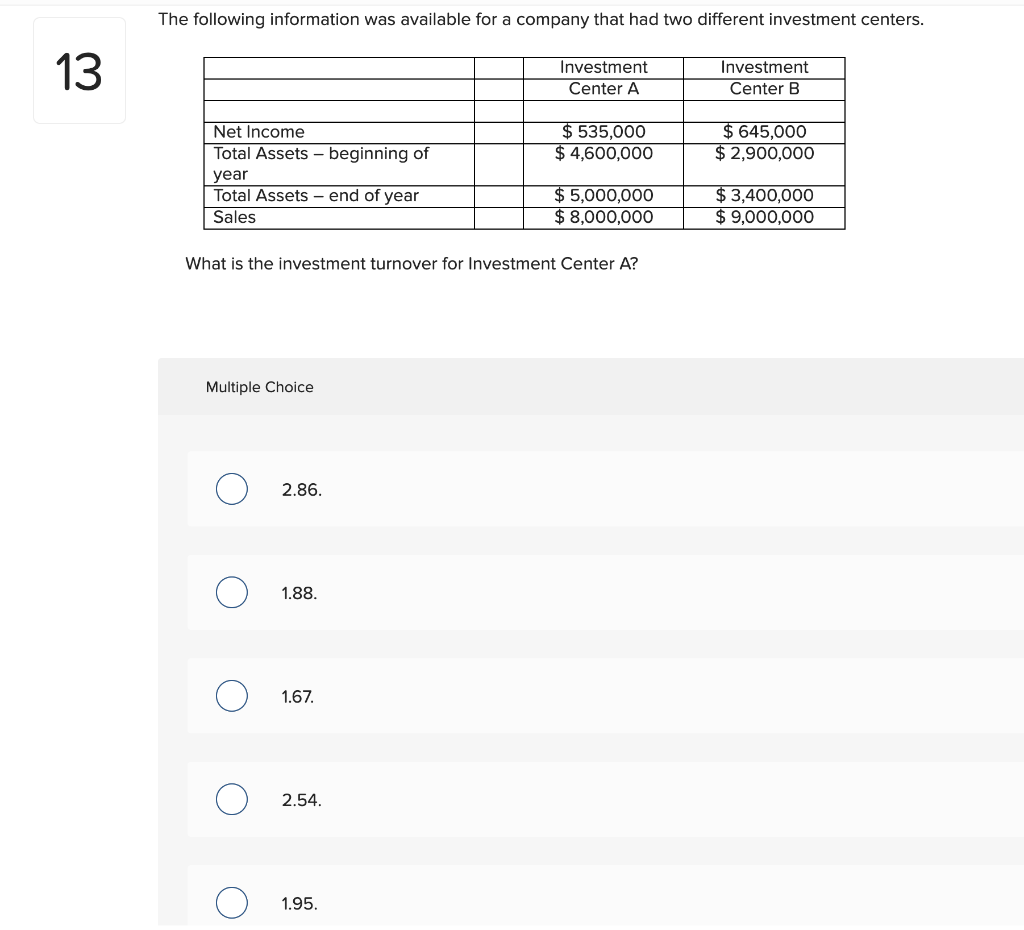

The Profit Margin for an investment center measures: 9 Multiple Choice How efficiently an investment center generates sales from its invested assets. Investment center income compared to target investment center income. Departmental contribution to overhead. Investment center income earned per dollar of sales. Investment center income generated from its invested assets. The management of a company uses a Balanced Scorecard to evaluate responsibility centers. In what perspective (category) would employee training be evaluated? 10 Multiple Choice Financial Customer. O Internal processes. Innovation and learning. O Key performance indicators. The following information was available for a company that had two different investment centers. 11 Investment Center A Investment Center B $ 535,000 $ 4,600,000 $ 645,000 $ 2,900,000 Net Income Total Assets - beginning of year Total Assets - end of year Sales $ 5,000,000 $ 25,000,000 $3,400,000 $ 30,000,000 What is the return on investment for Investment Center B? Multiple Choice 11.15%. 20.48%. 18.97%. 22.24% 10.7%. The following information was available for a company that had two different investment centers. 12 Investment Center A Investment Center B $ 125,670 $ 875,000 $ 112,590 $ 950,000 Net Income Total Assets - beginning of year Total Assets - end of year Sales $ 925,000 $ 1,200,000 $ 975,000 $ 1,100,000 What is the profit margin for Investment Center B? Multiple Choice 11.42%. 10.47% 9.76%. 10.24% 9.38%. A company reported the following financial information for one of its divisions: average total assets $12,600,000; sales $12,500,000; cost of goods sold $7,500,000; and operating expenses $2,500,000. Assume a target net income of 14% of average invested assets. Compute residual income for the division: 14 Multiple Choice $ 350,000 0 $ 475,000 U $ 736,000 O $375,000 c $ 750,000 15 A company reported the following financial information for one of its divisions: profit margin 25%; investment turnover 1.6; residual income $ 475,000. Management has a hurdle rate of 10% on all investments. What is the company's ROI? Multiple Choice 52.00% 64.00% 68.00% O O 40.00% 47.00% The following information was available for a company that had two different investment centers. 13 Investment Center A Investment Center B $ 535,000 $ 4,600,000 $ 645,000 $ 2,900,000 Net Income Total Assets - beginning of year Total Assets - end of year Sales $ 5,000,000 $ 8,000,000 $ 3,400,000 $ 9,000,000 What is the investment turnover for Investment Center A? Multiple Choice 2.86. 1.88. o 1.67. O 2.54. o 1.95