Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the project will require $15 million in working capital upfront (year U), which will be fully recovered in year 10. Next, you see they

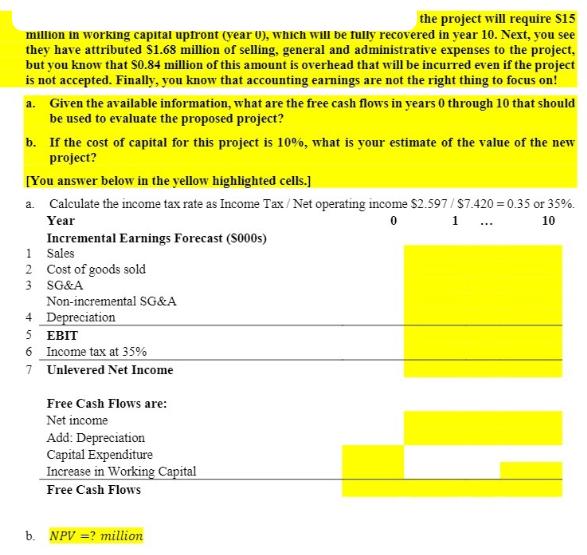

the project will require $15 million in working capital upfront (year U), which will be fully recovered in year 10. Next, you see they have attributed $1.68 million of selling, general and administrative expenses to the project, but you know that $0.84 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on! a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? b. If the cost of capital for this project is 10%, what is your estimate of the value of the new project? [You answer below in the yellow highlighted cells.] a. Calculate the income tax rate as Income Tax/Net operating income $2.597/$7.420= 0.35 or 35%. Year 0 1 ... 10 Incremental Earnings Forecast (S000s) 1 Sales 2 3 Cost of goods sold SG&A Non-incremental SG&A 4 Depreciation 5 EBIT 6 Income tax at 35% 7 Unlevered Net Income Free Cash Flows are: Net income Add: Depreciation Capital Expenditure Increase in Working Capital Free Cash Flows b. NPV =? million

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Given the available information the free cash flows in years 0 through 10 that should be used to e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started