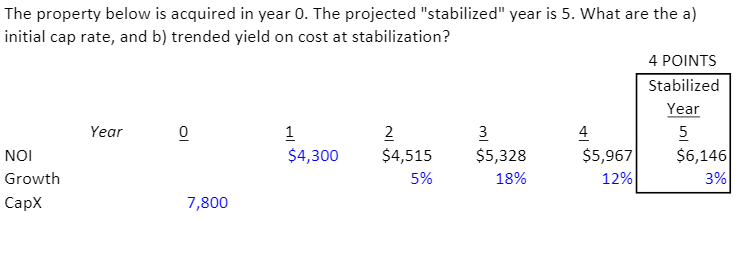

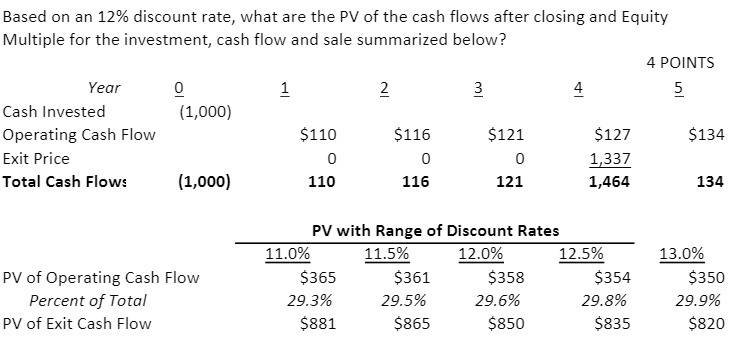

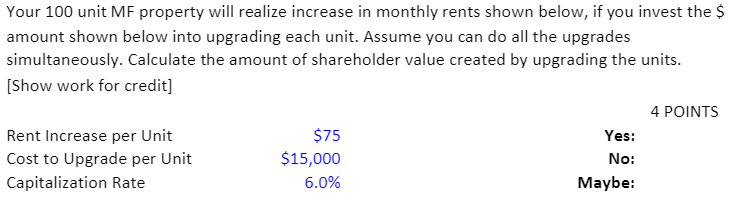

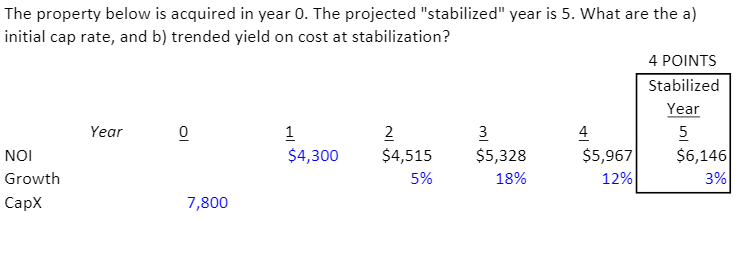

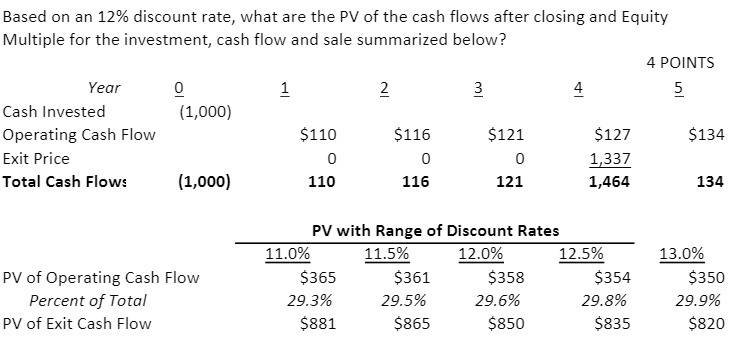

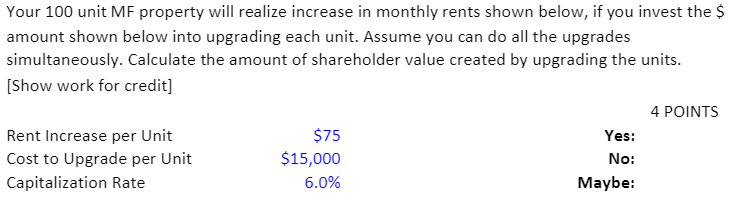

The property below is acquired in year 0. The projected "stabilized" year is 5. What are the a) initial cap rate, and b) trended yield on cost at stabilization? NOI Growth CapX Year 0 7,800 1 $4,300 2 $4,515 5% 3 $5,328 18% 4 $5,967 12% 4 POINTS Stabilized Year 5 $6,146 3% Based on an 12% discount rate, what are the PV of the cash flows after closing and Equity Multiple for the investment, cash flow and sale summarized below? Year Cash Invested Operating Cash Flow Exit Price Total Cash Flows 0 (1,000) (1,000) PV of Operating Cash Flow Percent of Total PV of Exit Cash Flow 1 $110 0 110 11.0% $365 29.3% 2 $881 $116 0 116 PV with Range of Discount Rates 11.5% 12.0% $361 29.5% 3 $865 $121 0 121 $358 29.6% $850 4 $127 1,337 1,464 12.5% $354 29.8% $835 4 POINTS 5 $134 134 13.0% $350 29.9% $820 Your 100 unit MF property will realize increase in monthly rents shown below, if you invest the $ amount shown below into upgrading each unit. Assume you can do all the upgrades simultaneously. Calculate the amount of shareholder value created by upgrading the units. [Show work for credit] Rent Increase per Unit Cost to Upgrade per Unit Capitalization Rate $75 $15,000 6.0% Yes: No: Maybe: 4 POINTS The property below is acquired in year 0. The projected "stabilized" year is 5. What are the a) initial cap rate, and b) trended yield on cost at stabilization? NOI Growth CapX Year 0 7,800 1 $4,300 2 $4,515 5% 3 $5,328 18% 4 $5,967 12% 4 POINTS Stabilized Year 5 $6,146 3% Based on an 12% discount rate, what are the PV of the cash flows after closing and Equity Multiple for the investment, cash flow and sale summarized below? Year Cash Invested Operating Cash Flow Exit Price Total Cash Flows 0 (1,000) (1,000) PV of Operating Cash Flow Percent of Total PV of Exit Cash Flow 1 $110 0 110 11.0% $365 29.3% 2 $881 $116 0 116 PV with Range of Discount Rates 11.5% 12.0% $361 29.5% 3 $865 $121 0 121 $358 29.6% $850 4 $127 1,337 1,464 12.5% $354 29.8% $835 4 POINTS 5 $134 134 13.0% $350 29.9% $820 Your 100 unit MF property will realize increase in monthly rents shown below, if you invest the $ amount shown below into upgrading each unit. Assume you can do all the upgrades simultaneously. Calculate the amount of shareholder value created by upgrading the units. [Show work for credit] Rent Increase per Unit Cost to Upgrade per Unit Capitalization Rate $75 $15,000 6.0% Yes: No: Maybe: 4 POINTS