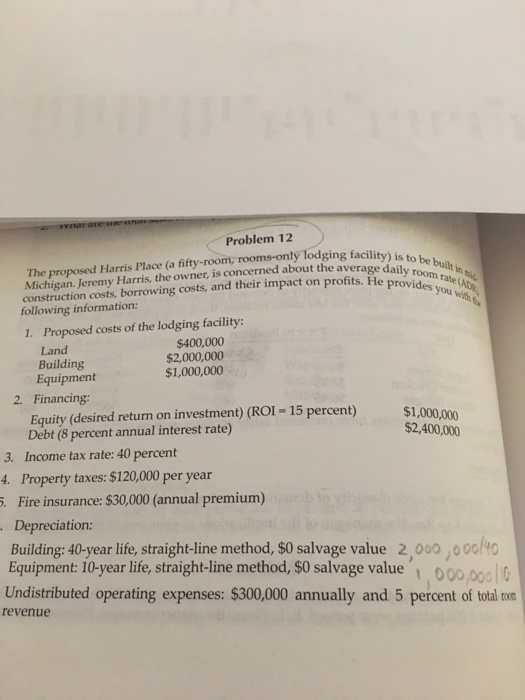

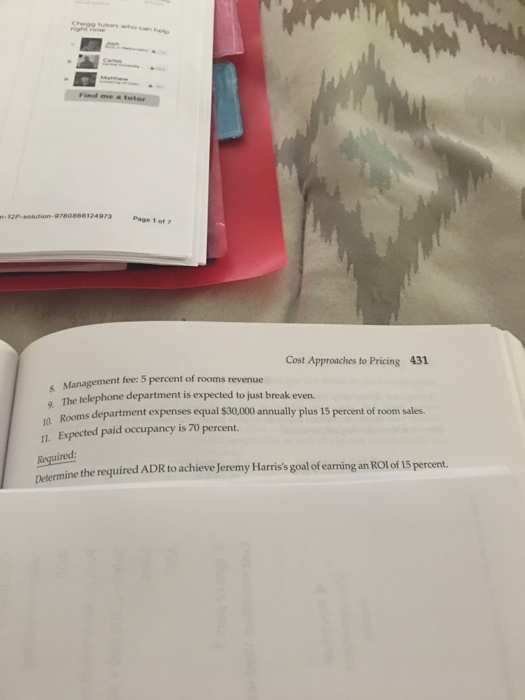

The proposed Harris Place (a fifty-room, rooms-only lodging facility) is to be built construction costs, borrowing costs, and their impact on profits. He provides you with Problem 12 room rate $1,000,000 $2,400,000 following information: 1. Proposed costs of the lodging facility: Land $400,000 Building $2,000,000 Equipment $1,000,000 2. Financing: Equity (desired return on investment) (ROI - 15 percent) Debt (8 percent annual interest rate) 3. Income tax rate: 40 percent 4. Property taxes: $120,000 per year 5. Fire insurance: $30,000 (annual premium) Depreciation: Building: 40-year life, straight-line method, $0 salvage value 3,000,000/40 Equipment: 10-year life, straight-line method, $0 salvage value Undistributed operating expenses: $300,000 annually and 5 percent of total com 1,000,00010 revenue Find me autor -12P-solution-9780866124973 Page 1 Cost Approaches to Pricing 431 & Management fee: 5 percent of rooms revenue The telephone department is expected to just break even. 10. Rooms department expenses equal $30,000 annually plus 15 percent of room sales. II. Expected paid occupancy is 70 percent. Required: Determine the required ADR to achieve Jeremy Harris's goal of earning an ROI of 15 percent. The proposed Harris Place (a fifty-room, rooms-only lodging facility) is to be built construction costs, borrowing costs, and their impact on profits. He provides you with Problem 12 room rate $1,000,000 $2,400,000 following information: 1. Proposed costs of the lodging facility: Land $400,000 Building $2,000,000 Equipment $1,000,000 2. Financing: Equity (desired return on investment) (ROI - 15 percent) Debt (8 percent annual interest rate) 3. Income tax rate: 40 percent 4. Property taxes: $120,000 per year 5. Fire insurance: $30,000 (annual premium) Depreciation: Building: 40-year life, straight-line method, $0 salvage value 3,000,000/40 Equipment: 10-year life, straight-line method, $0 salvage value Undistributed operating expenses: $300,000 annually and 5 percent of total com 1,000,00010 revenue Find me autor -12P-solution-9780866124973 Page 1 Cost Approaches to Pricing 431 & Management fee: 5 percent of rooms revenue The telephone department is expected to just break even. 10. Rooms department expenses equal $30,000 annually plus 15 percent of room sales. II. Expected paid occupancy is 70 percent. Required: Determine the required ADR to achieve Jeremy Harris's goal of earning an ROI of 15 percent