Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The purpose of this assignment is to calculate the QBI deduction at various taxable income before QBI thresholds. Imagine that you are working as a

The purpose of this assignment is to calculate the QBI deduction at various taxable income before QBI thresholds.

Imagine that you are working as a certified public accountant CPA and you have the following case:

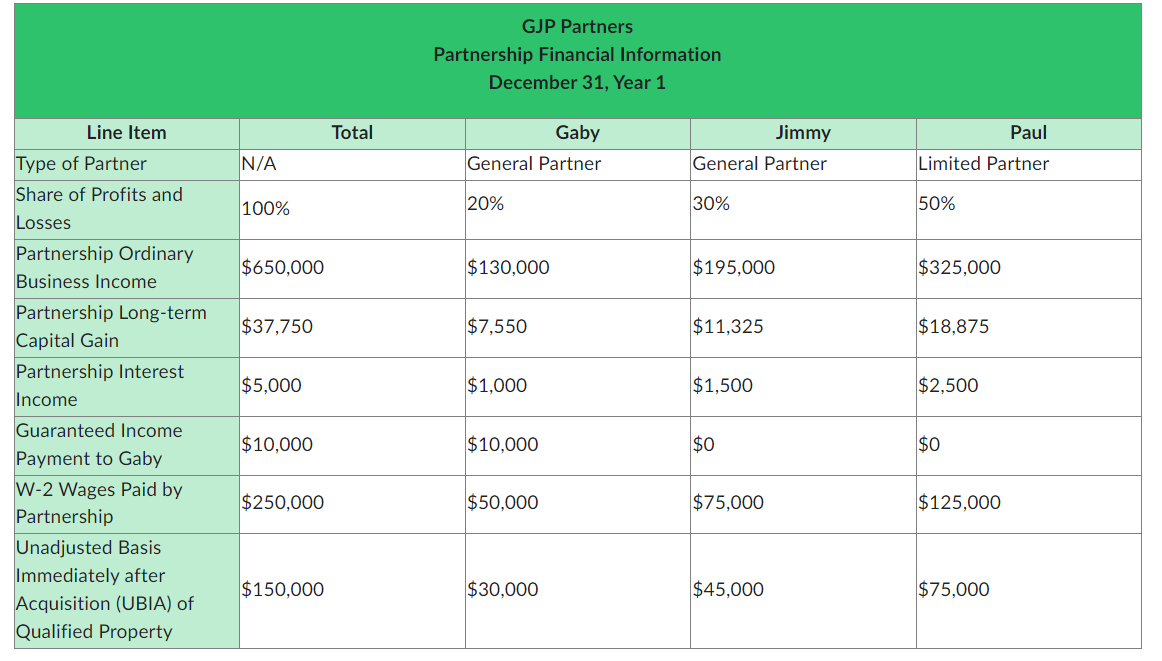

GJP Partnership is a calendaryear, nonpublicly traded partnership doing business in the United States. The partners have contacted you inquiring about the Section A qualified business income deduction. They have provided partnership information for Year in the exhibit below. The partners do not have any other sources of income in Year other than the partnershiprelated items provided. All of the partners are single and will use the single standard deduction of $ on their individual federal income tax returns.

For this example, assume the QBI phaseout beings for Single taxpayers with income of $ fully phasing in at

Using the information provided above and, in the table, below, enter the amount of each partners taxable income before the qualified business income QBI deduction and Section A QBI deduction for Year under two independent assumptions about GJP Partnership's business:

Dental services teeth examinations and treatment

Retail sales of dental supplies toothbrushes floss, etc.

For purposes of this simulation, ignore any deduction for onehalf of selfemployment tax. Use positive, whole numbers, and if the amount is zero, enter a zero Please submit your responses to this Dropbox, here is a template you can use to submit your answers not required to be done this way, just an optiontabletableGJP PartnersPartnership Financial InformationDecember Year Line Item,Total,Gaby,Jimmy,PaulType of Partner,NAGeneral Partner,General Partner,Limited PartnertableShare of Profits andLossestablePartnership OrdinaryBusiness Income$$$$tablePartnership LongtermCapital Gain$$$$tablePartnership InterestIncome$$$$tableGuaranteed IncomePayment to Gaby$$$$tableW Wages Paid byPartnership$$$$tableUnadjusted BasisImmediately afterAcquisition UBIA ofQualified Property$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started