Answered step by step

Verified Expert Solution

Question

1 Approved Answer

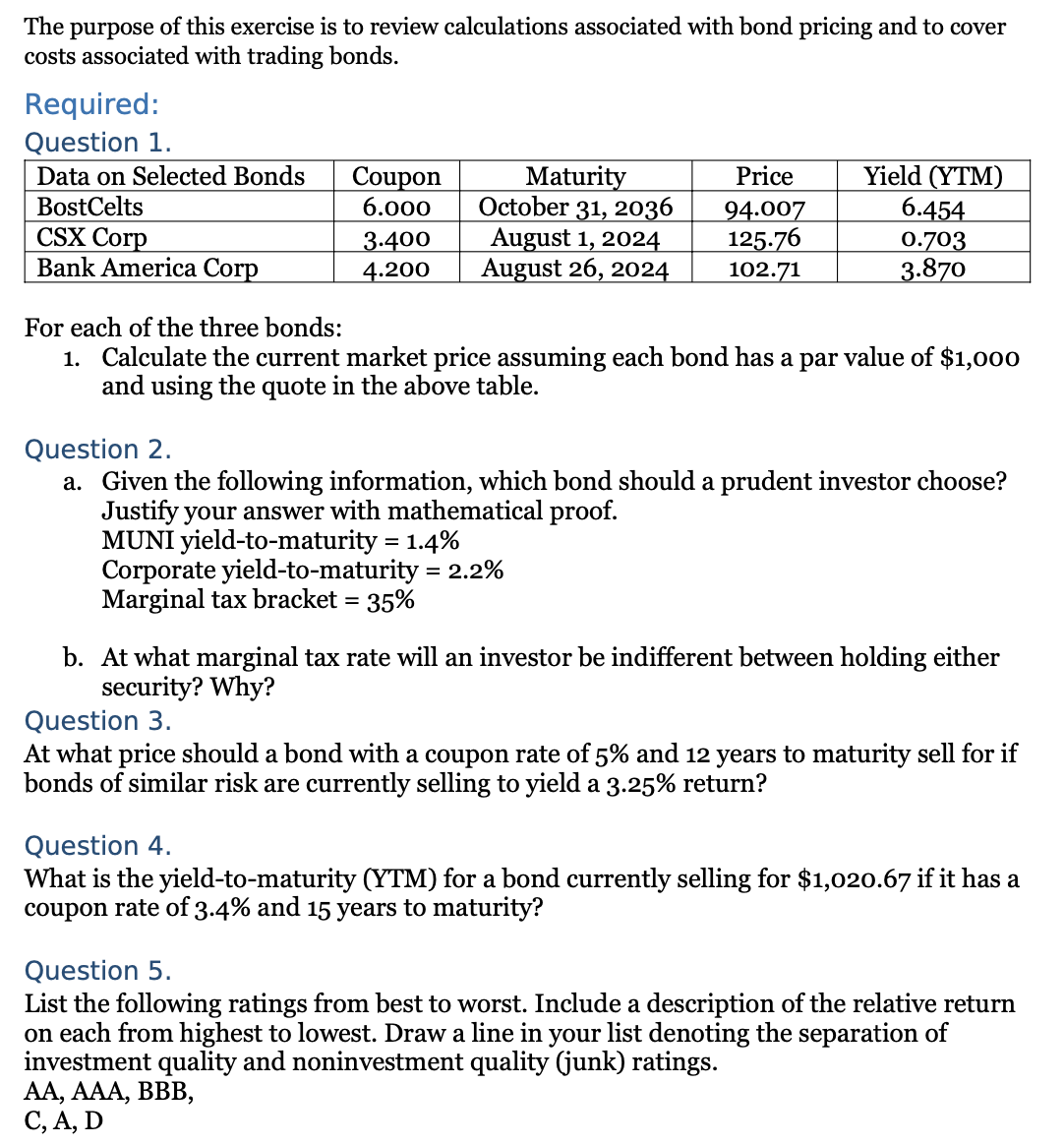

The purpose of this exercise is to review calculations associated with bond pricing and to cover costs associated with trading bonds. Required: Question 1. For

The purpose of this exercise is to review calculations associated with bond pricing and to cover costs associated with trading bonds. Required: Question 1. For each of the three bonds: 1. Calculate the current market price assuming each bond has a par value of $1,000 and using the quote in the above table. Question 2. a. Given the following information, which bond should a prudent investor choose? Justify your answer with mathematical proof. MUNI yield-to-maturity =1.4% Corporate yield-to-maturity =2.2% Marginal tax bracket =35% b. At what marginal tax rate will an investor be indifferent between holding either security? Why? Question 3. At what price should a bond with a coupon rate of 5% and 12 years to maturity sell for if bonds of similar risk are currently selling to yield a 3.25% return? Question 4. What is the yield-to-maturity (YTM) for a bond currently selling for $1,020.67 if it has a coupon rate of 3.4% and 15 years to maturity? Question 5. List the following ratings from best to worst. Include a description of the relative return on each from highest to lowest. Draw a line in your list denoting the separation of investment quality and noninvestment quality (junk) ratings. AA,AAA,BBB, C, A, D

The purpose of this exercise is to review calculations associated with bond pricing and to cover costs associated with trading bonds. Required: Question 1. For each of the three bonds: 1. Calculate the current market price assuming each bond has a par value of $1,000 and using the quote in the above table. Question 2. a. Given the following information, which bond should a prudent investor choose? Justify your answer with mathematical proof. MUNI yield-to-maturity =1.4% Corporate yield-to-maturity =2.2% Marginal tax bracket =35% b. At what marginal tax rate will an investor be indifferent between holding either security? Why? Question 3. At what price should a bond with a coupon rate of 5% and 12 years to maturity sell for if bonds of similar risk are currently selling to yield a 3.25% return? Question 4. What is the yield-to-maturity (YTM) for a bond currently selling for $1,020.67 if it has a coupon rate of 3.4% and 15 years to maturity? Question 5. List the following ratings from best to worst. Include a description of the relative return on each from highest to lowest. Draw a line in your list denoting the separation of investment quality and noninvestment quality (junk) ratings. AA,AAA,BBB, C, A, D Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started