Question

The Purpose to the assignment: To introduce the concept of risk and reward. The more risk that you take the more reward that you expect/desire/require

The Purpose to the assignment:

To introduce the concept of "risk and reward". The more risk that you take the more reward that you expect/desire/require

How to Complete the assignment:

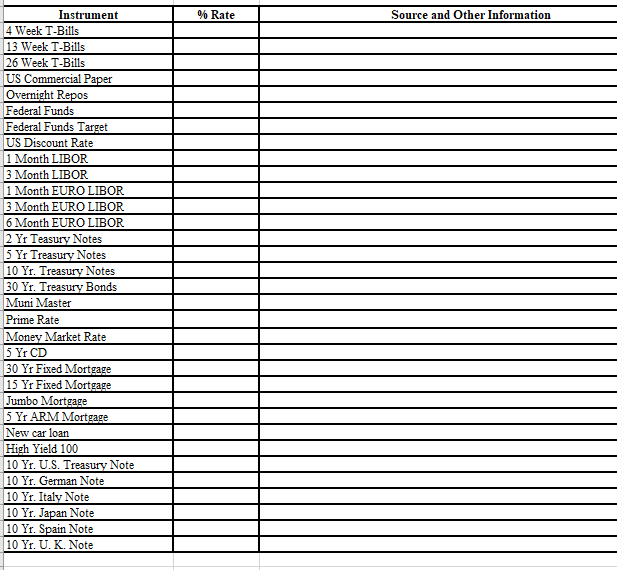

Using the Wall Street Journal (section B) or other financial source or the internet, determine for each of the financial instruments listed the rate (percentage) that you would earn or have to pay. Also, please include the source from which you found the rate Please note that the rates for several of the financial instruments will be dependent upon the rating of the company issuing the financial instrument or the length of time the instrument will be outstanding

Grading:

Grading will be determined by how many of the financial instruments you are able to find Is the rate that you found "reasonable"? For example, if the rate is 0.10%, a rate of 1.0% would not be reasonable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started