Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the question is answered before but I need it to be answered in the same schedule because I cant know the answers places Abram, Maccoy,

the question is answered before but I need it to be answered in the same schedule because I cant know the answers places

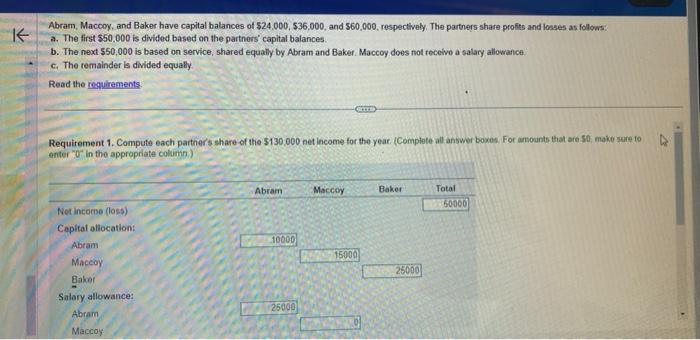

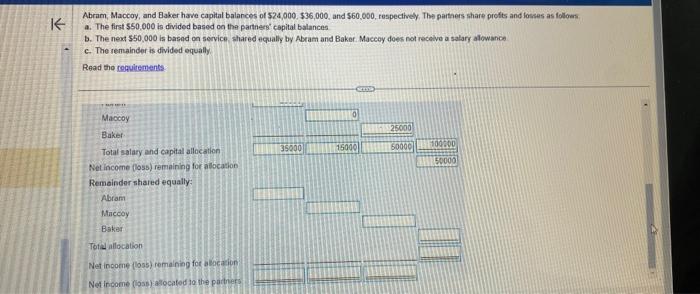

Abram, Maccoy, and Baker have capital balances of 524,000,536,000, and 560,000, respectively. The partners share profits and losses as follows: a. The first $50.000 is divided based on the partnors" capital baiances. b. The next $50,000 is based on service; shared equally by Abram and Baker. Maccoy does not recehvo a salary allowance. c. The remainder is divided equally Read the regulirements. Requirement 1. Compute each parther's share-of the $130,000 net lncome for the year, (Complete all answer boxes. For amounts that are So, make ware to enter "o 0+in the appropriate colimin) Abram, Maccoy, and Baker have capital balances of $24,000,$36,000, and 560,000 , respectively. The partaers share profts and losses as follomes a. The first $50,000 is divided based on the parthess' capital balances b. The neat 550,000 is based on service, shared ecually by Abeam and Baker. Maceoy does not recelve a salary alowanco c. The remainder is divided equally

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started