The question is in the following picture. Please explain and show the detailed steps and please do not use excel.

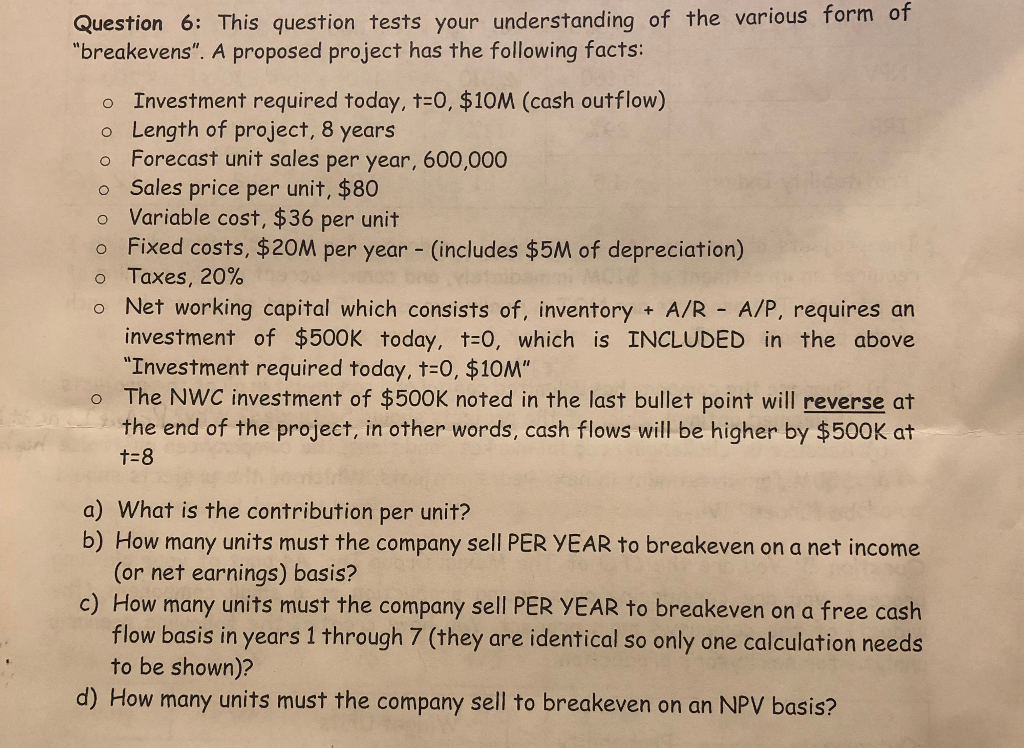

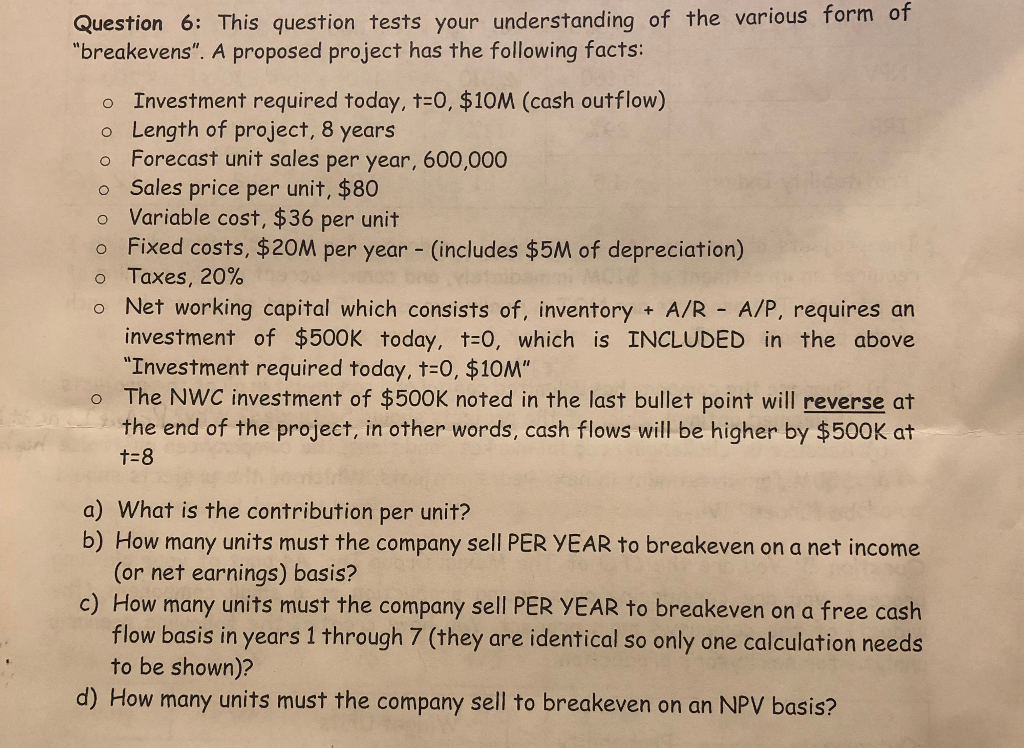

Question 6: This question tests your understanding of the various form of "breakevens". A proposed project has the following facts: o Investment required today, t-0, $10M (cash outflow) o Length of project, 8 years o Forecast unit sales per year, 600,000 o Sales price per unit, $80 o Variable cost, $36 per unit o Fixed costs, $20M per year - (includes $5M of depreciation) o Taxes, 20% o Net working capital which consists of, inventory A/R A/P, requires an investment of $500K today, t0, which is INCLUDED in the above "Investment required today, t-0, $10M" The NWC investment of $500K noted in the last bullet point will reverse at the end of the project, in other words, cash flows will be higher by $500K at t-8 a) What is the contribution per unit? b) How many units must the company sell PER YEAR to breakeven on a net income (or net earnings) basis? c) How many units must the company sell PER YEAR to breakeven on a free cash flow basis in years 1 through 7 (they are identical so only one calculation needs to be shown)? d) How many units must the company sell to breakeven on an NPV basis? Question 6: This question tests your understanding of the various form of "breakevens". A proposed project has the following facts: o Investment required today, t-0, $10M (cash outflow) o Length of project, 8 years o Forecast unit sales per year, 600,000 o Sales price per unit, $80 o Variable cost, $36 per unit o Fixed costs, $20M per year - (includes $5M of depreciation) o Taxes, 20% o Net working capital which consists of, inventory A/R A/P, requires an investment of $500K today, t0, which is INCLUDED in the above "Investment required today, t-0, $10M" The NWC investment of $500K noted in the last bullet point will reverse at the end of the project, in other words, cash flows will be higher by $500K at t-8 a) What is the contribution per unit? b) How many units must the company sell PER YEAR to breakeven on a net income (or net earnings) basis? c) How many units must the company sell PER YEAR to breakeven on a free cash flow basis in years 1 through 7 (they are identical so only one calculation needs to be shown)? d) How many units must the company sell to breakeven on an NPV basis