Answered step by step

Verified Expert Solution

Question

1 Approved Answer

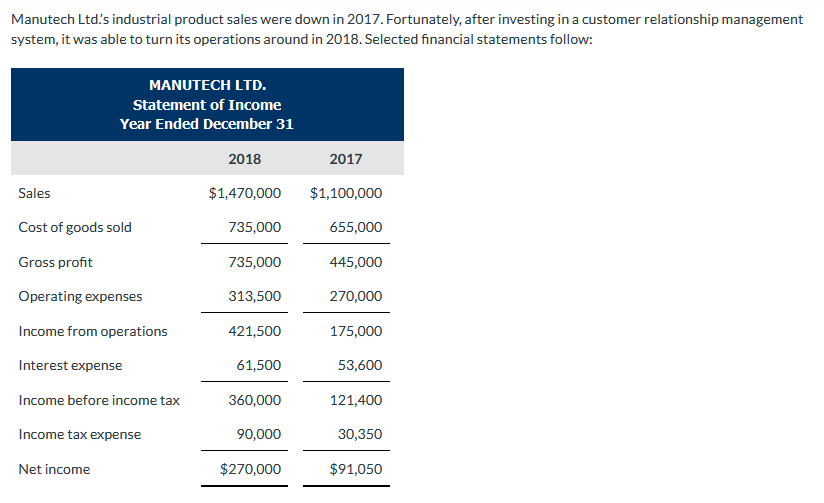

The question is to Identify the main reasons for the change in gross profit and net income between the two years. Manutech Ltd.'s industrial product

The question is to Identify the main reasons for the change in gross profit and net income between the two years.

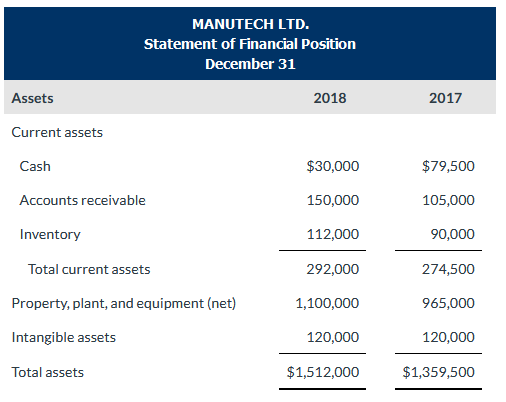

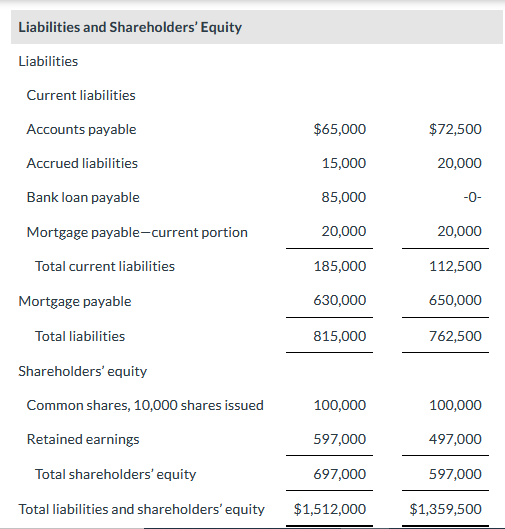

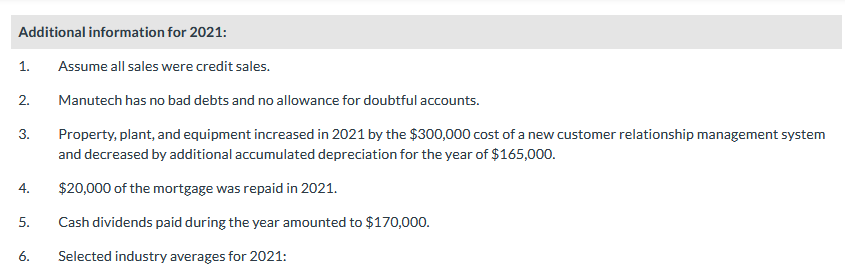

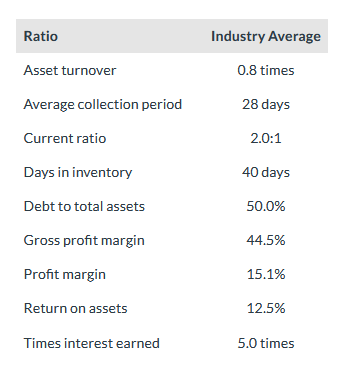

Manutech Ltd.'s industrial product sales were down in 2017 . Fortunately, after investing in a customer relationship management system, it was able to turn its operations around in 2018 . Selected financial statements follow: MANUTECH LTD. Statement of Financial Position December 31 Assets 2018 Current assets \begin{tabular}{lrr} Cash & $30,000 & $79,500 \\ Accounts receivable & 150,000 & 105,000 \\ Inventory & 112,000 & 90,000 \\ Total current assets & 292,000 & 274,500 \\ Property, plant, and equipment (net) & 1,100,000 & 965,000 \\ Intangible assets & 120,000 & 120,000 \\ \hline Total assets & $1,512,000 & $1,359,500 \\ \hline \end{tabular} Liabilities and Shareholders' Equity Liabilities Current liabilities Accounts payable Accrued liabilities \begin{tabular}{rrr} $65,000 & & $72,500 \\ 15,000 & 20,000 \\ 85,000 & 0 \\ 20,000 & & 20,000 \\ \cline { 1 - 1 } 185,000 & & 112,500 \\ 630,000 & & 650,000 \\ \cline { 1 - 1 } 5 & & 762,500 \\ \cline { 1 - 1 } 5 & & \end{tabular} Shareholders' equity Common shares, 10,000 shares issued 100,000100,000 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Additional information for 2021: 1. Assume all sales were credit sales. 2. Manutech has no bad debts and no allowance for doubtful accounts. 3. Property, plant, and equipment increased in 2021 by the $300,000 cost of a new customer relationship management system and decreased by additional accumulated depreciation for the year of $165,000. 4. $20,000 of the mortgage was repaid in 2021 . 5. Cash dividends paid during the year amounted to $170,000. 6. Selected industry averages for 2021 : Ratio Industry Average Asset turnover 0.8 times Average collection period 28 days Current ratio 2.0:1 Days in inventory 40 days Debt to total assets 50.0% Gross profit margin 44.5% Profit margin 15.1% Return on assets 12.5% Times interest earned 5.0 times Answer the following question from management: "We know that the sales volume has increased, but we don't know if gross profit and net income are increasing in proportion to sales: can you tell us?" Identify the primary reason(s) for the change in gross profit and net income between the two yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started