The question must be answered and elaborated upon inside of the excel sheet provided. Please help!!!

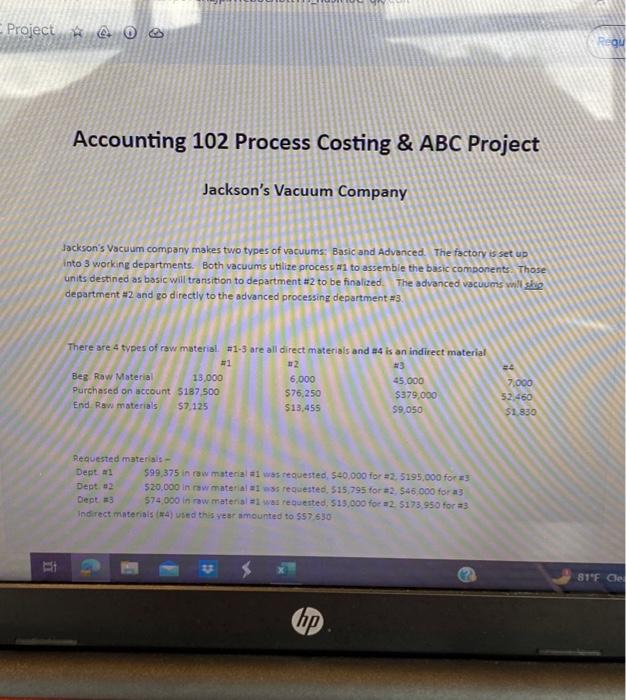

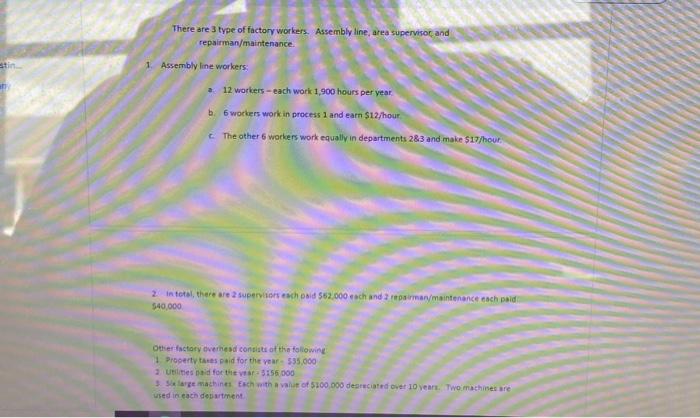

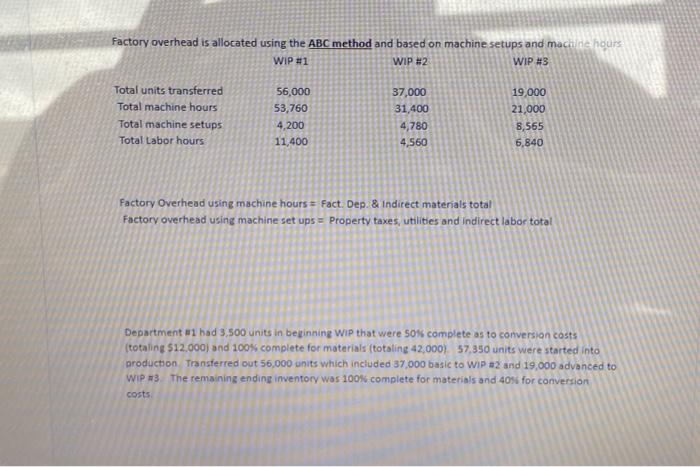

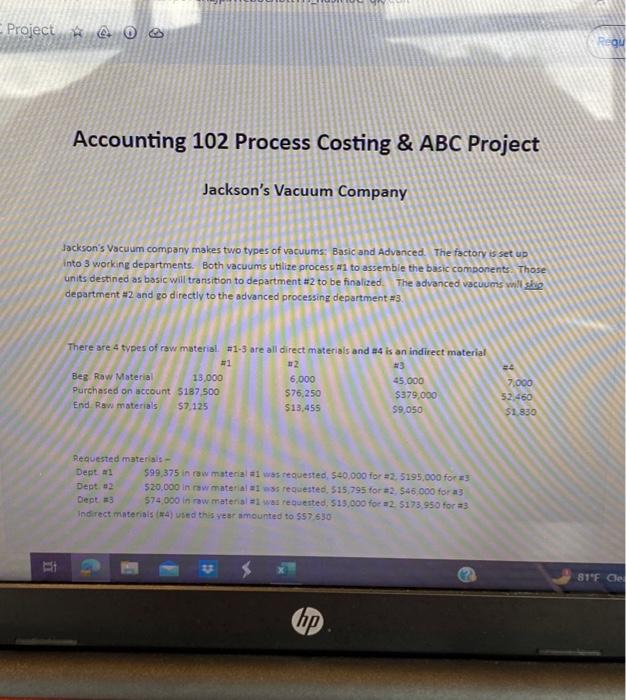

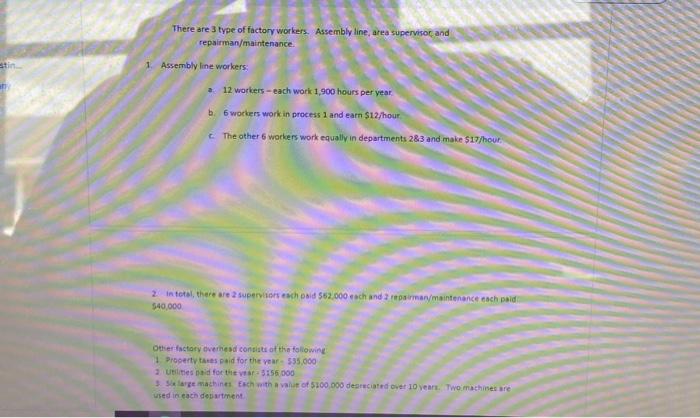

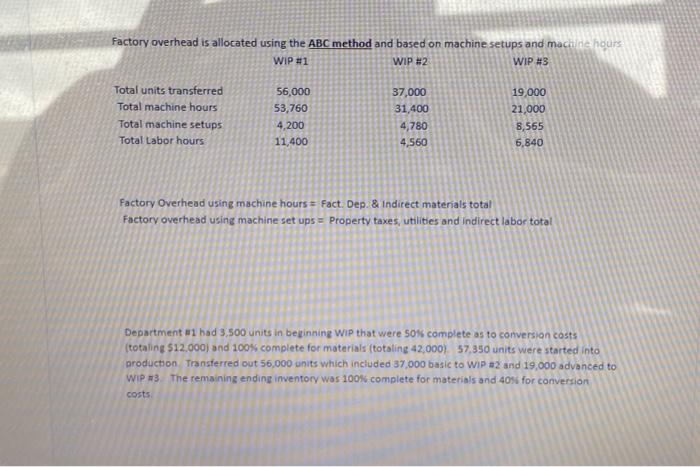

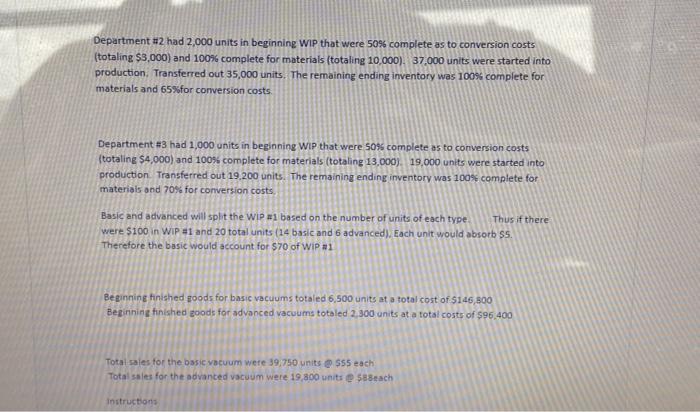

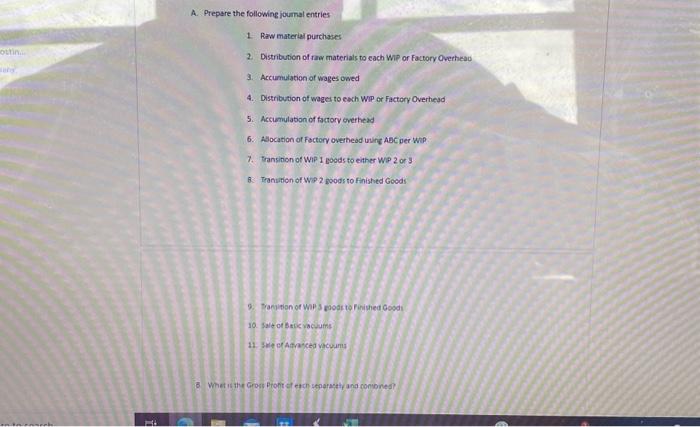

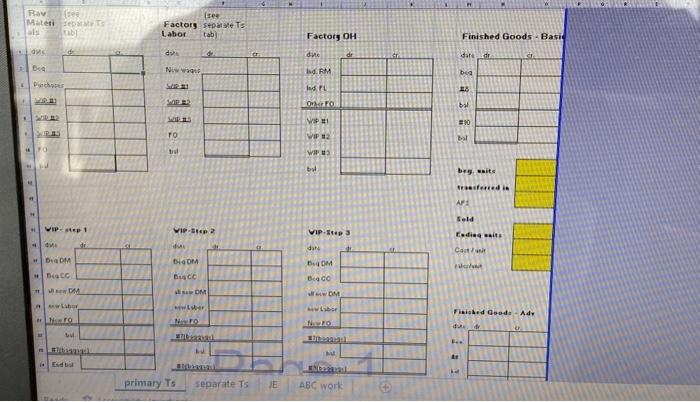

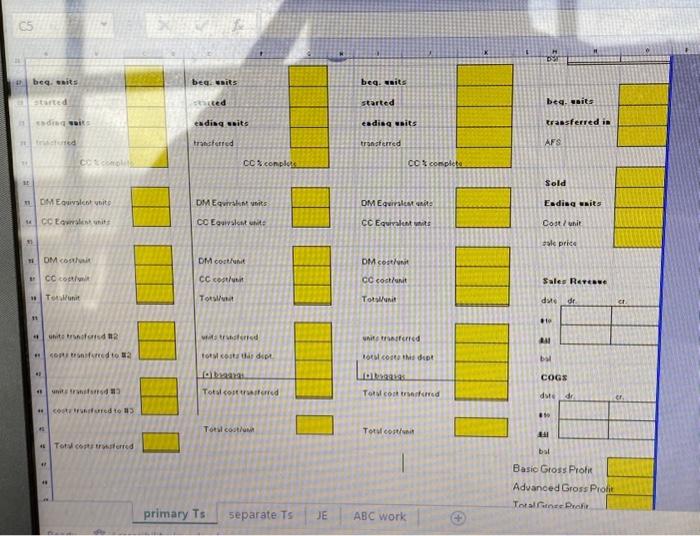

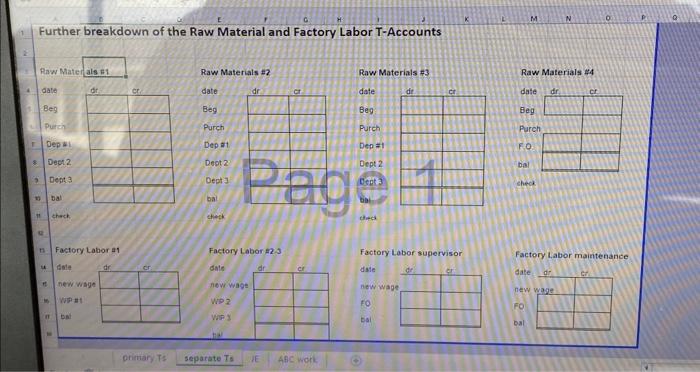

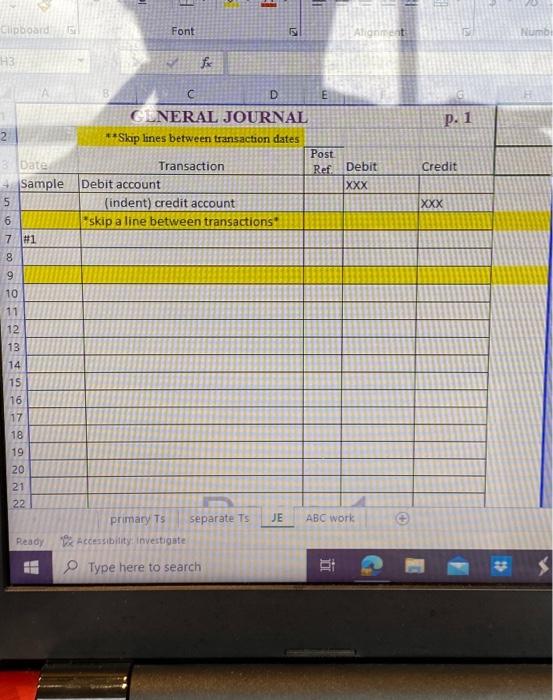

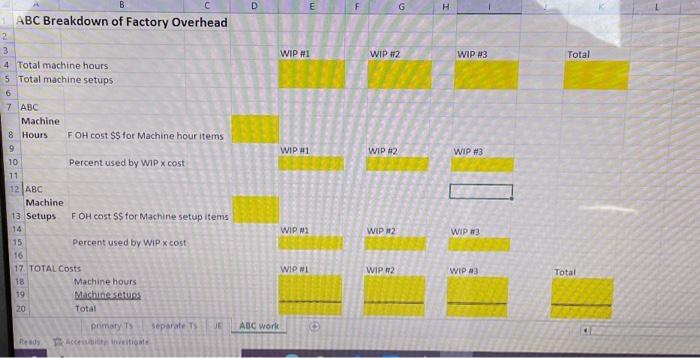

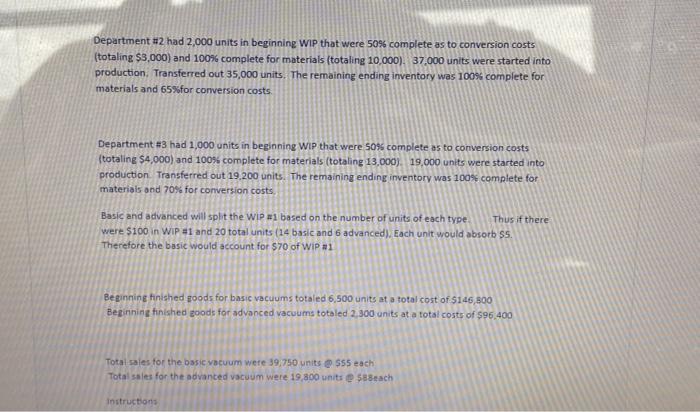

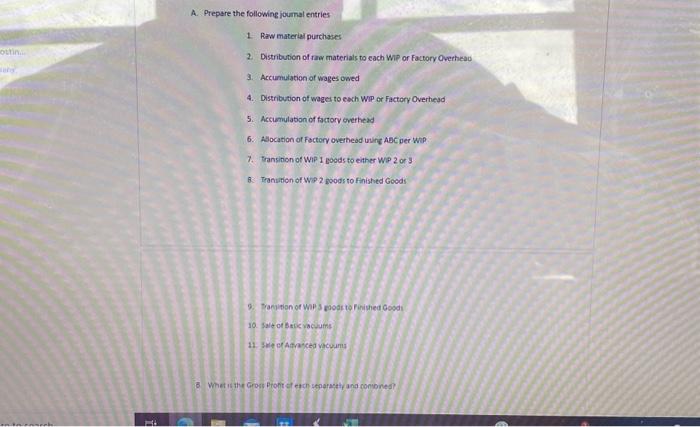

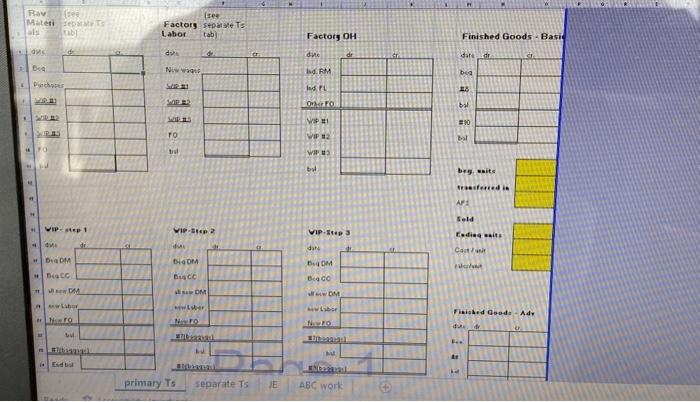

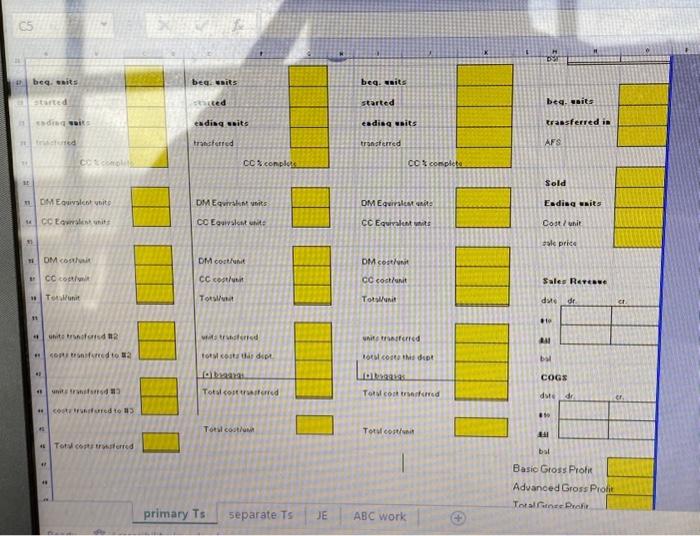

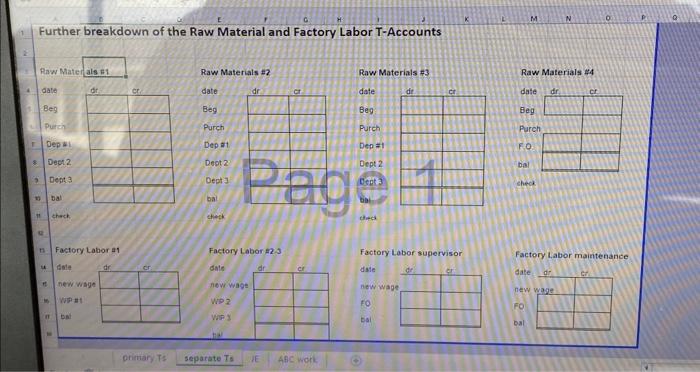

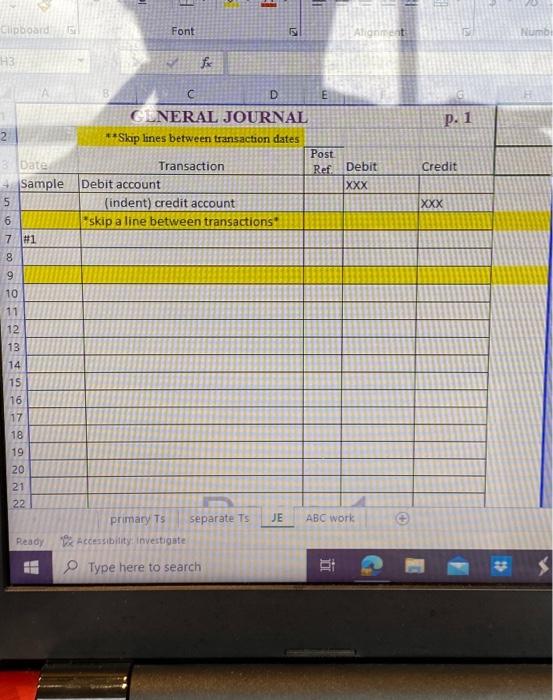

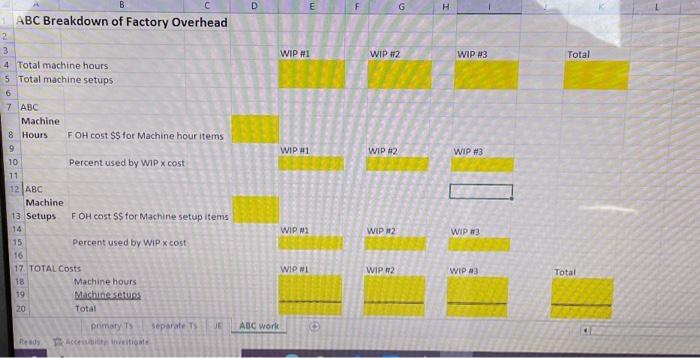

Factory overhead is allocated using the ABC method and based on machine setups and maching hours Factory Overhead using machine hours = Fact. Dep. \& Indirect materials total Factory overhead using machine set ups = Property taxes, utlities and indirect labor total Department a1 had 3,500 units in bezinning Wip that were 50% complete as to conversian costs (totaling $12,000 ) and 100$ complete for materials (totaling 42,000), 57,350 units were started into production. Transterred out 56,000 units which included 37,000 basic to Wip a 2 and 19,000 advanced to Wip 3. The remaining ending inventory was 1006 complete for materials and 4006 for conversion costs. There are 3 type of factory workers. Assembly line, area supervisoc and repairman/maintenance. 1. Assembly line workers: a. 12 workers-each work 1,900 hours per vear. b. 6 wockers work in process 1 and earn $12 hour c. The other 6 workers work equally in departments 283 and make $17 hour: 2 in tetal, there we 2 superviars each bsid 552,000 esch and 2 inpairman/maintenance each paid: 540,000 Other factory averinesd contists of tha followine 1. Propertv tanes peid for the vear - 535.000 used inceach department A. Prepare the following journal entries 1. Raw material purthases 2. Distribution of raw materials to each Wip or Factory Overheav 3. Accumulation of wages owed 4. Distribution of wages to each WIP or Factory Overhesd 5. Acciomulabon of factorv overhead 7. Transition of WiP 1 goods to either WP 2 or 3 B. Tranution of W9.2 noods to Finished Goods 10. Salt of Baik vacuifts 11. Sie of Afraved vacuars Department #2 had 2,000 units in beginning Wip that were 50% complete as to conversion costs (totaling $3,000 ) and 100% complete for materials (totaling 10,000), 37,000 units were started into production. Transferred out 35,000 units. The remaining ending inventory was 100s complete for materials and 65% for conversion costs. Department =3 had 1,000 units in beginning Wip that were 50% complete as to conversion costs (totaling $4,000 ) and 100% complete for materials (totaling 13,000), 19,000 units were started into production. Transferred out 19,200 units. The remaining ending inventory was 100% camplete for materiais and 70% for conversion costs. Basic and advanced will split the wip =1 based on the number of units of each type. Thus if there were $100 in WIP =1 and 20 total units ( 14 basic and 6 advanced). Each unit would absorb $5. Therefore the basic would account for $70 of WiP =1 Beginning finished goods for basic vacuums totaled 6,500 units at a total cost of $146,300 Bezinning finished zoods for advanced vacuums totaled 2,300 units at a total costs of $96,400 Tots sales for the basic vacuum were 39,750 units e $55 each Total sales for the advanced vacuum were 19,800 units 2588 sach Further breakdown of the Raw Material and Factory Labor T-Accounts Further breakdown of the Raw Material and Factory Labor T-Accounts Raw Mater als E1 Raw Materials =? Raw Materials =3 Raw Materials \#4 Ready Re Accessibinty invertigate 9 Type here to search Jackson's Vacuum company makes two types of vacuums: Basic and Advanced. The factory is set up into 3 working departments. Both vacuums utilize process A1 to assemble the basic components. Those units destined as basic will transition to department $2 to be finalized. The advanced vacuums will shiog department =2 and go directly to the advanced processing department =3. There are 4 tvpes of row material. $13 are all direct materials and $4 is an indirect material Bequested materiais - Dept a1 599,375 in row material =1 was requested, 540,000 for =2,5195,000 for x3 : Dept =3574,000 in row material =1 wos requerted, 519,000 for =2.5173,950 for =3 indirect materiais (4) used this yest amounted to $57.510 ABC Breakdown of Factory Overhead \begin{tabular}{c|c} 2 & \\ \hline 3 & \\ 4 & Total machine hours \\ \hline 5 & Total machine setups \\ \hline 6 & \end{tabular} 7ABC Machine 8 Hours FOH cost SS for Machine hour items 9 10 Percent used by WIP cost 1112ABC Machine Setups FOH cost $ S for Machine setup items \begin{tabular}{|r|r|} \hline 14 & \\ 15 & Per \\ 16 & \\ 17 & TOTAL Costs \\ 18 & \\ \hline \end{tabular} Machine hours Machinesetups Total WIP 41 WIP M1 WIP NI WIP \#1 WIP \#2 WIP #2 WIP #3 WIP 12 Wip 72 \begin{tabular}{l} Wip 72 : \\ 4 \\ \hline \end{tabular} WIP A3 Total L H Wip n3 WIP A3 Total