Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The questions are separate. Question 1 to 5 are all different questions 2.00 B 0.45 QUESTION ONE a) Suppose we have the three portfolios with

The questions are separate. Question 1 to 5 are all different questions

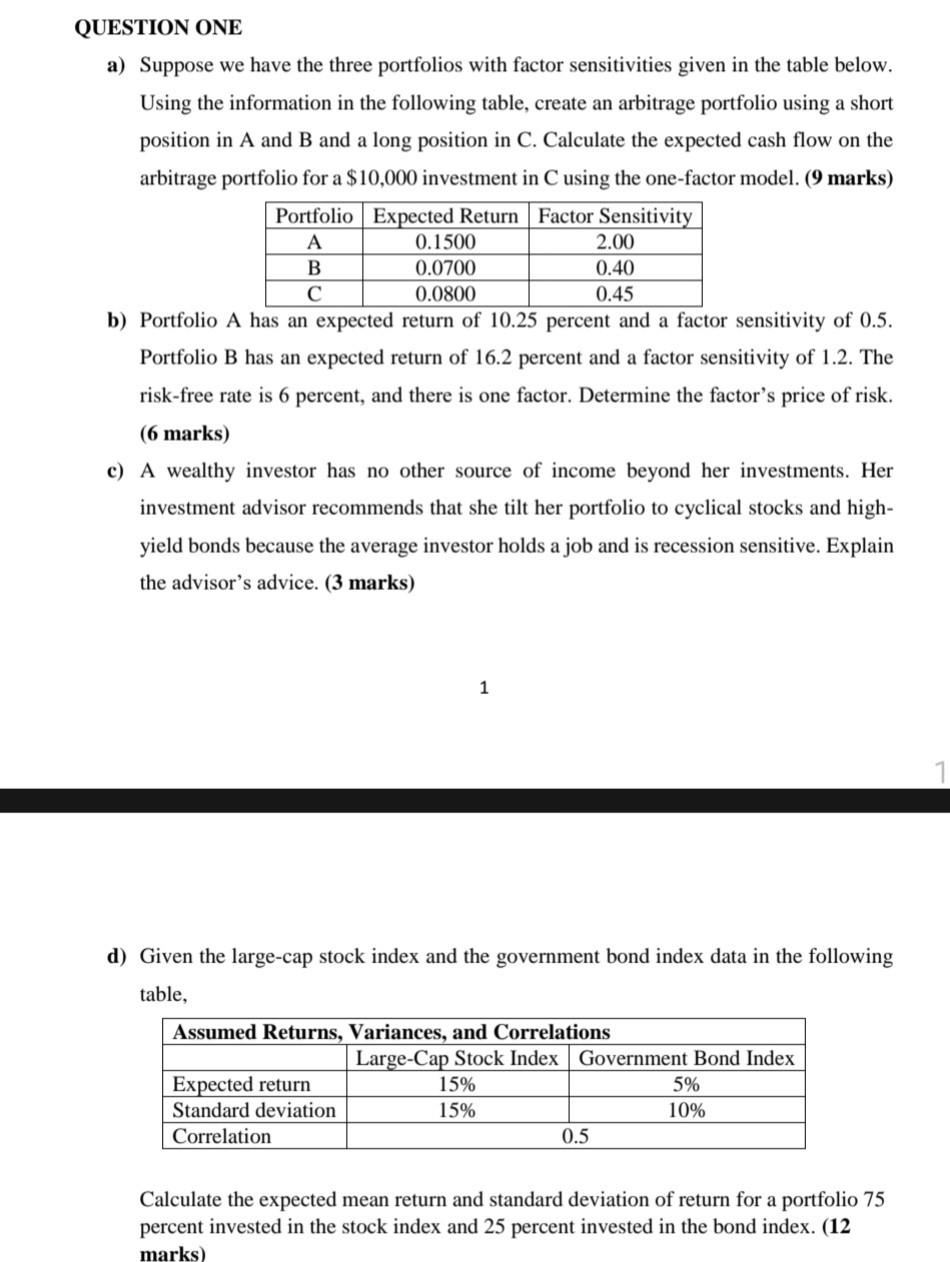

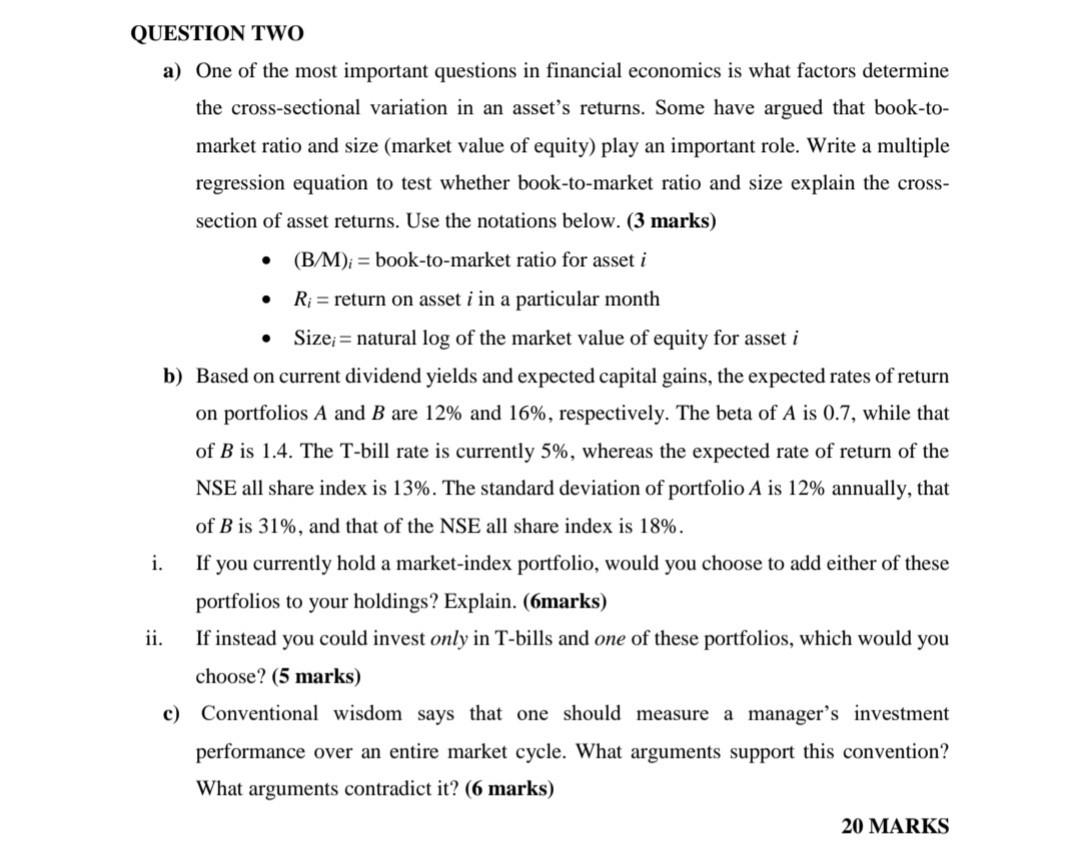

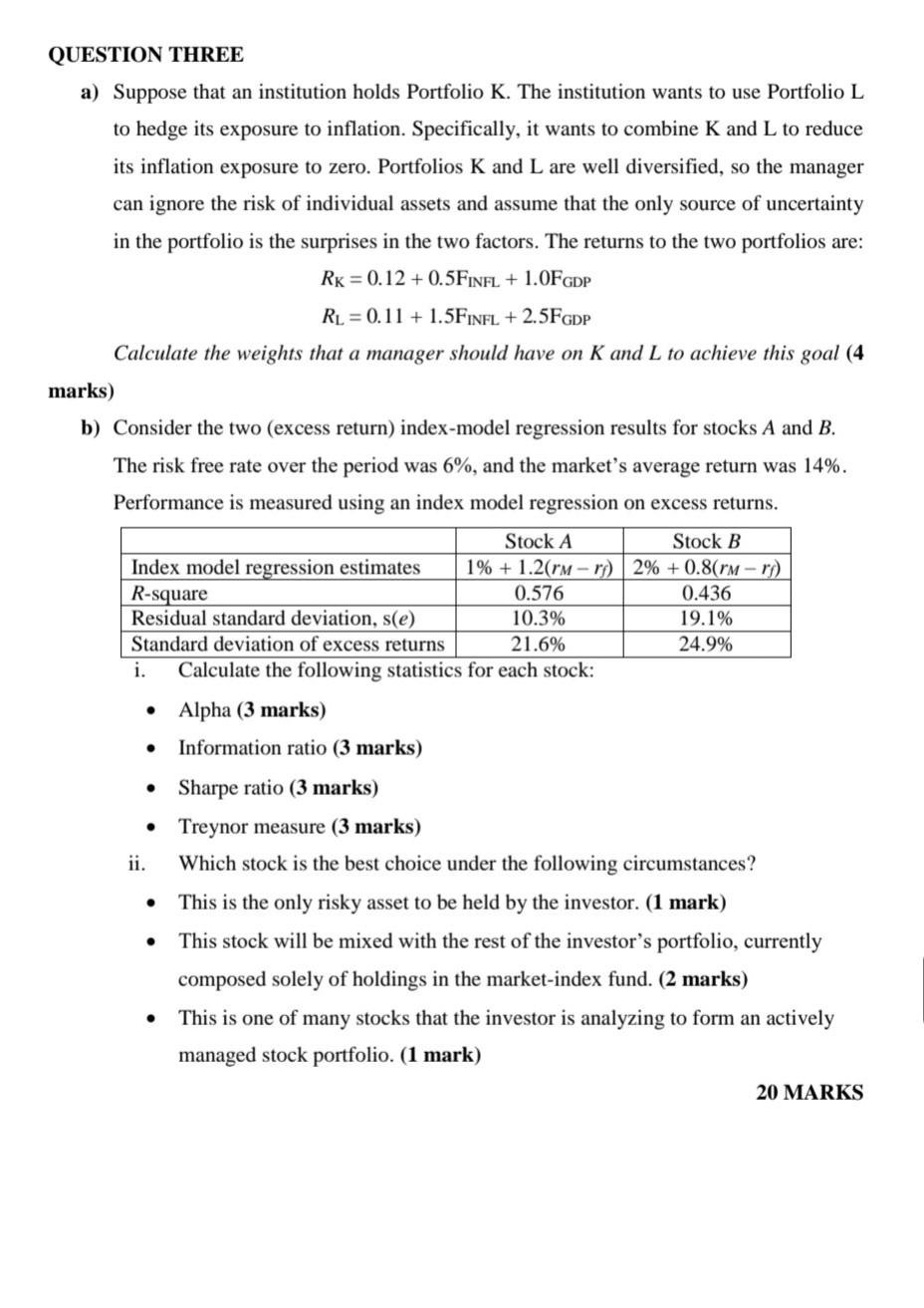

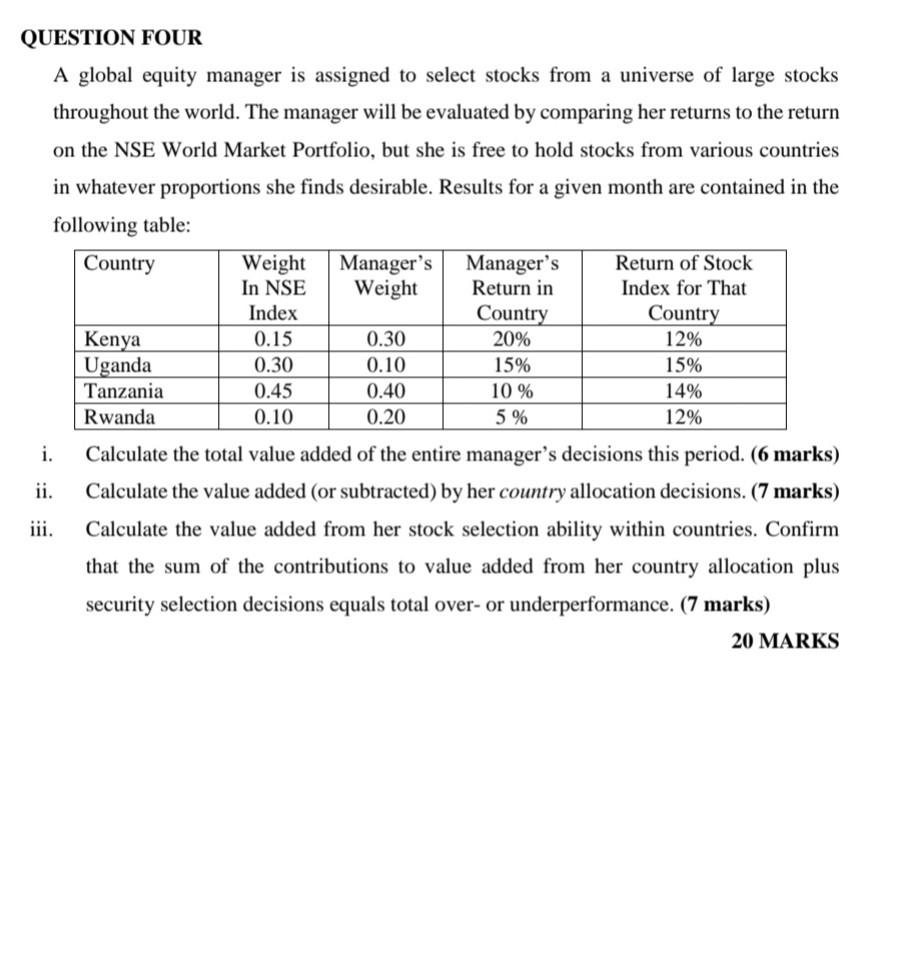

2.00 B 0.45 QUESTION ONE a) Suppose we have the three portfolios with factor sensitivities given in the table below. Using the information in the following table, create an arbitrage portfolio using a short position in A and B and a long position in C. Calculate the expected cash flow on the arbitrage portfolio for a $10,000 investment in C using the one-factor model. (9 marks) Portfolio Expected Return Factor Sensitivity A 0.1500 0.0700 0.40 0.0800 b) Portfolio A has an expected return of 10.25 percent and a factor sensitivity of 0.5. Portfolio B has an expected return of 16.2 percent and a factor sensitivity of 1.2. The risk-free rate is 6 percent, and there is one factor. Determine the factor's price of risk. (6 marks) c) A wealthy investor has no other source of income beyond her investments. Her investment advisor recommends that she tilt her portfolio to cyclical stocks and high- yield bonds because the average investor holds a job and is recession sensitive. Explain the advisor's advice. (3 marks) a 1 d) Given the large-cap stock index and the government bond index data in the following table, Assumed Returns, Variances, and Correlations Large-Cap Stock Index Government Bond Index Expected return 15% 5% Standard deviation 15% 10% Correlation 0.5 Calculate the expected mean return and standard deviation of return for a portfolio 75 percent invested in the stock index and 25 percent invested in the bond index. (12 marks) . QUESTION TWO a) One of the most important questions in financial economics is what factors determine the cross-sectional variation in an asset's returns. Some have argued that book-to- market ratio and size (market value of equity) play an important role. Write a multiple regression equation to test whether book-to-market ratio and size explain the cross- section of asset returns. Use the notations below. (3 marks) (B/M); = book-to-market ratio for asset i R; = return on asset i in a particular month Size; = natural log of the market value of equity for asset i b) Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 12% and 16%, respectively. The beta of A is 0.7, while that of B is 1.4. The T-bill rate is currently 5%, whereas the expected rate of return of the NSE all share index is 13%. The standard deviation of portfolio A is 12% annually, that of Bis 31%, and that of the NSE all share index is 18%. i. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain. (6marks) ii. If instead you could invest only in T-bills and one of these portfolios, which would you choose? (5 marks) c) Conventional wisdom says that one should measure a manager's investment performance over an entire market cycle. What arguments support this convention? What arguments contradict it? (6 marks) 20 MARKS QUESTION THREE a) Suppose that an institution holds Portfolio K. The institution wants to use Portfolio L to hedge its exposure to inflation. Specifically, it wants to combine K and L to reduce its inflation exposure to zero. Portfolios K and L are well diversified, so the manager can ignore the risk of individual assets and assume that the only source of uncertainty in the portfolio is the surprises in the two factors. The returns to the two portfolios are: RK = 0.12 +0.5FINFL + 1.0FGDP RL = 0.11 + 1.5FINFL + 2.5FGDP Calculate the weights that a manager should have on K and L to achieve this goal (4 marks) b) Consider the two (excess return) index-model regression results for stocks A and B. The risk free rate over the period was 6%, and the markets average return was 14%. Performance is measured using an index model regression on excess returns. Stock A Stock B Index model regression estimates 1% + 1.2(rm -r) 2% +0.8(rm -r) R-square 0.576 0.436 Residual standard deviation, s(e) 10.3% 19.1% Standard deviation of excess returns 21.6% 24.9% i. Calculate the following statistics for each stock: Alpha (3 marks) Information ratio (3 marks) Sharpe ratio (3 marks) Treynor measure (3 marks) ii. Which stock is the best choice under the following circumstances? This is the only risky asset to be held by the investor. (1 mark) This stock will be mixed with the rest of the investor's portfolio, currently composed solely of holdings in the market-index fund. (2 marks) This is one of many stocks that the investor is analyzing to form an actively managed stock portfolio. (1 mark) 20 MARKS . . . QUESTION FOUR A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the NSE World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table: Country Weight Manager's Manager's Return of Stock In NSE Weight Return in Index for That Index Country Country Kenya 0.15 0.30 20% 12% Uganda 0.30 0.10 15% 15% Tanzania 0.45 0.40 10 % 14% Rwanda 0.10 0.20 5 % 12% i. Calculate the total value added of the entire manager's decisions this period. (6 marks) ii. Calculate the value added (or subtracted) by her country allocation decisions. (7 marks) iii. Calculate the value added from her stock selection ability within countries. Confirm that the sum of the contributions to value added from her country allocation plus security selection decisions equals total over- or underperformance. (7 marks) 20 MARKS QUESTION FIVE During the annual review of Maxx's pension plan, several trustees questioned their investment consultant about various aspects of performance measurement and risk assessment. a) Comment on the appropriateness of using each of the following benchmarks for performance evaluation: i. Market index. (2 marks) ii. Benchmark normal portfolio. (2 marks) iii. Median of the manager universe. (2 marks) b) Distinguish among the following performance measures: The Sharpe ratio. The Treynor measure. Jensen's alpha. . . . i. Describe how each of the three performance measures is calculated. (9 marks) ii. State whether each measure assumes that the relevant risk is systematic, unsystematic, or total. Explain how each measure relates excess return and the relevant risk. (5 marks) 20 MARKS 2.00 B 0.45 QUESTION ONE a) Suppose we have the three portfolios with factor sensitivities given in the table below. Using the information in the following table, create an arbitrage portfolio using a short position in A and B and a long position in C. Calculate the expected cash flow on the arbitrage portfolio for a $10,000 investment in C using the one-factor model. (9 marks) Portfolio Expected Return Factor Sensitivity A 0.1500 0.0700 0.40 0.0800 b) Portfolio A has an expected return of 10.25 percent and a factor sensitivity of 0.5. Portfolio B has an expected return of 16.2 percent and a factor sensitivity of 1.2. The risk-free rate is 6 percent, and there is one factor. Determine the factor's price of risk. (6 marks) c) A wealthy investor has no other source of income beyond her investments. Her investment advisor recommends that she tilt her portfolio to cyclical stocks and high- yield bonds because the average investor holds a job and is recession sensitive. Explain the advisor's advice. (3 marks) a 1 d) Given the large-cap stock index and the government bond index data in the following table, Assumed Returns, Variances, and Correlations Large-Cap Stock Index Government Bond Index Expected return 15% 5% Standard deviation 15% 10% Correlation 0.5 Calculate the expected mean return and standard deviation of return for a portfolio 75 percent invested in the stock index and 25 percent invested in the bond index. (12 marks) . QUESTION TWO a) One of the most important questions in financial economics is what factors determine the cross-sectional variation in an asset's returns. Some have argued that book-to- market ratio and size (market value of equity) play an important role. Write a multiple regression equation to test whether book-to-market ratio and size explain the cross- section of asset returns. Use the notations below. (3 marks) (B/M); = book-to-market ratio for asset i R; = return on asset i in a particular month Size; = natural log of the market value of equity for asset i b) Based on current dividend yields and expected capital gains, the expected rates of return on portfolios A and B are 12% and 16%, respectively. The beta of A is 0.7, while that of B is 1.4. The T-bill rate is currently 5%, whereas the expected rate of return of the NSE all share index is 13%. The standard deviation of portfolio A is 12% annually, that of Bis 31%, and that of the NSE all share index is 18%. i. If you currently hold a market-index portfolio, would you choose to add either of these portfolios to your holdings? Explain. (6marks) ii. If instead you could invest only in T-bills and one of these portfolios, which would you choose? (5 marks) c) Conventional wisdom says that one should measure a manager's investment performance over an entire market cycle. What arguments support this convention? What arguments contradict it? (6 marks) 20 MARKS QUESTION THREE a) Suppose that an institution holds Portfolio K. The institution wants to use Portfolio L to hedge its exposure to inflation. Specifically, it wants to combine K and L to reduce its inflation exposure to zero. Portfolios K and L are well diversified, so the manager can ignore the risk of individual assets and assume that the only source of uncertainty in the portfolio is the surprises in the two factors. The returns to the two portfolios are: RK = 0.12 +0.5FINFL + 1.0FGDP RL = 0.11 + 1.5FINFL + 2.5FGDP Calculate the weights that a manager should have on K and L to achieve this goal (4 marks) b) Consider the two (excess return) index-model regression results for stocks A and B. The risk free rate over the period was 6%, and the markets average return was 14%. Performance is measured using an index model regression on excess returns. Stock A Stock B Index model regression estimates 1% + 1.2(rm -r) 2% +0.8(rm -r) R-square 0.576 0.436 Residual standard deviation, s(e) 10.3% 19.1% Standard deviation of excess returns 21.6% 24.9% i. Calculate the following statistics for each stock: Alpha (3 marks) Information ratio (3 marks) Sharpe ratio (3 marks) Treynor measure (3 marks) ii. Which stock is the best choice under the following circumstances? This is the only risky asset to be held by the investor. (1 mark) This stock will be mixed with the rest of the investor's portfolio, currently composed solely of holdings in the market-index fund. (2 marks) This is one of many stocks that the investor is analyzing to form an actively managed stock portfolio. (1 mark) 20 MARKS . . . QUESTION FOUR A global equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the NSE World Market Portfolio, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table: Country Weight Manager's Manager's Return of Stock In NSE Weight Return in Index for That Index Country Country Kenya 0.15 0.30 20% 12% Uganda 0.30 0.10 15% 15% Tanzania 0.45 0.40 10 % 14% Rwanda 0.10 0.20 5 % 12% i. Calculate the total value added of the entire manager's decisions this period. (6 marks) ii. Calculate the value added (or subtracted) by her country allocation decisions. (7 marks) iii. Calculate the value added from her stock selection ability within countries. Confirm that the sum of the contributions to value added from her country allocation plus security selection decisions equals total over- or underperformance. (7 marks) 20 MARKS QUESTION FIVE During the annual review of Maxx's pension plan, several trustees questioned their investment consultant about various aspects of performance measurement and risk assessment. a) Comment on the appropriateness of using each of the following benchmarks for performance evaluation: i. Market index. (2 marks) ii. Benchmark normal portfolio. (2 marks) iii. Median of the manager universe. (2 marks) b) Distinguish among the following performance measures: The Sharpe ratio. The Treynor measure. Jensen's alpha. . . . i. Describe how each of the three performance measures is calculated. (9 marks) ii. State whether each measure assumes that the relevant risk is systematic, unsystematic, or total. Explain how each measure relates excess return and the relevant risk. (5 marks) 20 MARKSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started