Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Really Sweet Snacks Company (RSS) will use 600,000 pounds of sugar to January 2015 and has decided to hedge 50% of its requirements.

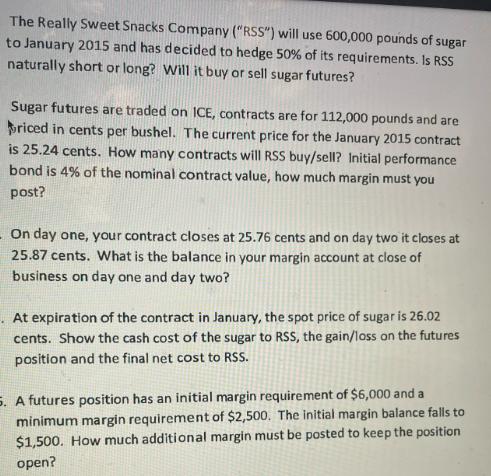

The Really Sweet Snacks Company ("RSS") will use 600,000 pounds of sugar to January 2015 and has decided to hedge 50% of its requirements. Is RSS naturally short or long? Will it buy or sell sugar futures? Sugar futures are traded on ICE, contracts are for 112,000 pounds and are riced in cents per bushel. The current price for the January 2015 contract is 25.24 cents. How many contracts will RSS buy/sell? Initial performance bond is 4% of the nominal contract value, how much margin must you post? - On day one, your contract closes at 25.76 cents and on day two it closes at 25.87 cents. What is the balance in your margin account at close of business on day one and day two? At expiration of the contract in January, the spot price of sugar is 26.02 cents. Show the cash cost of the sugar to RSS, the gain/loss on the futures position and the final net cost to RSS. 5. A futures position has an initial margin requirement of $6,000 and a minimum margin requirement of $2,500. The initial margin balance falls to $1,500. How much additional margin must be posted to keep the position open?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

RSS is naturally long and it will buy sugar futures RSS will buy 5 contracts o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started