Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The records of XYZ Corp. provided the following data: a. Purchased a capital asset for $343,000; paid cash. b. Depreciation expense is $135,500. c. Sold

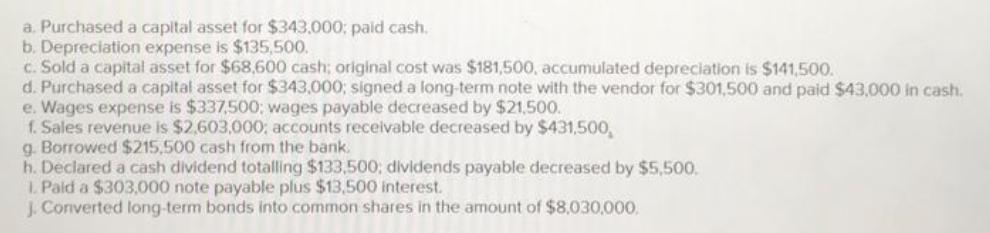

The records of XYZ Corp. provided the following data:

a. Purchased a capital asset for $343,000; paid cash. b. Depreciation expense is $135,500. c. Sold a capital asset for $68,600 cash; original cost was $181,500, accumulated depreciation is $141,500. d. Purchased a capital asset for $343,000; signed a long-term note with the vendor for $301,500 and paid $43,000 in cash. e. Wages expense is $337,500; wages payable decreased by $21,500. f. Sales revenue is $2,603,000; accounts receivable decreased by $431,500, g. Borrowed $215,500 cash from the bank. h. Declared a cash dividend totalling $133,500; dividends payable decreased by $5,500. 1. Paid a $303,000 note payable plus $13,500 interest. J. Converted long-term bonds into common shares in the amount of $8,030,000.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Sure heres how each of the given items would be classified and appear on the Statement of Cash Flows SCF using the indirect method a Purchased a capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started