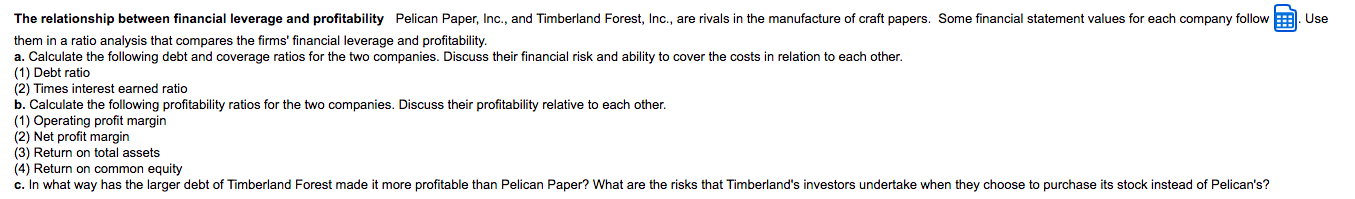

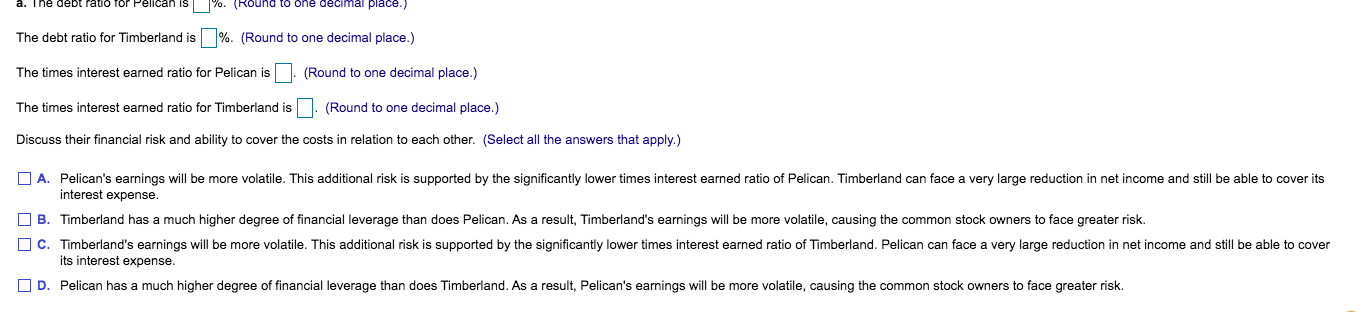

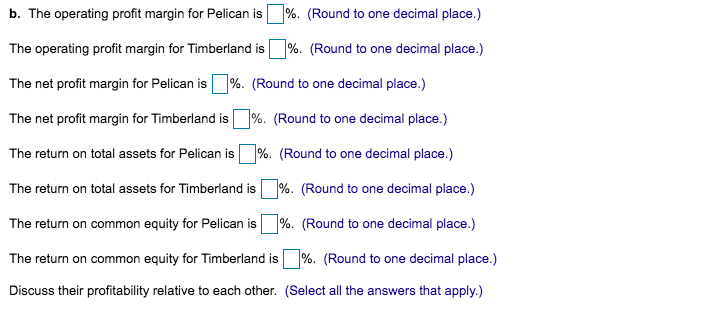

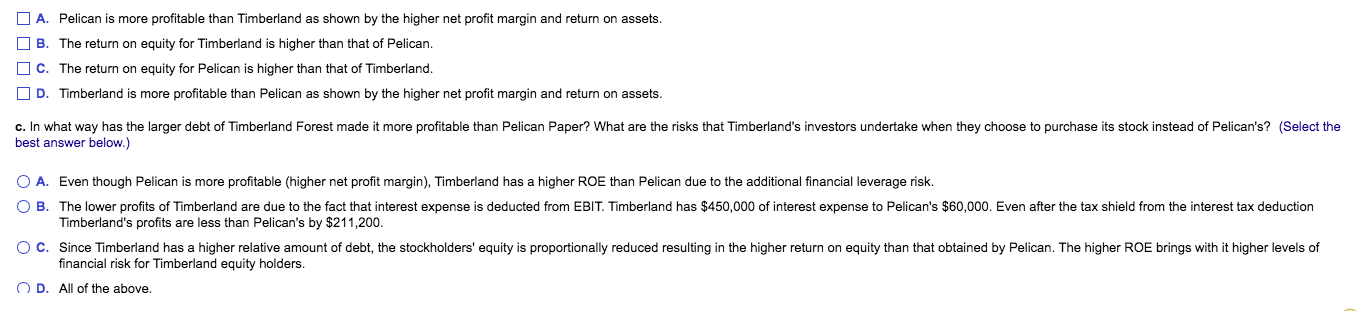

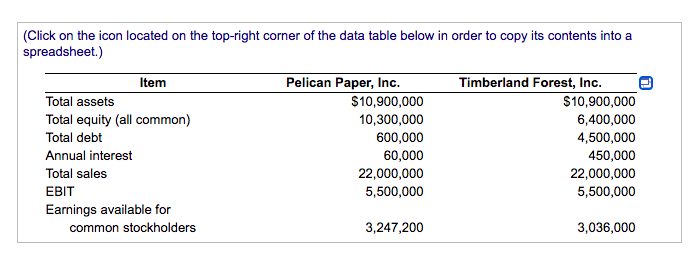

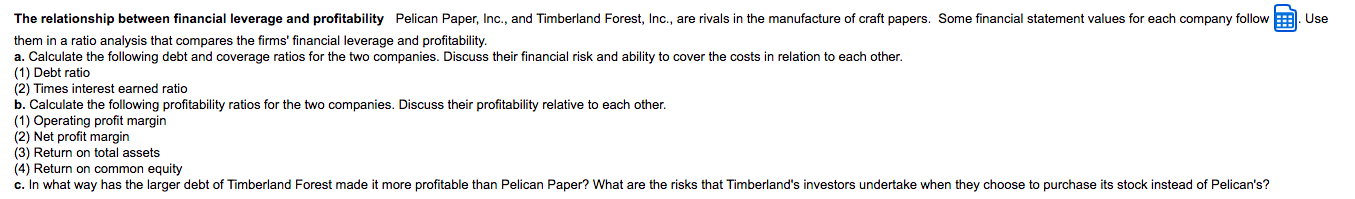

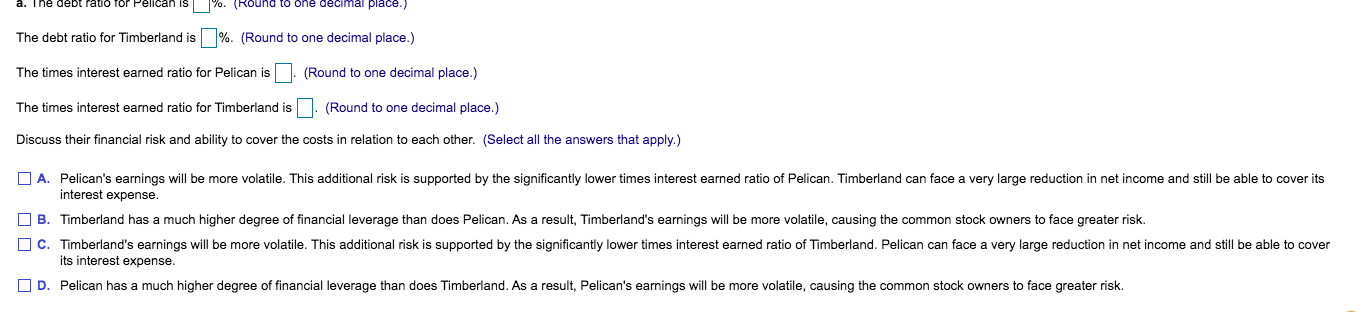

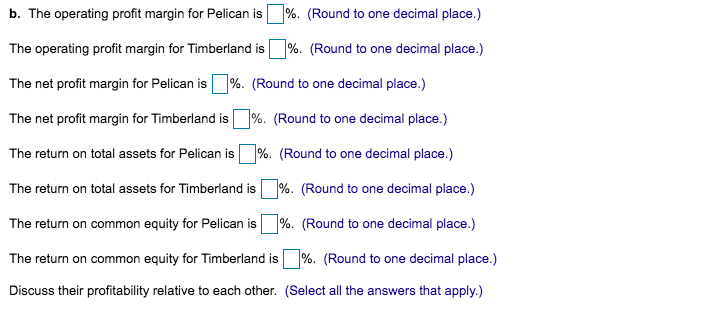

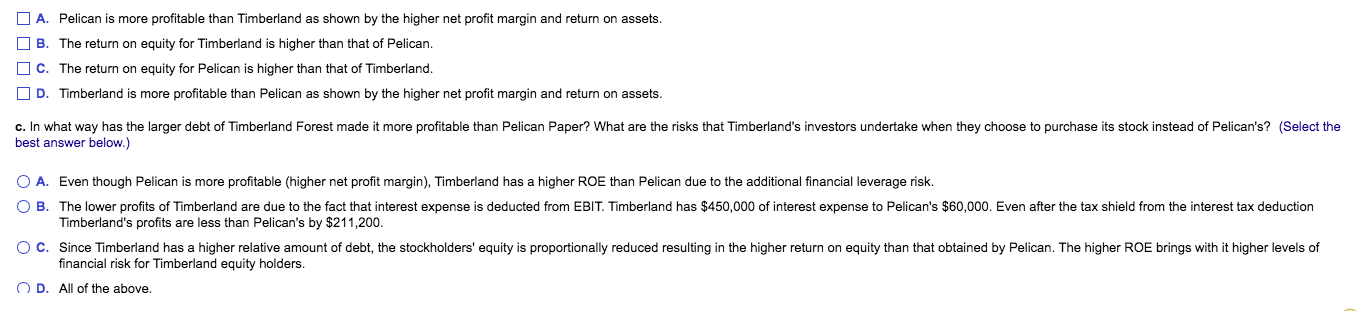

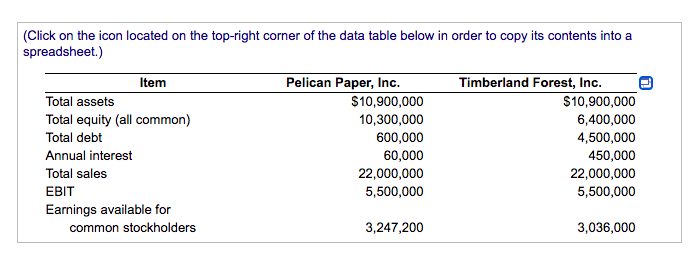

The relationship between financial leverage and profitability Pelican Paper, Inc., and Timberland Forest, Inc., are rivals in the manufacture of craft papers. Some financial statement values for each company follow Use them in a ratio analysis that compares the firms' financial leverage and profitability. a. Calculate the following debt and coverage ratios for the two companies. Discuss their financial risk and ability to cover the costs in relation to each other. (1) Debt ratio (2) Times interest earned ratio b. Calculate the following profitability ratios for the two companies. Discuss their profitability relative to each other. (1) Operating profit margin (2) Net profit margin (3) Return on total assets (4) Return on common equity c. In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland's investors undertake when they choose to purchase its stock instead of Pelican's? a. The debt ratio for Pelican (Round to one decimal place.) The debt ratio for Timberland is%. (Round to one decimal place.) The times interest earned ratio for Pelican is (Round to one decimal place.) The times interest earned ratio for Timberland is. (Round to one decimal place.) Discuss their financial risk and ability to cover the costs in relation to each other. (Select all the answers that apply.) A. Pelican's earnings will be more volatile. This additional risk is supported by the significantly lower times interest earned ratio of Pelican. Timberland can face a very large reduction in net income and still be able to cover its interest expense. B. Timberland has a much higher degree of financial leverage than does Pelican. As a result, Timberland's earnings will be more volatile, causing the common stock owners to face greater risk. C. Timberland's earnings will be more volatile. This additional risk is supported by the significantly lower times interest earned ratio of Timberland. Pelican can face a very large reduction in net income and still be able to cover its interest expense. OD. Pelican has a much higher degree of financial leverage than does Timberland. As a result, Pelican's earnings will be more volatile, causing the common stock owners to face greater risk. b. The operating profit margin for Pelican is %. (Round to one decimal place.) The operating profit margin for Timberland is l%. (Round to one decimal place.) The net profit margin for Pelican is %. (Round to one decimal place.) The net profit margin for Timberland is %. (Round to one decimal place.) The return on total assets for Pelican is %. (Round to one decimal place.) The return on total assets for Timberland is %. (Round to one decimal place.) The return on common equity for Pelican is %. (Round to one decimal place.) The return on common equity for Timberland is %. (Round to one decimal place.) Discuss their profitability relative to each other. (Select all the answers that apply.) A. Pelican is more profitable than Timberland as shown by the higher net profit margin and return on assets. OB. The return on equity for Timberland is higher than that of Pelican. C. The return on equity for Pelican is higher than that of Timberland. D. Timberland is more profitable than Pelican as shown by the higher net profit margin and return on assets. c. In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland's investors undertake when they choose to purchase its stock instead of Pelican's? (Select the best answer below.) O A. Even though Pelican is more profitable (higher net profit margin), Timberland has a higher ROE than Pelican due to the additional financial leverage risk. OB. The lower profits of Timberland are due to the fact that interest expense is deducted from EBIT. Timberland has $450,000 of interest expense to Pelican's $60,000. Even after the tax shield from the interest tax deduction Timberland's profits are less than Pelican's by $211,200. O C. Since Timberland has a higher relative amount of debt, the stockholders' equity is proportionally reduced resulting in the higher return on equity than that obtained by Pelican. The higher ROE brings with it higher levels of financial risk for Timberland equity holders. OD. All of the above. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Item Pelican Paper, Inc. Timberland Forest, Inc. Total assets $10,900,000 $10,900,000 Total equity (all common) 10,300,000 6,400,000 Total debt 600,000 4,500,000 Annual interest 60,000 450,000 Total sales 22,000,000 22,000,000 EBIT 5,500,000 5,500,000 Earnings available for common stockholders 3,247,200 3,036,000