Question: The relevant documents:- 1. Consolidated financial statement POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 Approved for

The relevant documents:-

1. Consolidated financial statement

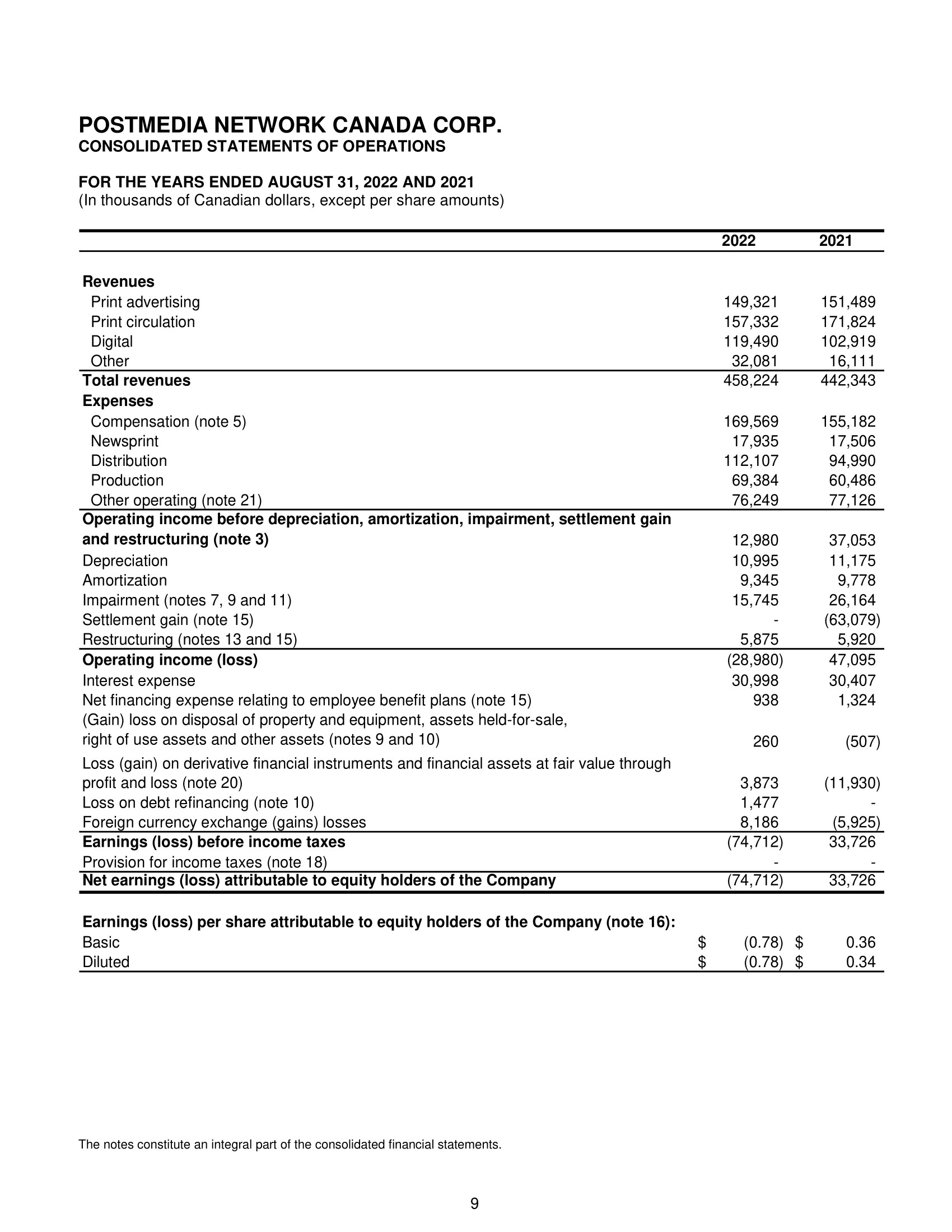

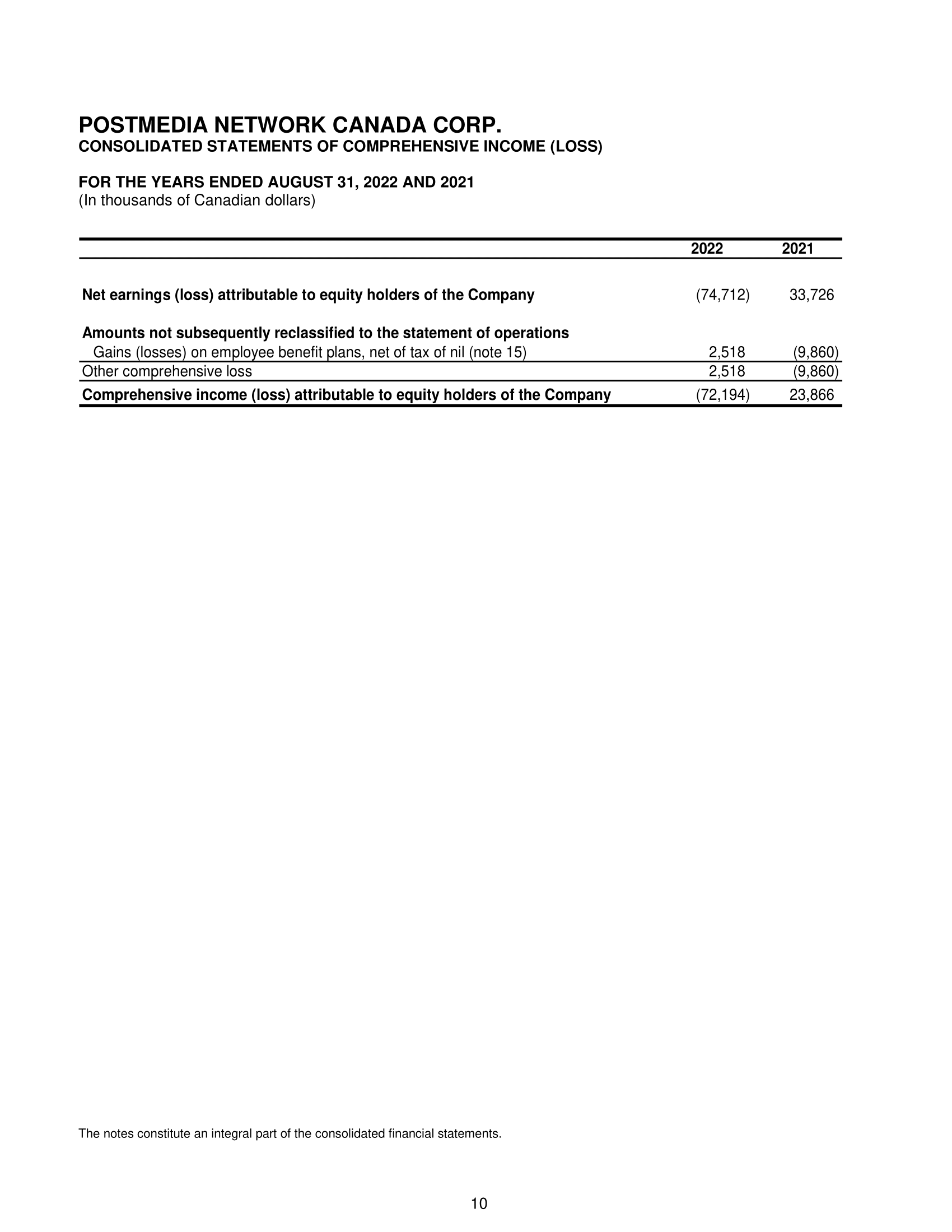

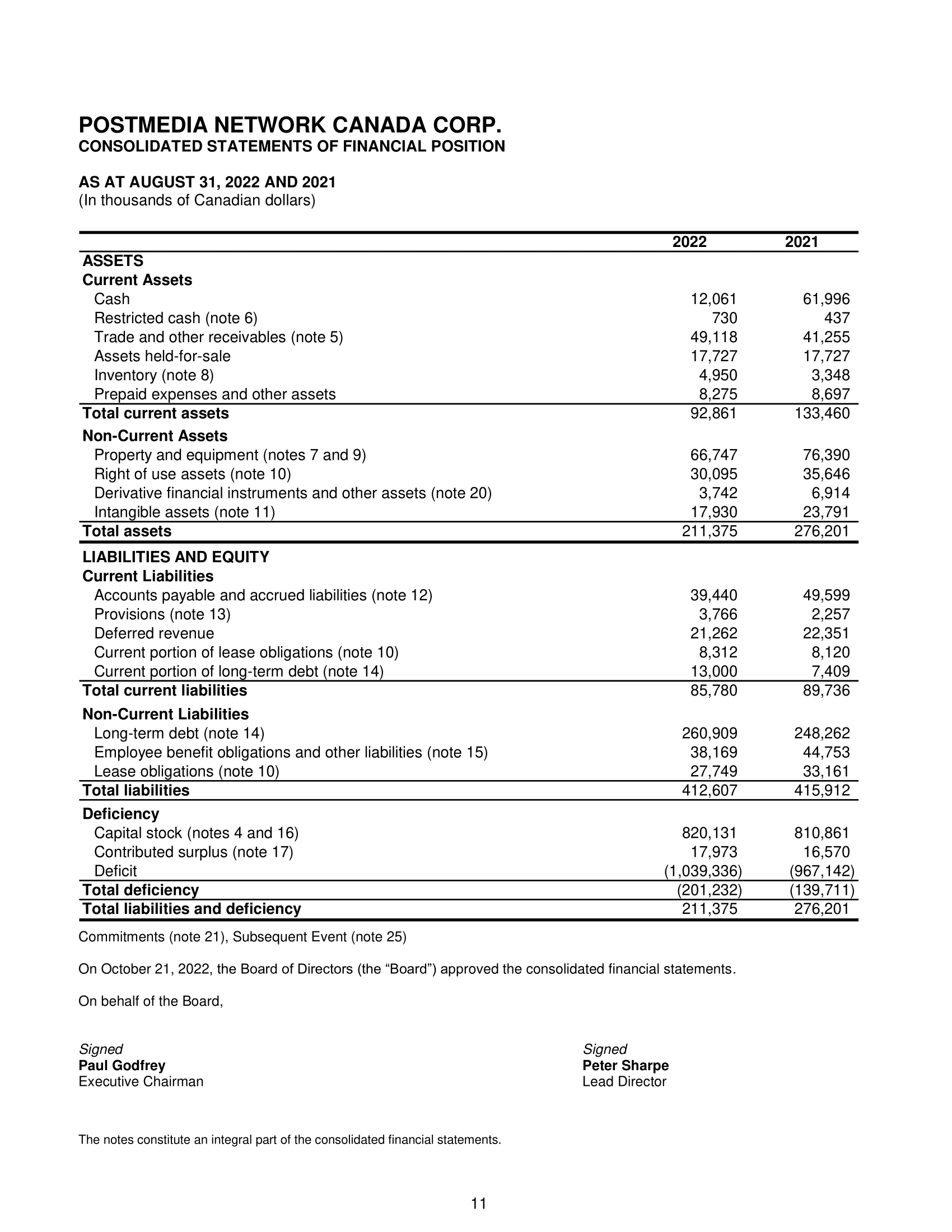

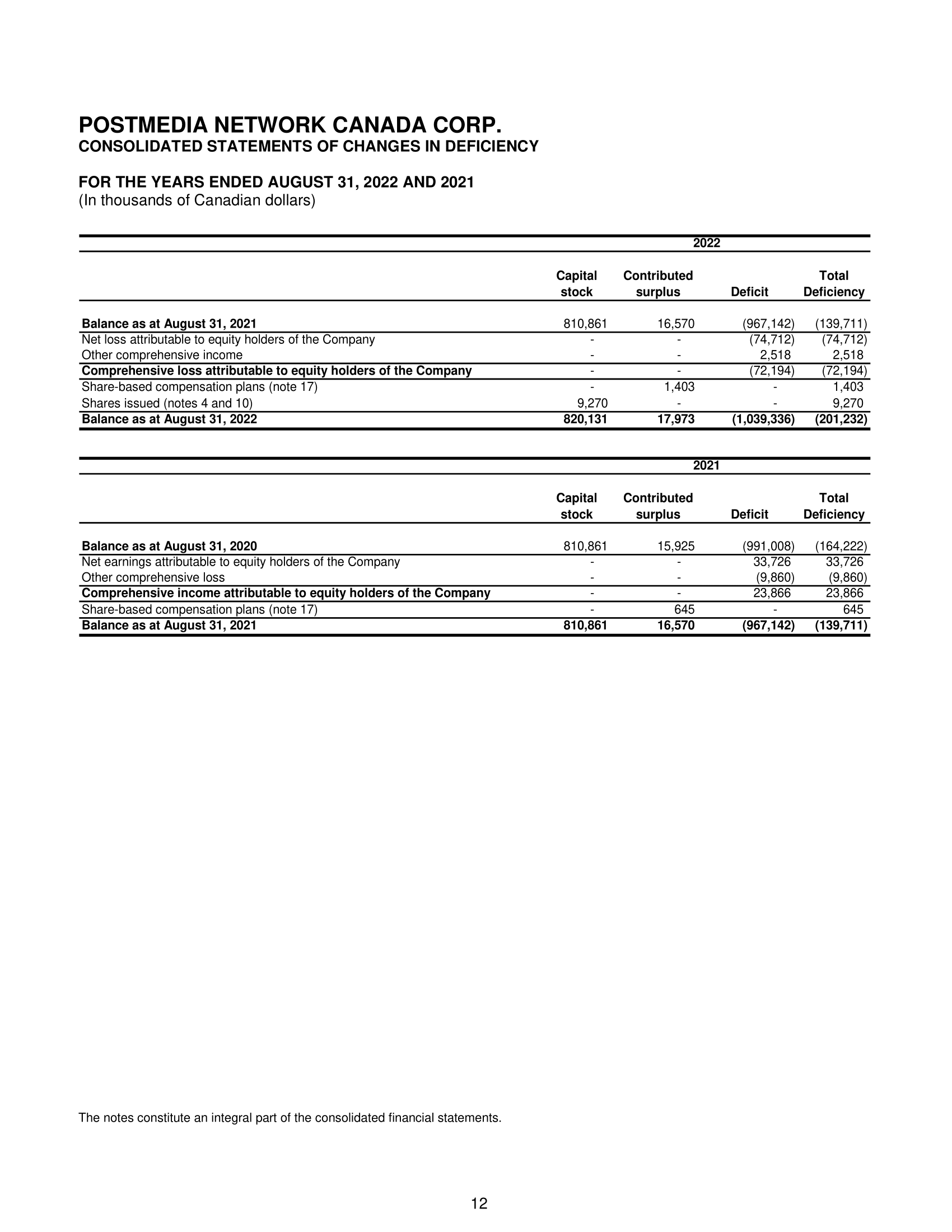

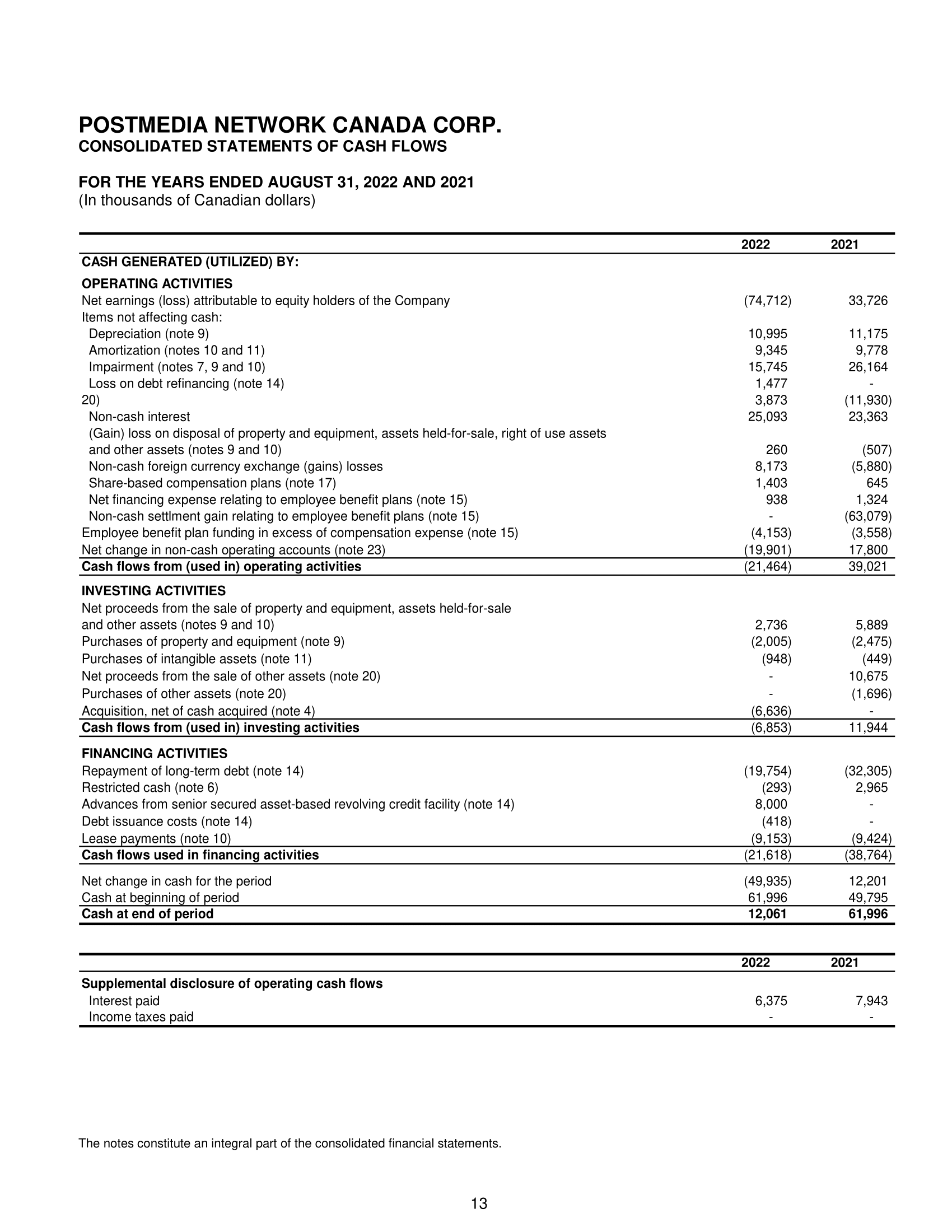

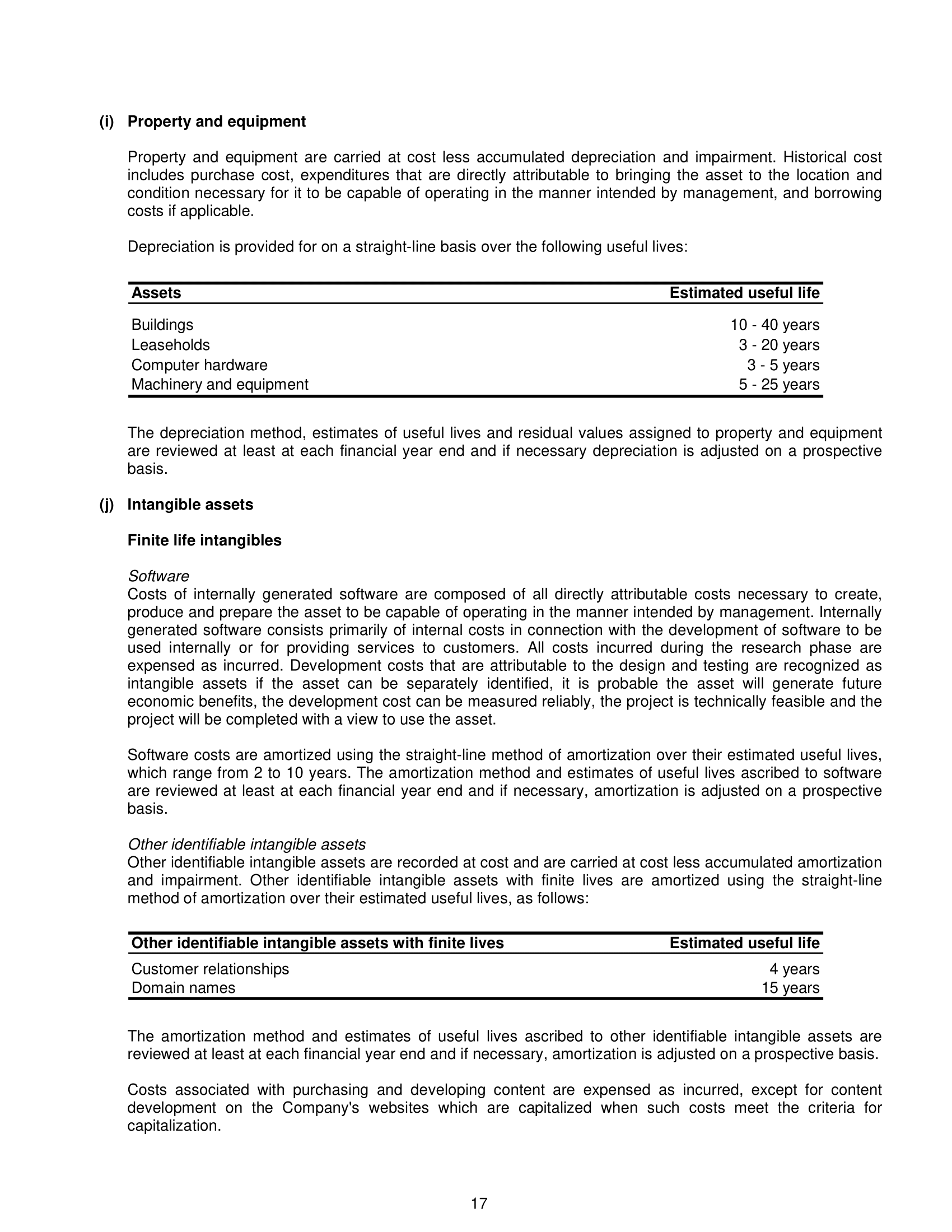

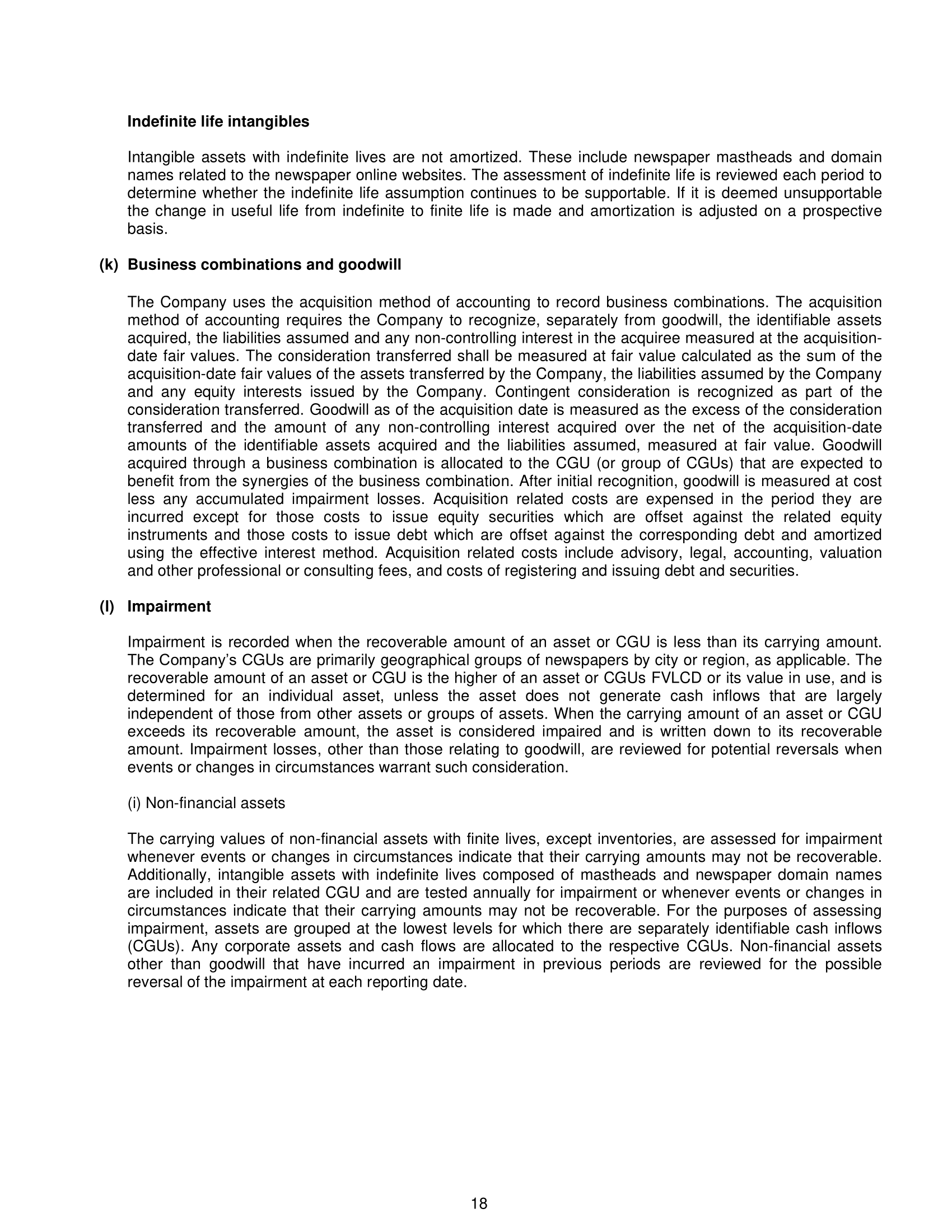

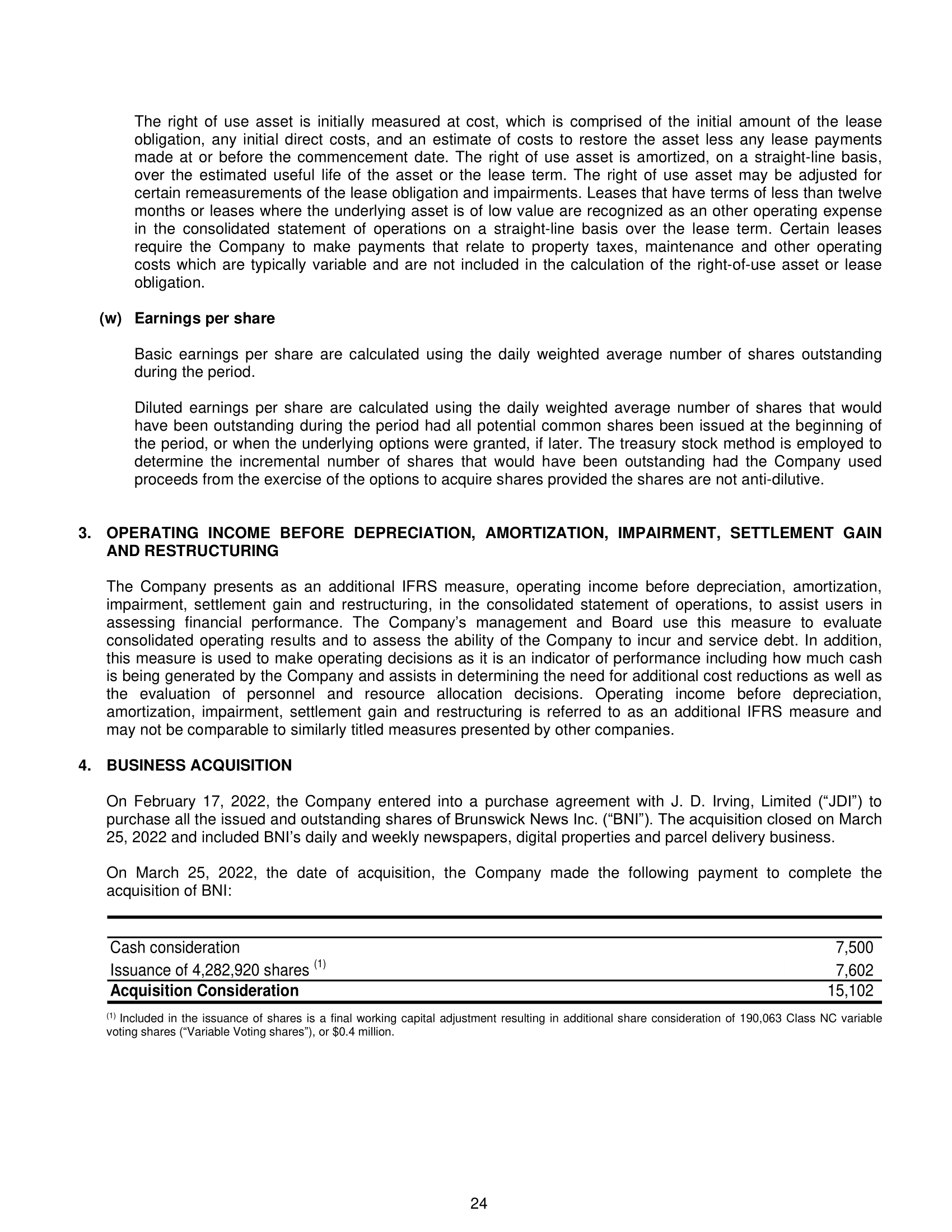

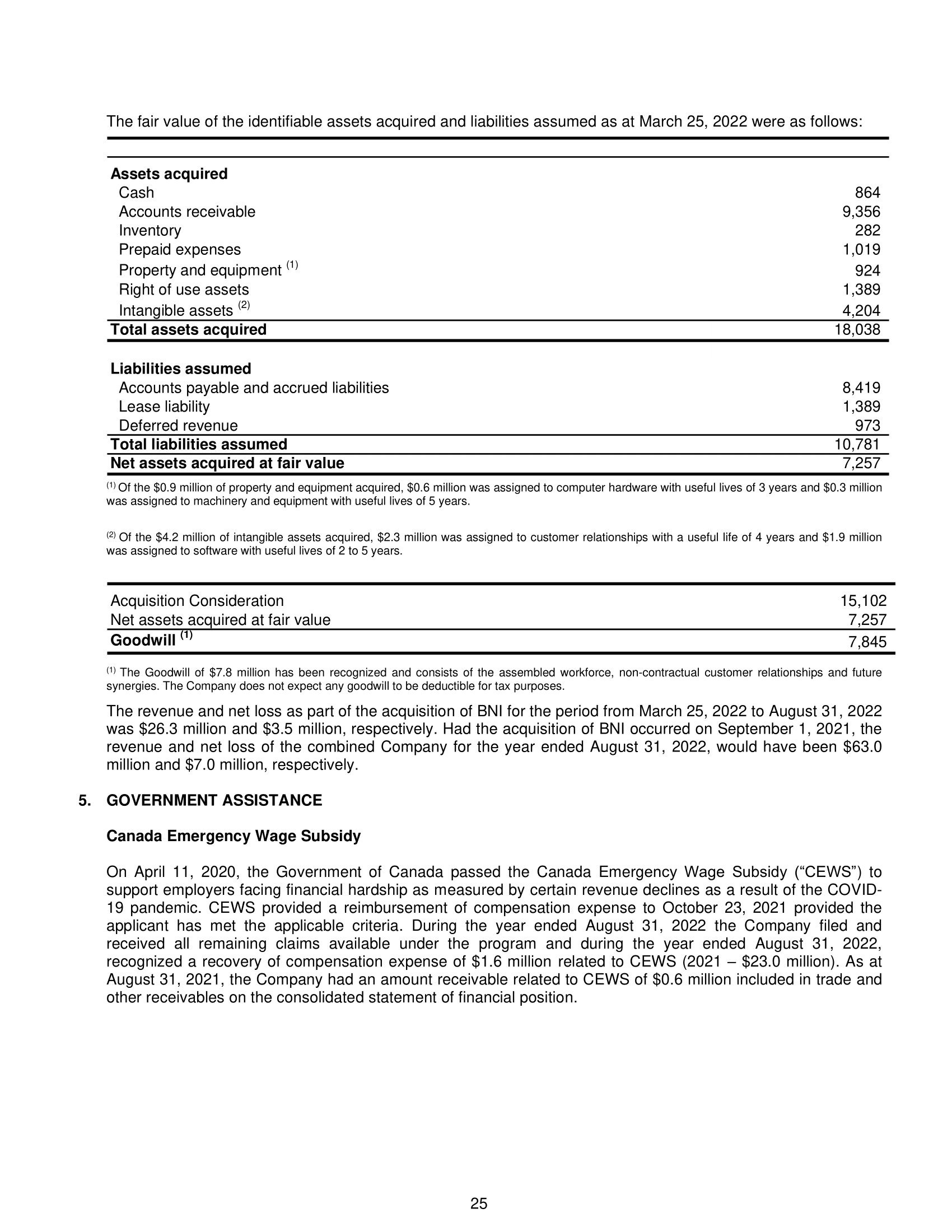

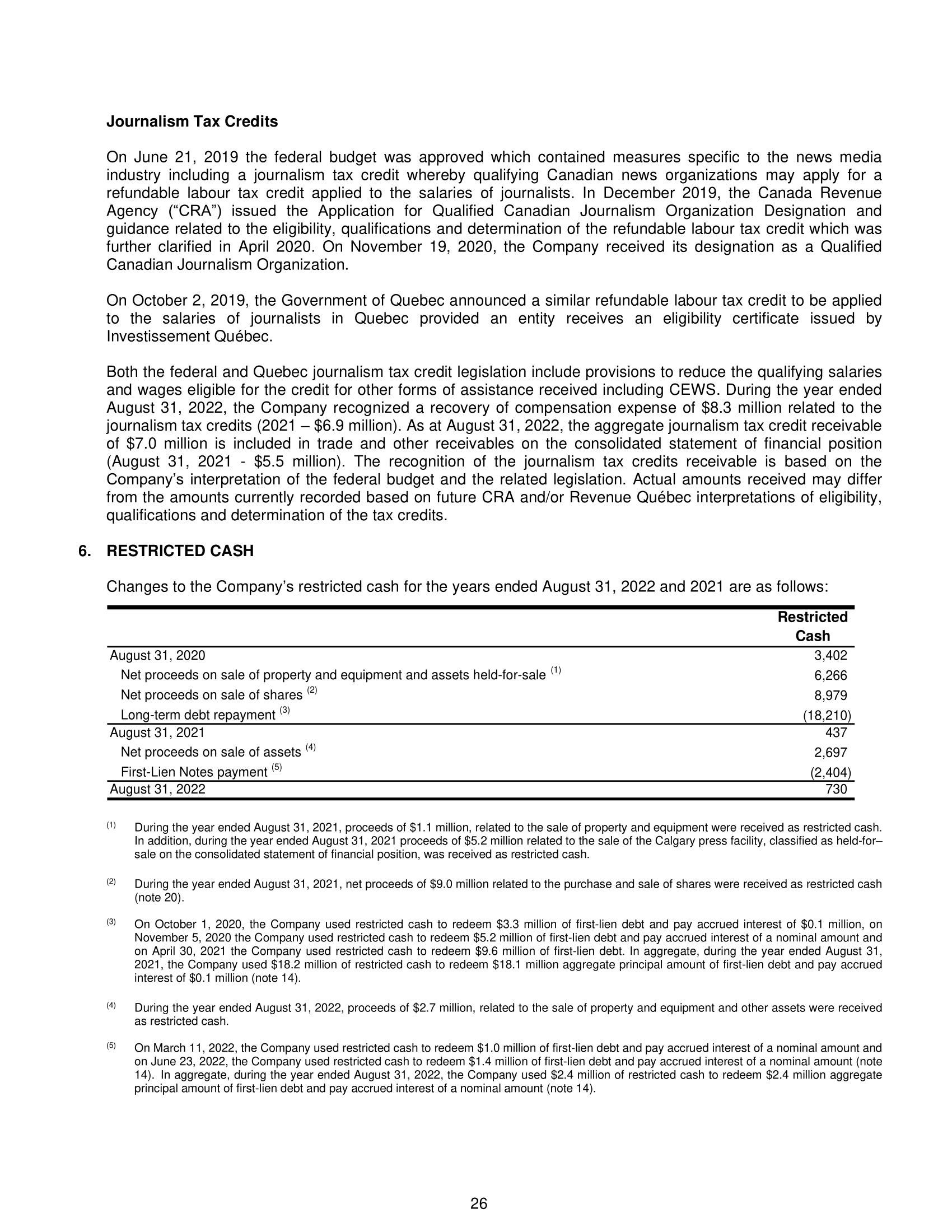

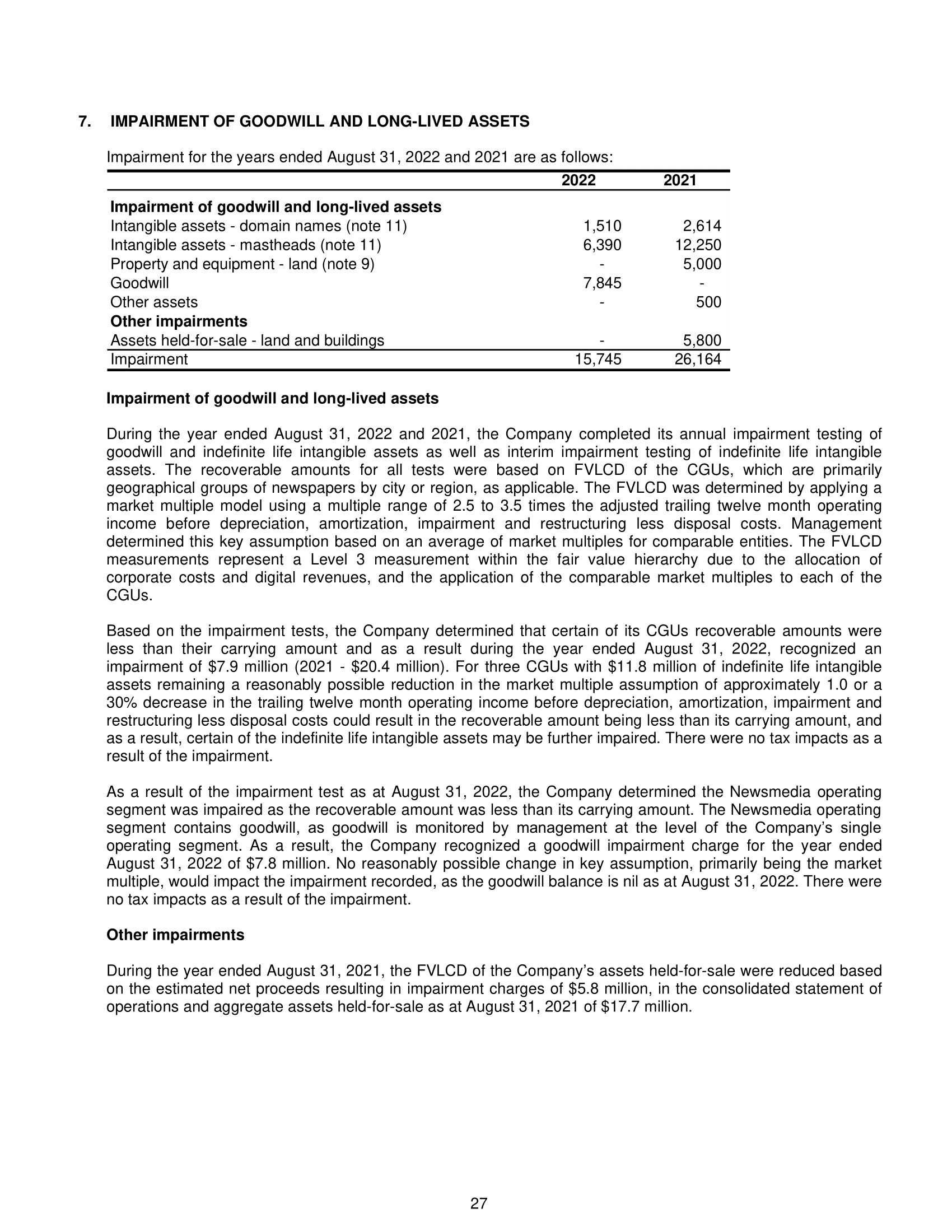

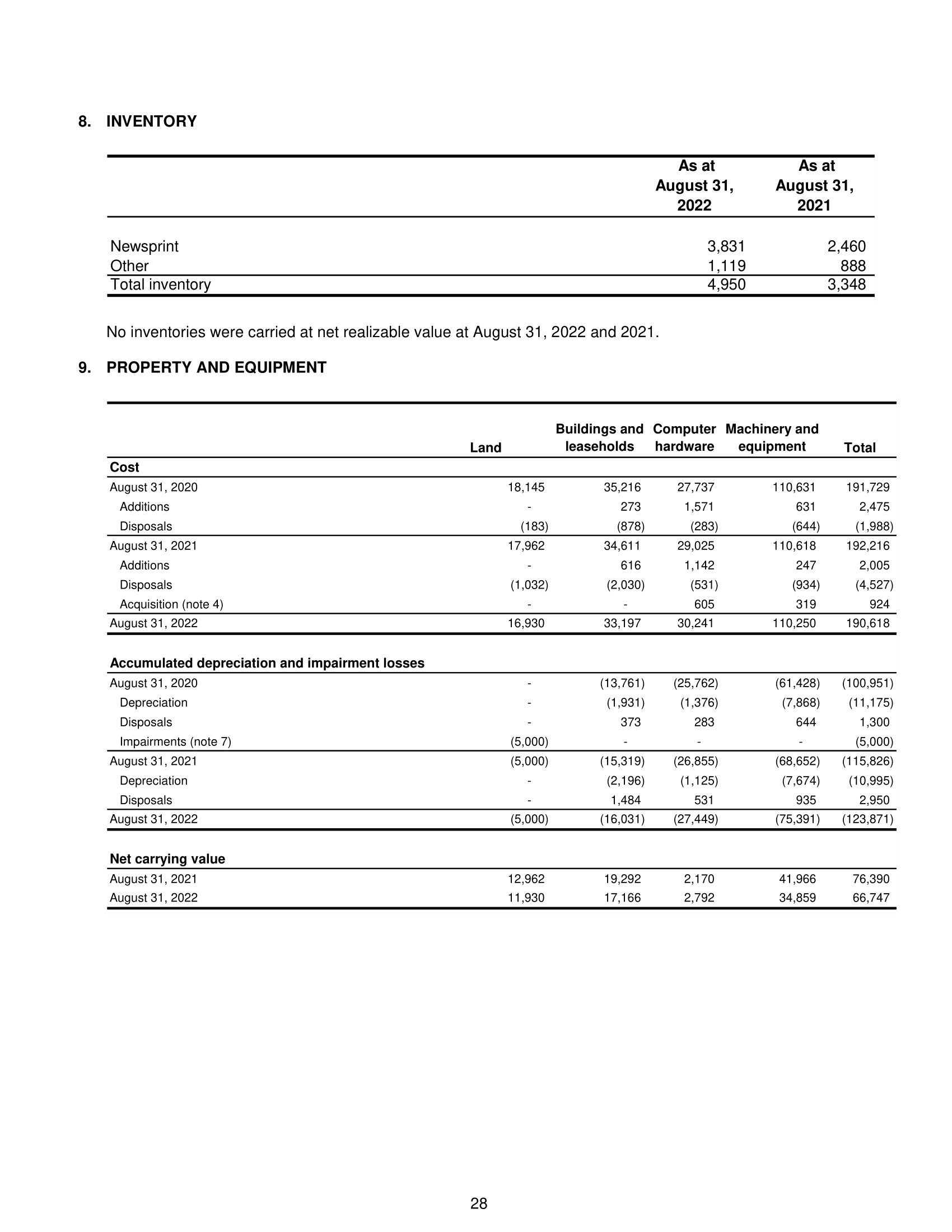

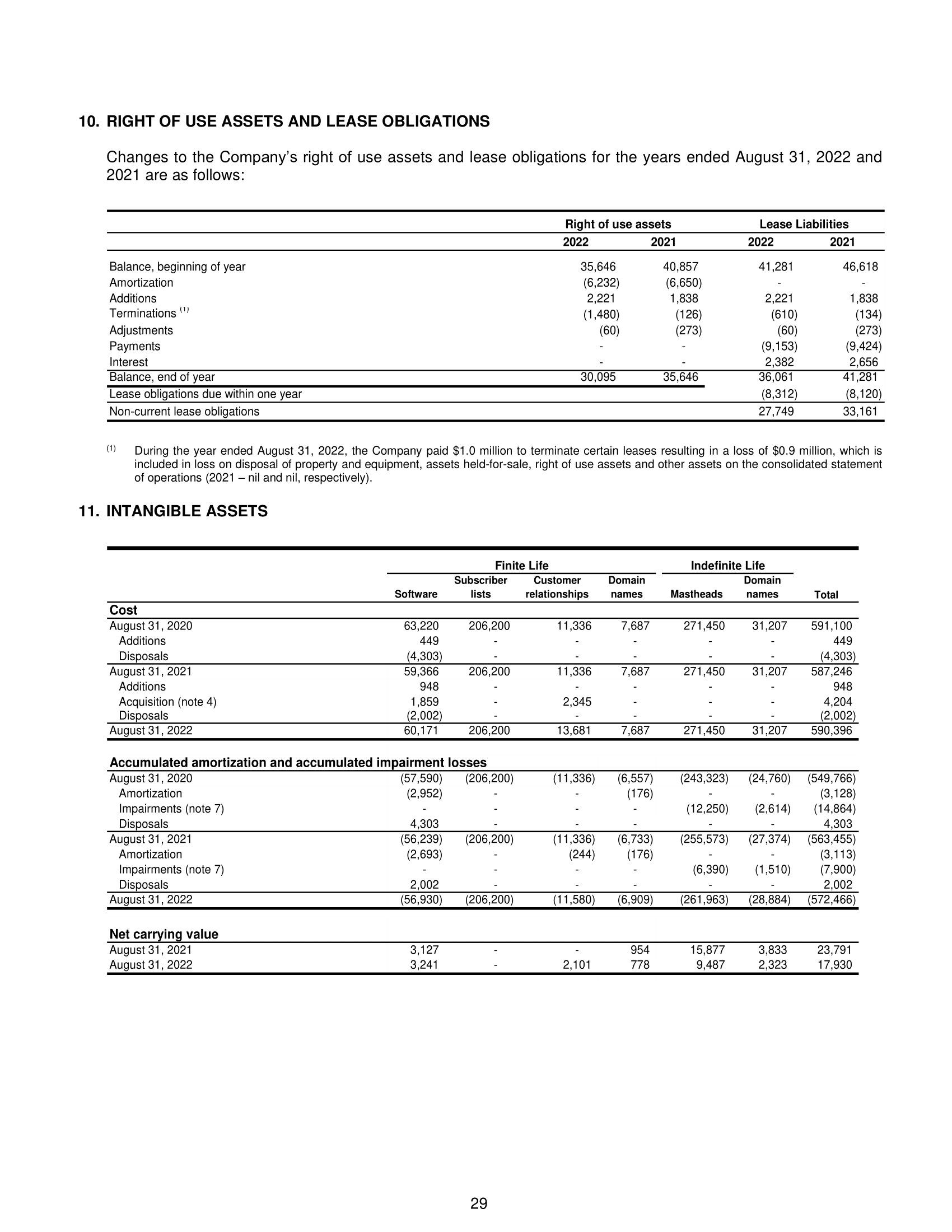

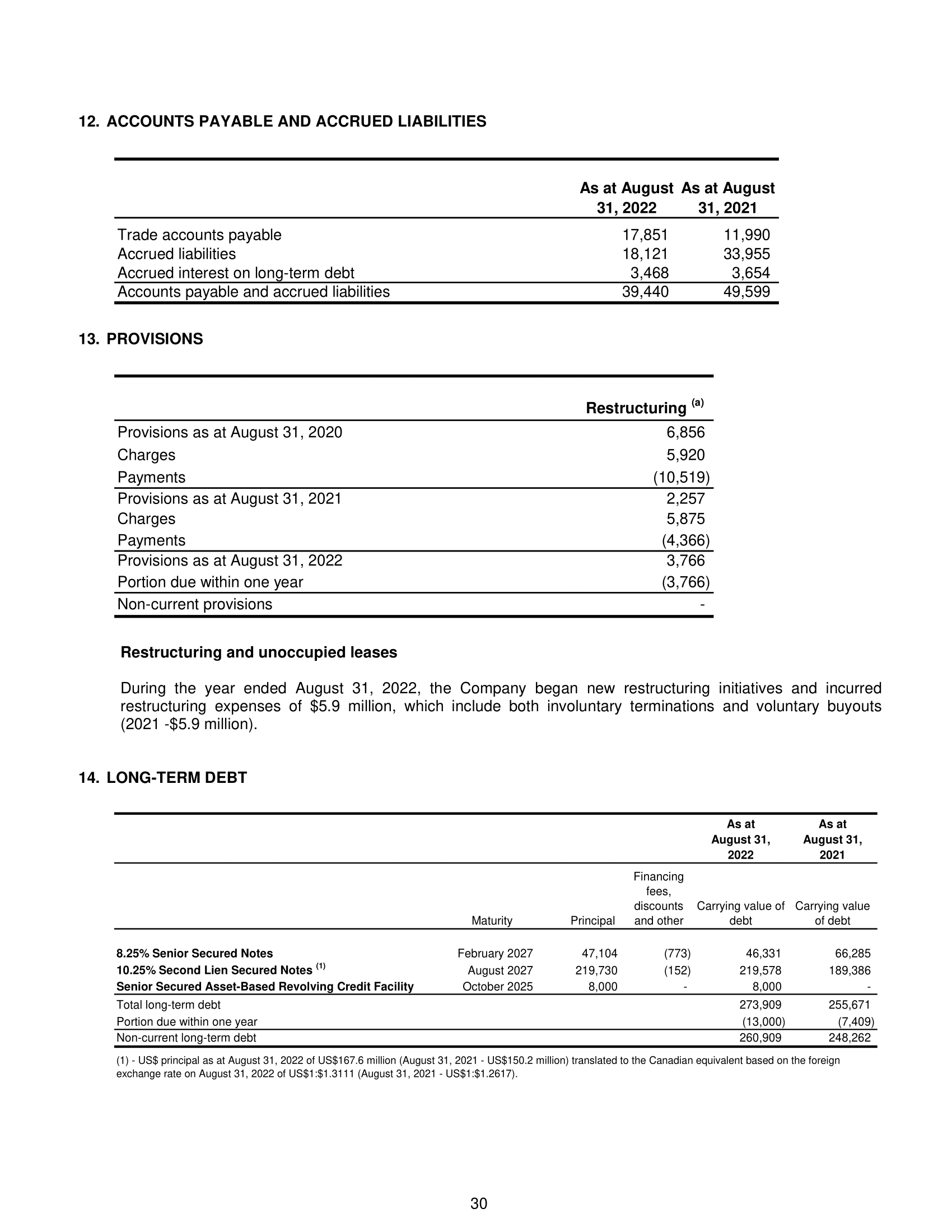

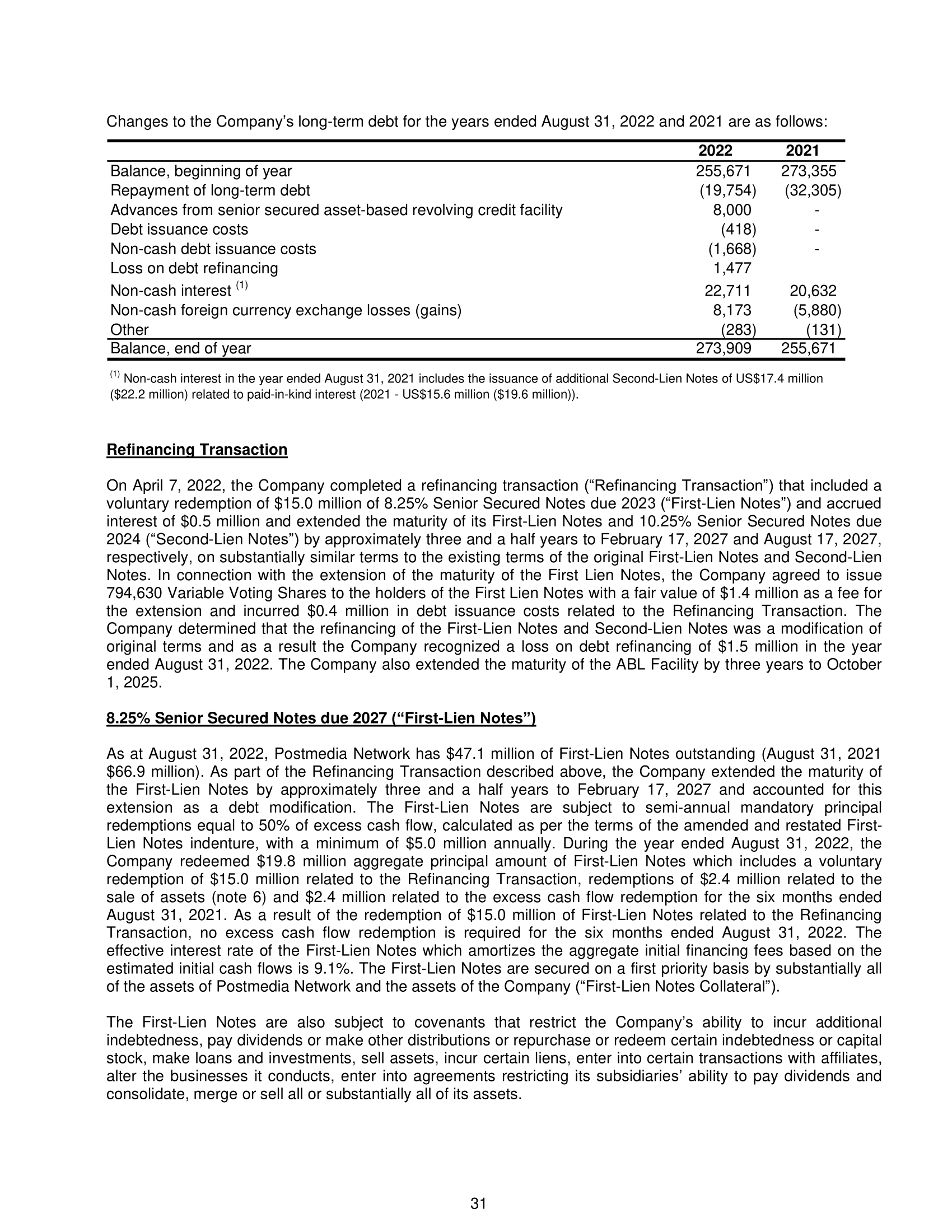

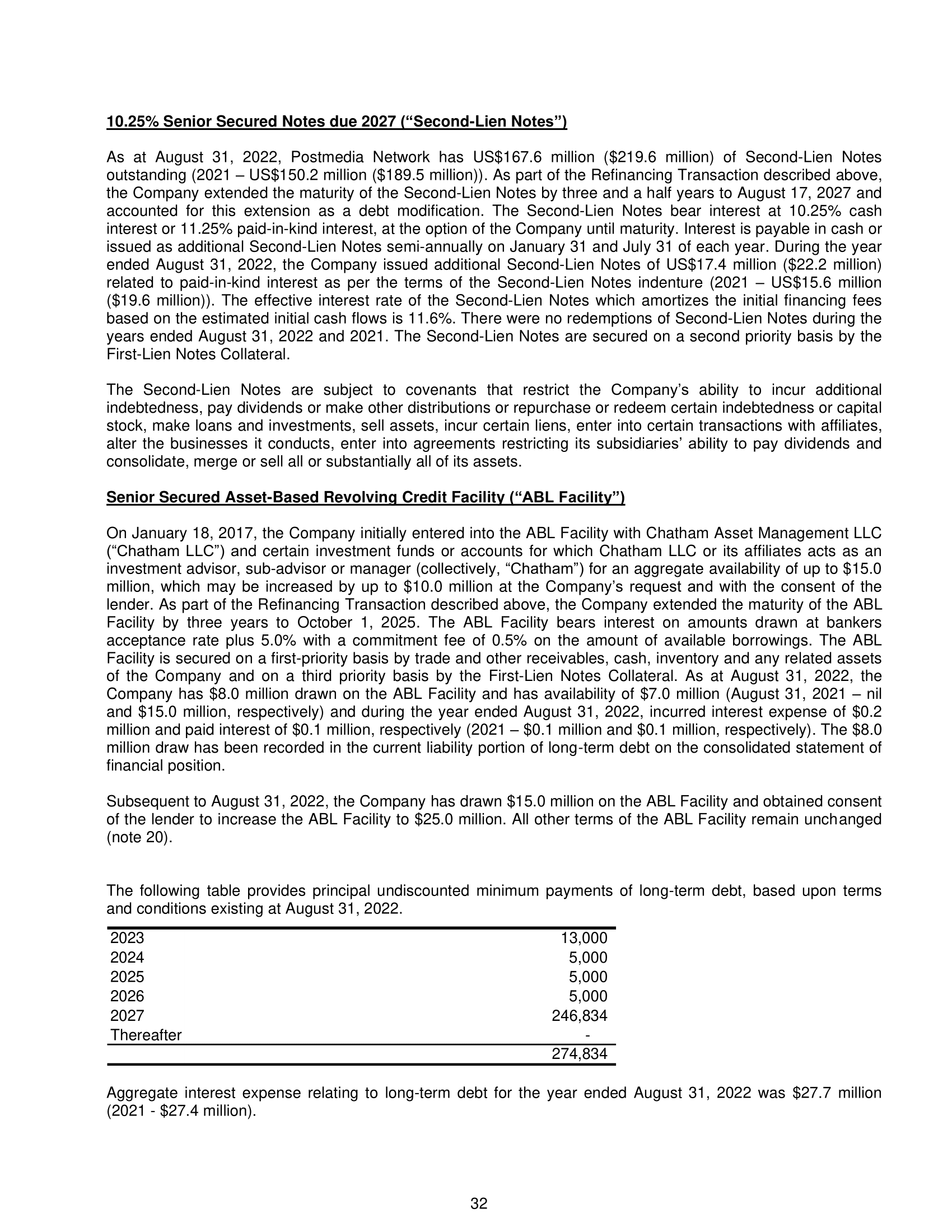

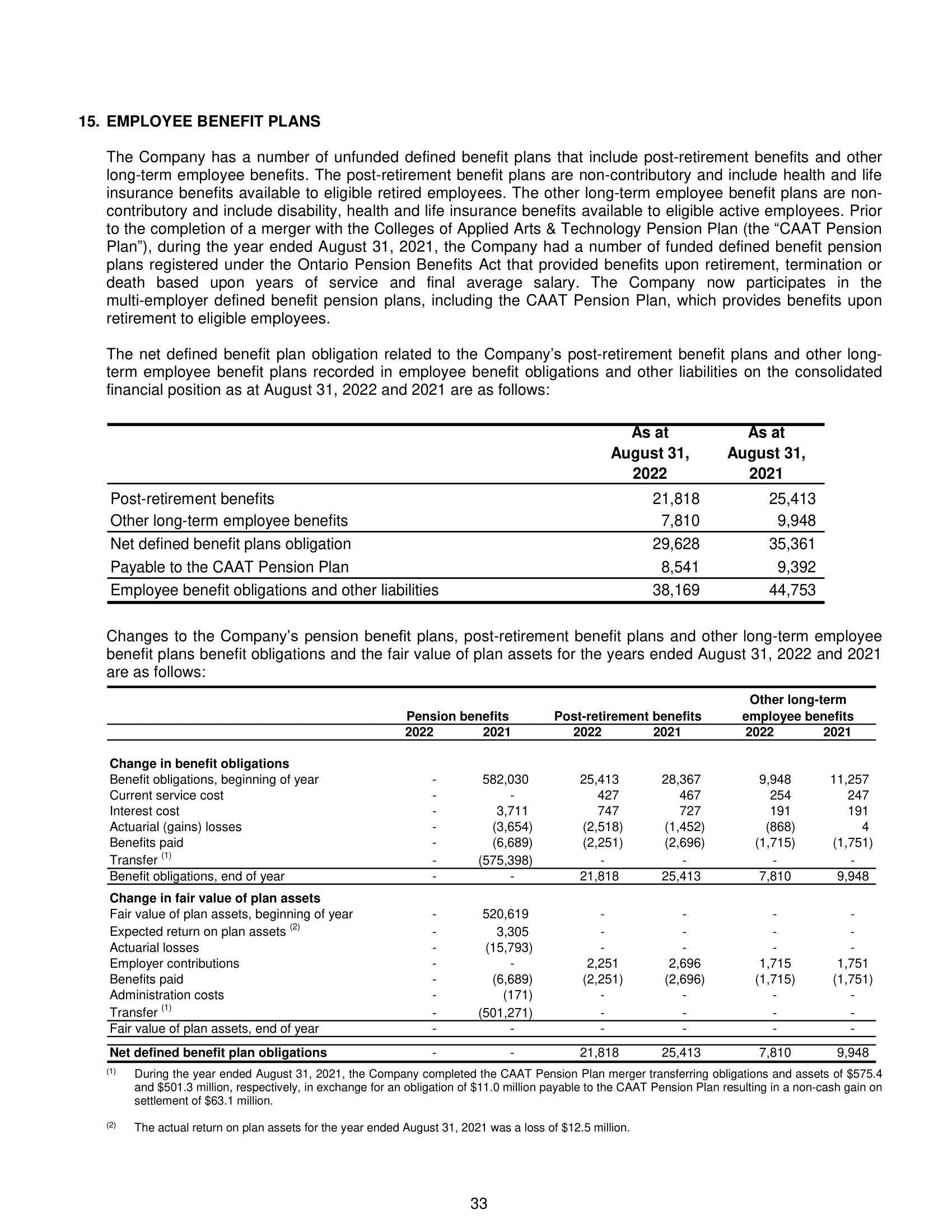

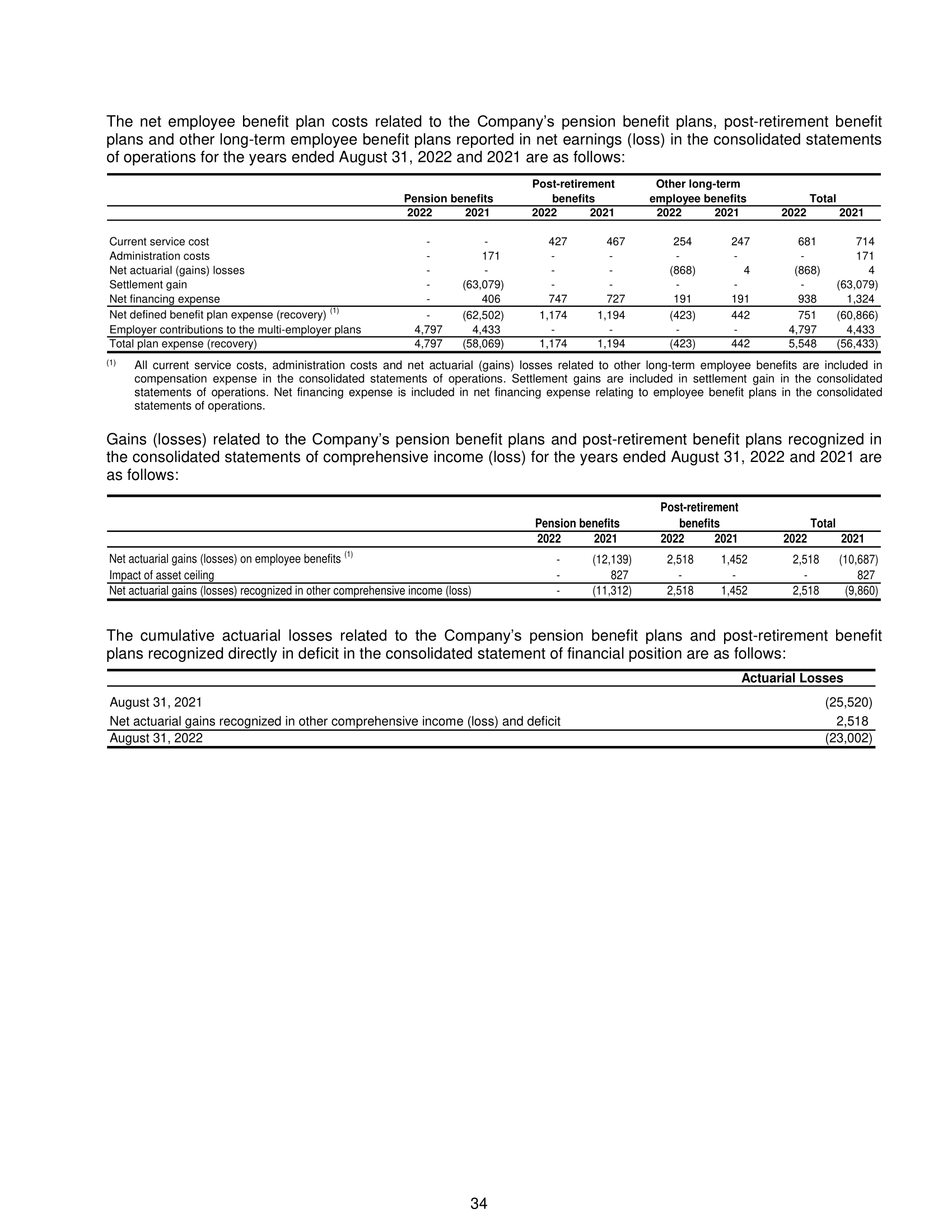

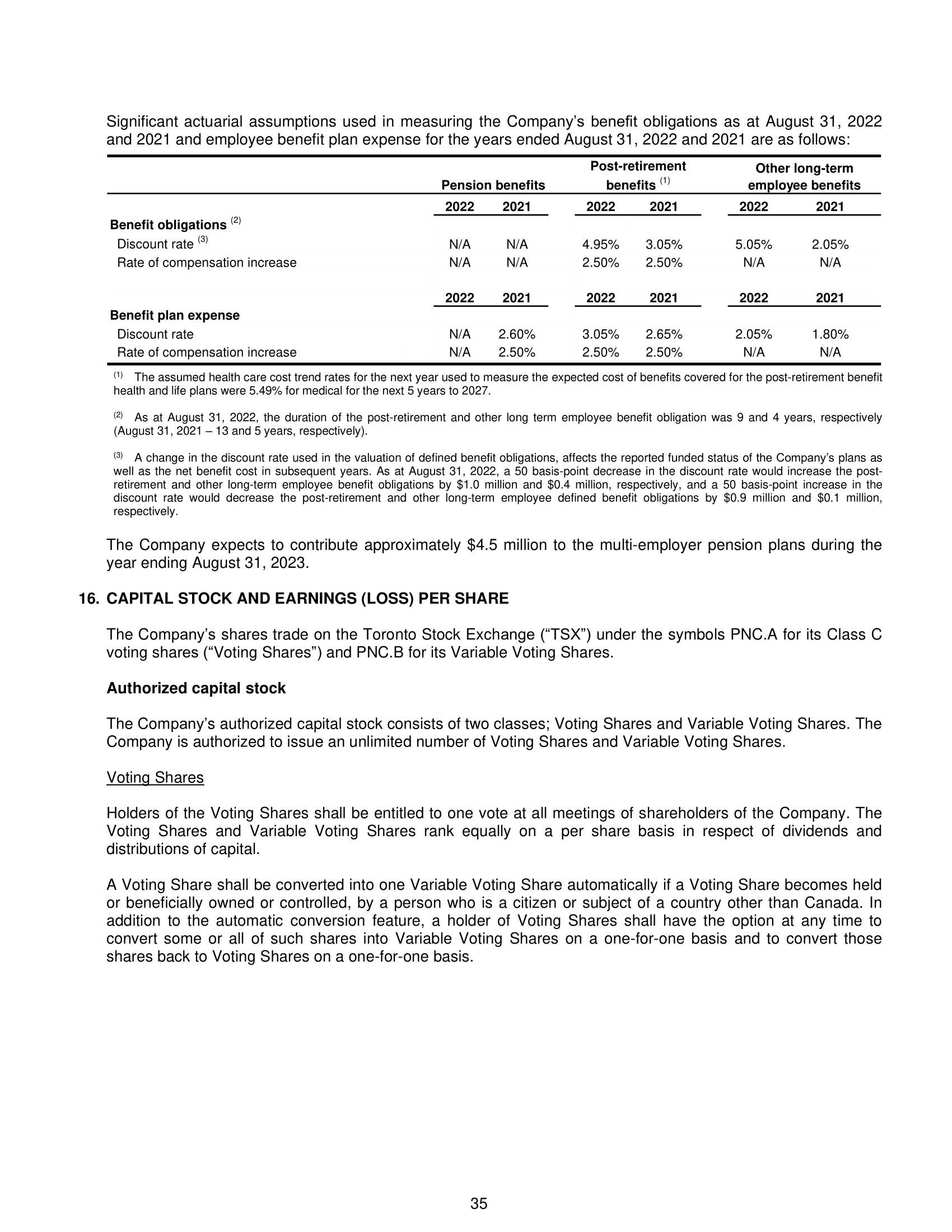

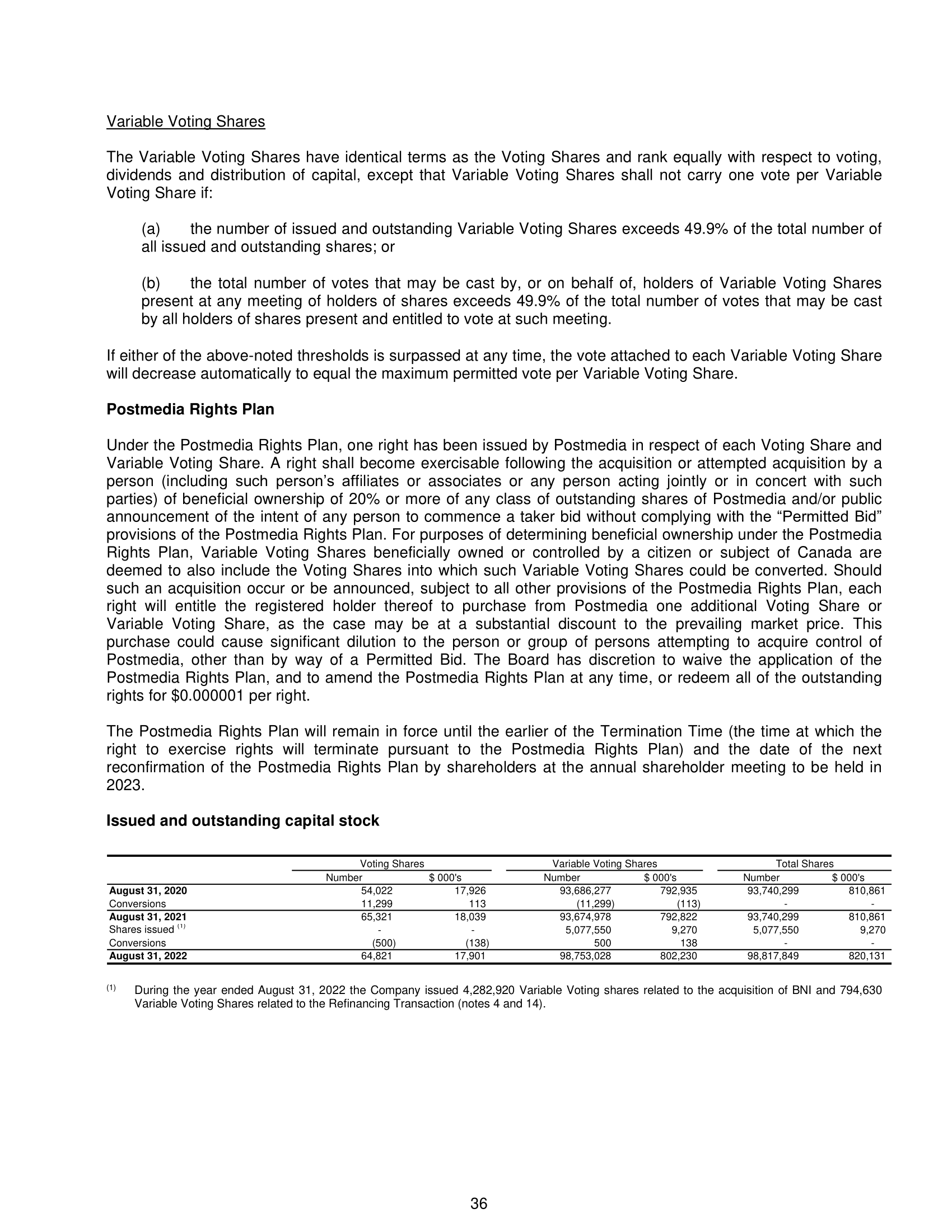

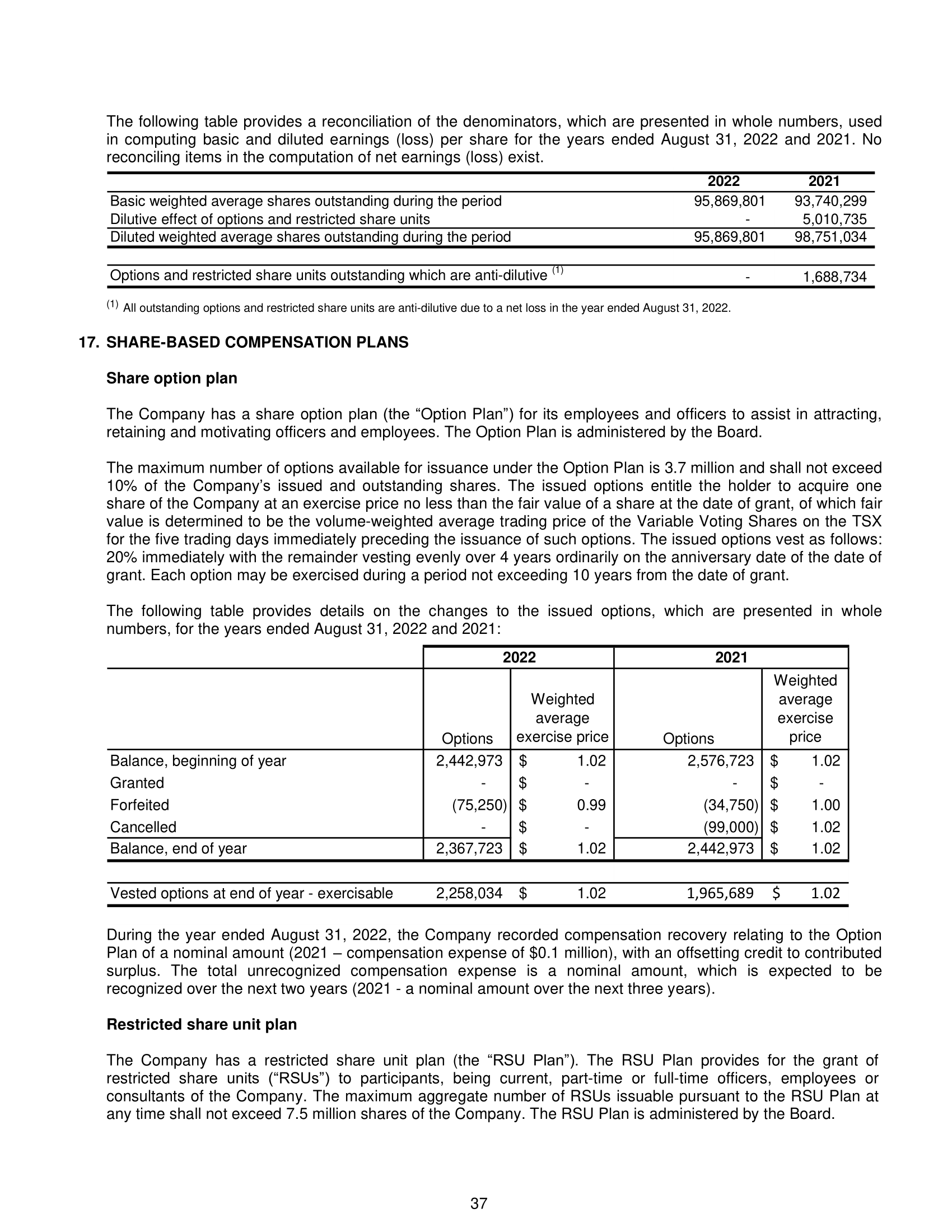

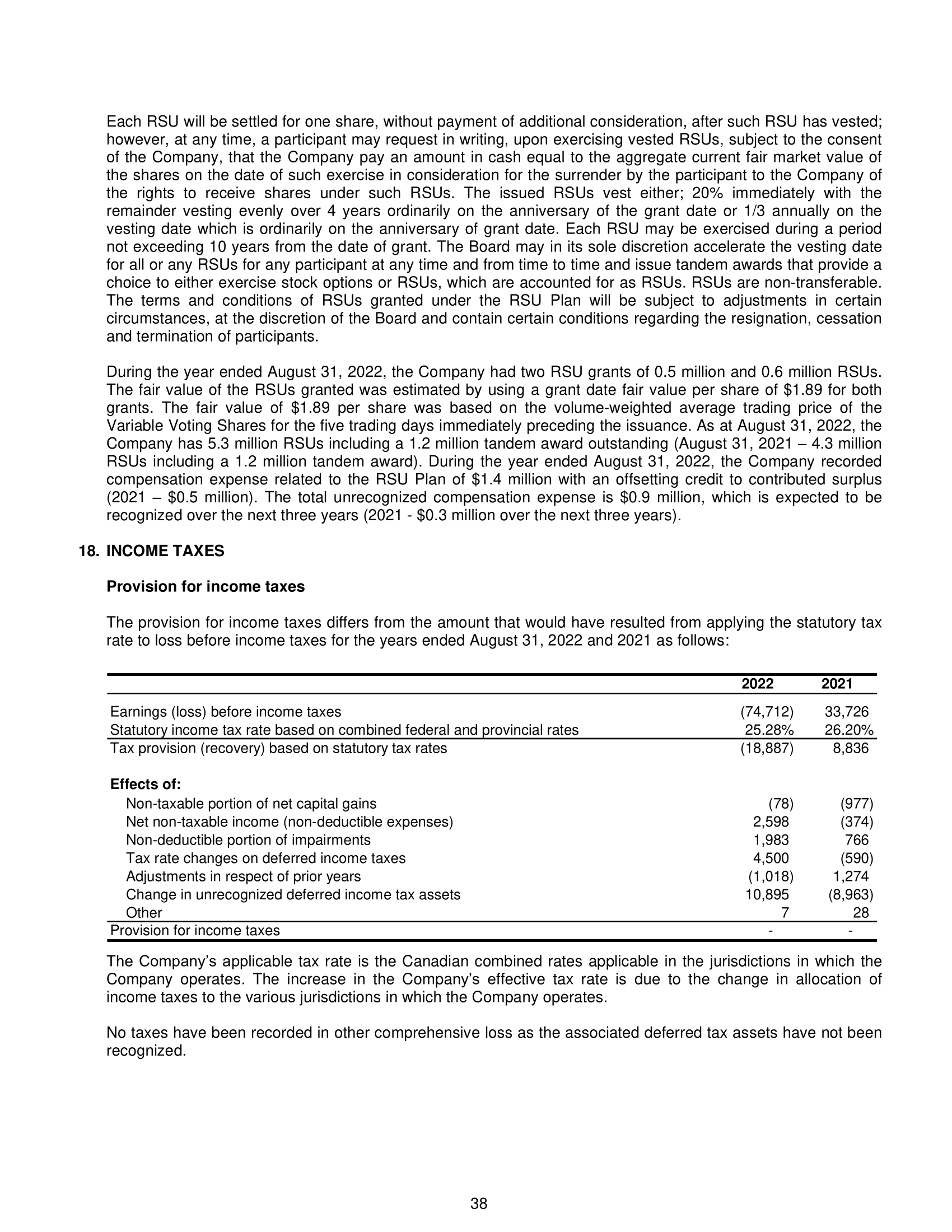

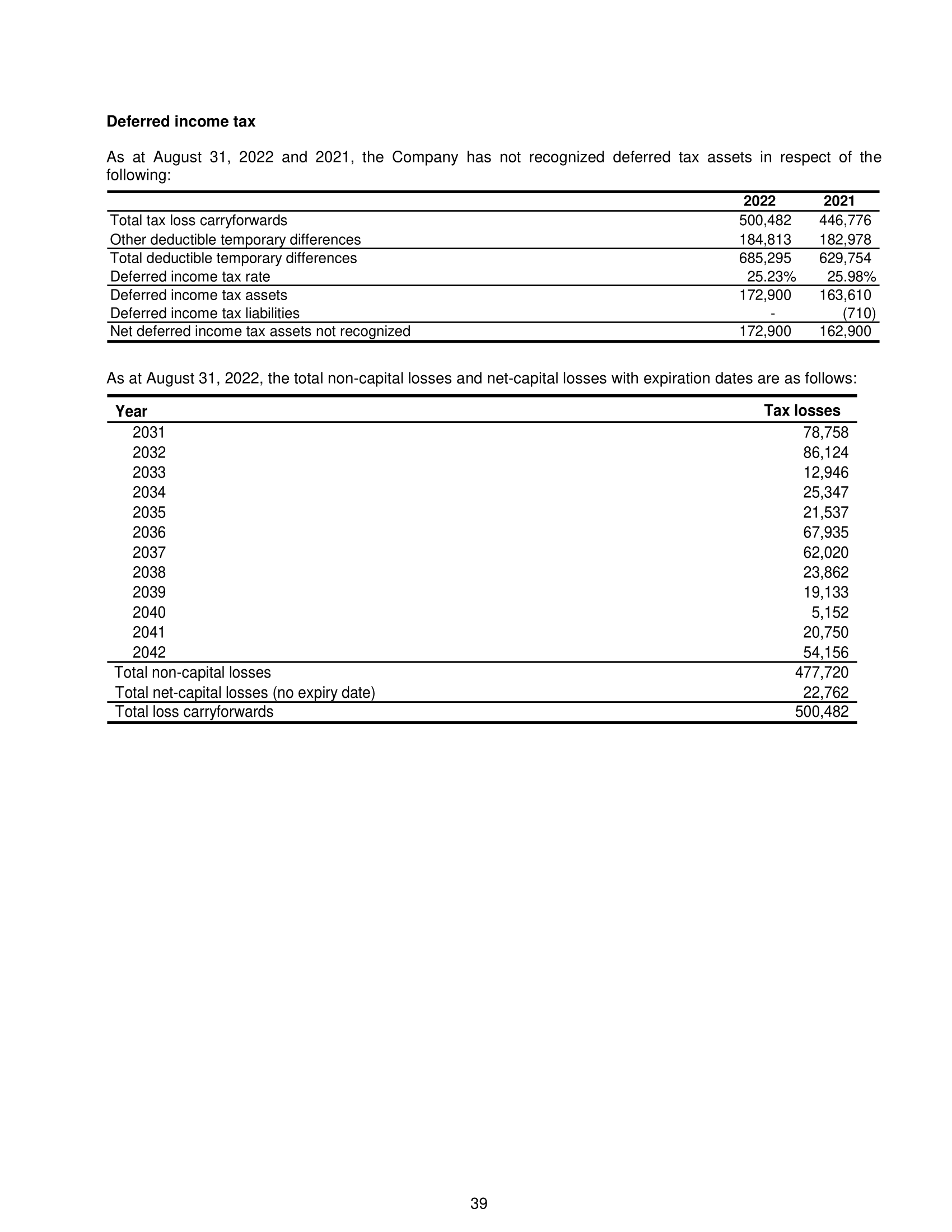

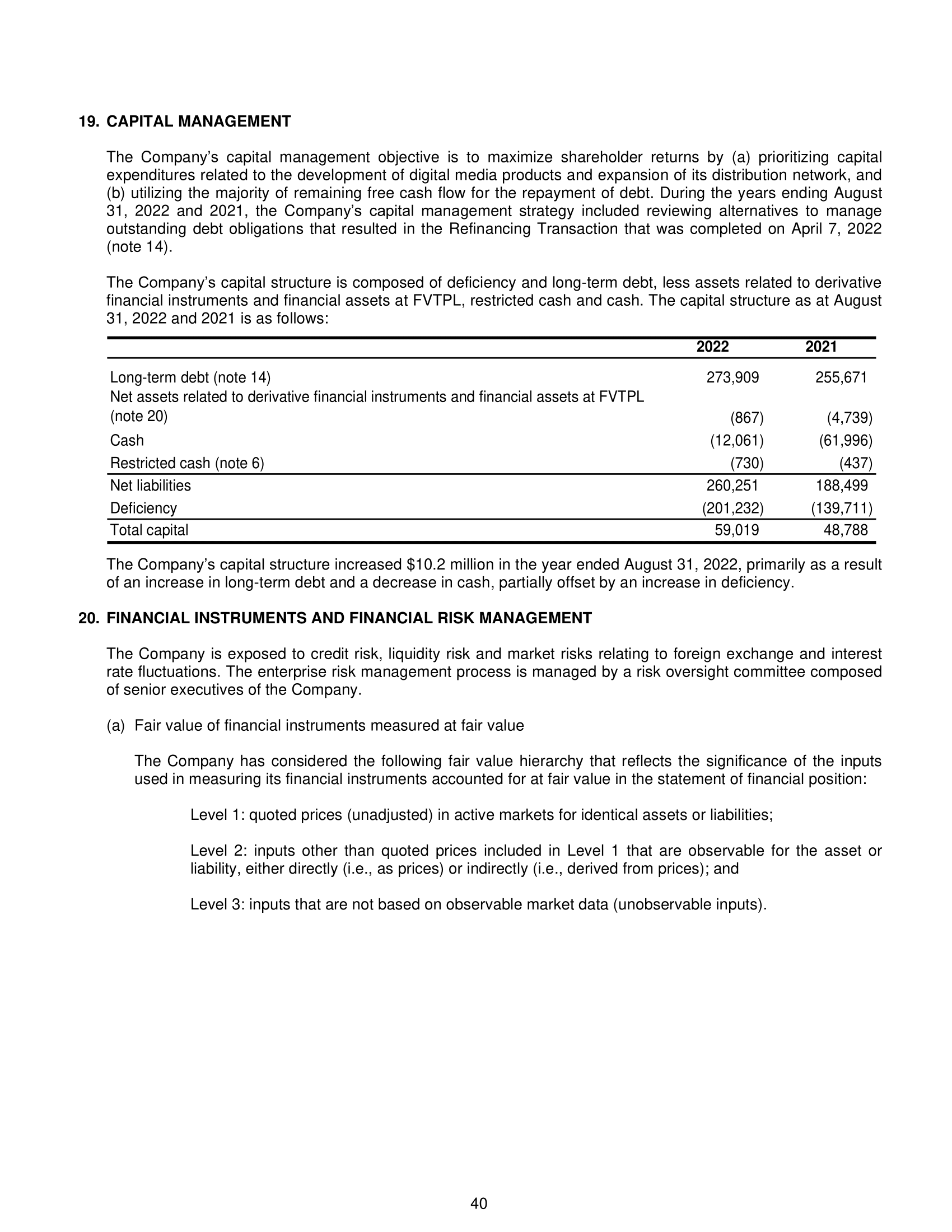

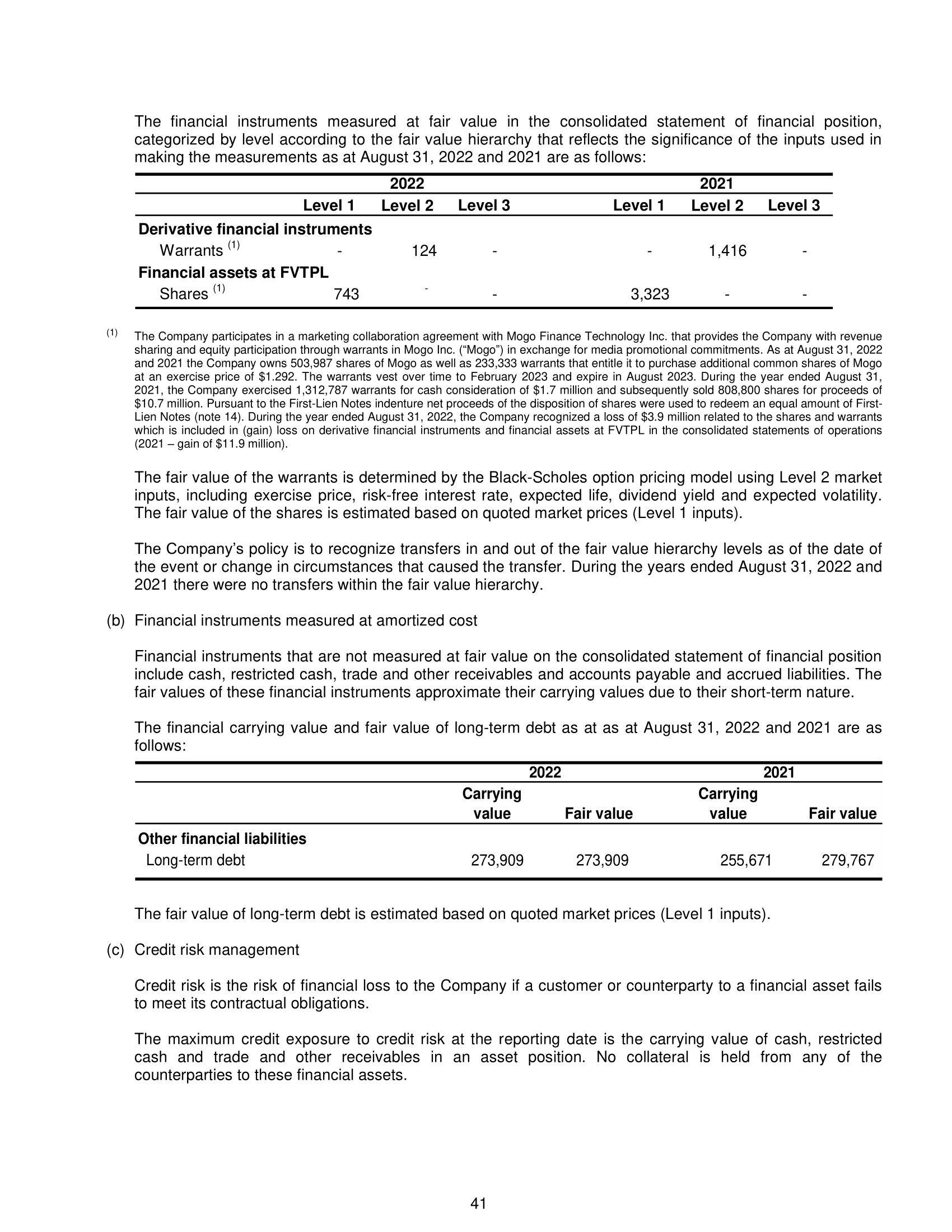

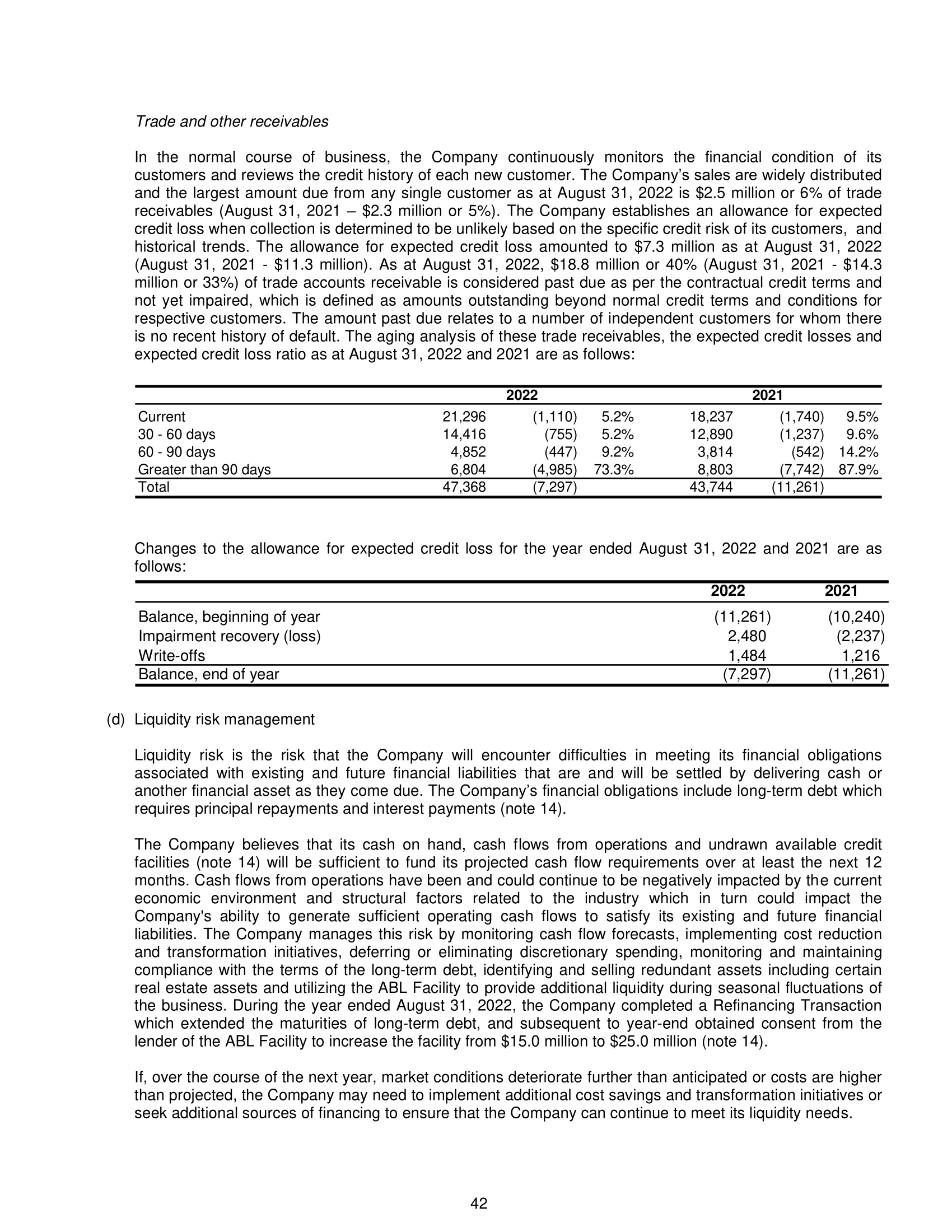

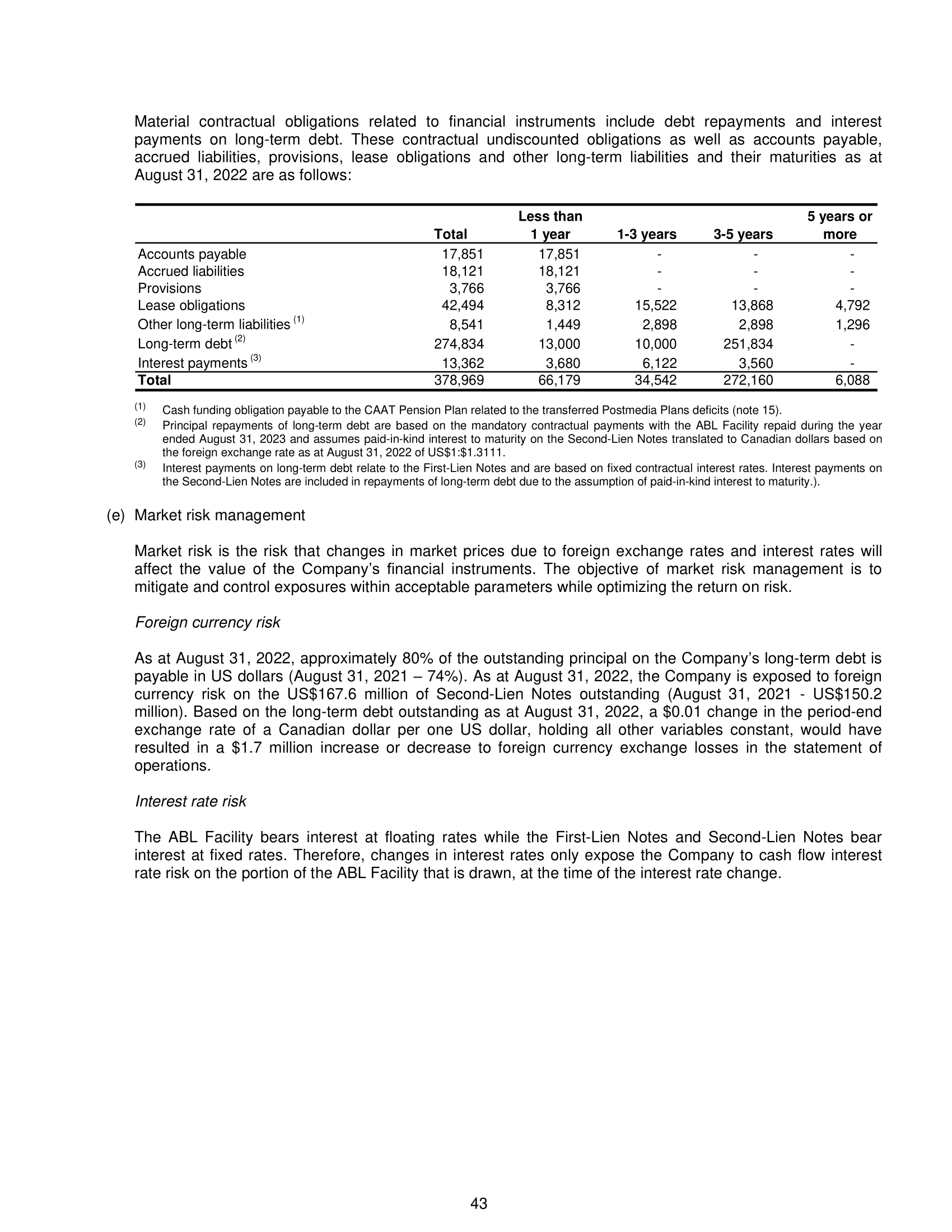

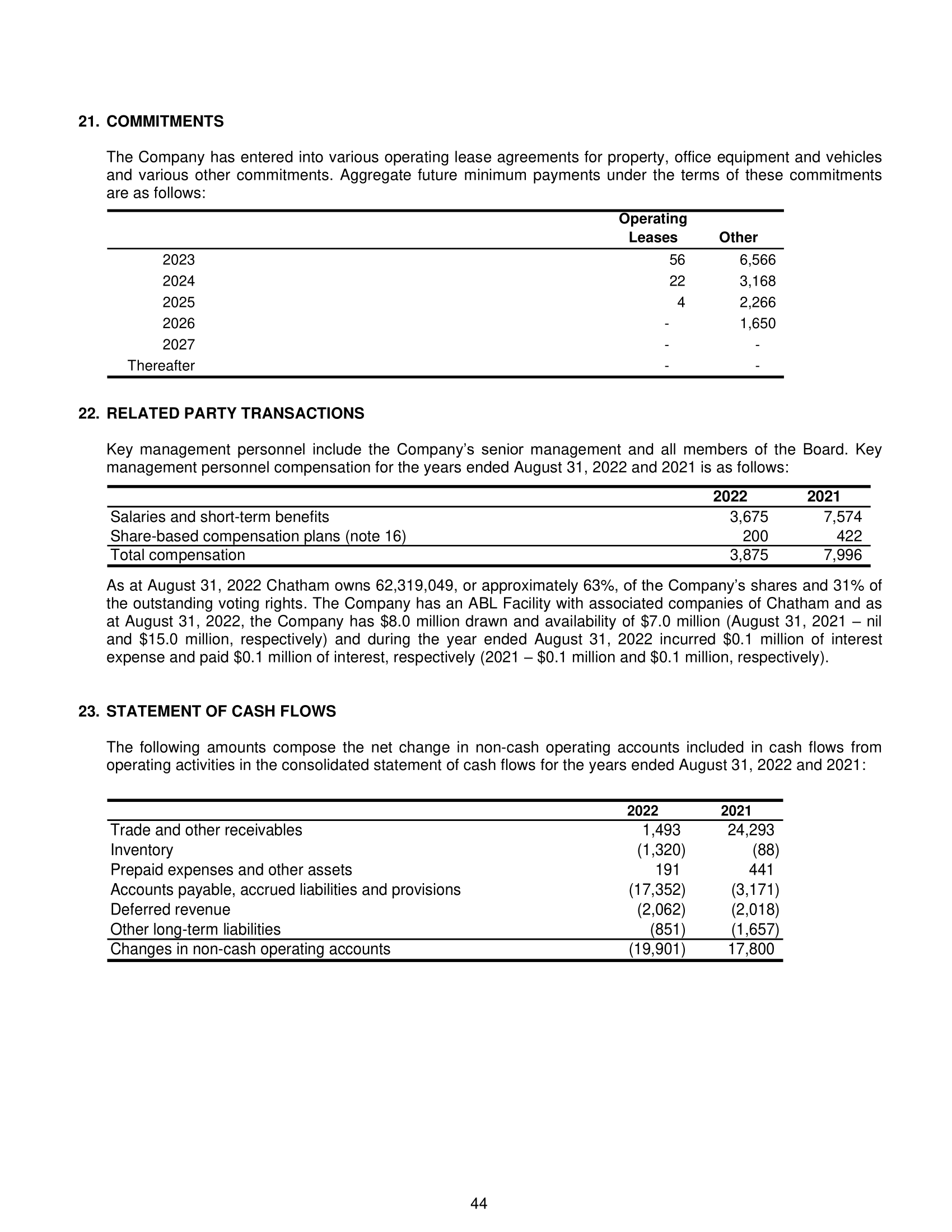

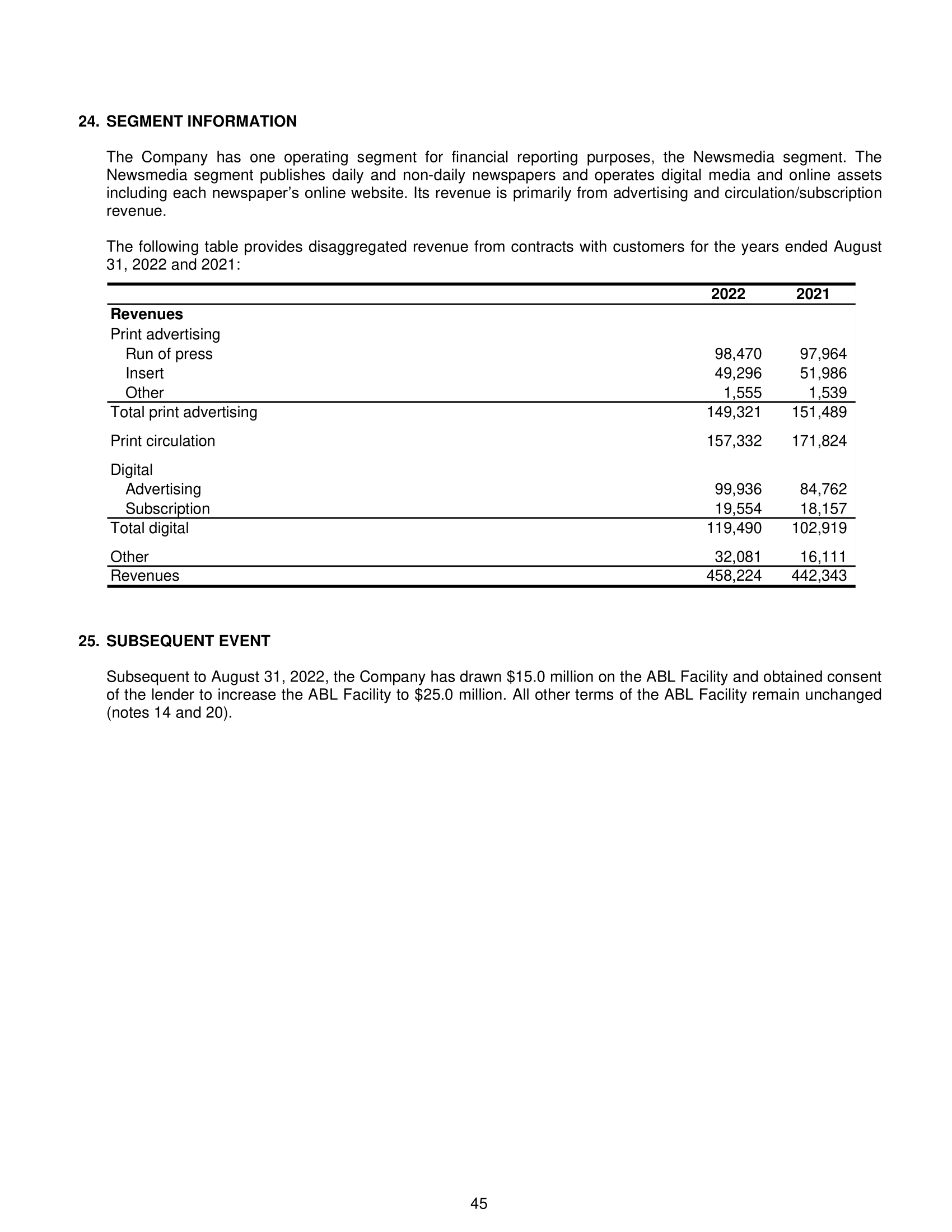

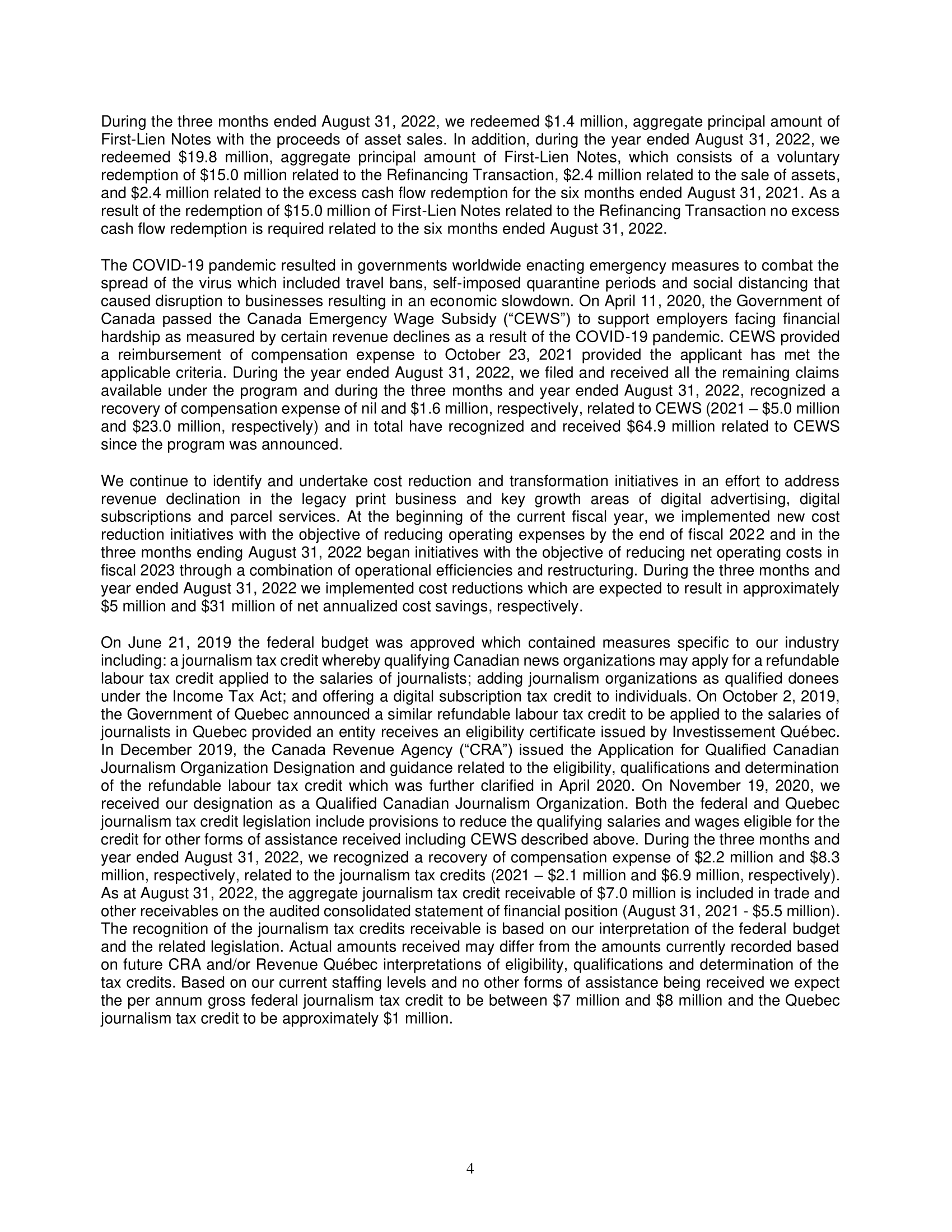

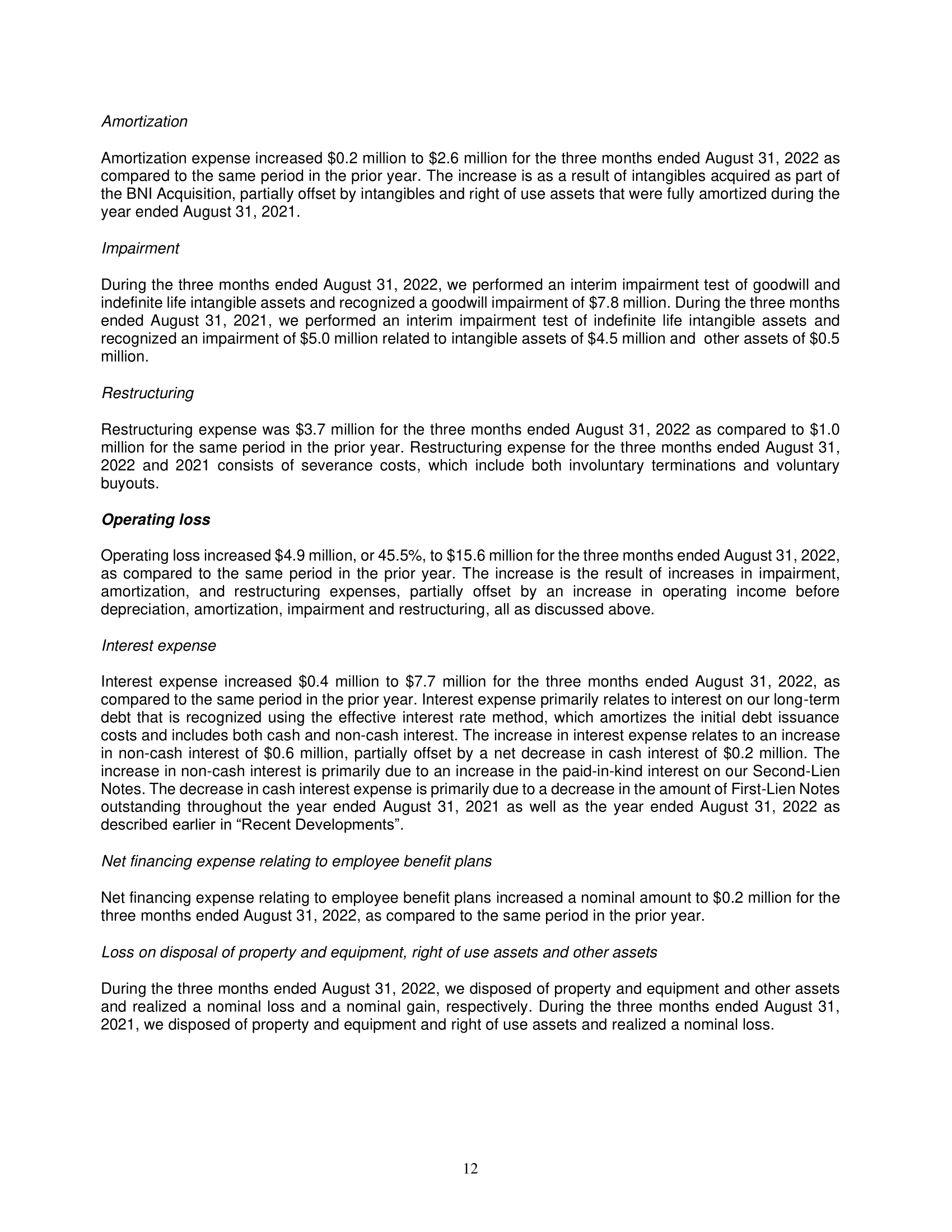

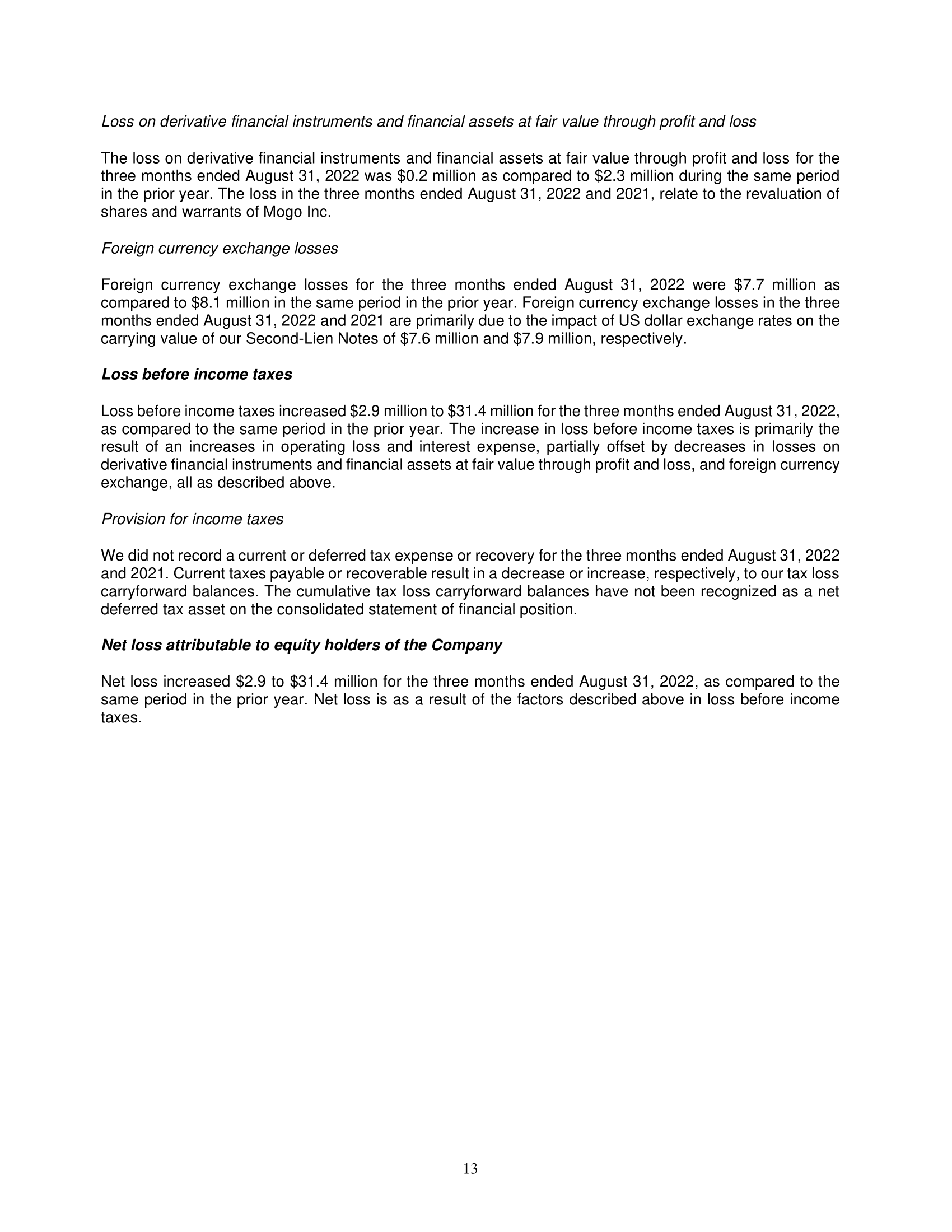

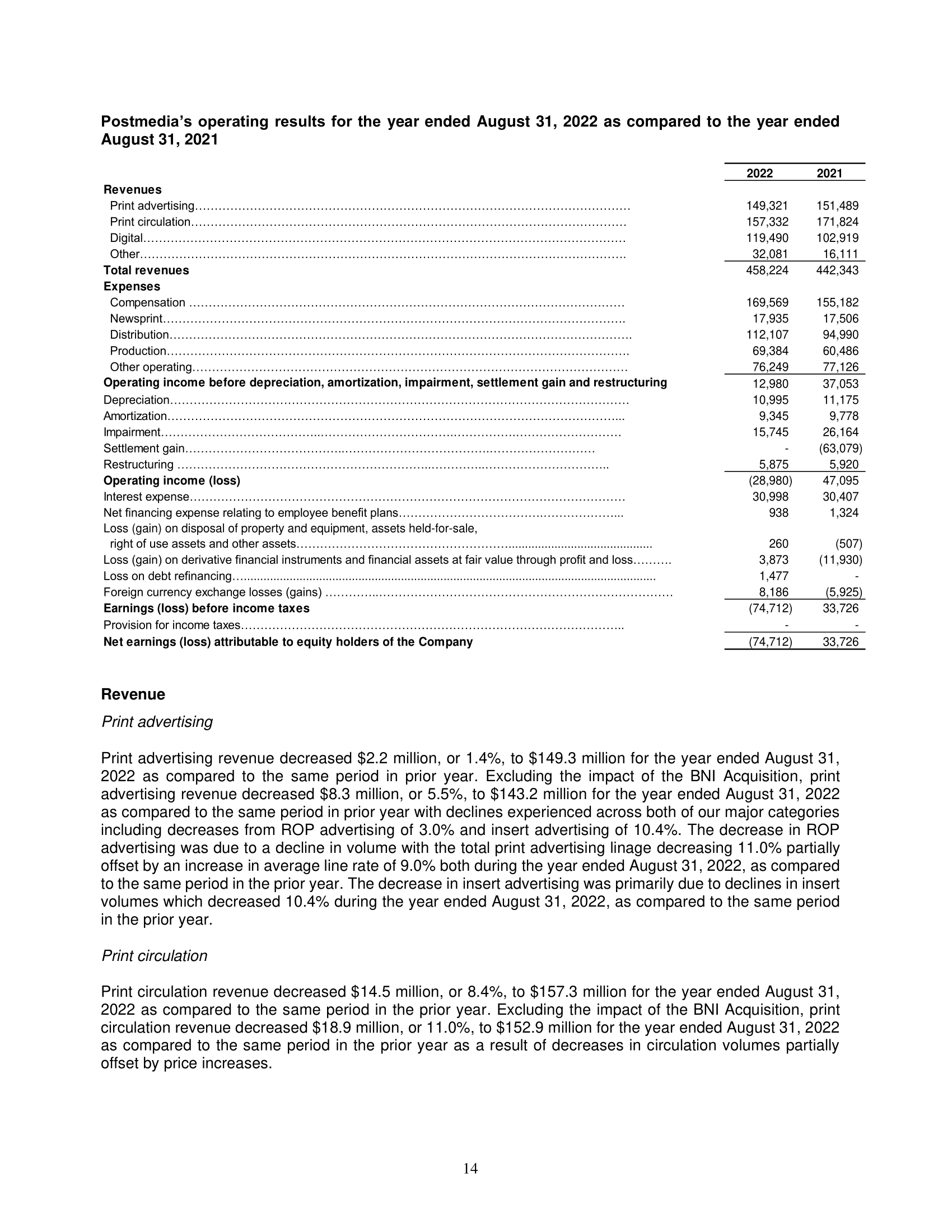

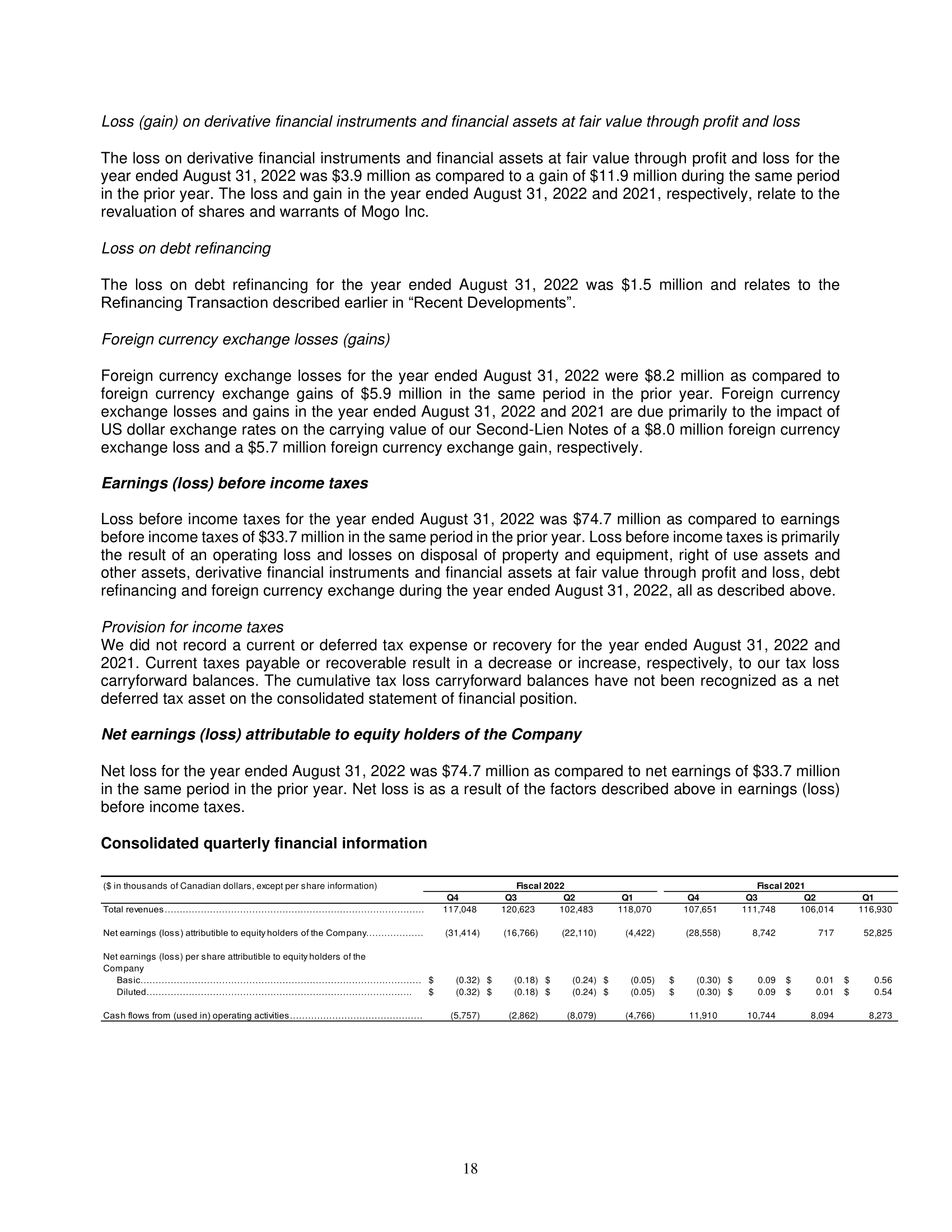

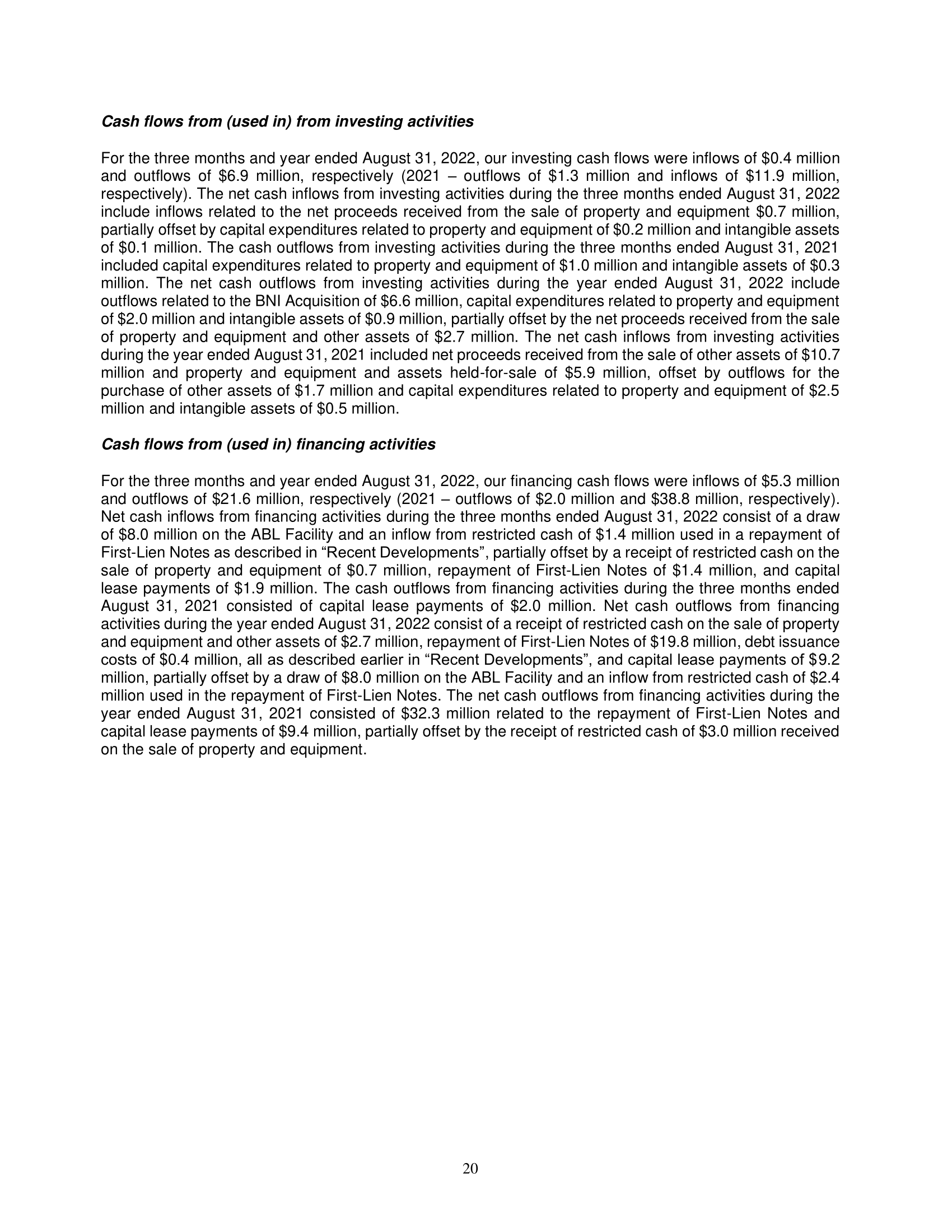

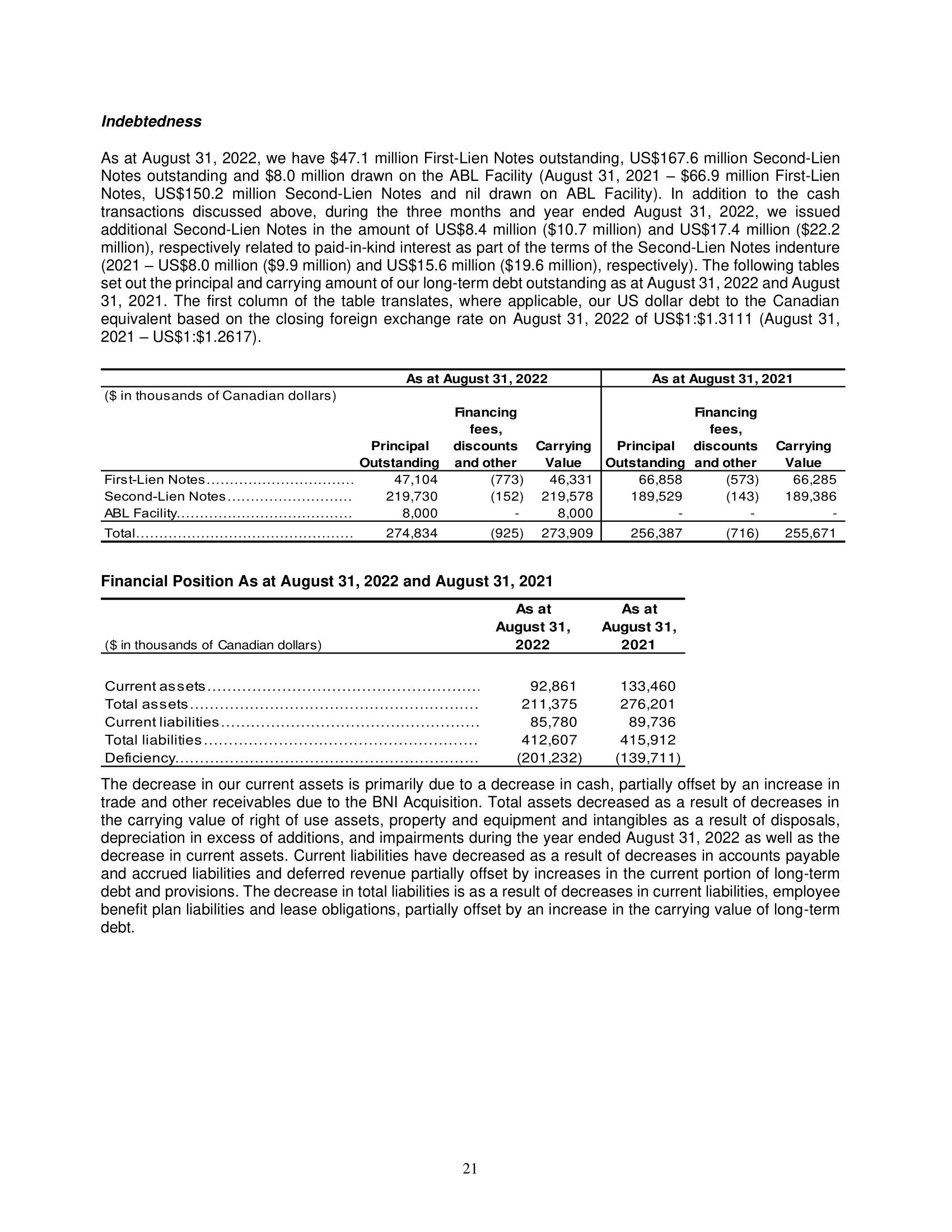

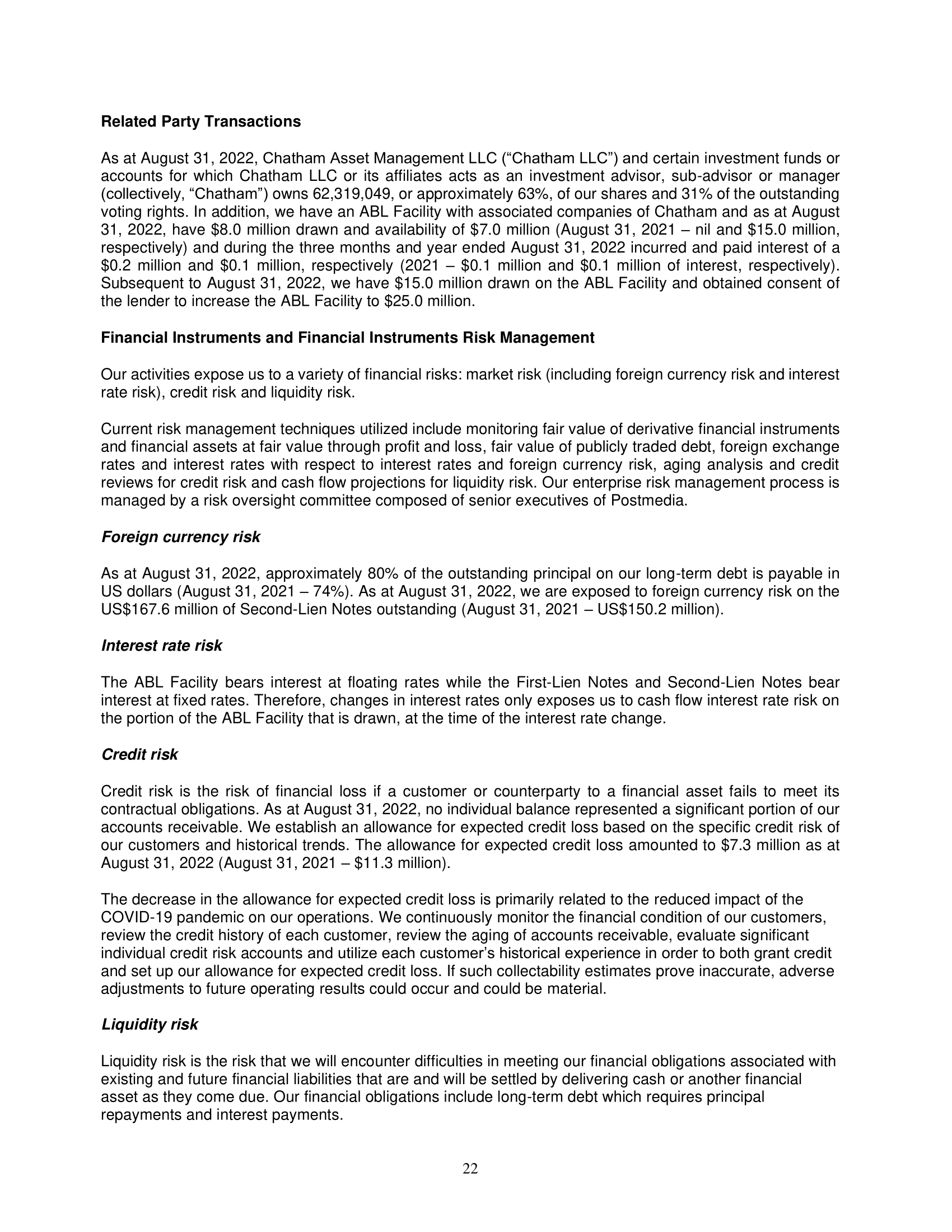

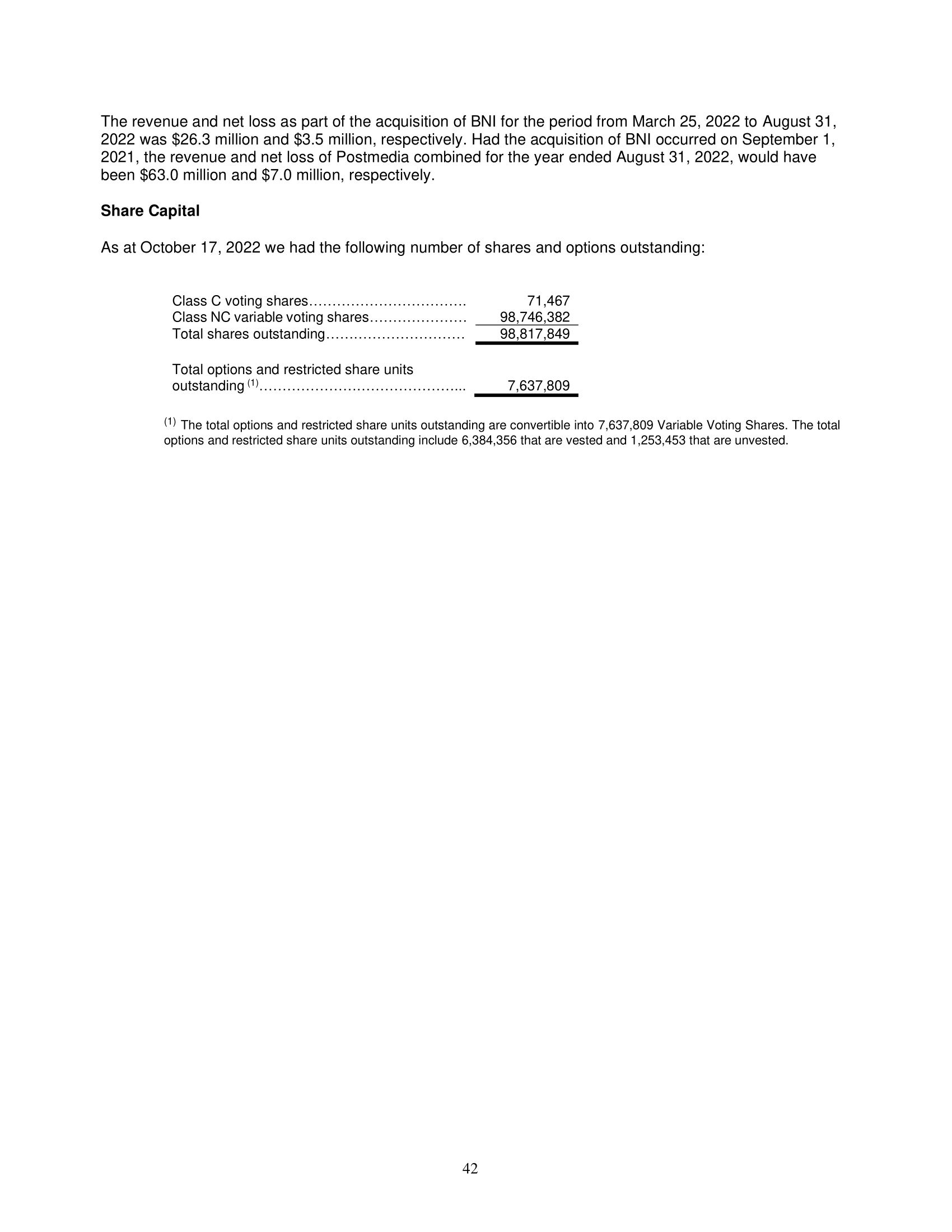

POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 Approved for issuance: October 21, 2022 1Management's Responsibility for Consolidated Financial Statements The accompanying consolidated financial statements of Postmedia Network Canada Corp. (the \"Company\") and its subsidiaries are the responsibility of management and have been approved by the Board of Directors of Postmedia Network Canada Corp. Management is responsible for the preparation of these consolidated financial statements in conformity with International Financial Reporting Standards, as issued by the International Accounting Standards Board, the selection of accounting policies and making significant accounting estimates, assumptions and judgements. Management is also responsible for establishing and maintaining adequate internal control over financial reporting which includes those policies and procedures that provide reasonable assurance over the completeness, fairness and accuracy of the consolidated financial statements and other financial items. The Board of Directors fulfills its responsibility for the consolidated financial statements principally through its Audit Committee, which is composed of independent external directors. The Audit Committee reviews the Company's annual consolidated financial statements and recommends their approval to the Board of Directors. The Audit Committee meets with the Company's management and external auditors to discuss internal controls over the financial reporting process, auditing matters and financial reporting issues, and formulates the appropriate recommendations to the Board of Directors. The auditor appointed by the shareholders has full access to the Audit Committee, with or without management being present. The external auditors appointed by the Company's shareholders, PricewaterhouseCoopers LLP, conducted an independent audit of the consolidated financial statements in accordance with Canadian generally accepted auditing standards and express their opinion thereon. Those standards require that the audit is planned and performed to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. Signed Signed Andrew MacLeod Mary Anne Lavallee President and Executive Vice President, Chief Operating Chief Executive Officer Officer and Interim Chief Financial Officer Toronto, Canada October 21, 2022 pwc Independent auditor's report To the Shareholders of Postmedia Network Canada Corp. Our opinion In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of Postmedia Network Canada Corp. and its subsidiary (together, the Company) as at August 31, 2022 and 2021, and its financial performance and its cash flows for the years then ended in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (IFFIS). What we have audited The Company's consolidated financial statements comprise: - the consolidated statements of operations for the years ended August 31, 2022 and 2021; - the consolidated statements of comprehensive income (loss) for the years ended August 31, 2022 and 2021; . the consolidated statements of financial position as at August 31, 2022 and 2021; . the consolidated statements of changes in deficiency for the years ended August 31, 2022 and 2021; . the consolidated statements of cash flows for the years ended August 31, 2022 and 2021; and . the notes to the consolidated financial statements, which include significant accounting policies and other explanatory information. Basis for opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor's responsibilities for the audit of the consolidated financial statements section of our report. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Independence We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada. We have fulfilled our other ethical responsibilities in accordance with these requirements. PricewaterhouseCoopers LLP Richardson Building, One Lombard Place, Suite 2300, Winnipeg, Manitoba, Canada R3B 0X6 T: +1 204 926 2400, F: +1 204 944 1020 \"PWC\" refers to FricewaternouseCoopers LLP, an Ontario limited liability partnership. pwc Key audit matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements for the year ended August 31, 2022. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. Key audit matter How our audit addressed the key audit matter Assessment of liquidity risk Our approach to addressing the matter included the following procedures, among others: Refer to note 2 Significant accounting policies, note 14 Long-term debt and note 20 Financial - Evaluated management's assessment of the instruments and financial risk management to the Company's liquidity risk, which included the consolidated financial statements. following: For the year ended August 31, 2022, the Company 7 Tested the reasonableness of the key reported a net loss of $74.7 million and negative cash flows from operating activities of $21.5 million. As at August 31, 2022, the Company had working capital of $7.1 million which included a cash balance of $12.1 million and a draw on the senior secured assetbased revolving credit facility (ABL Facility) of $8.0 million. Subsequent to year-end, the draw on the ABL Facility increased to $15.0 million and the Company obtained consent from the lender to increase the ABL Facility to $25.0 million. The Company manages its liquidity by monitoring cash flow forecasts, implementing cost reduction and transformation initiatives and utilizing the ABL Facility to provide additional liquidity during seasonal fluctuations of the business. Cash flow forecasts reflect judgments determined by management. The future cash flow forecasts include key assumptions and estimates regarding the timing and amounts of future revenues and expenses, and the use of the ABL facility. We considered this a key audit matter due to the judgments made by management in developing the cash flow forecasts, including the development of key assumptions. This led to a high degree of auditor judgment, subjectivity and audit effort in performing procedures to evaluate the cash flow forecasts and the Company's liquidity risk. assumptions underlying the cash flow forecasts, including the timing and amounts of future revenues and expenses, by comparing to past performance of the Company, industry information or other supporting information, including Board approved budgets, as applicable. Performed sensitivity analysis to assess the possible impact of changes to the key assumptions used by management in developing the cash flow forecasts. Read the contractual arrangements regarding the existing credit facilities and the amended ABL Facility to assess the ability to use the ABL facility. Tested the underlying data used by management in developing the cash flow forecasts and recalculated the mathematical accuracy of the cash flow forecasts. Assessed the consolidated financial statement disclosures related to the Company's liquidity risk. _I. pwc Key audit matter How our audit addressed the key audit matter Impairment assessment of indefinite life Our approach to addressing the matter involved the intangible assets following procedures, among others: Flefer to note 2 Significant accounting policies, . Tested how management determined the note 7 impairment of goodwill and long-lived assets and note 11 Intangible assets to the consolidated financial statements. The Company had indefinite life intangible assets consisting of mastheads and domain names amounting to $11.8 million as at August 31, 2022. Management performs an impairment assessment annually, or more frequently if there are indicators that an impairment may have arisen. In testing for impairment, assets including indefinite life intangible assets are grouped into cash generating units (CGUs). An impairment loss is recorded when the recoverable amount of a CGU is less than its carrying amount. The recoverable amounts were determined based on a fair value less cost of disposal method by applying a market multiple model. The key assumption used by management in the model is a multiple range, which is applied to the adjusted trailing 12 months' operating income before depreciation, amortization, impairment and restructuring less disposal costs of each CGU. Management determined this key assumption based on an average of market multiples for comparable entities. For the year ended August 31, 2022, management recognized an impairment loss of $7.9 million on indefinite life intangible assets. We considered this a key audit matter due to the judgment by management in developing the key assumption to determine the recoverable amounts of the CGUs. This has resulted in a high degree of subjectivity and audit effort in performing audit procedures to test the recoverable amounts determined by management. Professionals with specialized skill and knowledge in the field of valuation assisted us in performing our procedures. recoverable amounts of the CGUs, which included the following: Evaluated the appropriateness of the method used by management. Utilized professionals with specialized skill and knowledge in the field of valuation to assist in assessing the reasonability of the range of multiples used by management and the appropriateness of the market multiple model. Tested the mathematical accuracy of the market multiple model prepared by management. Considered whether the adjusted trailing 12 months' operating income before depreciation, amortization, impairment and restructuring less disposal costs was consistent with evidence obtained in other areas of the audit. Tested the disclosures made in the consolidated financial statements, including the impact of any sensitivity of the key assumption to the determined recoverable amounts. pwc Other information Management is responsible for the other information. The other information comprises the Management's Discussion and Analysis, which we obtained prior to the date of this auditor's report, and the information, other than the consolidated financial statements and our auditor's report thereon, included in the annual report, which is expected to be made available to us after that date. Our opinion on the consolidated financial statements does not cover the other information and we do not and will not express an opinion or any form of assurance conclusion thereon. In connection with our audit of the consolidated financial statements, our responsibility is to read the other information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated. lf, based on the work we have performed on the other information that we obtained prior to the date of this auditor's report, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard. When we read the information, other than the consolidated financial statements and our auditor's report thereon, included in the annual report, if we conclude that there is a material misstatement therein, we are required to communicate the matter to those charged with governance. Responsibilities of management and those charged with governance for the consolidated financial statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRS, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is responsible for assessing the Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Company's financial reporting process. Auditor's responsibilities for the audit of the consolidated financial statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and _I. pwc are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements. As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also: . Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. . Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. - Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. - Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Company to cease to continue as a going concern. - Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. - Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Company to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor's report unless law or _I. pwc regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. The engagement partner on the audit resulting in this independent auditor's report is Nicole Murray. ls/PricewaterhouseCoopers LLP Chartered Professional Accountants Winnipeg, Manitoba October 21, 2022 POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars, except per share amounts) 2022 2021 Revenues Print advertising 149,321 151,489 Print circulation 157,332 171,824 Digital 119,490 102,919 Other 32,081 16,111 Total revenues 458,224 442,343 Expenses Compensation (note 5) 169,569 155,182 Newsprint 17,935 17,506 Distribution 112,107 94,990 Production 69,384 60,486 Other 0 eratin note 21 76,249 77,126 Operating income before depreciation, amortization, impairment, settlement gain and restructuring (note 3) 12,980 37,053 Depreciation 10,995 11,175 Amortization 9,345 9,778 Impairment (notes 7, 9 and 11) 15,745 26,164 Settlement gain (note 15) - (63,079) Restructurin notes 13 and 15 5,875 5,920 Operating income (loss) (28,980) 47,095 Interest expense 30,998 30,407 Net financing expense relating to employee benefit plans (note 15) 938 1,324 (Gain) loss on disposal of property and equipment, assets heldfor-sale, right of use assets and other assets (notes 9 and 10) 260 (507) Loss (gain) on derivative financial instruments and financial assets at fair value through profit and loss (note 20) 3,873 (11,930) Loss on debt refinancing (note 10) 1,477 - Foreign currency exchange (gains) losses 8,186 (5,925) Earnings (loss) before income taxes (74,712) 33,726 Provision for income taxes (note 18) - - Net earnings (loss) attributable to equity holders of the Company (74,712 33,726 Earnings (loss) per share attributable to equity holders ot the Company (note 16): Basic 63 (0.78) $ 0.36 Diluted $ (0.78) $ 0.34 The notes constitute an integral part of the consolidated financial statements. POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars) 2022 2021 Net earnings (loss) attributable to equity holders of the Company (74,712) 33,726 Amounts not subsequently reclassified to the statement of operations Gains (losses) on employee benefit plans, net of tax of nil (note 15) 2,518 (9,860) Other comprehensive loss 2,518 9,860) Comprehensive income (loss) attributable to equity holders of the Company (72, 194) 23,866 The notes constitute an integral part of the consolidated financial statements. 10POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AS AT AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars) 2022 2021 ASSETS Current Assets Cash 12,061 61,996 Restricted cash (note 6) 730 437 Trade and other receivables (note 5) 49,118 41,255 Assets held-forsale 17,727 17,727 Inventory (note 8) 4,950 3,348 Prepaid expenses and other assets 8,275 8,697 Total current assets 92,861 133,460 Non-Current Assets Property and equipment (notes 7 and 9) 66,747 76,390 Flight of use assets (note 10) 30,095 35,646 Derivative financial instruments and other assets (note 20) 3,742 6,914 Intangible assets (note 11) 17,930 23,791 Total assets 211,375 276,201 LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued liabilities (note 12) 39,440 49,599 Provisions (note 13) 3,766 2,257 Deferred revenue 21,262 22,351 Current portion of lease obligations (note 10) 8,312 8,120 Current portion of long-term debt (note 14) 13,000 7,409 Total current liabilities 85,780 89,736 Non-Current Liabilities Long-term debt (note 14) 260,909 248,262 Employee benefit Obligations and other liabilities (note 15) 38,169 44,753 Lease obligations (note 10) 27,749 33,161 Total liabilities 412,607 415,912 Deficiency Capital stock (notes 4 and 16) 820,131 810,861 Contributed surplus (note 17) 17,973 16,570 Deficit (1,039,336) (967,142) Total deficiency (201,232) (139,711) Total liabilities and deficiency 211,375 276,201 Commitments (note 21), Subsequent Event (note 25) On October 21, 2022, the Board of Directors (the \"Board\") approved the consolidated financial statements. On behalf of the Board, Signed Signed Paul Godfrey Peter Sharpe Executive Chairman Lead Director The notes constitute an integral part of the consolidated financial statements. 11 POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED STATEMENTS OF CHANGES IN DEFICIENCY FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars) 2022 Capital Contributed Total stock surplus Deficit Deciency Balance as at August 31, 2021 810,861 16,570 (967,142) (139,711) Net loss attributable to equity holders of the Company - - (74,712) (74,712) Other comprehensive income - - 2,518 2,518 Comprehensive loss attributable to equity holders of the Company - - (72,194) (72,194) Share-based compensation plans (note 17) - 1,403 - 1,403 Shares issued (notes 4 and 10) 9,270 - - 9,270 Balance as at August 31, 2022 820,131 17,973 (1,039,336) (201,232) 2021 Capital Contributed Total stock surplus Deficit Deticiency Balance as at August 31, 2020 810,861 15,925 (991 ,008) (164,222) Net earnings attributable to equity holderS of the Company - - 33,726 33,726 Other comprehensive loss - - (9,860) (9,860) Comprehensive income attributable to equity holders of the Company - - 23,866 23,866 Shareebased compensation plans (note 17) , 645 , 645 Balance as at August 31, 2021 810,861 16,570 (967,142) (139,711) The notes constitute an integral part of the consolidated financial statements. 12 POSTMEDIA NETWORK CANADA CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars) 2022 2021 CASH GENERATED (UTILIZED) BY: OPERATING ACTIVITIES Net earnings (loss) attributable to equity holders of the Company (74,712) 33,726 Items not affecting cash: Depreciation (note 9) 10,995 11,175 Amortization (notes 10 and 11) 9,345 9,778 Impairment (notes 7, 9 and 10) 15,745 26,164 Loss on debt refinancing (note 14) 1,477 - 20) 3,873 (11,930) Non-cash interest 25,093 23,363 (Gain) loss on disposal of property and equipment, assets held-tor-sale, right of use assets and other assets (notes 9 and 10) 260 (507) Non-cash foreign currency exchange (gains) losses 8,173 (5,880) Share-based compensation plans (note 17) 1,403 645 Net financing expense relating to employee benefit plans (note 15) 938 1,324 Non-cash settlment gain relating to employee benefit plans (note 15) - (63,079) Employee benefit plan funding in excess of compensation expense (note 15) (4,153) (3,558) Net chan e in non-cash o eratin accounts note 23 19,901 17,800 Cash flows from (used in) operating activities (21 ,464) 39,021 INVESTING ACTIVITIES Net proceeds from the sale of property and equipment, assets heldrforrsale and other assets (notes 9 and 10) 2,735 5,889 Purchases of property and equipment (note 9) (2,005) (2,475) Purchases of intangible assets (note 11) (948) (449) Net proceeds trom the sale of other assets (note 20) - 10,675 Purchases of other assets (note 20) (1,696) Acquisition, net of cash acquired (note 4) (6,636) - Cash flows from (used in) investing activities (6,853) 11,944 FINANCING ACTIVITIES Repayment of longterm debt (note 14) (19,754) (32,305) Restricted cash (note 6) (293) 2,965 Advances from senior secured asset-based revolving credit facility (note 14) 8,000 - Debt issuance costs (note 14) (418) - Lease a meme note 10 9,153 9,424 Cash flows used in financing activities (21,618) (38,764) Net change in cash for the period (49,935) 12,201 Cash at beginning of period 61,996 49,795 Cash at end of period 12,061 61,996 2022 2021 Supplemental disclosure of operating cash flows Interest paid 6,375 7,943 Income taxes paid - - The notes constitute an integral part of the consolidated financial statements. 13 POSTMEDIA NETWORK CANADA CORP. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARS ENDED AUGUST 31, 2022 AND 2021 (In thousands of Canadian dollars, except as otherwise noted) 1. DESCRIPTION OF BUSINESS Postmedia Network Canada Corp. (\"Postmedia\" or the \"Company\") is a holding company that has a 100% interest in its subsidiary Postmedia Network Inc. (\"Postmedia Network"). The Company was incorporated on April 26, 2010, pursuant to the Canada Business Corporations Act. The Company's head ofce and registered office is 365 Bloor Street East, 12th Floor, Toronto, Ontario. The Company's operations consist of news and information gathering and dissemination operations, with products offered in local, regional and major metropolitan markets in Canada through print, online and mobile platforms. The Company's operations include an extensive distribution network, which offers distribution services, for advertising flyers and parcels. The Company supports these operations through a variety of centralized shared services. The Company has one operating segment for financial reporting purposes, the Newsmedia segment. The Newsmedia segment's revenue is primarily from print and digital advertising and circulation/subscription revenue. SIGNIFICANT ACCOUNTING POLICIES The significant accounting policies used in the preparation of these consolidated financial statements are described below. (a) Basis of presentation The Company prepares its consolidated financial statements in accordance with International Financial Reporting Standards (\"IFRS\") as issued by the International Accounting Standards Board. The Company applies the going concern basis of accounting in preparing its financial statements which is dependent upon its ability to generate sufficient profits and cash flows to ensure it has sufficient liquidity to meet its obligations as they fall due. Management is satisfied that the Company's cash flow forecasts, taking into account any reasonably possible changes in results and other uncertainties, will provide sufficient liquidity for at least the next twelve months (note 20). (b) Basis of measurement These consolidated financial statements have been prepared under the historical cost convention, except for the revaluation of derivative financial instruments and financial assets to fair value, and certain assets classified as heldforsale which were recorded at the lower of the carrying amount and fair value less costs of disposal (\"FVLCD"). (c) Principles of consolidation These consolidated financial statements include the accounts of the Company and Postmedia Network, along with its subsidiary. A subsidiary is an entity which the Company controls. For accounting purposes, control is established by an investor when it is exposed to, or has rights to, variable returns from its involvement with the entity and has the ability to affect those returns through its power over the entity. All intercompany transactions and balances have been eliminated on consolidation. 14 (d) Critical accounting estimates The preparation of financial statements in accordance with IFFtS requires management to make estimates, assumptions and judgements that affect the reported amounts of assets and liabilities, related amounts of revenues and expenses, and disclosure of contingent assets and liabilities. Although these estimates, assumptions and judgements are based upon management's knowledge of the amount, event or actions; actual results could differ from those estimates, assumptions and judgements. The following significant areas require management to use assumptions and to make estimates: Future cash flow forecasts The estimate of future cash flows in the Company's forecasts used in the going concern assumption takes into consideration the strength of the economy including current inflationary pressures on the Company and its advertisers and subscribers as well as competition from other forms of media and alternative emerging technologies. In addition, the COVID19 pandemic caused a disruption to the economy of which the duration and long-term effects remain uncertain which could further impact the Company's future cash flow forecasts and liquidity. The Company's cash flow forecast contains planned cost reduction and transformation initiatives to address revenue declination in the legacy print business and key growth areas of digital advertising, digital subscriptions and parcel delivery. The cash flow forecast uses considerable judgement applied by management and includes key assumptions and estimates regarding the timing and amounts of future revenues and expenses and their impact on liquidity, which includes the use of the senior secured assetbased revolving credit facility (\"ABL Facility\") (note 20). The cash flow forecast and estimates of expected liquidity needs are sensitive to these assumptions. Impairment of goodwill and long lived assets The Company tests goodwill and indefinite life intangible assets for impairment annually, or more frequently if there are indicators that an impairment may have arisen. In testing for impairment, assets including indefinite life intangible assets and other long lived assets, are grouped into a cash generating unit ("CGU" or "CGUs") which represents the lowest level for which there are separately identifiable cash inflows. For the purpose of goodwill impairment testing, goodwill is allocated to each CGU (or group of CGUs) based on the level at which management monitors goodwill, however not higher than an operating segment. Accordingly, management has allocated its goodwill to its single operating segment, the Newsmedia operating segment. The recoverable amount of each CGU or group of CGUs is based on the higher of value in use and FVLCD calculations. During the years ended August 31, 2022 and 2021, the Company computed the FVLCD for each CGU by applying a market multiple model using a multiple range of 2.5 to 3.5 times the adjusted trailing twelve month operating income before depreciation, amortization, impairment, settlement gain, and restructuring, less disposal costs. Management determined this key assumption based on an average of market multiples for comparable entities. Additional information on the Company's impairment testing is contained in note 7. In addition, estimates were required in the determination of FVLCD for the Company's held-for-sale assets (note 9). Employee future benefits The cost of defined benefit post-retirement benefit plans and other long-term employee benefit plans and the present value of the defined benefit obligation are determined using actuarial valuations. An actuarial valuation involves making various assumptions including the discount rate and mortality rates, among others to measure the net defined benefit obligation. Due to the complexity of the actuarial valuations and the long-term nature of employee future benefits, the corresponding obligation is highly sensitive to changes in assumptions. Discount rates are reviewed at each reporting date and corresponding adjustments to the net defined benefit obligation are recognized in other comprehensive income and deficit. Additional information on the Company's employee benefit plans is contained in note 15. 15 (e) (f) (g) (h) The following areas require management to use significantjudgements apart from those involving estimates: Determination of useful lives for the depreciation and amortization of assets with finite lives For each class of assets with finite lives, management has to determine over which period the Company will consume the asset's future economic benefits. The determination of such periods and if necessary, the subsequent revision of such periods, involves judgement and has an impact on the depreciation and amortization recorded in the consolidated statements of operations. The Company takes into account industry trends and Company specific factors, including changing technologies and expectations for the in-service period of assets, when determining their respective useful lives. Determination of the measurement of government grants and tax credits Judgement is required in determining when government grants and tax credits are recognized. Government grants and tax credits are recognized when there is reasonable assurance that the Company has complied with the conditions associated with the relevant government program. The determination of reasonable assurance involves judgement due to the complexity of the programs and related claim and review processes. Disposals of non-current assets and discontinued operations Non-current assets are classified as held-forsale if the carrying amount will be recovered principally through a sale transaction rather than through continued use, they are available for sale in their present condition and such sale is considered highly probable. The criteria for a sale to be considered highly probable includes a firm decision by the appropriate level of management or the Board to dispose of a business or a group of assets, such business or group of assets must be actively marketed for a price that is reasonable in relation to their current market value and there must be an expectation that such disposal will be completed within a twelve-month period. Assets held-for-sale are carried at the lower of their carrying amount and FVLCD. Assets held-for-sale are classified as discontinued operations if the operations and cash flows can be clearly distinguished, both operationally and for financial reporting purposes, from the rest of the Company and they represent a separate major line of business or geographical area of operations, or are part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations, or is a subsidiary acquired with the view to resell. Foreign currency translation These consolidated financial statements are presented in Canadian dollars, the Company's functional and reporting currency. As at the date of the statement of financial position, monetary assets and liabilities denominated in foreign currencies are translated into Canadian dollars using the foreign currency exchange rate in effect at that date. Revenues and expense items are translated at the foreign currency exchange rate in effect when the transaction occurred. The resulting foreign currency exchange gains and losses are recognized in the statement of operations in foreign currency exchange (gains) losses. Cash and restricted cash Cash is composed of cash on hand and current balances with banks. Pursuant to the indenture that governs the Company's first-lien debt, any net proceeds from an asset disposition in excess of $0.1 million will be held in a collateral account by the noteholders and when the aggregate amount of the collateral account exceeds $1.0 million it will be used to make an offer to redeem an equal amount of firstlien debt. Such cash is classified as restricted cash on the statement of financial position. Borrowing costs Borrowing costs consist of interest and other costs that the Company incurs in connection with the borrowing of funds. Borrowing costs directly attributable to the acquisition. construction or production of an asset that takes a substantial period of time to get ready for its intended use or sale are capitalized as part of the cost of the asset. All other borrowing costs are expensed in the period they are incurred in interest expense in the statement of operations. 16 (i) (i) Property and equipment Property and equipment are carried at cost less accumulated depreciation and impairment. Historical cost includes purchase cost, expenditures that are directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management, and borrowing costs if applicable. Depreciation is provided for on a straightline basis over the following useful lives: Assets Estimated useful life Buildings 10 - 40 years Leaseholds 3 - 20 years Computer hardware 3 - 5 years Machinery and equipment 5 - 25 years The depreciation method, estimates of useful lives and residual values assigned to property and equipment are reviewed at least at each financial year end and if necessary depreciation is adjusted on a prospective basis. Intangible assets Finite life intangibles Software Costs of internally generated software are composed of all directly attributable costs necessary to create, produce and prepare the asset to be capable of operating in the manner intended by management. Internally generated software consists primarily of internal costs in connection with the development of software to be used internally or for providing services to customers. All costs incurred during the research phase are expensed as incurred. Development costs that are attributable to the design and testing are recognized as intangible assets if the asset can be separately identified, it is probable the asset will generate future economic benefits, the development cost can be measured reliably, the project is technically feasible and the project will be completed with a view to use the asset. Software costs are amortized using the straight-line method of amortization over their estimated useful lives, which range from 2 to 10 years. The amortization method and estimates of useful lives ascribed to software are reviewed at least at each financial year end and if necessary, amortization is adjusted on a prospective basis. Other identifiable intangible assets Other identifiable intangible assets are recorded at cost and are carried at cost less accumulated amortization and impairment. Other identifiable intangible assets with finite lives are amortized using the straight-line method of amortization over their estimated useful lives. as follows: Other identifiable intangible assets with finite lives Estimated useful life Customer relationships 4 years Domain names 15 years The amortization method and estimates of useful lives ascribed to other identifiable intangible assets are reviewed at least at each financial year end and if necessary, amortization is adjusted on a prospective basis. Costs associated with purchasing and developing content are expensed as incurred, except for content development on the Company's websites which are capitalized when such costs meet the criteria for capitalization. 17 (k) (I) Indefinite life intangibles Intangible assets with indefinite lives are not amortized. These include newspaper mastheads and domain names related to the newspaper online websites. The assessment of indefinite life is reviewed each period to determine whether the indefinite life assumption continues to be supportable. If it is deemed unsupportable the change in useful life from indefinite to finite life is made and amortization is adjusted on a prospective basis. Business combinations and goodwill The Company uses the acquisition method of accounting to record business combinations. The acquisition method of accounting requires the Company to recognize, separately from goodwill, the identifiable assets acquired, the liabilities assumed and any noncontrolling interest in the acquiree measured at the acquisition date fair values. The consideration transferred shall be measured at fair value calculated as the sum of the acquisitiondate fair values of the assets transferred by the Company, the liabilities assumed by the Company and any equity interests issued by the Company. Contingent consideration is recognized as part of the consideration transferred. Goodwill as of the acquisition date is measured as the excess of the consideration transferred and the amount of any non-controlling interest acquired over the net of the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed, measured at fair value. Goodwill acquired through a business combination is allocated to the CGU (or group of CGUs) that are expected to benefit from the synergies of the business combination. After initial recognition. goodwill is measured at cost less any accumulated impairment losses. Acquisition related costs are expensed in the period they are incurred except for those costs to issue equity securities which are offset against the related equity instruments and those costs to issue debt which are offset against the corresponding debt and amortized using the effective interest method. Acquisition related costs include advisory, legal. accounting. valuation and other professional or consulting fees, and costs of registering and issuing debt and securities. Impairment Impairment is recorded when the recoverable amount of an asset or CGU is less than its carrying amount. The Company's CGUs are primarily geographical groups of newspapers by city or region. as applicable. The recoverable amount of an asset or CGU is the higher of an asset or CGUs FVLCD or its value in use, and is determined for an individual asset, unless the asset does not generate cash inflows that are largely independent of those from other assets or groups of assets. When the carrying amount of an asset or CGU exceeds its recoverable amount, the asset is considered impaired and is written down to its recoverable amount. Impairment losses, other than those relating to goodwill. are reviewed for potential reversals when events or changes in circumstances warrant such consideration. (i) Non-financial assets The carrying values of non-financial assets with finite lives. except inventories. are assessed for impairment whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Additionally, intangible assets with indefinite lives composed of mastheads and newspaper domain names are included in their related CGU and are tested annually for impairment or whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash inflows (CGUs). Any corporate assets and cash flows are allocated to the respective CGUs. Nonfinancial assets other than goodwill that have incurred an impairment in previous periods are reviewed for the possible reversal of the impairment at each reporting date. 18 (ii) Goodwill Goodwill is reviewed for impairment annually or more frequently if there are indications that impairment may have occurred. For the purpose of impairment testing, goodwill is allocated to each CGU (or group of CGUs) based on the level at which management monitors goodwill, however not higher than an operating segment. impairment is determined by assessing the recoverable amount of each CGU (or group of CGUs) to which the goodwill relates. Accordingly, management has allocated its goodwill to its single operating segment, the Newsmedia operating segment. Impairment losses relating to goodwill cannot be reversed in future periods. (m) Revenue Recognition The Company has a number of different revenue streams all of which are derived from contracts with customers. Print and digital advertising revenue is primarily generated through advertisements in print publications, and on various digital platforms. Print and digital circulation/subscription revenue is generated by home delivery subscriptions; single copy sales at newsstands and vending machines; and digital subscriptions. Other revenues are generated from commercial printing for external customers, parcel delivery and the sale of various products and services. Revenue is measured based on the consideration specified in a contract and the Company recognizes revenue when it transfers control of a product or provides a service to a customer. A corresponding receivable is recognized in instances where credit terms are extended as this is the point in time that the consideration is unconditional because only the passage of time is required before the payment is due. No element of financing is deemed present as normal credit terms are 30 days or less, upon delivery. The contracts with customers typically have no further separate performance obligations to which a portion of the transaction price should be allocated nor are they subject to variable consideration. When payment is received in advance of the criteria being met for recognition of revenue, a contract liability is recognized in deferred revenue which is typically a maximum period of one year. With respect to incremental costs such as sales commissions incurred in obtaining a contract, the Company has elected to apply the practical expedient to expense these costs when incurred as the term of the Company's contracts are one year or less. Print advertising revenue Revenue related to print advertising is recognized when a print advertisement or flyer is included in the newspaper and the newspapers are delivered. Digital advertising revenue The Company has a number of digital advertising revenue streams. The majority of the Company's digital revenue is recognized when advertisements are placed on digital platforms and to a lesser extent when a user clicks on an advertisement, on a per click basis. Circulation/subscription revenue Revenue from subscribers of print newspapers is recognized at the time of delivery of the newspaper to the subscriber. Revenue from single copy sales of print newspapers is recognized at the time of delivery of the newspaper to the newsstand net of a provision for returns based on historical rates of returns. Subscription revenue from digital subscribers is recognized proportionately over the term of the subscription. All Access, print and digital, subscriptions represent a series of distinct goods or services that are substantially the same and have the same pattern of transfer to the customer and are recognized over the term of the subscription. Other revenue Other revenue is recognized upon delivery to or at the time that goods are made available to the customer and includes products printed for external customers and parcel delivery where revenue is recognized at the time that such materials are made available to the customer. (n) Inventory inventory, consisting primarily of printing materials, is valued at the lower of cost, using the first-in-first out cost formula, and net realizable value. Reversals of previous writedowns to net realizable value are required when there is a subsequent increase in the value of inventories. 19 (0) (P) Share-based compensation The Company uses share-based compensation that is settled through the issuance of shares of Postmedia or through cash at the option of the Company. The Company uses the graded vesting method to calculate compensation expense for all share-based compensation plans. The Company recognizes compensation expense for all share options granted based on the fair value of the option on the date of grant, net of estimated forfeitures, using the BlackScholes option pricing model. The fair value of the options is recognized as compensation expense over the vesting period of the options, with a corresponding credit to contributed surplus. The contributed surplus balance is reduced as options are exercised through a credit to capital stock when the options are exercised. The Company recognizes compensation expense for all restricted share units granted based on the fair value of the Company's shares on the issuance date of each restricted share unit grant net of estimated forfeitures. The fair value of the restricted share units is recognized as compensation expense, over the vesting period of each restricted share unit grant, with a corresponding credit to contributed surplus. Compensation expense is not adjusted for subsequent changes in the fair value of the Company's shares. The contributed surplus balance is reduced as units are exercised through a credit to capital stock. Financial instruments The Company classifies its financial assets in the following measurement categories: . Debt instruments at amortized cost - Debt instruments at fair value through other comprehensive income (\"FVOCI") . Equity instruments at fair value through profit and loss (\"FVTPL") - Financial assets at FVTPL The classification depends on the Company's business model for managing the financial assets and the contractual terms of the cash flow. The Company assesses the business model and cash flows of debt instruments on the date of initial application and the date of initial recognition thereafter. Equity instruments are generally classified as FVTPL, however for those that are not held for trading, the Company can make an irrevocable election on initial recognition to classify the instrument as FVOCI with no recycling of gains or losses to earnings on derecognition. Measurement At initial recognition, the Company measures a financial asset at its fair value plus, in the case of a financial asset not at FVTPL, transaction costs that are directly attributable to the acquisition of the financial asset. The transaction costs of a financial asset carried at FVTPL are expensed in profit or loss. Debt instruments at amortized cost Debt instruments at amortized cost, includes cash, restricted cash, trade and other receivables and are held to collect contractual cash flows and the contractual terms give rise to cash flows on specified dates that are solely payments of principal and interest on the principal amount outstanding. Debt instruments at amortized cost are initially recognized at fair value plus transaction costs and subsequently carried at amortized cost using the effective interest method, less a provision for impairment. Financial assets at F VTPL Financial assets at FVTPL are those not measured at amortized cost or at FVOCI. Assets in this category principally include warrants and shares held by the Company. Financial assets at FVTPL are carried at fair value with changes recognized in the statement of operations. Other financial iiabiiities Other financial liabilities, includes accounts payable and accrued liabilities, long-term debt and other non- current liabilities. Other financial liabilities are initially recognized at fair value plus transaction costs and subsequently carried at amortized cost using the effective interest method. 20 (Ct) (r) Derecognition A financial asset is derecognized when the rights to receive cash flows from the asset have expired or when the Company has transferred its rights to receive cash flows from the asset. A financial liability is derecognized when the obligation under the liability is discharged, cancelled, or expires. Impairment of nancial assets For trade receivables the Company applies a simplified approach in calculating expected credit losses and recognizes a loss allowance based on lifetime expected credit losses at each reporting date. The Company has established a provision matrix that is based on its historical credit loss experience, adjusted for forward- looking factors specific to the debtors and the economic environment. Derivative financial instruments and hedging The Company used derivative financial instruments to manage its exposure to fluctuations in foreign currency rates and interest rates. Derivative financial instruments are initially recognized at fair value on the date a contract is entered into and are subsequently remeasured at their fair value. The method of recognizing the resulting gain or loss depends on whether the derivative financial instrument is designated as a hedging instrument and the nature of the item being hedged. The Company documents at the inception of the transaction the relationship between hedging instruments and hedged items, as well as its strategy for using hedges and its risk management objectives. The Company also documents its assessment, both at hedge inception and on an ongoing basis, of whether the derivative financial instruments that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flows of hedged items. Nonperformance risk, including credit risk, is considered when determining the fair value of derivative financial instruments. The Company does not ho

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts