Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Reserve Bank of Australia raised the cash rate by 50 bps to 1.35% during its July 2022 meeting. The move followed June's 50-bps

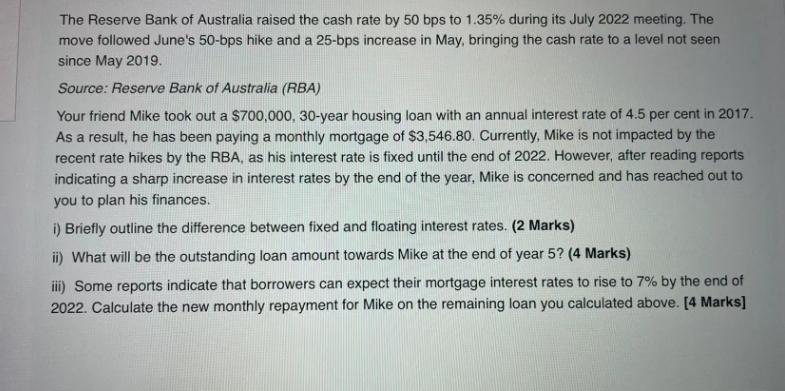

The Reserve Bank of Australia raised the cash rate by 50 bps to 1.35% during its July 2022 meeting. The move followed June's 50-bps hike and a 25-bps increase in May, bringing the cash rate to a level not seen since May 2019. Source: Reserve Bank of Australia (RBA) Your friend Mike took out a $700,000, 30-year housing loan with an annual interest rate of 4.5 per cent in 2017. As a result, he has been paying a monthly mortgage of $3,546.80. Currently, Mike is not impacted by the recent rate hikes by the RBA, as his interest rate is fixed until the end of 2022. However, after reading reports indicating a sharp increase in interest rates by the end of the year, Mike is concerned and has reached out to you to plan his finances. i) Briefly outline the difference between fixed and floating interest rates. (2 Marks) ii) What will be the outstanding loan amount towards Mike at the end of year 5? (4 Marks) iii) Some reports indicate that borrowers can expect their mortgage interest rates to rise to 7% by the end of 2022. Calculate the new monthly repayment for Mike on the remaining loan you calculated above. [4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The difference between fixed and floating interest rates is as follows Fixed interest rate A fixed interest rate remains constant throughout the loa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started