Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The restaurant chain, War in the Buffet, is considering two mutually exclusive projects in two different cities near the chain's founder. He has analyzed

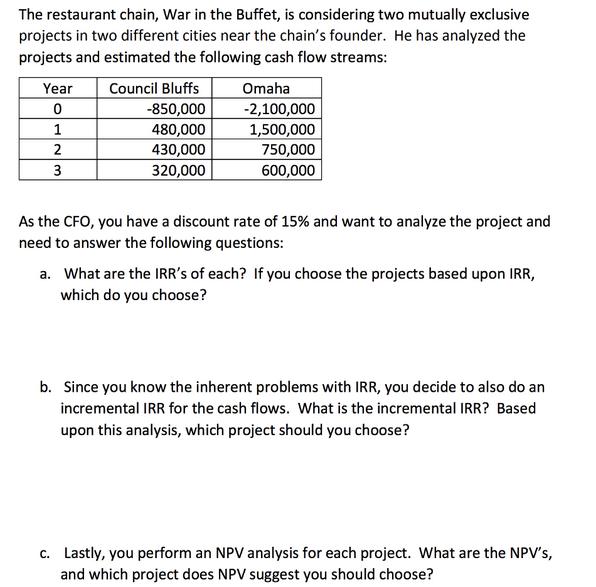

The restaurant chain, War in the Buffet, is considering two mutually exclusive projects in two different cities near the chain's founder. He has analyzed the projects and estimated the following cash flow streams: Year 0 Council Bluffs Omaha -850,000 -2,100,000 1 480,000 1,500,000 2 430,000 750,000 3 320,000 600,000 As the CFO, you have a discount rate of 15% and want to analyze the project and need to answer the following questions: a. What are the IRR's of each? If you choose the projects based upon IRR, which do you choose? b. Since you know the inherent problems with IRR, you decide to also do an incremental IRR for the cash flows. What is the incremental IRR? Based upon this analysis, which project should you choose? c. Lastly, you perform an NPV analysis for each project. What are the NPV's, and which project does NPV suggest you should choose?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started