Question

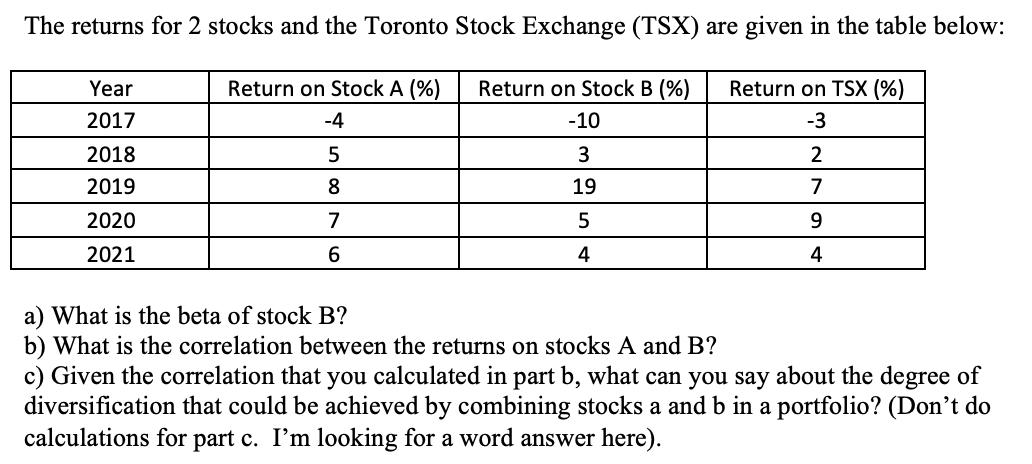

The returns for 2 stocks and the Toronto Stock Exchange (TSX) are given in the table below: Return on TSX (%) -3 Year 2017

The returns for 2 stocks and the Toronto Stock Exchange (TSX) are given in the table below: Return on TSX (%) -3 Year 2017 2018 2019 2020 2021 Return on Stock A (%) -4 5 8 7 6 Return on Stock B (%) -10 3 19 5 4 2 7 9 4 a) What is the beta of stock B? b) What is the correlation between the returns on stocks A and B? c) Given the correlation that you calculated in part b, what can you say about the degree of diversification that could be achieved by combining stocks a and b in a portfolio? (Don't do calculations for part c. I'm looking for a word answer here).

Step by Step Solution

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Beta of stock B The beta of stock B is 07 This means that stock B is expected to move 07 times as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Mechanics Statics & Dynamics

Authors: Russell C. Hibbeler

15th Edition

0134895150, 9780134895154

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App