Question

The revenues and costs at ABC company vary from month to month and can be modeled as random variables. ABC estimates (based on past data)

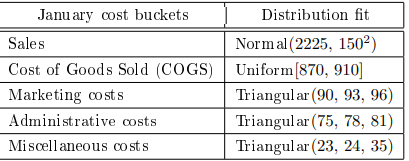

The revenues and costs at ABC company vary from month to month and can be modeled as random variables. ABC estimates (based on past data) that its sales, cost of goods sold (COGS), marketing costs, administrative costs and miscellaneous costs for the month of January have the following distributions:

In addition, the percentage change in the sales, COGS, marketing, administrative and miscellaneous costs from one month to the next can be modeled as independent normal random variables with a mean of 1.5% and a standard deviation of 1%. For example,

SalesFeb = SalesJan(1 + XJan-Sales), and COGSFeb = COGSJan(1 + XJan-COGS),

where XJan-Sales denotes the percentage change in sales from January to February, XJan-COGS denotes the percentage change in COGS from January to February. XJan-Sales and XJan-COGS are independent Normal(1.5%, 1%) random variables. In addition, the tax rate is 33%. Estimate the annual net income of ABC after taxes. Give the mean and a 95% condence interval. Note that: Net Income after taxes (in a month) = Net Income before taxes ? Tax, where Net income before taxes = Gross Margin ? Total expenses, Gross margin = Sales ? Cost of goods sold, Total expenses = Marketing costs + Administrative costs + Miscellaneous costs, and Tax = Tax rate Net Income before taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started