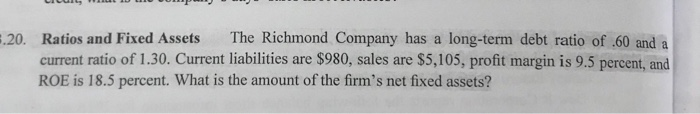

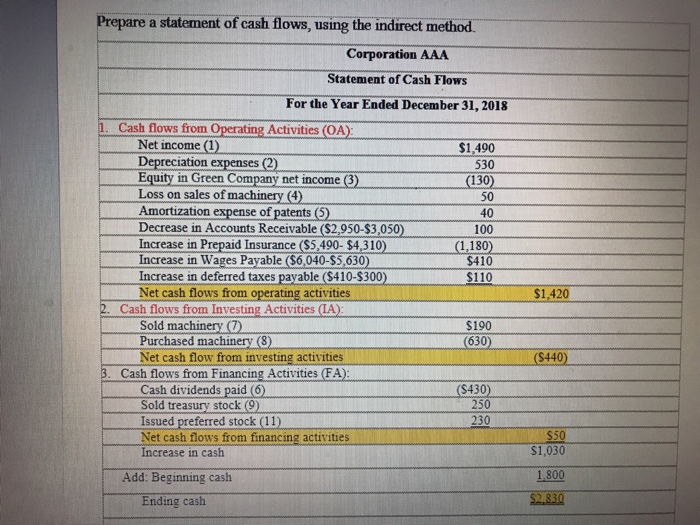

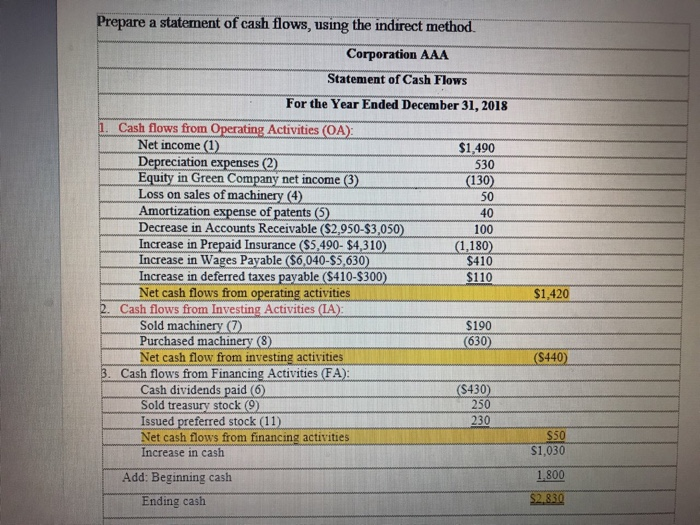

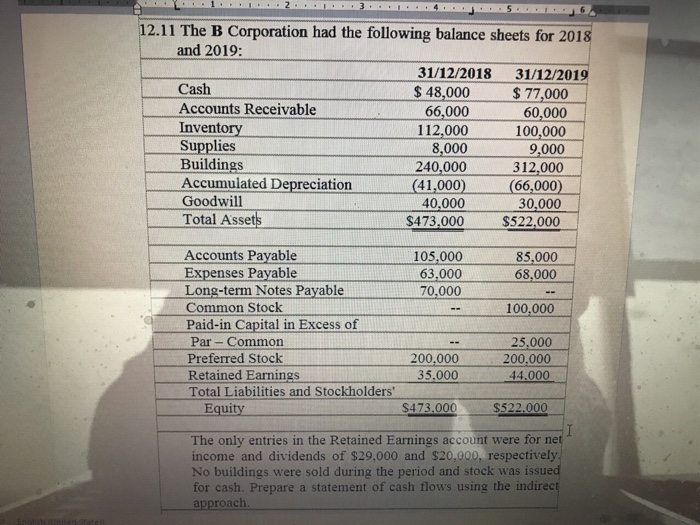

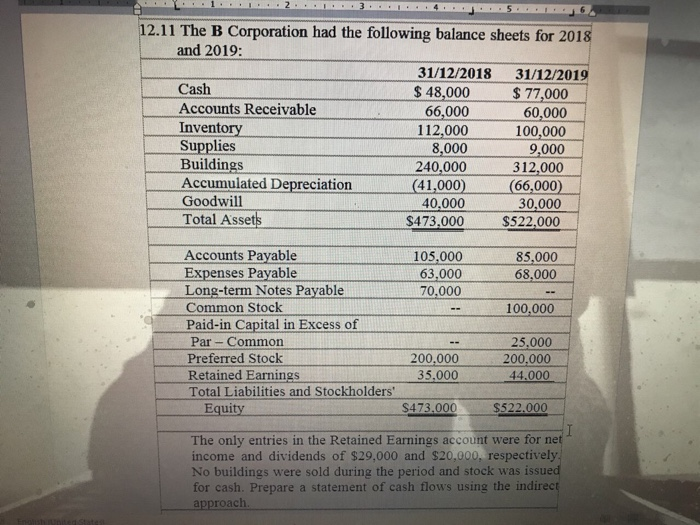

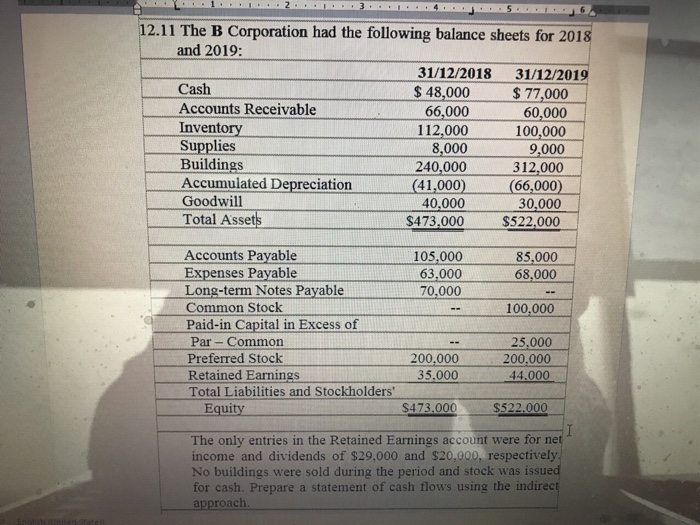

The Richmond Company has a long-term debt ratio of .60 and a $980, sales are $5,105, profit margin is 9.5 percent, and 20 Ratios and Fixed Assets current ratio of 1.30. Current liabilities are ROE is 18.5 percent. What is the amount of the firm's net fixed assets? Prepare a statement of cash flows, using the indirect method Corporation AAA Statement of Cash Flows For the Year Ended December 31, 2018 1. Cash flows from Operating Activities (OA): Net income (1) $1,490 Depreciation expenses (2) Equity in Green Company net income Loss on sales of machinery (4) Amortization expense of patents (5) Decrease in Accounts Receivable (S2,950-$3,050) Increase in Prepaid Insurance ($5,490-$4.310) Increase in Wages Payable ($6,040-S5,630) Increase in defered taxes payable (S410-$300) Net cash flows from operating activities 2. Cash flows from Investing Activities (LA) Sold machinery (7) Purchased machinery (8) Net cash flow from investing activities 3. Cash flows from Financing Activities (FA): Cash dividends paid (6) Sold treasury stock (9) Issued preferred stock (11) 530 (3) (130) 50 40 100 ( 1,180) $410 $110 $1,420 $190 (630) (S440) (S430) 250 230 $50 Net cash flows from financ $1,030 Increase in cash 1,800 Add: Beginning cash $2.830 Ending cash Prepare a statement of cash flows, using the indirect method Corporation AAA Statement of Cash Flows For the Year Ended December 31, 2018 1. Cash flows from Operating Activities (OA): Net income (1) $1,490 Depreciation expenses (2) Equity in Green Company net income Loss on sales of machinery (4) Amortization expense of patents (5) Decrease in Accounts Receivable (S2,950-$3,050) Increase in Prepaid Insurance ($5,490-$4.310) Increase in Wages Payable ($6,040-S5,630) Increase in defered taxes payable (S410-$300) Net cash flows from operating activities 2. Cash flows from Investing Activities (LA) Sold machinery (7) Purchased machinery (8) Net cash flow from investing activities 3. Cash flows from Financing Activities (FA): Cash dividends paid (6) Sold treasury stock (9) Issued preferred stock (11) 530 (3) (130) 50 40 100 ( 1,180) $410 $110 $1,420 $190 (630) (S440) (S430) 250 230 $50 Net cash flows from financ $1,030 Increase in cash 1,800 Add: Beginning cash $2.830 Ending cash 12.11 The B Corporation had the following balance sheets for 2018 and 2019: 31/12/2019 $77,000 60,000 100,000 9,000 312,000 (66,000) 30,000 $522,000 31/12/2018 Cash $ 48,000 66.000 112,000 8,000 240,000 (41,000) 40,000 $473,000 Accounts Receivable Inventory Supplies Buildings Accumulated Depreciation Goodwill Total Assets Accounts Payable 105,000 85,000 68,000 Expenses Payable Long-term Notes Payable Common Stock Paid-in Capital in Excess of Par -Common Preferred Stock Retained Earnings 63,000 70.000 100,000 25,000 200,000 44,000 200,000 35,000 Total Liabilities and Stockholders' $473,000 Equity $522.000 The only entries in the Retained Earnings account were for net income and dividends of $29,000 and $20,000, respectively No buildings were sold during the period and stock was issued for cash. Prepare approach. a statement of cash flows using the indirect 12.11 The B Corporation had the following balance sheets for 2018 and 2019: 31/12/2019 $77,000 60,000 100,000 9,000 312,000 (66,000) 30,000 $522,000 31/12/2018 Cash $ 48,000 66.000 112,000 8,000 240,000 (41,000) 40,000 $473,000 Accounts Receivable Inventory Supplies Buildings Accumulated Depreciation Goodwill Total Assets Accounts Payable 105,000 85,000 68,000 Expenses Payable Long-term Notes Payable Common Stock Paid-in Capital in Excess of Par -Common Preferred Stock Retained Earnings 63,000 70.000 100,000 25,000 200,000 44,000 200,000 35,000 Total Liabilities and Stockholders' $473,000 Equity $522.000 The only entries in the Retained Earnings account were for net income and dividends of $29,000 and $20,000, respectively No buildings were sold during the period and stock was issued for cash. Prepare approach. a statement of cash flows using the indirect The Richmond Company has a long-term debt ratio of .60 and a $980, sales are $5,105, profit margin is 9.5 percent, and 20 Ratios and Fixed Assets current ratio of 1.30. Current liabilities are ROE is 18.5 percent. What is the amount of the firm's net fixed assets? Prepare a statement of cash flows, using the indirect method Corporation AAA Statement of Cash Flows For the Year Ended December 31, 2018 1. Cash flows from Operating Activities (OA): Net income (1) $1,490 Depreciation expenses (2) Equity in Green Company net income Loss on sales of machinery (4) Amortization expense of patents (5) Decrease in Accounts Receivable (S2,950-$3,050) Increase in Prepaid Insurance ($5,490-$4.310) Increase in Wages Payable ($6,040-S5,630) Increase in defered taxes payable (S410-$300) Net cash flows from operating activities 2. Cash flows from Investing Activities (LA) Sold machinery (7) Purchased machinery (8) Net cash flow from investing activities 3. Cash flows from Financing Activities (FA): Cash dividends paid (6) Sold treasury stock (9) Issued preferred stock (11) 530 (3) (130) 50 40 100 ( 1,180) $410 $110 $1,420 $190 (630) (S440) (S430) 250 230 $50 Net cash flows from financ $1,030 Increase in cash 1,800 Add: Beginning cash $2.830 Ending cash Prepare a statement of cash flows, using the indirect method Corporation AAA Statement of Cash Flows For the Year Ended December 31, 2018 1. Cash flows from Operating Activities (OA): Net income (1) $1,490 Depreciation expenses (2) Equity in Green Company net income Loss on sales of machinery (4) Amortization expense of patents (5) Decrease in Accounts Receivable (S2,950-$3,050) Increase in Prepaid Insurance ($5,490-$4.310) Increase in Wages Payable ($6,040-S5,630) Increase in defered taxes payable (S410-$300) Net cash flows from operating activities 2. Cash flows from Investing Activities (LA) Sold machinery (7) Purchased machinery (8) Net cash flow from investing activities 3. Cash flows from Financing Activities (FA): Cash dividends paid (6) Sold treasury stock (9) Issued preferred stock (11) 530 (3) (130) 50 40 100 ( 1,180) $410 $110 $1,420 $190 (630) (S440) (S430) 250 230 $50 Net cash flows from financ $1,030 Increase in cash 1,800 Add: Beginning cash $2.830 Ending cash 12.11 The B Corporation had the following balance sheets for 2018 and 2019: 31/12/2019 $77,000 60,000 100,000 9,000 312,000 (66,000) 30,000 $522,000 31/12/2018 Cash $ 48,000 66.000 112,000 8,000 240,000 (41,000) 40,000 $473,000 Accounts Receivable Inventory Supplies Buildings Accumulated Depreciation Goodwill Total Assets Accounts Payable 105,000 85,000 68,000 Expenses Payable Long-term Notes Payable Common Stock Paid-in Capital in Excess of Par -Common Preferred Stock Retained Earnings 63,000 70.000 100,000 25,000 200,000 44,000 200,000 35,000 Total Liabilities and Stockholders' $473,000 Equity $522.000 The only entries in the Retained Earnings account were for net income and dividends of $29,000 and $20,000, respectively No buildings were sold during the period and stock was issued for cash. Prepare approach. a statement of cash flows using the indirect 12.11 The B Corporation had the following balance sheets for 2018 and 2019: 31/12/2019 $77,000 60,000 100,000 9,000 312,000 (66,000) 30,000 $522,000 31/12/2018 Cash $ 48,000 66.000 112,000 8,000 240,000 (41,000) 40,000 $473,000 Accounts Receivable Inventory Supplies Buildings Accumulated Depreciation Goodwill Total Assets Accounts Payable 105,000 85,000 68,000 Expenses Payable Long-term Notes Payable Common Stock Paid-in Capital in Excess of Par -Common Preferred Stock Retained Earnings 63,000 70.000 100,000 25,000 200,000 44,000 200,000 35,000 Total Liabilities and Stockholders' $473,000 Equity $522.000 The only entries in the Retained Earnings account were for net income and dividends of $29,000 and $20,000, respectively No buildings were sold during the period and stock was issued for cash. Prepare approach. a statement of cash flows using the indirect