Answered step by step

Verified Expert Solution

Question

1 Approved Answer

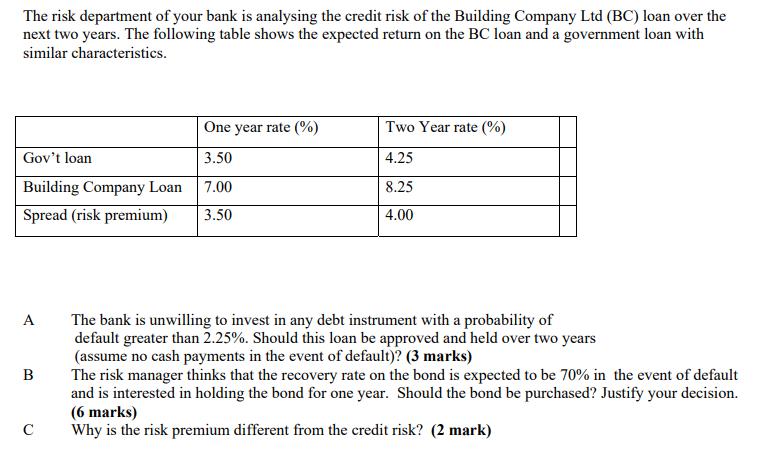

The risk department of your bank is analysing the credit risk of the Building Company Ltd (BC) loan over the next two years. The

The risk department of your bank is analysing the credit risk of the Building Company Ltd (BC) loan over the next two years. The following table shows the expected return on the BC loan and a government loan with similar characteristics. One year rate (%) Gov't loan 3.50 Building Company Loan 7.00 Spread (risk premium) 3.50 A C Two Year rate (%) 4.25 8.25 4.00 The bank is unwilling to invest in any debt instrument with a probability of default greater than 2.25%. Should this loan be approved and held over two years (assume no cash payments in the event of default)? (3 marks) The risk manager thinks that the recovery rate on the bond is expected to be 70% in the event of default and is interested in holding the bond for one year. Should the bond be purchased? Justify your decision. (6 marks) Why is the risk premium different from the credit risk? (2 mark)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Rate on 2 Years with company Loan 825 Rate on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started