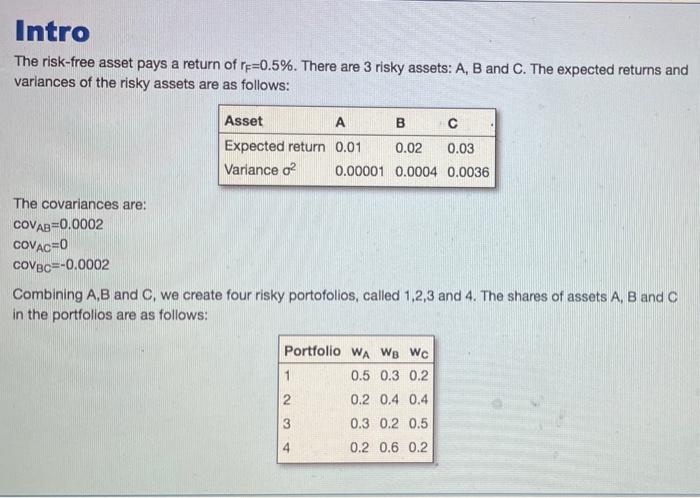

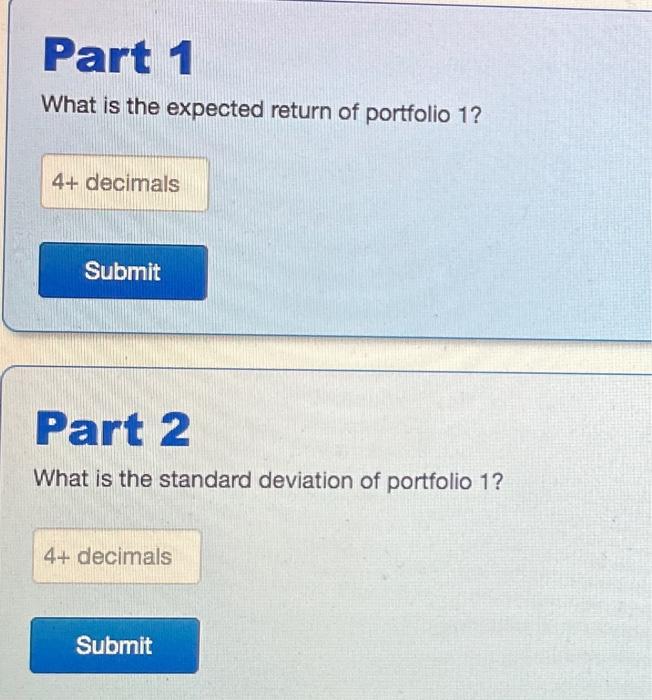

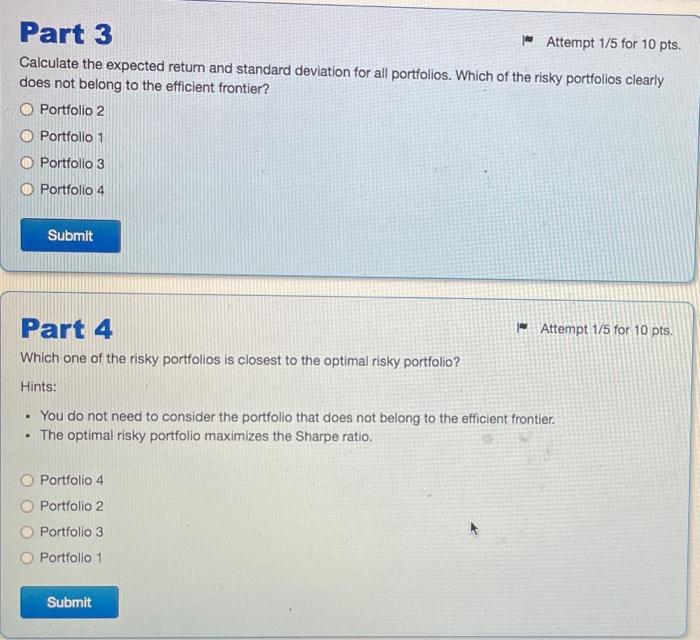

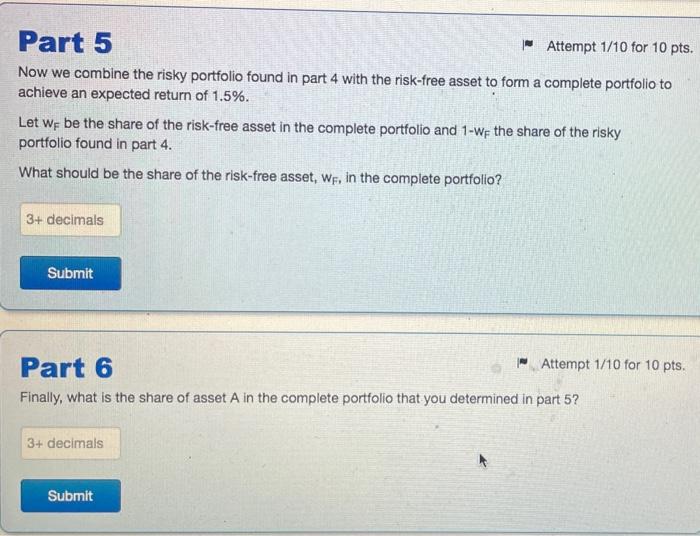

The risk-free asset pays a return of rF=0.5%. There are 3 risky assets: A,B and C. The expected returns and variances of the risky assets are as follows: The covariances are: covAB=0.0002covAC=0covBC=0.0002 Combining A,B and C, we create four risky portofolios, called 1,2,3 and 4. The shares of assets A, B and C in the portfolios are as follows: What is the expected return of portfolio 1? Part 2 What is the standard deviation of portfolio 1? Calculate the expected return and standard deviation for all portfolios. Which of the risky portfolios clearly does not belong to the efficient frontier? Portfolio 2 Portfolio 1 Portfolio 3 Portfolio 4 Part 4 1. Attempt 1/5 for 10 pts. Which one of the risky portfolios is closest to the optimal risky portfolio? Hints: - You do not need to consider the portfolio that does not belong to the efficient frontier. - The optimal risky portfolio maximizes the Sharpe ratio. Portfolio 4 Portfolio 2 Portfolio 3 Portfolio 1 Now we combine the risky portfolio found in part 4 with the risk-free asset to form a complete portfolio to achieve an expected return of 1.5%. Let wF be the share of the risk-free asset in the complete portfolio and 1wF the share of the risky portfolio found in part 4. What should be the share of the risk-free asset, wF, in the complete portfolio? Part 6 Attempt 1/10 for 10 pts. Finally, what is the share of asset A in the complete portfolio that you determined in part 5 ? The risk-free asset pays a return of rF=0.5%. There are 3 risky assets: A,B and C. The expected returns and variances of the risky assets are as follows: The covariances are: covAB=0.0002covAC=0covBC=0.0002 Combining A,B and C, we create four risky portofolios, called 1,2,3 and 4. The shares of assets A, B and C in the portfolios are as follows: What is the expected return of portfolio 1? Part 2 What is the standard deviation of portfolio 1? Calculate the expected return and standard deviation for all portfolios. Which of the risky portfolios clearly does not belong to the efficient frontier? Portfolio 2 Portfolio 1 Portfolio 3 Portfolio 4 Part 4 1. Attempt 1/5 for 10 pts. Which one of the risky portfolios is closest to the optimal risky portfolio? Hints: - You do not need to consider the portfolio that does not belong to the efficient frontier. - The optimal risky portfolio maximizes the Sharpe ratio. Portfolio 4 Portfolio 2 Portfolio 3 Portfolio 1 Now we combine the risky portfolio found in part 4 with the risk-free asset to form a complete portfolio to achieve an expected return of 1.5%. Let wF be the share of the risk-free asset in the complete portfolio and 1wF the share of the risky portfolio found in part 4. What should be the share of the risk-free asset, wF, in the complete portfolio? Part 6 Attempt 1/10 for 10 pts. Finally, what is the share of asset A in the complete portfolio that you determined in part 5