Question

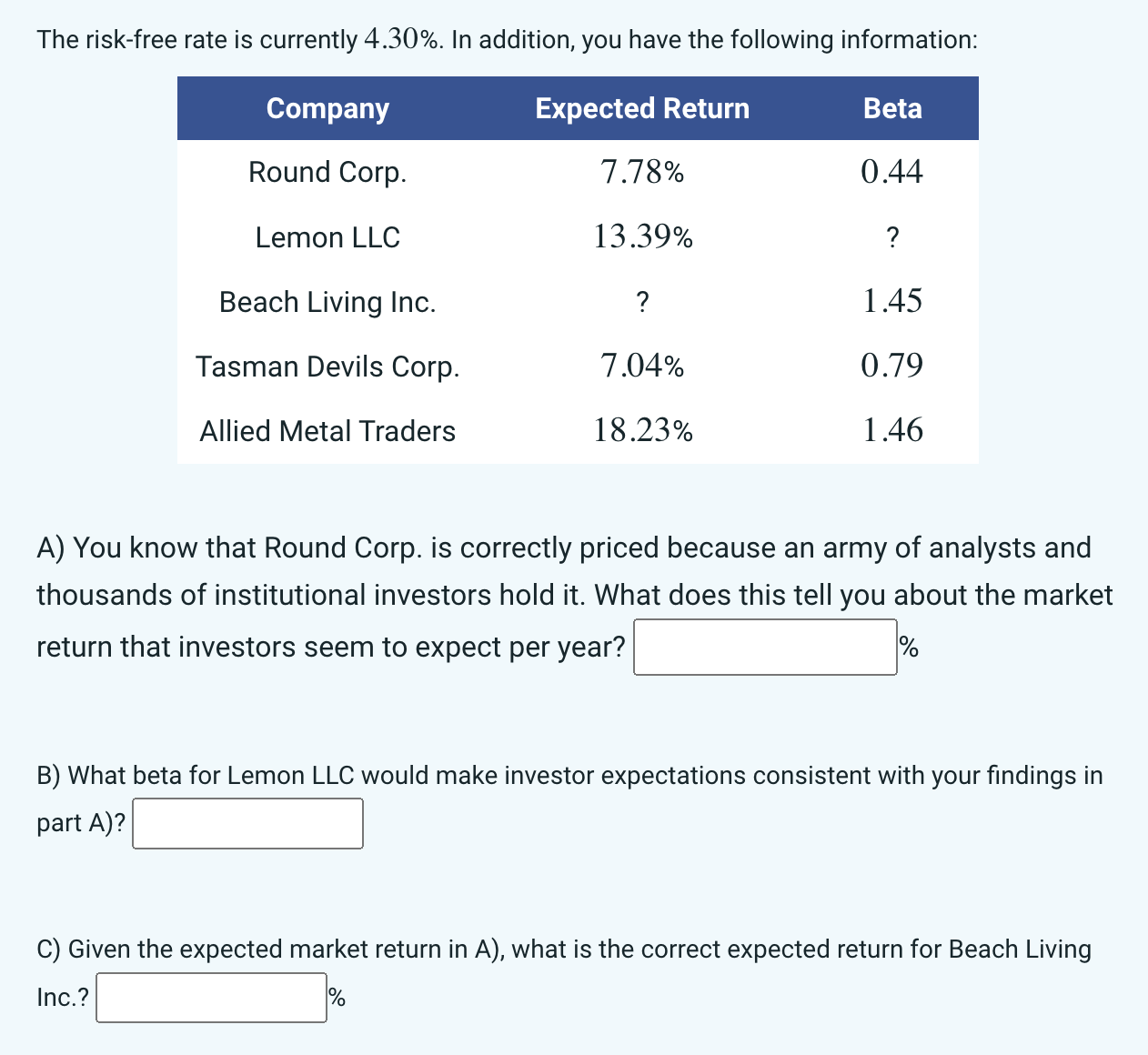

The risk-free rate is currently 4.30%. In addition, you have the following information: Expected Return Company Beta Round Corp. 7.78% 0.44 Lemon LLC 13.39%

The risk-free rate is currently 4.30%. In addition, you have the following information: Expected Return Company Beta Round Corp. 7.78% 0.44 Lemon LLC 13.39% ? Beach Living Inc. ? 1.45 Tasman Devils Corp. 7.04% 0.79 Allied Metal Traders 18.23% 1.46 A) You know that Round Corp. is correctly priced because an army of analysts and thousands of institutional investors hold it. What does this tell you about the market return that investors seem to expect per year? % B) What beta for Lemon LLC would make investor expectations consistent with your findings in part A)? C) Given the expected market return in A), what is the correct expected return for Beach Living Inc.? %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Berk, DeMarzo, Harford

2nd edition

132148234, 978-0132148238

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App