Question

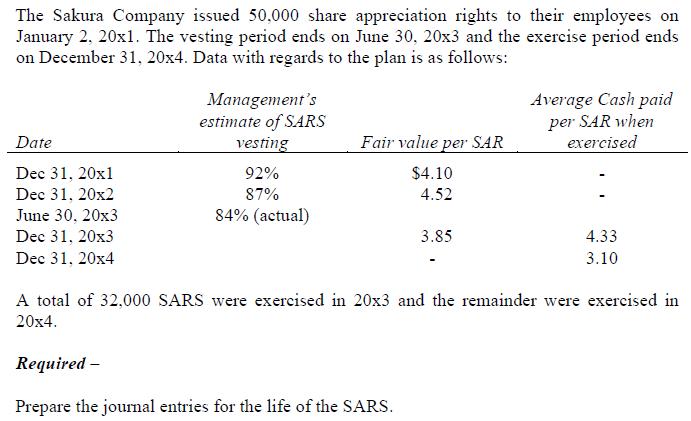

The Sakura Company issued 50,000 share appreciation rights to their employees on January 2, 20x1. The vesting period ends on June 30, 20x3 and

The Sakura Company issued 50,000 share appreciation rights to their employees on January 2, 20x1. The vesting period ends on June 30, 20x3 and the exercise period ends on December 31, 20x4. Data with regards to the plan is as follows: Date Dec 31, 20x1 Dec 31, 20x2 June 30, 20x3 Dec 31, 20x3 Dec 31, 20x4 Management's estimate of SARS vesting 92% 87% 84% (actual) Fair value per SAR $4.10 4.52 3.85 Required - Prepare the journal entries for the life of the SARS. Average Cash paid per SAR when exercised 4.33 3.10 A total of 32,000 SARS were exercised in 20x3 and the remainder were exercised in 20x4.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry Date Particular Amt 31122001 Employee Benefit ExpenseDr 18860000 To Share Based Paymen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella

1st edition

978-0133251579, 133251578, 013216230X, 978-0134102313, 134102312, 978-0132162302

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App