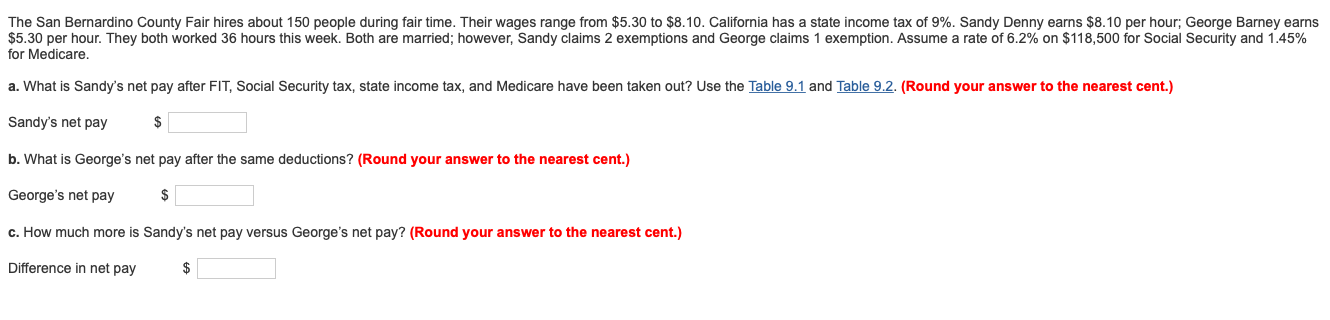

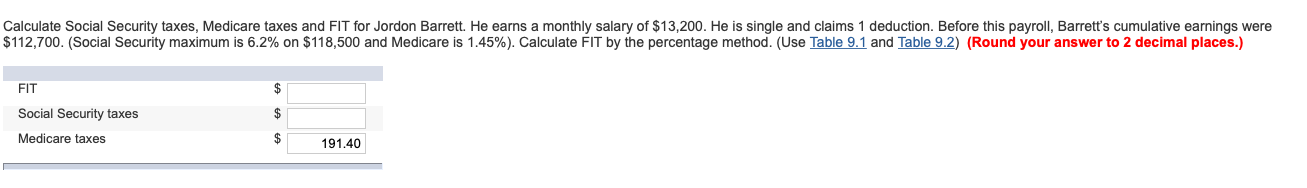

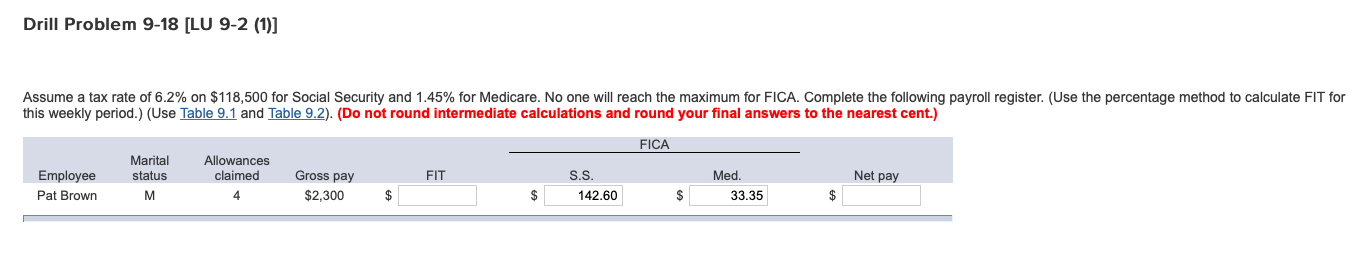

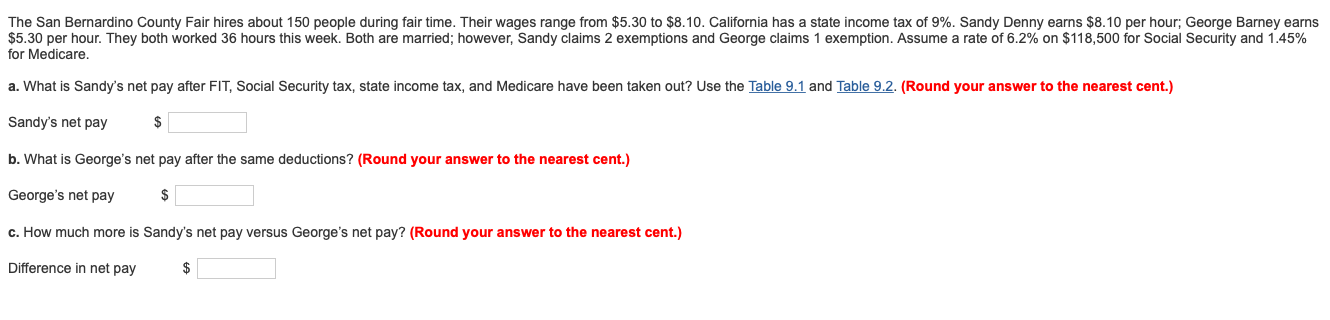

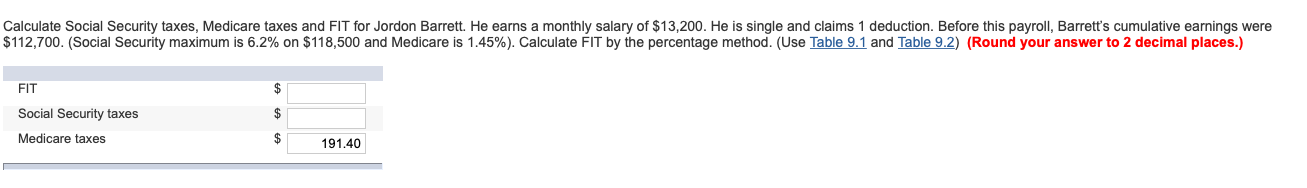

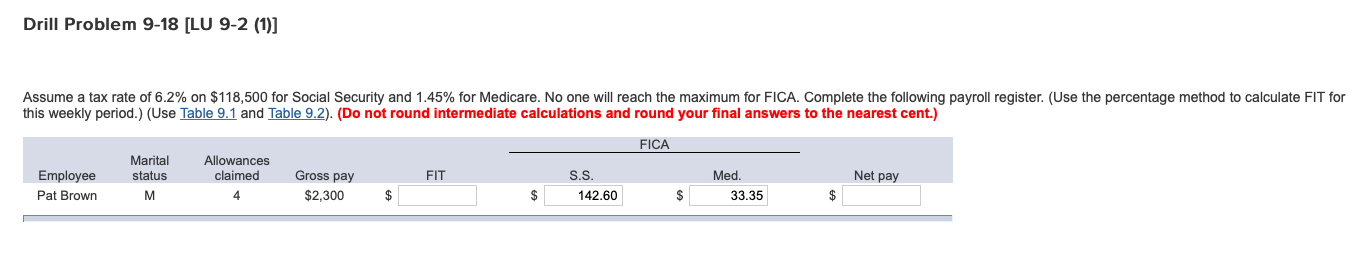

The San Bernardino County Fair hires about 150 people during fair time. Their wages range from $5.30 to $8.10. California has a state income tax of 9%. Sandy Denny earns $8.10 per hour; George Barney earns $5.30 per hour. They both worked 36 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT, Social Security tax, state income tax, and Medicare have been taken out? Use the Table 9.1 and Table 9.2. (Round your answer to the nearest cent.) Sandy's net pay $ b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay $ c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.) Difference in net pay Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $13,200. He is single and claims 1 deduction. Before this payroll, Barrett's cumulative earnings were $112,700. (Social Security maximum is 6.2% on $118,500 and Medicare is 1.45%). Calculate FIT by the percentage method. (Use Table 9.1 and Table 9.2) (Round your answer to 2 decimal places.) FIT A Social Security taxes Medicare taxes 191.40 Drill Problem 9-18 [LU 9-2 (1)] Assume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1 and Table 9.2). (Do not round intermediate calculations and round your final answers to the nearest cent.) FICA Marital status M Allowances claimed FIT Employee Pat Brown Net pay Gross pay $2,300 S.S. 142.60 $ $ $ Med. 33.35 The San Bernardino County Fair hires about 150 people during fair time. Their wages range from $5.30 to $8.10. California has a state income tax of 9%. Sandy Denny earns $8.10 per hour; George Barney earns $5.30 per hour. They both worked 36 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT, Social Security tax, state income tax, and Medicare have been taken out? Use the Table 9.1 and Table 9.2. (Round your answer to the nearest cent.) Sandy's net pay $ b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay $ c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.) Difference in net pay Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $13,200. He is single and claims 1 deduction. Before this payroll, Barrett's cumulative earnings were $112,700. (Social Security maximum is 6.2% on $118,500 and Medicare is 1.45%). Calculate FIT by the percentage method. (Use Table 9.1 and Table 9.2) (Round your answer to 2 decimal places.) FIT A Social Security taxes Medicare taxes 191.40 Drill Problem 9-18 [LU 9-2 (1)] Assume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1 and Table 9.2). (Do not round intermediate calculations and round your final answers to the nearest cent.) FICA Marital status M Allowances claimed FIT Employee Pat Brown Net pay Gross pay $2,300 S.S. 142.60 $ $ $ Med. 33.35