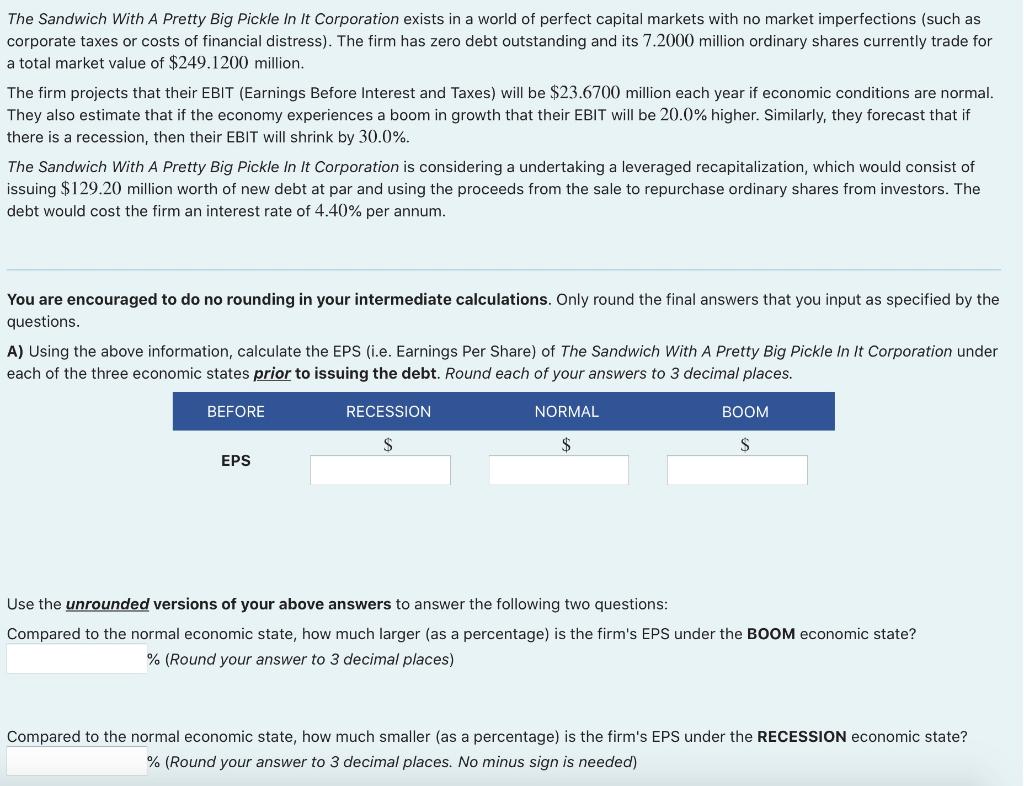

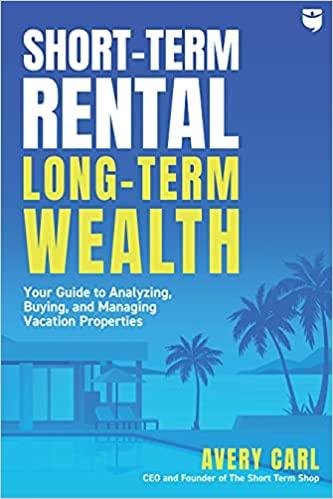

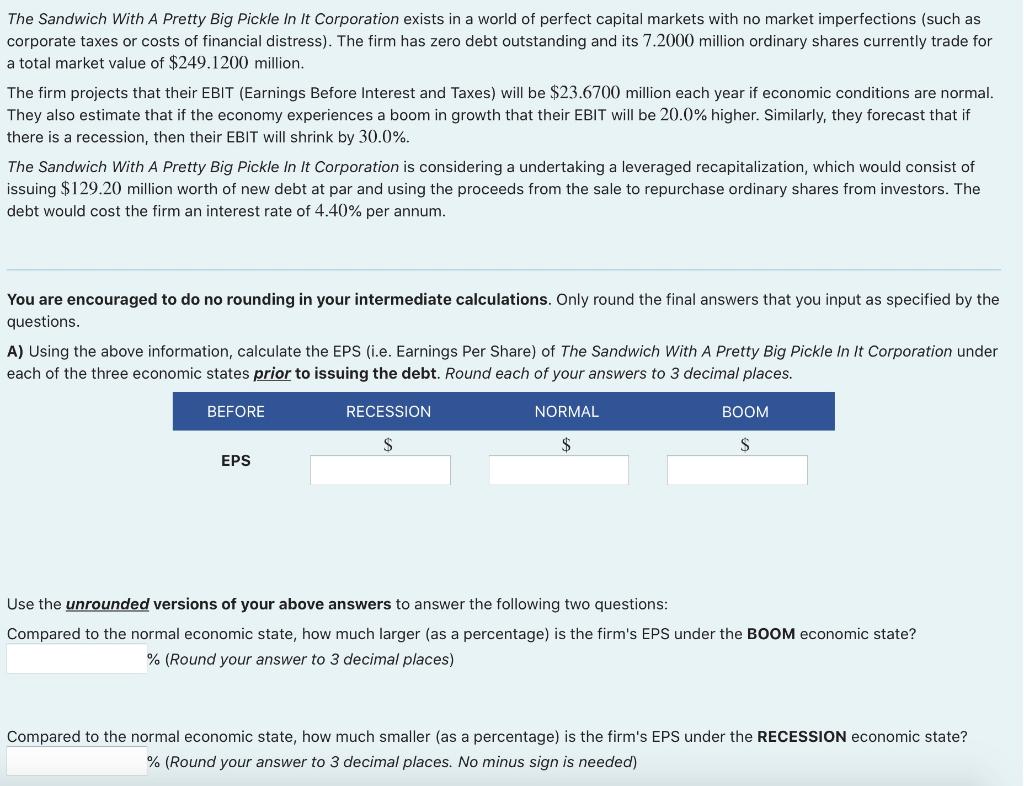

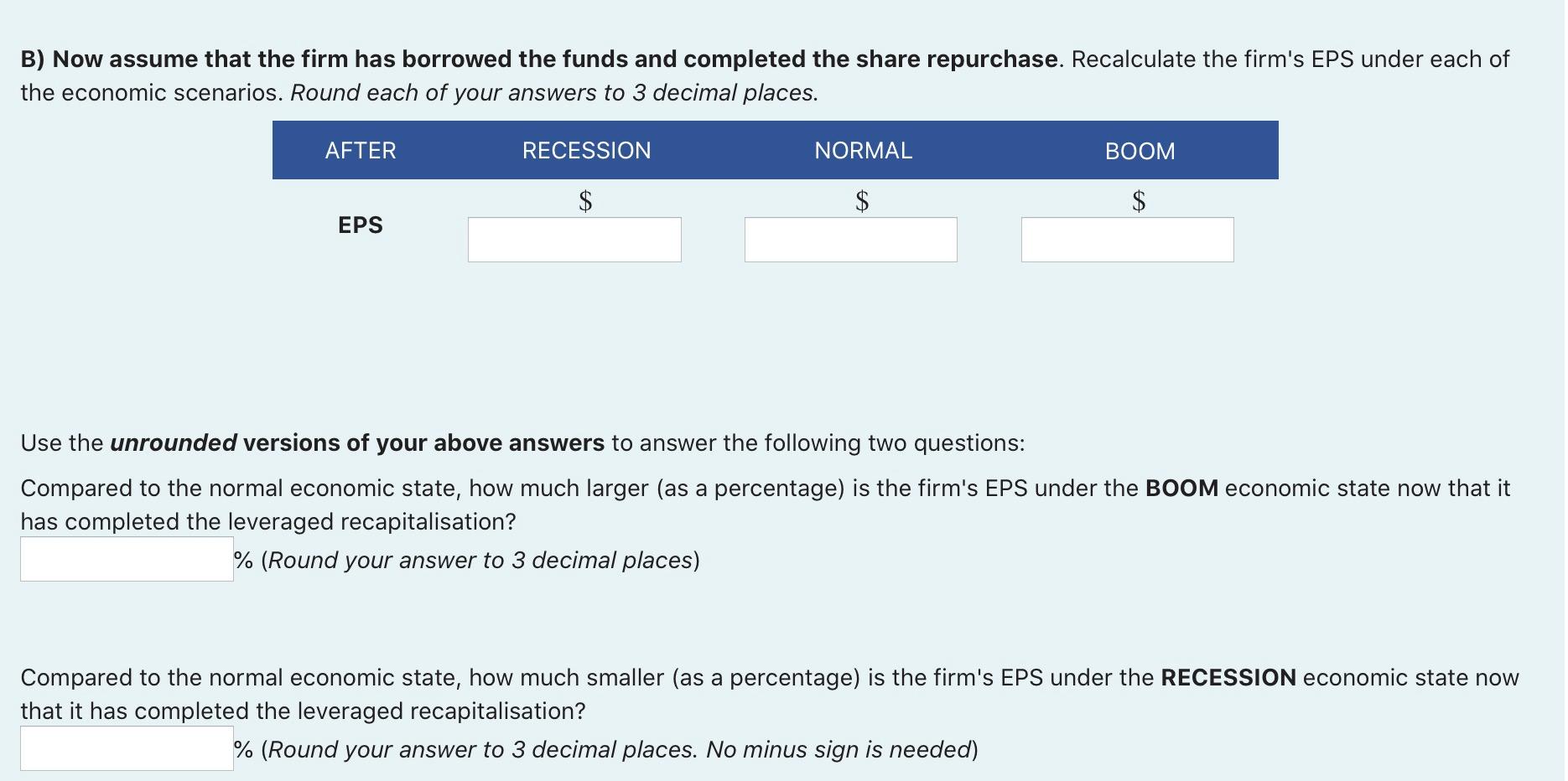

The Sandwich With A Pretty Big Pickle In It Corporation exists in a world of perfect capital markets with no market imperfections (such as corporate taxes or costs of financial distress). The firm has zero debt outstanding and its 7.2000 million ordinary shares currently trade for a total market value of $249.1200 million. The firm projects that their EBIT (Earnings Before Interest and Taxes) will be $23.6700 million each year if economic conditions are normal. They also estimate that if the economy experiences a boom in growth that their EBIT will be 20.0% higher. Similarly, they forecast that if there is a recession, then their EBIT will shrink by 30.0%. The Sandwich With A Pretty Big Pickle In It Corporation is considering a undertaking a leveraged recapitalization, which would consist of issuing $129.20 million worth of new debt at par and using the proceeds from the sale to repurchase ordinary shares from investors. The debt would cost the firm an interest rate of 4.40% per annum. You are encouraged to do no rounding in your intermediate calculations. Only round the final answers that you input as specified by the questions. A) Using the above information, calculate the EPS (i.e. Earnings Per Share) of The Sandwich With A Pretty Big Pickle In It Corporation under each of the three economic states prior to issuing the debt. Round each of your answers to 3 decimal places. Use the unrounded versions of your above answers to answer the following two questions: Compared to the normal economic state, how much larger (as a percentage) is the firm's EPS under the BOOM economic state? % (Round your answer to 3 decimal places) Compared to the normal economic state, how much smaller (as a percentage) is the firm's EPS under the RECESSION economic state? % (Round your answer to 3 decimal places. No minus sign is needed) B) Now assume that the firm has borrowed the funds and completed the share repurchase. Recalculate the firm's EPS under each of the economic scenarios. Round each of your answers to 3 decimal places. Use the unrounded versions of your above answers to answer the following two questions: Compared to the normal economic state, how much larger (as a percentage) is the firm's EPS under the BOOM economic state now that it has completed the leveraged recapitalisation? 1%(Roundyouranswerto3decimalplaces) Compared to the normal economic state, how much smaller (as a percentage) is the firm's EPS under the RECESSION economic state now that it has completed the leveraged recapitalisation? \% (Round your answer to 3 decimal places. No minus sign is needed)