Question

The SBT Corporation is considering making a major investment in a new product that will cost $500,000 upfront to develop and launch. The sales department

The SBT Corporation is considering making a major investment in a new product that will cost $500,000 upfront to develop and launch. The sales department claims that this new product is needed to help stay competitive. The sales department was asked by the finance department to forecast the profit (cash flows) each year over the next 5 years. The finance department feels that going beyond 5 years is not reasonable given changes in technology and customer needs.

The finance department feels that the total present value of the annual profits must exceed the initial investment (500K) to make the investment worthwhile financially. The company has determined that their opportunity cost (what they can earn with the 500K if these used it for another purpose) is 5%.

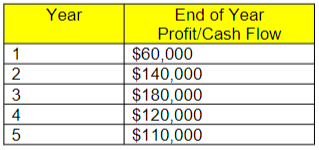

The sales department came back with the following end of year annual forecast of profit (cash flows).

Note: Assume the terms profit and cash flows mean the same thing for this excersie. 1. What is the present value of the cash flows, each year and in total? (4 points)

Note: Assume the terms profit and cash flows mean the same thing for this excersie. 1. What is the present value of the cash flows, each year and in total? (4 points)

2. Based on the sales forecast, and the initial investment required, should the company make the investment, why or why not? (4 points)

3. What concerns do you have about this type of analysis? In other words, what are the potential weaknesses. This answer is not addressed specifically in your book. Think about it. What could go wrong or change? You can also search the web for topics such as Pitfalls of Discounted Cash Flows, or DCF weaknesses. Now look at this case and point out the specific areas of concern. (3 points).

1 2345 2 Year End of Year Profit/Cash Flow $60,000 $140,000 $180,000 $120,000 $110,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started