Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Scene: Early evening in an ordinary family room in Manhattan. Modern furniture, with old copies of The Wall Street Journal and the Financial Times

The Scene: Early evening in an ordinary family room in Manhattan. Modern furniture, with old copies of The Wall Street Journal and the Financial Times scattered around. Autographed photos of Alan Greenspan and George Soros are prominently displayed. A picture window reveals a distant view of lights on the Hudson River. John Jones sits at a computer terminal, glumly sipping a glass of chardonnay and trading Japanese yen over the Internet. His wife Marsha enters. Marsha: Hi honey. Glad to be home. Lousy day on the trading floor, though. Dullsville. No volume. But I did manage to hedge next year's production from our copper mine. I couldn't get a good quote on the right package of futures contracts, so I arranged a commodity swap.Joh doesn't reply.Marsha: John, what's wrong? Have you been buying yen again? That's been a losing trade for weeks.John: Well, yes. I shouldn't have gone to Goldman Sachs's foreign exchange brunch. But I've got to get out of the house somehow. Im cooped up here all day calculating covariances and efficient riskreturn trade offs while you're out trading commodity futures. You get all the glamour and excitement.Marsha: Don't worry dear, it will be over soon. We only recalculate our most efficient common stock portfolio once a quarter. Then you can go back to leveraged leases.John: You trade, and I do all the worrying. Now there's a rumour that our leasing company is going to get a hostile takeover bid. I knew the debt ratio was too low, and you forgot to put on the poison pill. And now you've made a negativeNPV investment!Marsha: What investment?John: That fancy new Mercedes horse transporter. The caretaker on our Connecticut estate told me it arrived today. He said it cost $ Sometimes I think you love that horse Kosak more than you love meMarsha: There, there, don't you believe it You always come first. But after all, Kosak is a champion Hanoverian gelding. We can't show up at the dressage competitions in a ratty rented horsebox.John and Marsha's teenage son Johnny bursts into the room.Johnny: Hi Dad! Hi Mom! Guess what? I've made the junior varsity derivatives team! That means I can go on the field trip to the Chicago Board Options Exchange. Pauses What's wrong?John: Your mother has made another negativeNPV investment. A horse transporter.Johnny: That's OK Dad. Mom told me about it We'llsave on rentals. Remember, Mom goes to dressage every other week, and a rented transporter costs $ per day plus $ per mile. Most of the trips are or miles oneway. And then we usually give the driver a $ tip. With the new transporter, we'll only have to pay for diesel fuel and maintenanceprobably only about $ per mile.John: What about insurance? What about depreciation?Marsha: Insurance is only $ per year. And by the way, the transporter isn't new, it's reconditioned. It's a Troja horsebox on a Mercedes truck chassis. It'll hold its value pretty well. The salesman said we could probably resell it for $ after eight years, when Kosak will be ready to retireand that assumes no inflation. I think inflation will be at least percent per year.John: Operating costs will inflate too. So what's theNPV?Marsha: Well, I didn't calculate...convenience is worth something, you know.Johnny: I'll do the calculation, Dad. I was going to do it yesterday, but my corporate finance teacher asked us to calculate default probabilities for a sample of junk bonds. Is a percent nominal cost of capital OKMarsha: Sure, Johnny.John: I just wish we could make your horse into a tax shelter. Takes a deep breath and stands up Anyway, how about a nice family dinner? I've reserved our usual table at the Four Seasons.Everyone exits.Announcer: Was the horse transporter really negative NPV Will John and Marsha have to fight a hostile takeover? Will Johnny's derivatives team use Black Scholes or the binomial method? Find out in the next episode of The Jones Family, Incorporated.You may not aspire to the Jones family's way of life, but you will learn about all their activities, from futures contracts to binomial option pricing, later in this book. Meanwhile, you may wish to

replicate Johnny's NPV analysis.

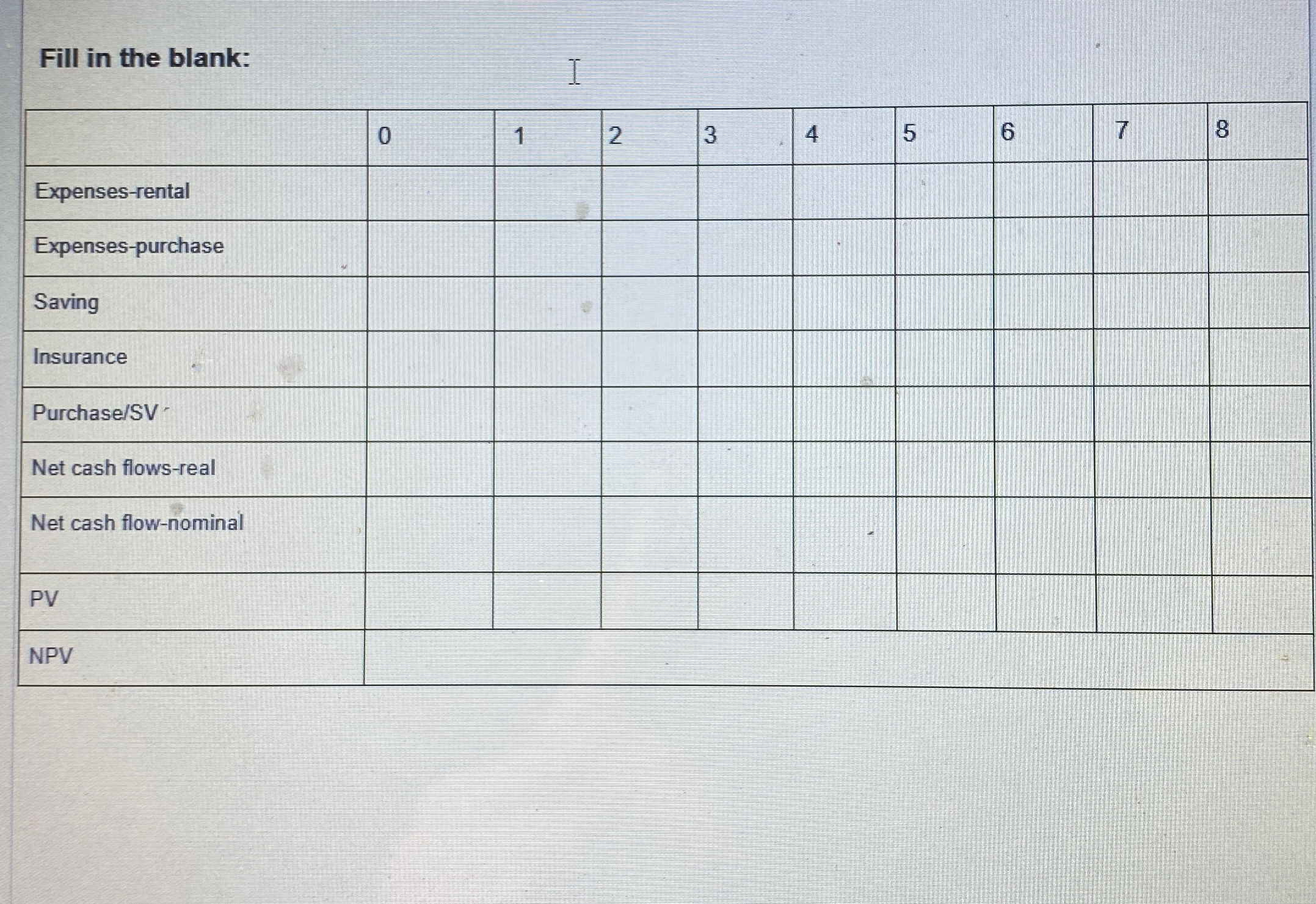

Fill in the blank:

tableExpensesrental,,,,,,,,,Expensespurchase,,,,,,,,,SavingInsurancePurchaseSVNet cash flowsreal,,,,,,,,,Net cash flownominal,,,,,,,,,PVNPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started