Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The scrap value corresponds to the remaining value of the assets and is settled in cash after year 5. Investors demand a 15% return on

The scrap value corresponds to the remaining value of the assets and is settled in cash after year 5. Investors demand a 15% return on investment. Is the project profitable with a 5-year horizon?

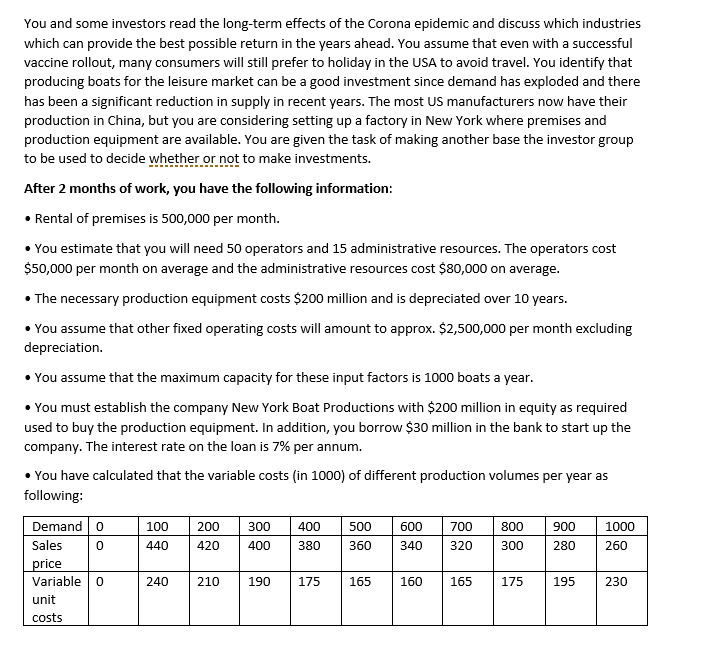

You and some investors read the long-term effects of the Corona epidemic and discuss which industries which can provide the best possible return in the years ahead. You assume that even with a successful vaccine rollout, many consumers will still prefer to holiday in the USA to avoid travel. You identify that producing boats for the leisure market can be a good investment since demand has exploded and there has been a significant reduction in supply in recent years. The most US manufacturers now have their production in China, but you are considering setting up a factory in New York where premises and production equipment are available. You are given the task of making another base the investor group to be used to decide whether or not to make investments. After 2 months of work, you have the following information: Rental of premises is 500,000 per month. You estimate that you will need 50 operators and 15 administrative resources. The operators cost $50,000 per month on average and the administrative resources cost $80,000 on average. The necessary production equipment costs $200 million and is depreciated over 10 years. You assume that other fixed operating costs will amount to approx. $2,500,000 per month excluding depreciation. You assume that the maximum capacity for these input factors is 1000 boats a year. You must establish the company New York Boat Productions with $200 million in equity as required used to buy the production equipment. In addition, you borrow $30 million in the bank to start up the company. The interest rate on the loan is 7% per annum. . You have calculated that the variable costs (in 1000) of different production volumes per year as following: Demand o 800 900 Sales 0 380 360 300 280 260 price Variable 200 400 500 1000 100 440 300 400 600 340 700 320 420 240 210 190 175 165 160 165 175 195 230 unit costs You and some investors read the long-term effects of the Corona epidemic and discuss which industries which can provide the best possible return in the years ahead. You assume that even with a successful vaccine rollout, many consumers will still prefer to holiday in the USA to avoid travel. You identify that producing boats for the leisure market can be a good investment since demand has exploded and there has been a significant reduction in supply in recent years. The most US manufacturers now have their production in China, but you are considering setting up a factory in New York where premises and production equipment are available. You are given the task of making another base the investor group to be used to decide whether or not to make investments. After 2 months of work, you have the following information: Rental of premises is 500,000 per month. You estimate that you will need 50 operators and 15 administrative resources. The operators cost $50,000 per month on average and the administrative resources cost $80,000 on average. The necessary production equipment costs $200 million and is depreciated over 10 years. You assume that other fixed operating costs will amount to approx. $2,500,000 per month excluding depreciation. You assume that the maximum capacity for these input factors is 1000 boats a year. You must establish the company New York Boat Productions with $200 million in equity as required used to buy the production equipment. In addition, you borrow $30 million in the bank to start up the company. The interest rate on the loan is 7% per annum. . You have calculated that the variable costs (in 1000) of different production volumes per year as following: Demand o 800 900 Sales 0 380 360 300 280 260 price Variable 200 400 500 1000 100 440 300 400 600 340 700 320 420 240 210 190 175 165 160 165 175 195 230 unit costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started