the second part!

thank u so much!

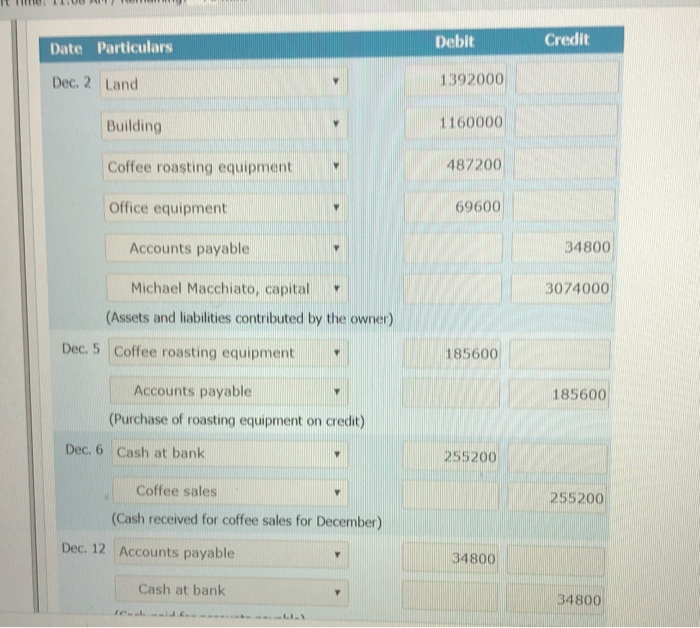

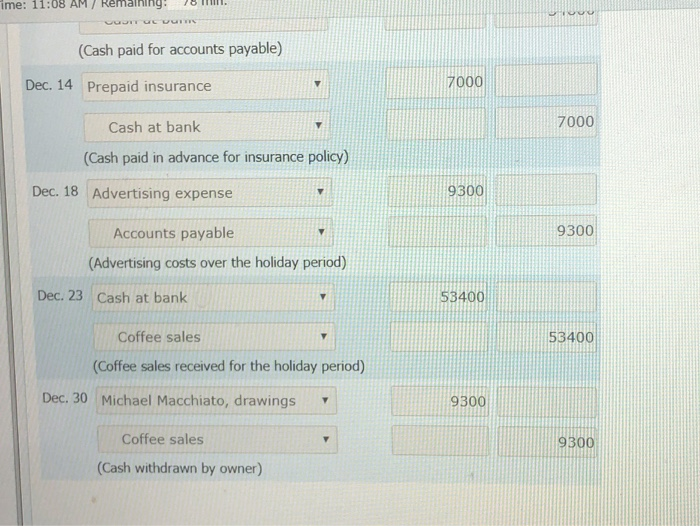

Question In December 2013, the following transactions occurred is Macchiato Coffee Roasters business that supplies cafes and also sells dvect to the public ignore GST) De Michael Macchiato wrested $3,074,00 into the business of Macchiato's Coffee Roasters by purchauty equipped coffee roosting business. The business acquired consisted of the following assets Land $1,399.000 Bulan 1.160,000 Coffee Roasting equipment 487,200 Ocenent 600 34,000 5 Purchased some wroting equipment on credit for $165,600. 6 Collected from customers for the month $255,200 12 Pad the accounts payable owing on December when Michael purchased the business 14 Purchased an insurance policy for the year for $7,000 cash 18 Purchased television advertising for the Christmas - New Year period for $9,300 to be paid for 30 days 23 Collected fees in cash from customers for the Christmas - New Year period, amounting to $53,400. 30 Michael with $9,300 cash in order to pay for private Christmas presents and parties, Debit Credit Date Particulars Dec, 2 Land 1392000 Building 1160000 Coffee roasting equipment 487200 Office equipment 69600 Accounts payable 34800 Michael Macchiato, capital 3074000 (Assets and liabilities contributed by the owner) Dec. 5 Coffee roasting equipment 185600 185600 Accounts payable (Purchase of roasting equipment on credit) Dec. 6 Cash at bank 255200 255200 Coffee sales (Cash received for coffee sales for December) Dec. 12 Accounts payable 34800 Cash at bank 34800 ime: 11:08 AM / Remaining: JE (Cash paid for accounts payable) Dec. 14 Prepaid insurance 7000 Cash at bank 7000 (Cash paid in advance for insurance policy) Dec. 18 Advertising expense 9300 9300 Accounts payable (Advertising costs over the holiday period) Dec. 23 Cash at bank 53400 Coffee sales v 53400 (Coffee sales received for the holiday period) Dec. 30 Michael Macchiato, drawings 9300 Coffee sales 9300 (Cash withdrawn by owner) b. Post the entries to ledger T accounts and balance the accounts as at 31 December 2019. (Post entries in the order of journal entries presented in the previous part. Leave blank any fields following your answers that do not require an entry. For example, if there are two rows for entre and only one entry is required, enter your answer in the first row and leave the second row Bank.) Cash at bank Land Building Ver24 Land Building Coffee roasting equipment Office equipment Prepaid insurance Accounts payable Accounts payable 7 Michael Macchiato, capital Michael Macchiato, drawings Coffee sales Michael Macchiato, capital Michael Macchiato, drawings Coffee sales Advertising expense