The second pic is the solution to a previous attempt

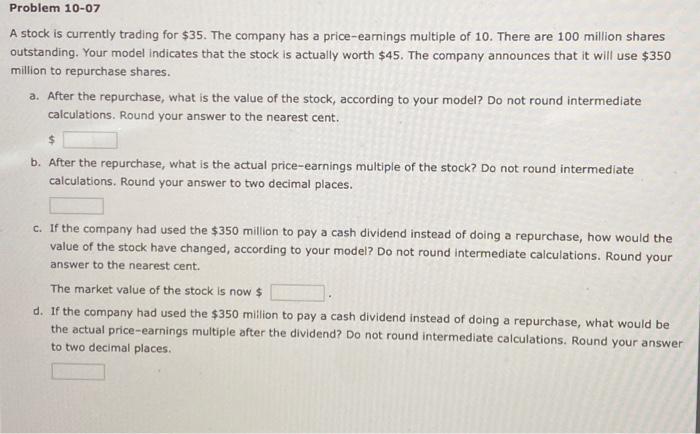

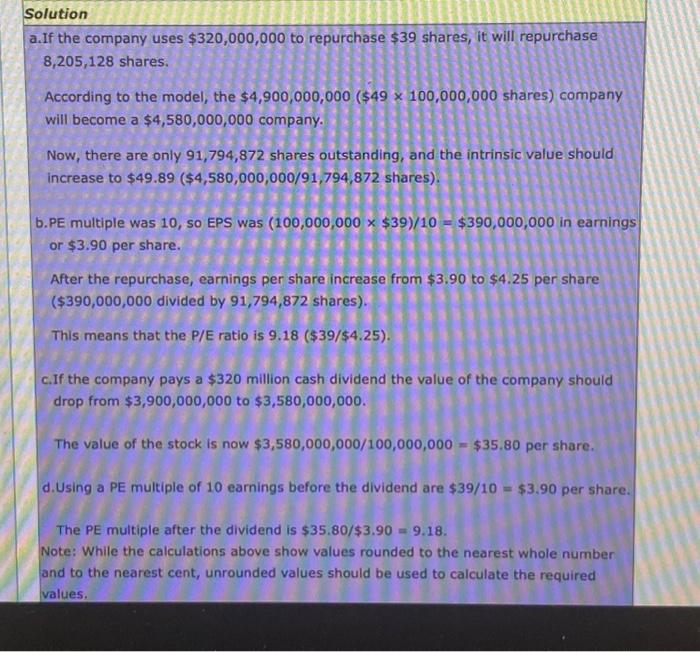

A stock is currently trading for $35. The company has a price-eamings multiple of 10 . There are 100 million shares outstanding. Your model indicates that the stock is actually worth $45. The company announces that it will use $350 million to repurchase shares. a. After the repurchase, what is the value of the stock, according to your model? Do not round intermediate calculations. Round your answer to the nearest cent. b. After the repurchase, what is the actual price-earnings multiple of the stock? Do not round intermediate calculations. Round your answer to two decimal places. c. If the company had used the $350 million to pay a cash dividend instead of doing a repurchase, how would the value of the stock have changed, according to your model? Do not round intermediate calculations. Round your answer to the nearest cent. The market value of the stock is now $ d. If the company had used the $350 milion to pay a cash dividend instead of doing a repurchase, what would be the actual price-earnings multiple after the dividend? Do not round intermediate calculations. Round your answer to two decimal places. .If the company uses $320,000,000 to repurchase $39 shares, it will repurchase 8,205,128 shares. According to the model, the $4,900,000,000($49100,000,000 shares) company will become a $4,580,000,000 company. Now, there are only 91,794,872 shares outstanding, and the intrinsic value should increase to $49.89($4,580,000,000/91,794,872 shares). b. PE multiple was 10 , so EPS was (100,000,000$39)/10=$390,000,000 in earnings or $3.90 per share. After the repurchase, earnings per share increase from $3.90 to $4.25 per share ($390,000,000 divided by 91,794,872 shares). This means that the P/E ratio is 9.18($39/$4.25). c. If the company pays a $320 million cash dividend the value of the company should drop from $3,900,000,000 to $3,580,000,000. The value of the stock is now $3,580,000,000/100,000,000=$35.80 per share. d. Using a PE multiple of 10 earnings before the dividend are $39/10=$3.90 per share. The PE multiple after the dividend is $35.80/$3.90=9.18. Note: While the calculations above show values rounded to the nearest whole number and to the nearest cent, unrounded values should be used to calculate the required values