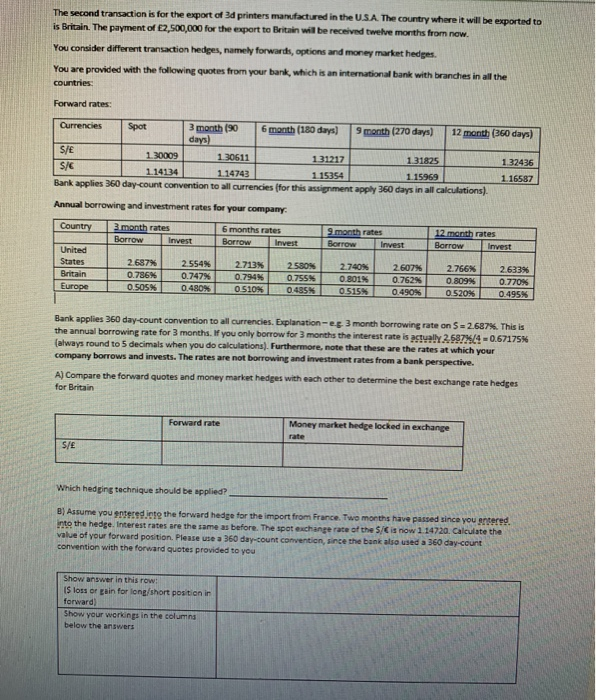

The second transaction is for the export of 3d printers manufactured in the USA The country where it will be exported to is Britain. The payment of 2,500,000 for the export to Britain wil be received twelve months from now. You consider different transaction hedges, namely forwards, options and money market hedges. You are provided with the following quotes from your bank, which is an international bank with branches in all the countries Forward rates Currencies 3 month (90 days) Spot 6 manth (180 days) 9 month (270 days) 12 month (360 days) S/E 1.30009 1.30611 131217 131825 132436 114134 114743 115354 1.15969 1.16587 Bank applies 360 day-count convention to all currencies (for this assignment apply 360 days in all calculations). Annual borrowing and investment rates for your compamy Country 3month rates 6 months rates 9month rates 12 month rates Borrow Invest Borrow Invest Borrow Invest Borrow Invest United 2.687 % 0.786 % 0.505 % States 2.554% 2.713% 2.580% 2607 % 2.740% 2.766% 2.633% Britain 0.747 % 0.794% 0.755 % 0.801 % 0.762% 0.809 % 0770% 0.495 % Europe 0.480% 0.510% 0485% 0.515% 0.490% 0520% Bank applies 360 day-count convention to all currencies. Explanation-e.g 3 month borrowing rate on $ 2.687 %. This is the annual borrowing rate for 3 months. If you only borrow for 3 months the interest rate is actually 2.687 % / 4 -0.67175 % (always round to 5 decimals when you do calculations). Furthermore, note that these are the rates at which your company borrows and invests. The rates are not borrowing and investment rates from a bank perspective. A) Compare the forward quotes and money market hedges with each other to determine the best exchange rate hedges for Britain Forward rate Money market hedge locked in exchange rate S/E Which hedging technique should be applied? B) Assume you entered into the forward hedge for the import from France. Two months have passed since you entered into the hedge. Interest rates are the same as before. The spat exchange rate of the $/C is now 1.14720. Calculate the value of your forward position. Please use a 360 day-count convention, since the bank also used a 360 day-count convention with the forward quotes provided to you Show answer in this row: IS loss or gain for long/short position in forward) Show your workings in the columns below the answers