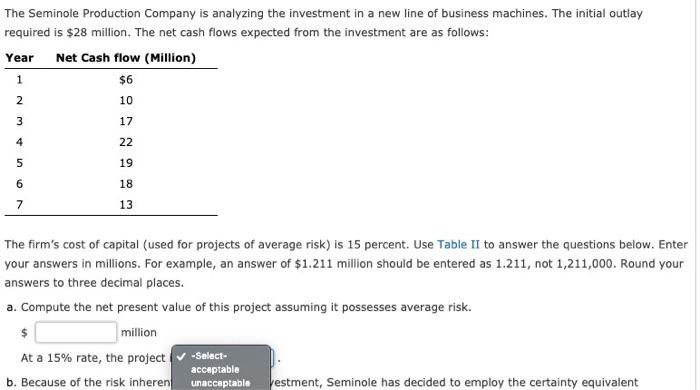

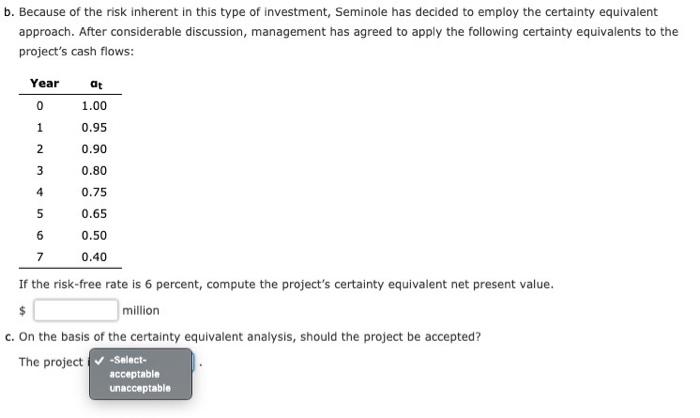

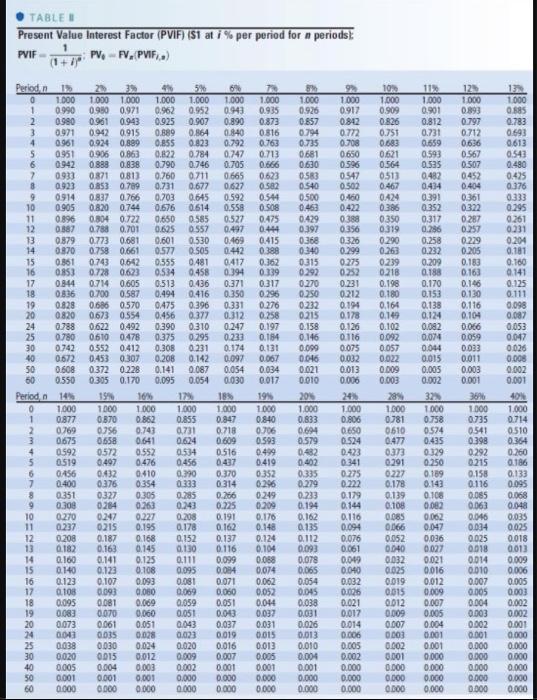

The Seminole Production Company is analyzing the investment in a new line of business machines. The initial outlay required is $28 million. The net cash flows expected from the investment are as follows: Year Net Cash flow (Million) $6 2 1 10 3 17 4 22 5 19 6 18 7 13 The firm's cost of capital (used for projects of average risk) is 15 percent. Use Table II to answer the questions below. Enter your answers in millions. For example, an answer of $1.211 million should be entered as 1.211, not 1,211,000. Round your answers to three decimal places. a. Compute the net present value of this project assuming it possesses average risk. million At a 15% rate, the project -Select- acceptable b. Because of the risk inheren unacceptable vestment, Seminole has decided to employ the certainty equivalent b. Because of the risk inherent in this type of investment, Seminole has decided to employ the certainty equivalent approach. After considerable discussion, management has agreed to apply the following certainty equivalents to the project's cash flows: Year 0 1.00 1 0.95 2 0.90 3 0.80 4 0.75 5 0.65 6 0.50 7 0.40 If the risk-free rate is 6 percent, compute the project's certainty equivalent net present value. $ million c. On the basis of the certainty equivalent analysis, should the project be accepted? The project-Select- acceptable unacceptable TABLE Present Value Interest Factor (PV1F) ($1 at i % per period for a periods) 1 PVIF PV-FV, PVIF. (1 + i)" 1.000 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 O SOS 0.475 0.444 0.415 1.000 0.911 0.842 0.772 0.708 0.650 0.596 0547 0.502 0.4460 0.422 0.388 0.356 0326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.126 0.116 0.075 0.032 0.013 0.006 0442 0399 Perioden 1.000 1 0.990 2 0.980 3 0.971 4 0961 5 0951 6 0.942 2 0933 8 0.923 9 0914 10 0905 11 0.896 12 0.387 13 0.879 14 0.870 15 0.861 16 0.853 17 0844 18 0.836 19 0.828 20 0.820 24 0.788 25 0.780 30 0.742 40 0.672 50 0.608 50 0.550 Period, 14% 1.000 1 0.877 2 0.769 3 0.675 4 0592 5 0.519 6 0456 7 0.400 8 0.351 9 0.308 10 0.270 11 0.237 12 0.208 13 0.182 14 0.160 15 0.140 16 0.123 17 0.108 18 0.095 19 0.083 20 0.073 24 0043 25 0038 30 0020 40 0.005 50 0.001 60 0.000 23 3 48 5% 600 1.000 1.000 1.000 1.000 1.000 0.980 0.971 0.962 0.952 0.943 0961 0943 0.925 0.907 0.890 0.942 0915 0.889 0.864 0.840 0.924 0.889 0.85S 0.823 0.792 0906 0.863 0.822 0.784 0.747 0888 0.838 0790 0.746 0.705 0.871 0.81) 0.760 0.711 0665 0.853 0.789 0.731 0.677 0.627 0.837 0.766 0.703 0.645 0.592 0.820 0.744 0.676 0.614 0.558 0.804 0.722 0650 0.585 0.527 0.788 0.701 0.625 0557 0.497 0.773 0.681 0.601 0.530 0.469 0.758 0.661 0.577 0.505 0.743 0642 0.355 0.481 0417 0.728 0.623 0.534 0.458 0.394 0.714 0.605 0.513 0.436 0.371 0.700 0.587 0.494 0.416 0.350 0.686 0.570 0475 0.396 0.331 0.673 0.554 0.456 0.377 0.312 0.622 0.492 0.390 0.310 0.247 0610 0.478 0.375 0.295 0.233 0.552 0412 0.308 0.231 0.174 0.453 0307 0.208 0.142 0.097 0372 0.228 0.141 0.087 0.054 0.305 0.170 0.095 0.054 0.030 16% 17 18% 1000 1.000 1.000 1.000 0.870 0.862 0.855 0.947 0.756 0.743 0731 0.718 0658 0.641 0.624 0609 0.572 0.552 0.534 0.497 0.476 0456 0.437 0.432 0.410 0.390 0.370 0376 0.354 0.333 0.314 0327 0305 0.285 0.266 0.284 0.263 0.243 0.225 0.247 0.227 0.208 0.191 0.215 0.195 0.178 0.162 0.187 0.168 0.152 0.137 0.163 0.145 0.130 0.116 0.141 0.125 0.111 0.099 0.123 0.108 0.095 0.084 0.107 0.093 0.081 0.071 0.000 0.069 0.050 0.081 0.069 0.059 0.051 0.070 0.060 0.051 0.003 0.061 0.051 0,043 0.037 0035 0.028 0.023 0.019 0.030 0.024 0.020 0.016 0.015 0.012 0.009 0.007 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0.362 0.339 0.317 0.296 0.276 0.258 0.197 0.164 0.131 0.067 0.034 0.017 19% 1.000 0.840 0.706 1.000 0.926 0.857 0.794 0.735 0.681 0.630 0583 0.540 0.500 0.463 0.429 0.397 0368 0.340 0.315 0.292 0.270 0.250 0.232 0215 0.158 0.146 0.009 0.046 0.021 0.010 203 1.000 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 0.135 0.112 0.093 0.078 0.065 0.054 0.045 0.038 0.031 0.026 0.013 0.010 0.004 0.001 0.000 0.000 10% 1.000 0.909 0826 0.751 0.683 0.621 0.564 0.513 0.467 0424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.102 0.092 0.057 0.022 0.009 0.003 289 1.000 0.781 0610 0.477 0.373 0.291 0227 0.178 0.139 0.108 0.085 0066 0.052 0.040 0.032 0.025 0.019 0.015 0.012 0.009 0.007 0.003 0.002 0.001 0.000 0.000 DOO 1.000 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0352 0.317 0.256 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.082 0.074 0.044 0.015 0.005 0.002 32 1000 0.758 0.574 125 1.000 0.893 0797 0.712 0636 0.567 0.507 0.452 0.404 0.361 0322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.066 0.059 0.033 0.011 0.003 0.001 3510 1000 0735 0.541 0398 0.292 0.215 0.158 0.116 0.085 0.063 1.000 0.585 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.2014 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.053 0.042 0.026 0.008 0.002 0.001 40% 1.000 0.714 0510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 2013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0.000 0.000 0.000 0.000 0.000 0.000 0593 0.435 0.516 1.000 0.806 0.650 0524 0.423 0341 0.275 0.222 0.179 0.144 0.116 0.094 0.076 0.046 0.061 0.499 0.419 0.352 0.296 0249 0209 0.176 0.140 0.124 0.104 0.088 0.074 0.062 0.052 0.014 0.037 0.031 0.015 0.013 0.005 0.001 0.000 0.000 0329 0.250 0.189 0.143 0.108 0.083 0.062 0.047 0.036 0.027 0.021 0.016 0.012 0.009 0.007 0.005 0.004 0.001 0.001 0.000 0.000 0.000 0.000 0.019 0.040 0.032 0.026 0.021 0.017 0.014 0.006 0.005 0.002 0.000 0.000 0.000 0.093 0.034 0.025 0018 0.014 0.010 0.007 0.005 0.004 0.003 0.002 0.001 0.000 0.000 0.000 0.000 0.000